Investors Turn to Fundamentals as GBTC plunges to a 9% Discount

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 69

Bitcoin’s blockchain data is our linchpin as it reports the vibrancy of blockchain activity. It has always been the case that a growing network has coincided with a rising bitcoin price and vice versa. That said, the past few months have seen another force dominate events.

At ByteTree, we see the six-fold move from $10,000 in October, largely attributable to institutional investment flows. They see bitcoin as an asset that protects against inflation and gives them an opportunity to participate in a growing network. They are right.

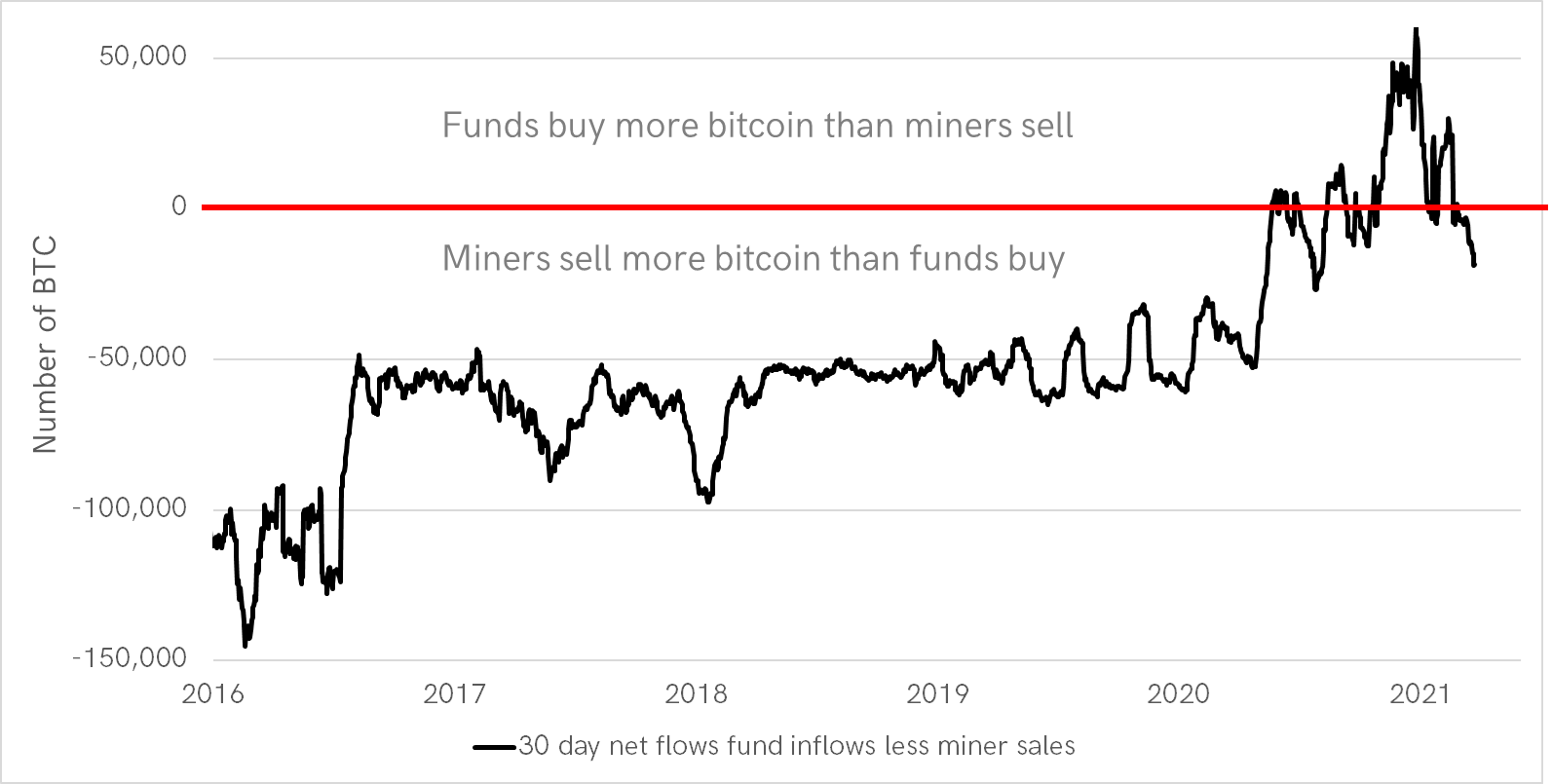

Over the past five years, there has been a quantum shift in institutional activity. Back in 2016, the Bitcoin funds were buying 100,000 BTC less than was being mined. The slack was taken up by retail investors, who enthusiastically bought sub $1,000.

Between the second halving (9 July 2016) and the third halving (12 May 2020), this deficit (from institutional demand) reduced to 50,000 BTC per month. Again, retail investors carried on buying sub $10,000.

Then since last May, the situation has shifted to a surplus. The Bitcoin network has been bolstered by insatiable institutional demand, never previously seen.

Bitcoin fund demand versus miner selling pressure

However, recent data show that this has begun to slow down. It may prove temporary, or it may not.

Last week I discussed the largest Bitcoin Fund, the Grayscale Bitcoin Trust (GBTC). The discount closed at -9.6% yesterday, which means investors holding GBTC have become willing sellers, while there is a shortage of willing buyers. The result is GBTC shares trade below their intrinsic value represented by the BTC held.

The Grayscale discount widens

It is yet unknown whether this is a GBTC problem or a broader problem for the network. In any event, GBTC will no longer see inflows because you wouldn’t pay $100 for $90 of BTC by subscribing to GBTC when you can buy $100 of BTC for $90 by buying the shares in the market.

The job of accumulating BTC must now be continued by the other funds. They are still making good progress, but at a slower pace than we saw in Q4 2020. With fund flows no longer being so dominant in setting the price, I believe it is time to revisit the on-chain data and see what it is telling us about the underlying strength of the network.

On-chain transaction value (TV$)

Over the years, the price of Bitcoin and the TV$ have remained close. This deviated in late 2020, with price and TV$ becoming disjointed. TV$ recently touched $90bn in a single week, which is the highest level on record. This has turned down to $53bn at the time of writing.

Most trading volume is not recorded on the blockchain. An exchange or market maker might carry out multiple trades before settling on the blockchain. However, the on-chain data shows the overall result of all settled activity.

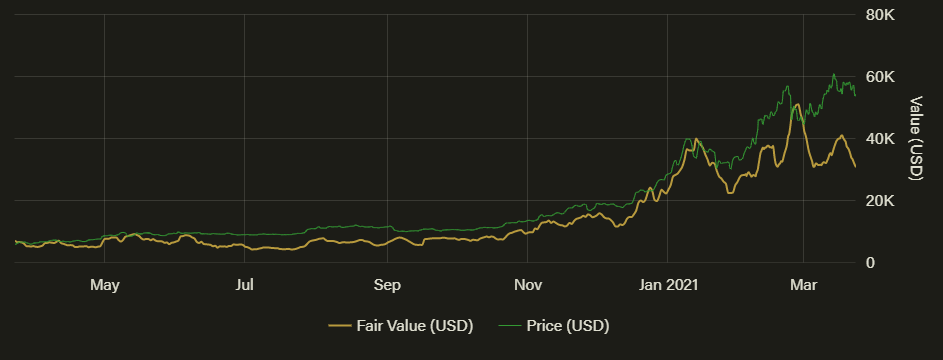

Bitcoin Fair Value

TV$ is closely linked to price, and so we can calibrate the two in order to estimate the fair value for Bitcoin. That means a historical best fit is calculated to better understand the link. At ByteTree, we use the past two years of historic data, which ensures the relationship is regularly refreshed. The link between TV$ and price today is not quite the same as it was in 2013, but it is surprisingly close.

The fair value touched $50,000 in late February but has subsequently retreated to $35,000, as on-chain activity has cooled. It may turn up again, but definitely one to watch.

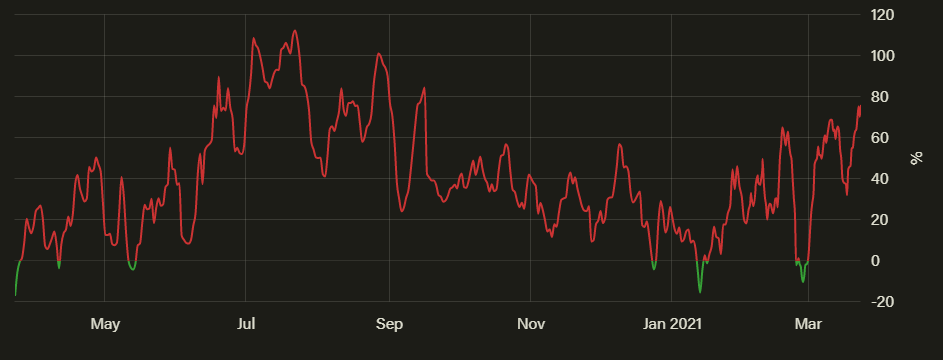

The Bitcoin Premium

Just as GBTC has a premium or discount in relation to intrinsic or net asset value, the same method is used to measure the gap between the Bitcoin price and ByteTree’s fair value. That is currently showing an 80% premium, which is the highest reading since this rally began in October.

The premium was high last summer in the aftermath of halving in May. That was a period of hype, but the rally soon fizzled out.

The price rallied from $9,000 in July to $12,500 before retreating back to $10,000 in September. Incidentally, the premium was -50% at the lows in March 2020, during the Covid-19 market crisis, when the price fell below $5,000.

The three recent discounts occurred on 24 December 2020 at $23,400, on 11 January at $33,600 and 26 February at $44,000. Given how things have turned out, these were all good entry points.

The current 80% premium urges caution. That is not to say Bitcoin doesn’t go higher, but right now, it is unlikely to be a good entry point.

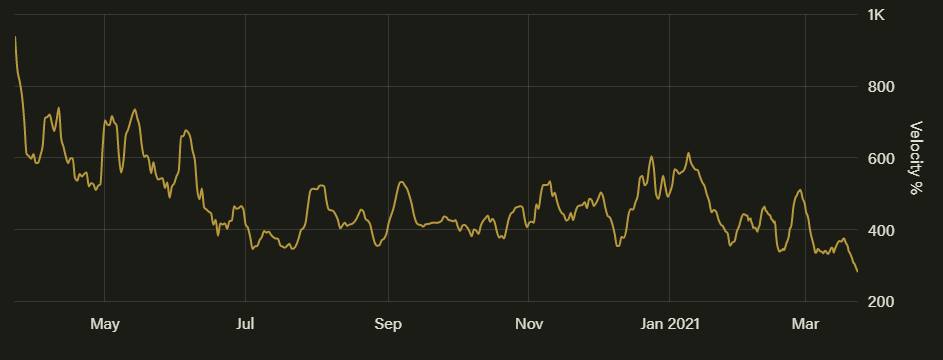

Velocity

We have recently seen velocity fall to low levels. This records the number of times a typical bitcoin circulates within the network each year. The current reading of 285% is extremely low by historic standards.

Some people argue that with so much bitcoin being locked up (HODL) and held for the long-term, this measure is less relevant than it once was. I would agree, and so we allow for this. But even so, the current reading is a cause for concern.

The trouble with the institutional dominance of the network is that it becomes more expensive to transact. That reduces the vibrancy of the network, which is probably not a good thing if Bitcoin is to have a network effect, utility and purpose, as opposed to solely being an alternative monetary asset.

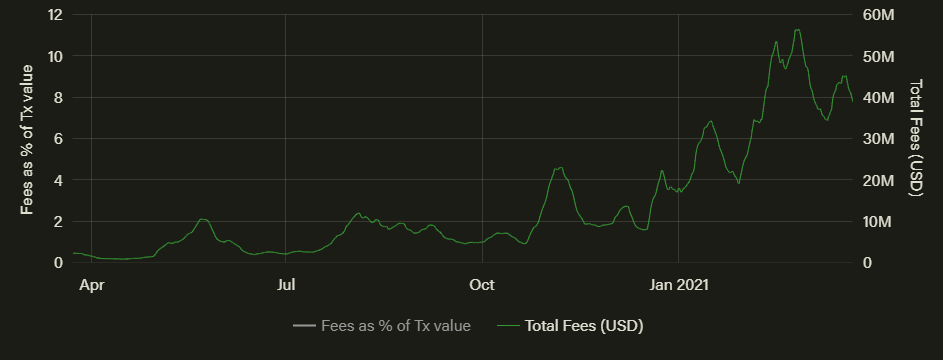

Fees

The network fees have also risen significantly since October, from $5m to over $50m a week, boosting the average transaction fee to $7. This high transaction cost shows, once again, how excessive fees choke off network demand. Velocity, shown above, has fallen as fees have risen. This is repeated every cycle.

Fees are now falling from their highs, despite the Bitcoin price making a recent all-time high. Historically, changes in fees have been one of the best market timing indicators. They are always a little late, but decisive in their message.

To avoid the pain, check the chain

Like many Bitcoin enthusiasts, I look at these charts every day of my life. Sometimes they aren’t saying much, but sometimes the answers leap off the page. That is how I see things today. The price is significantly ahead of events, and the levels of activity are turning down.

I have been quiet on blockchain activity in recent months because flows have been a much bigger story. The Grayscale discount is telling you that institutional appetite is waning, and that means the on-chain data will once again return to being our rock.

Comments ()