The World Is Running Out of DOGE

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 74

DOGE arrived in late 2013 at the height of the market. It wasn’t exactly serious, but it certainly caught peoples’ attention. Unlike Bitcoin, with a 10-minute block interval, DOGE’s blocks came every minute.

With everything sped up, DOGE completed six halvings by early 2015, with none since. It has settled down with a new supply rate of 13.5 million DOGE per day, and as a result, there are 130 billion DOGE in circulation, growing at 3.8% per annum. Like Bitcoin, this growth rate (or inflation rate) will tend towards zero over time.

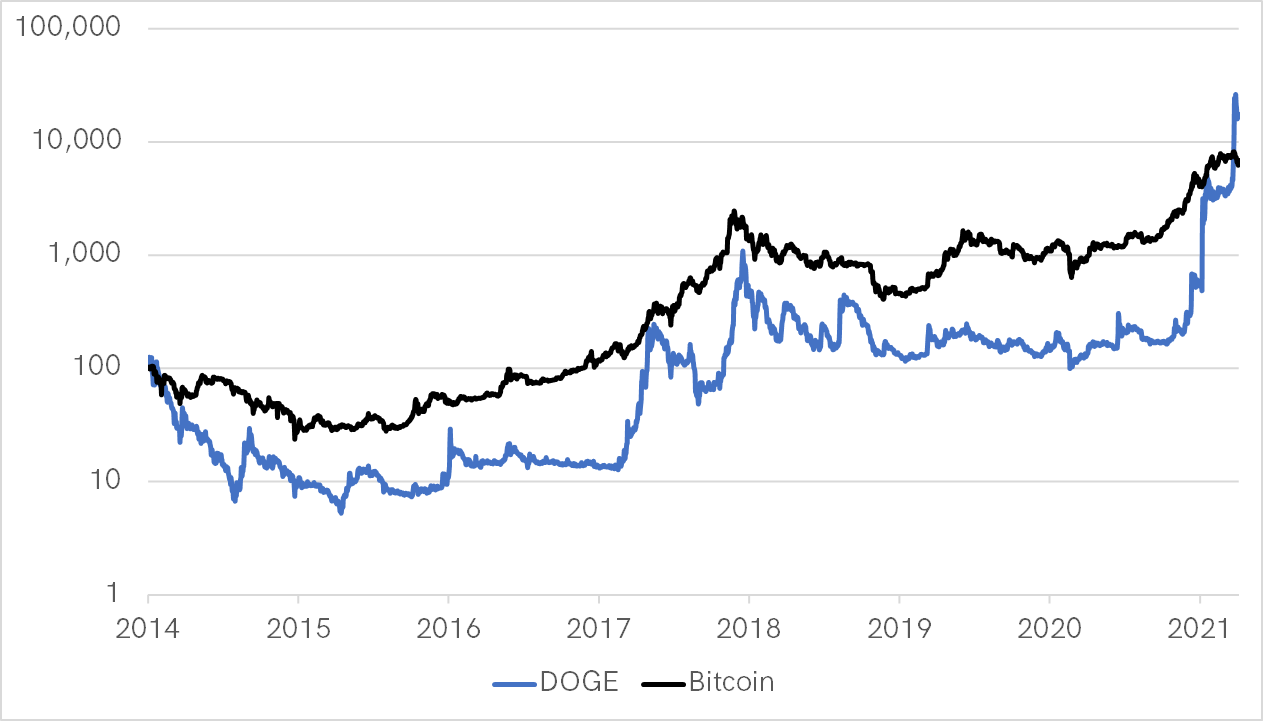

We joke about DOGE, but for some reason or another, it has outperformed Bitcoin since it first came to be. I have rebased this chart to 100 for both assets. In recent weeks, DOGE has claimed a gold medal.

Wow, so great, much popular

The DOGE community has had a sense of humour. They sponsored a Nascar race in 2014…

…and sent the Jamaican bobsled team to Sochi later that year.

DOGE has been fun to watch and has livened up the crypto space. You might think these short ramps are amusing, but the current rally values DOGE at $42 billion and, according to CoinMarketCap, trades $9 billion per day. How is this possible?

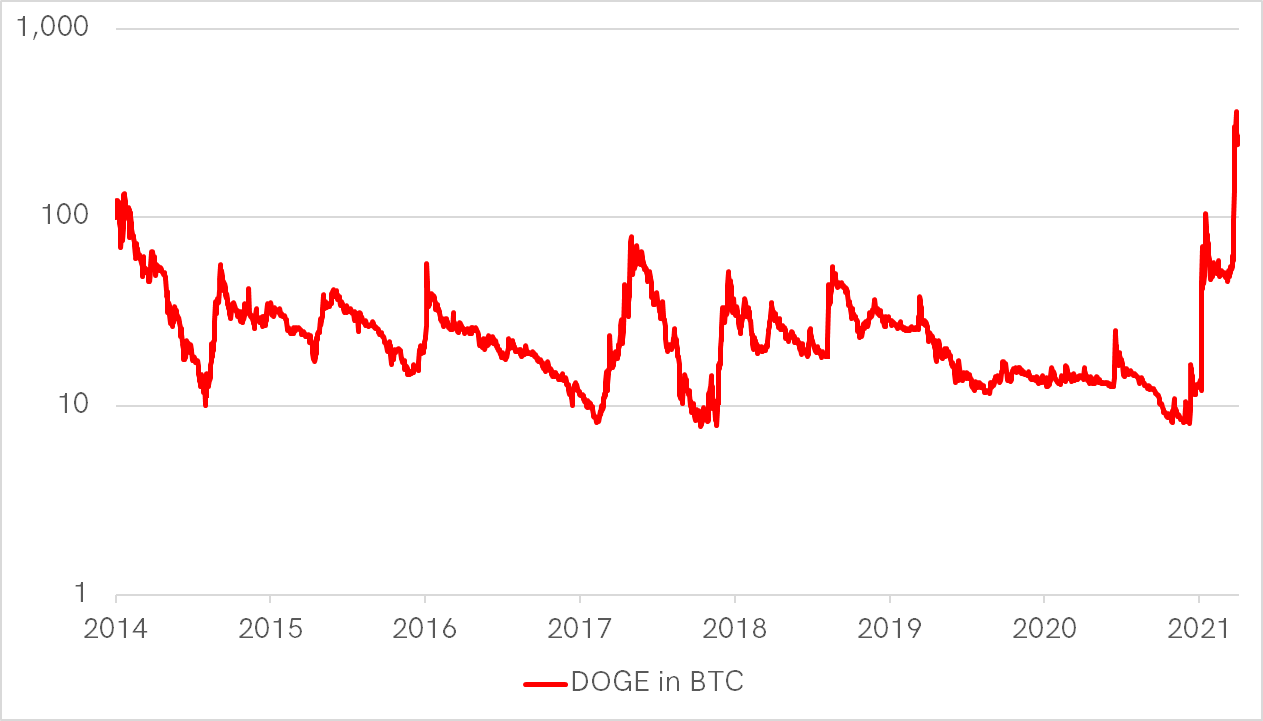

Even more remarkable is the consistent trading range with Bitcoin that has lasted for seven years. I have rebased this to 100 at the start. The DOGE per Bitcoin value relationship (recall rebased) has moved between 10 and 100 consistently. The 10s have come in bear markets, while the 100s have come during the good times.

The recent rally has been the best ever, breaking out of this established range. Since 21 Jan 2021, when Elon Musk ramped up his crypto tweets, DOGE has beaten Bitcoin 20-fold. It is truly remarkable.

This has happened despite DOGE not even pretending to have a purpose in contrast to Bitcoin, which presents itself as a deadly serious and institutional-grade store of value.

When the wind picks up, even the turkeys fly

This has to be one of my favourite expressions in finance. It holds true because once a trend is established and becomes well known, investors hunt for similar opportunities.

We routinely see this in natural resources. The profitable companies rise first, while the loss-making prospectors follow behind, only to surge in the final moments of the bull.

The same has happened in tech. The giants have enjoyed a ten-year run, while in recent months, they have stalled. Just a small amount of money leaving big tech has seen many loss-making great-concept-no-profit stocks surge.

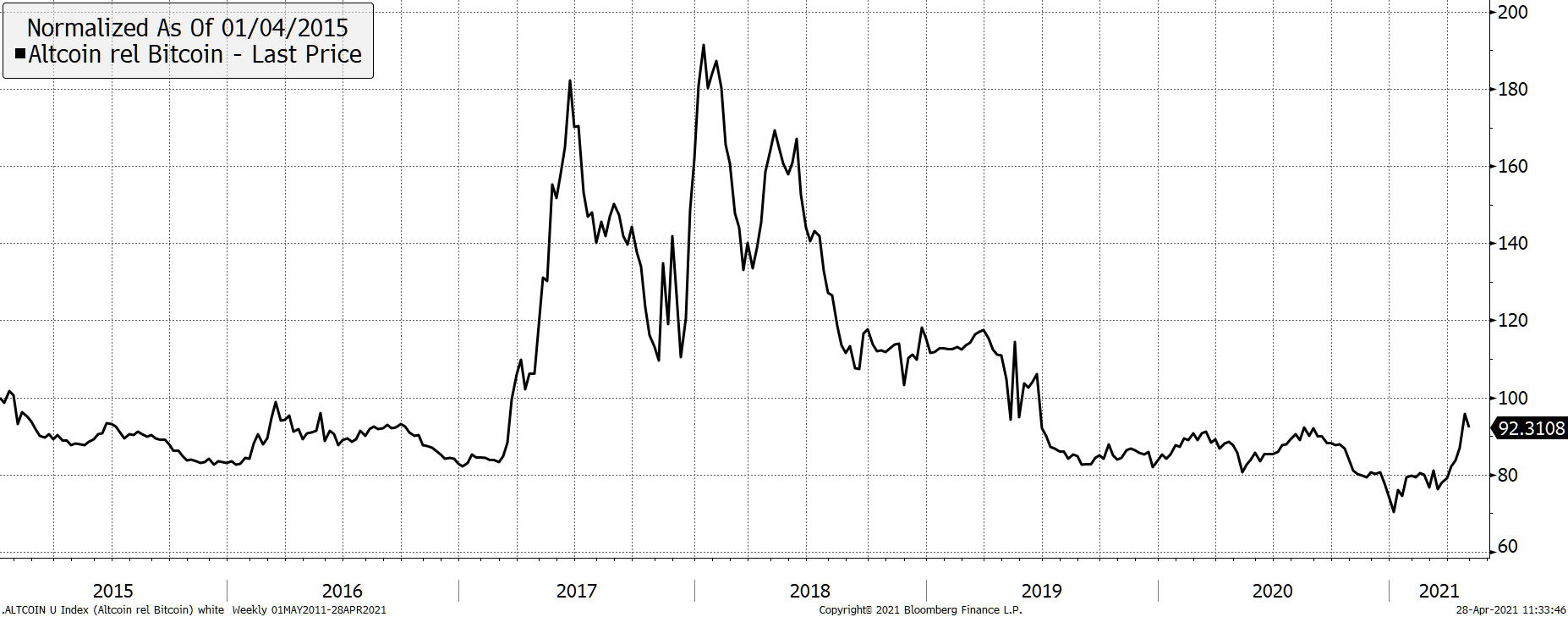

This is a cycle that repeats itself. The irony is that in crypto, the 100 leading cryptos have lost just 8% versus Bitcoin since 2015, meaning that it hasn’t much mattered whether you bought Bitcoin or altcoins. The results have been so similar in aggregate (although, undoubtedly Ethereum boosts this).

The altcoins have surged in the late bull markets, something that also happened in 2013. They have then held up for a surprisingly long time before giving up. Notice how Bitcoin bottomed in November 2018 while the altcoins carried on underperforming.

Altcoins have outperformed in 2021

Bitcoin’s network value is $1 trillion, while the whole space is worth approximately $2 trillion. That means Bitcoin today represents half of the value of the space, which is a sharp reduction from a year ago when it was even more dominant. Bitcoin dominance is another way to describe Bitcoin relative performance.

This strength in altcoins, especially DOGE, is remarkable. Fortunes are made in these coins, but only by those who bought early. Those who bought late have tended to be the cannon fodder.

How long will this go on?

It is hard to say, but I suspect it continues for as long as the central banks keep watering the money tree.

I do not believe that crypto can thrive in isolation, at least not yet. So far, it has always seen strength when shadowed by general asset prices. They remain perky but won’t forever.

There is one caveat where stocks could come under pressure while crypto is perceived to be a real asset. In which case, inflation is its friend and the stockmarket’s foe. It is lucky for the space that inflation forecasts just made another new high - the highest since 2012 and still rising.

Crypto likes inflation

Maybe the world is running out of DOGE. With 130 billion in circulation, that’s not even 20 for every living person!

Comments ()