Maker: Real-World Assets on the Blockchain

Disclaimer: Your capital is at risk. This is not investment advice.

How the Maker Protocol Can Bring $Trillion-Markets to DeFi

Since January 2021, Decentralised Finance (DeFi) has captured $50bn of total value locked (TVL). This is still very small in comparison to the $50trn held by traditional sectors, which DeFi is attempting to disrupt. DeFi certainly has the capacity for future growth, and tokenising real-world assets is the key.

Tokenising Assets

The digital asset ecosystem has been doing a great job at catering for crypto users but often neglects the wider traditional market; this is where the money is. DeFi emphasises community-based, wide-ranging financial products, and this is fine. However, to cater for the trillion-dollar markets, more tailored products are needed because big money needs a personal touch.

Bringing real-world assets into DeFi will trigger the largest growth the sector has experienced. This will naturally happen as the crypto space moves away from its contrarian ideology, but protocols like Centrifuge, Tinlake and Maker are leading the charge; tokenisation is enabling this movement.

NFTs and DeFi

Non-fungible tokens, or NFTs, have got ahead of themselves. Perhaps, Taco Bell tokenising a spicy potato soft taco was the signal? Or maybe Beeple being the third most successful living artist purely due to his $69m NFT, after not selling a physical art piece for more than $100 before November 2020? Either way, this should not detract from the true value and utility that NFTs can bring, especially when integrated with DeFi.

Any real-world asset that wishes to enter the highly accessible, liquid, transparent and global DeFi market must be tokenised. Immortalising real estate on the blockchain is a very early example of real-world value being put on the blockchain. RealT, a company specialising in real estate powered by blockchain, has enabled mostly unhindered access to the US housing market by digitising unique housing deeds. These are split into RealTokens (specific for the property) and then sold to investors. The greatest part is:

“RealTokens are a claim on the asset, regardless of whether RealT exists or not.”

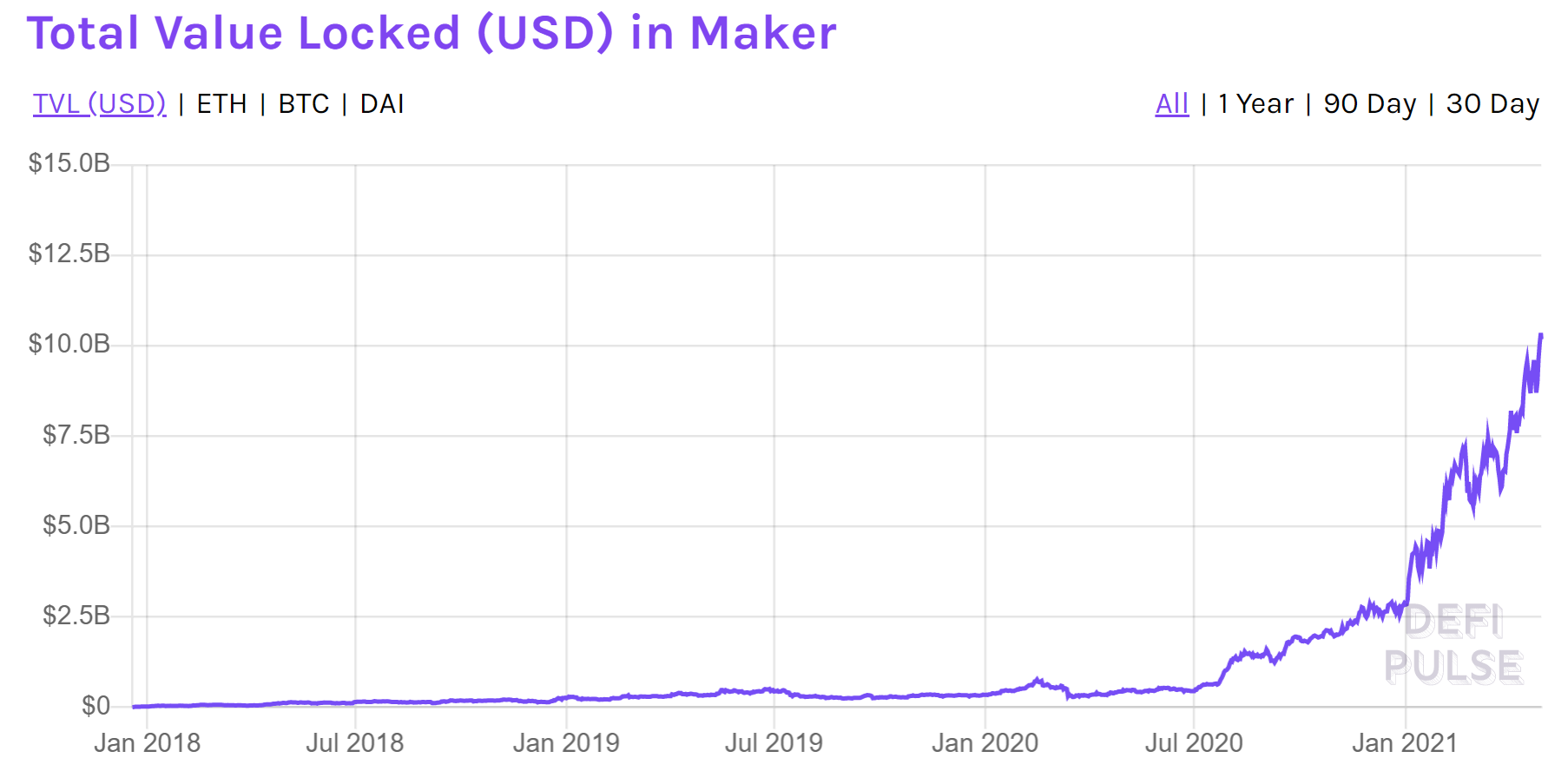

In this next section, we will look at the Maker Protocol more closely. The Maker Protocol aims to use its $10bn of TVL (according to DeFiPulse) to improve on the ideas of RealT.

Bringing the Enterprise to NFTs

Maker enables users to generate DAI, a crypto-backed USD stablecoin, through leveraging collateralised digital assets. In recent years, Maker has been looking to generate additional value from the protocol by enabling users to generate DAI through collateralising real-world assets, such as mortgage and housing deeds, and unpaid invoices.

In mid-April 2021, Maker was bombarded with news coverage because it had successfully created its first real-world asset-backed pool through integration with the Centrifuge blockchain and Tinlake protocol. This meant that Maker users could buy ERC-20 (fungible) tokens, which directly represent an ownership stake in a basket of non-fungible real-estate assets from the lending company New Silver.

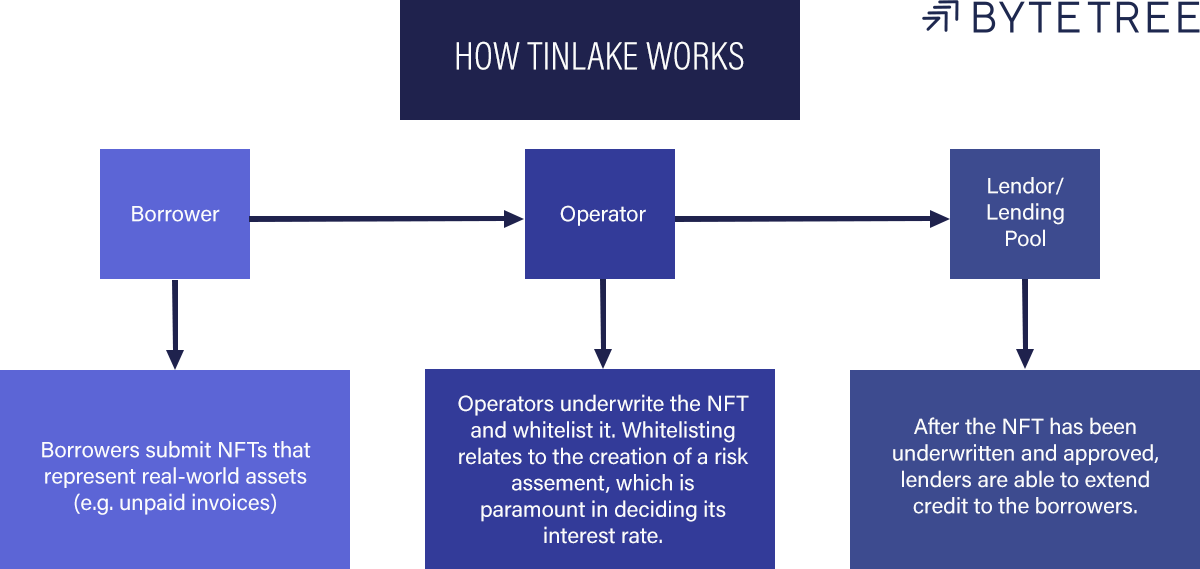

The Centrifuge and Tinlake protocols are responsible for enabling this bridge between the traditional market and the crypto-world. Tinlake is a set of smart contacts that enables borrowers to draw loans against any asset that can be represented as a non-fungible token (unique asset); this essentially includes any real-world asset. The Tinlake process is outlined in the flow chart below.

The Centrifuge blockchain is part of the Polkadot universe, but integration with the Tinlake dApp enables it to access the highly liquid Ethereum DeFi markets. Meaning, they have found a cheap, fast and highly liquid solution for bringing the trillion-dollar real-world asset market into DeFi, without compromising on the advantages of a blockchain. Very bullish.

Additionally, Centrifuge aims to create a finance system that is accessible to everyone by bringing DeFi into the “real-world”. They comment on this concept as:

“A DeFi that is connected to real businesses and real people financing trillions in assets. We believe that, in order to be most efficient and cost-effective, all global commerce will eventually run on smart contracts digitizing traditional financial structures. DeFi is the next step in the evolution of the Internet and a fundamental building block that will help real-world businesses access global liquidity.”

Composability

This is not just experimental; these real-world assets benefit from permissionless liquidity, on-chain transparency, hyper accessibility and reduced transactional friction. Furthermore, composability, which aims to create seamless interaction between different digital asset protocols and chains, is a significant technological advancement. Composability promotes the possibility of exponential growth within all liquid markets in DeFi, where the Maker Protocol is the starting point.

The chart above shows the total value locked in the Maker Protocol. If Maker manages to bring just 1% of the traditional real-estate assets to its protocol, then we could expect to see its total value 9x to $100bn. This is significant for the whole digital asset space because having previously untapped business on-chain will enable access to a wide range of competitive liquidity pools across DeFi.

Not just Real-Estate

Tinlake and Centrifuge have a much larger scope for business than just the $9trn real-estate market. Their mission is to help foster economic opportunities everywhere. This includes:

“facilitating access to liquidity for SMEs around the world and unlock value that is currently inaccessible”

For those not familiar, SMEs are small to medium-sized enterprises who often rely heavily on on-time invoices to keep their operations running. Traditional companies tend to have unpaid invoices, which cause negative implications for their cashflow; this can be crippling. According to Tinlake, they can fix this issue:

“Our technology will help to access the $30 Trillion globally that is locked up in unpaid invoices at any given time”

Yes, the unpaid invoice world is worth $30trn (wow!). Capturing 1% of that market could transform the entire DeFi space, catapulting it to a quarter trillion-dollar industry. Investors should see this as an opportunity to quantify the effect this type of event would have on the wider ecosystem – think Ethereum and Polkadot.

Conclusion

Overall, the digital asset ecosystem is fantastic at providing equal-minded users with accommodating financial products. Perhaps this could make DeFi a trillion-dollar industry? I think tailored products for large institutional players is a much quicker path. DeFi has $65bn, and the traditional real-estate market has $9trn; growth is ready for the taking.

Centrifuge, Tinlake and Maker are the frontrunners in this sector of innovation. By harnessing the power of NFTs, they can offer the borrowing market a highly liquid and accessible digital market. As illustrated by the recent hype, NFTs need a different narrative, and this is by far the best.

Lastly, we need to consider the positive impact these events could have on the wider digital asset ecosystem. Ethereum and Polkadot are the vessels for this innovation, so capital allocation to these blockchains could prove lucrative in the future.

Comments ()