Bitcoin's Taproot Upgrade

Disclaimer: Your capital is at risk. This is not investment advice.

Bitcoin Developers Aren't Schnorring

Bitcoin is often criticised for its high transaction fees and low throughput. In fact, at times of high fees (relative to transaction value), the market is often unfavourable to Bitcoin’s short-term price. A common misconception is that Bitcoin’s technology is outdated or that it is not actively evolving with network demand. Some also posit that Bitcoin developers are asleep at the wheel, which simply isn’t true.

Our readers may have seen Taproot appear across media channels in recent weeks because it is the biggest upgrade to Bitcoin since 2017. In this article, I will share a high-level view of what Taproot and Schnorr signatures are and what the implications are for Bitcoin Network users and investors like you.

Taproot is generally used as the name for the upgrade proposal. Whilst it will help with privacy to an extent, Schnorr signatures greatly improve upon Taproot, and that is why we will focus more on Schnorr in this article.

Taproot: Part of Bitcoin’s 341st Improvement Proposal (BIP-0341)

Taproot is part of a soft fork Bitcoin Improvement Proposal, known as a BIP-0341, which officially aims to;

“… improve privacy, efficiency, and flexibility of Bitcoin’s scripting capabilities without adding new security assumptions”

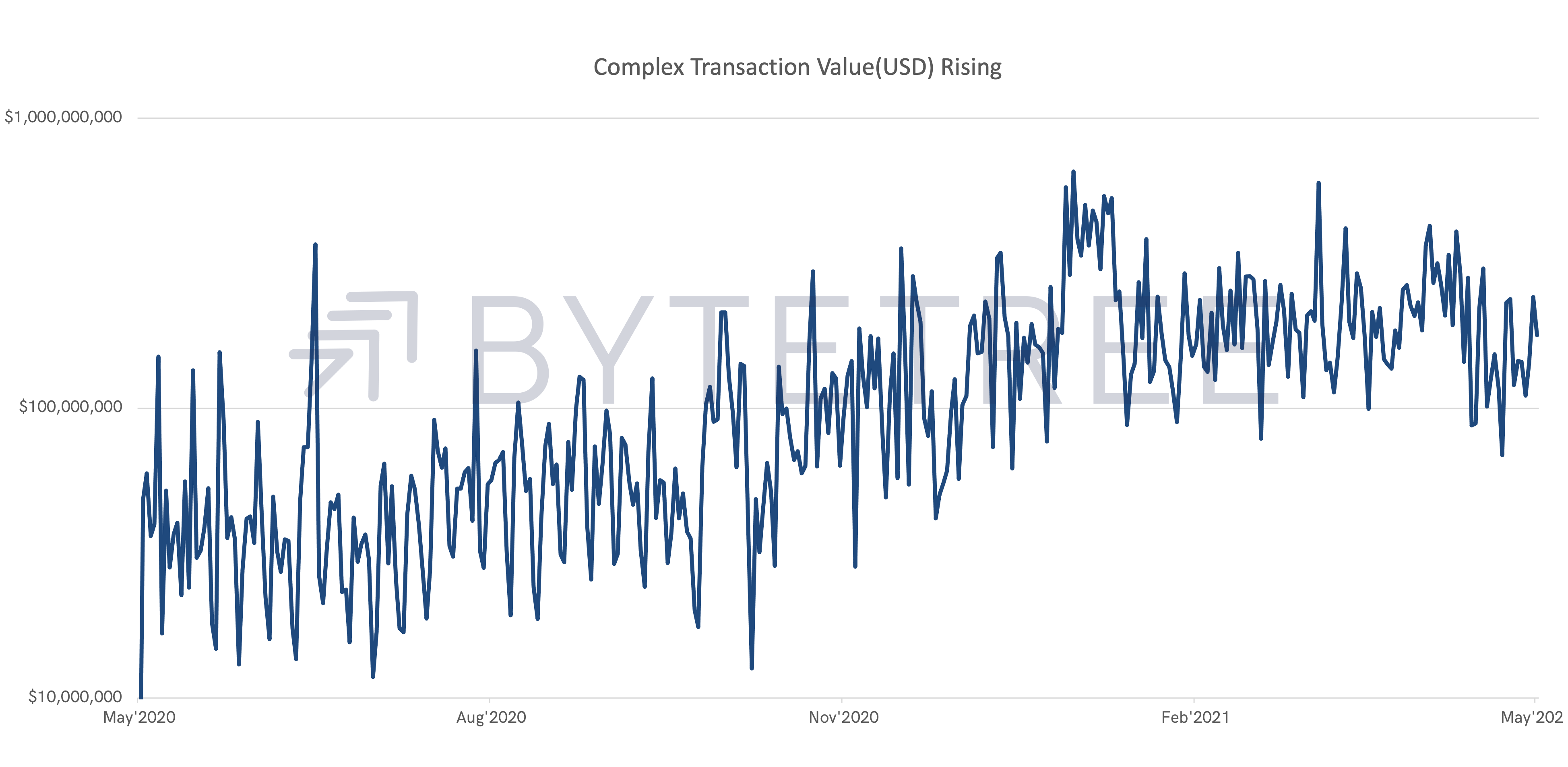

Privacy is a major driver for Taproots origin. At ByteTree, we have seen an increase in the value transacted that we class as “complex” or “batched” transactions. These transactions likely use one of the following privacy preserving techniques; Coin Mixers and CoinJoin. Taproot aims to improve upon these by bringing similar methods into Bitcoin’s software stack.

What Are Soft-Forks?

To advance Bitcoin’s underlying technology, miners must collectively agree to implement technical restrictions or improvements. This normally comes in the form of a “soft fork” or a “hard fork”.

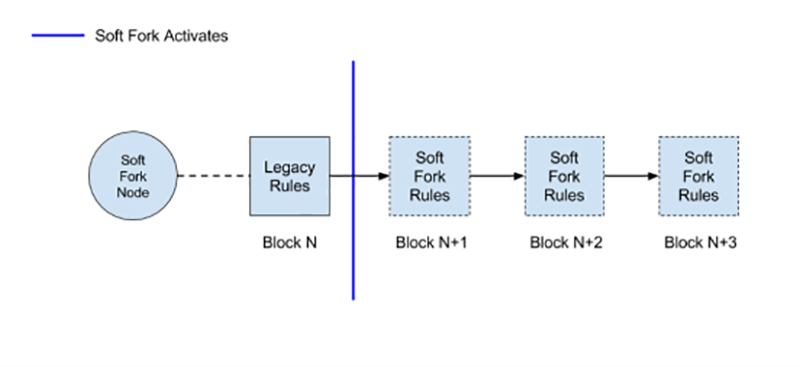

Without being too technical, a soft fork implements a set of rules on every block after a set block; the chart above illustrates this perfectly. The soft fork will delegate a block (in this case, Block N) to be the “legacy” block. meaning the last block before changes are made.

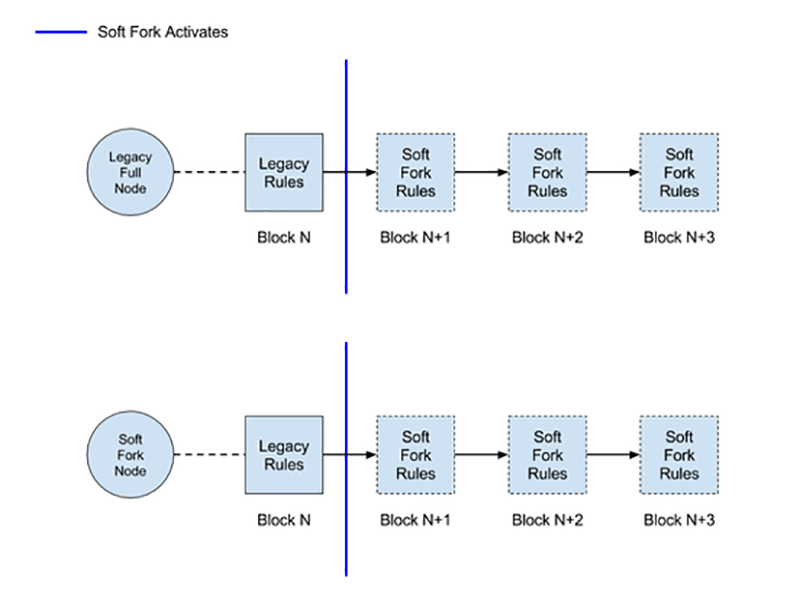

Every block after N is subject to the new “rules” unless there is a disagreement between nodes and miners, as illustrated by the above diagram. Unlike hard forks, soft forks are compatible with legacy nodes, which means that whichever side has more nodes and hashpower will be the chain that most likely carries on (Soft Fork Rules in the case above).

SegWit – The Last Significant Soft Fork

In 2017, Segregating Witness, or SegWit, was the last significant soft fork on the Bitcoin Network. From a high-level view, SegWit reduced the capacity needed to store a transaction in a bitcoin block. This increased the spare capacity per block (lower fees) and consequently the transaction capacity (faster transactions).

Schnorr Signatures

Taproot is critical in future-proofing Bitcoin’s compatibility with more complex transactions. However, it’s only one aspect of the proposal. As we mentioned previously, Schnorr signatures are arguably the most significant feature within BIP-0341 because they provide the script framework that makes Taproot (as a whole) more effective.

Claus-Peter Schnorr released the technology in the 1980s, but due to a patent (which ended in 2008), Satoshi could not implement it when creating Bitcoin. Instead, Satoshi went with the Elliptic Curve Digital Signature Algorithm (ECDSA) as this was the more standardised approach, albeit not as effective.

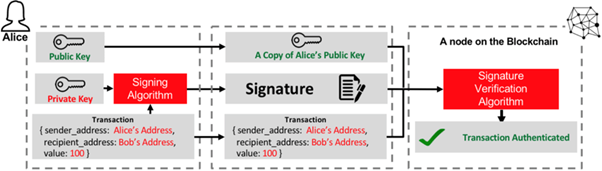

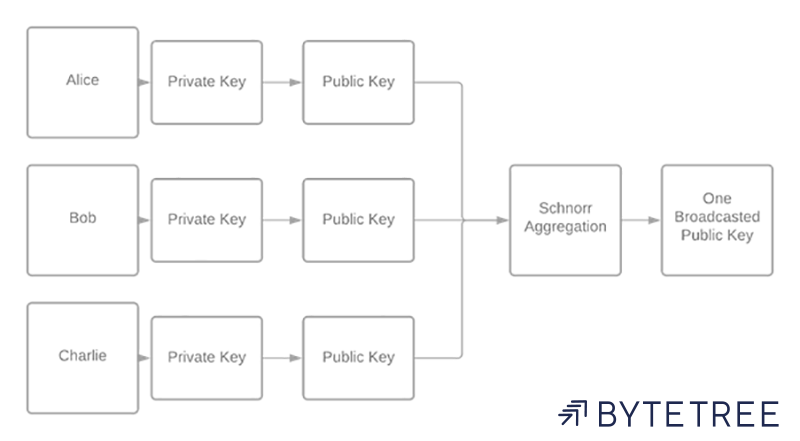

When transacting over the Bitcoin Network, a user requires a private and a public key. A private key should never be broadcasted because this represents ownership of funds, whereas the public key represents identity and where the funds are sent.

To send a transaction, party A (Alice) needs to prove that she has the funds to complete the transaction. Currently, ECDSA enables this without Alice having to compromise her private key. It achieves this through generating two numbers that, when put together with Alice’s public key, represent a digital signature that verifies the available funds.

Schnorr improves on ECDSA by simplifying the digital signature and verification, thereby producing improved privacy and more efficient use of transaction block capacity. Ultimately, the new signatures enable value-generating potential for Bitcoin’s capability with multi-sig and smart contract functionality.

When Will It Happen?

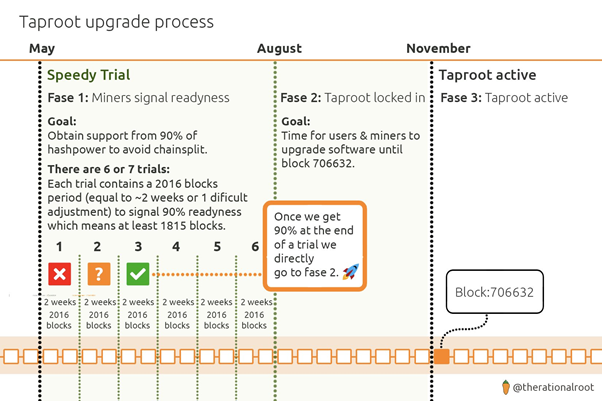

Taproot still has a long way to go before full deployment. For the Taproot soft fork to take place, 90% of all transactional blocks are required to collectively agree to this upgrade by 11 August 2021 (for reference, the SegWit upgrade required a 95% consensus for implementation). As of 12 May 2021, this has not yet happened.

To signal for Taproot, miners must simply put the number “4” at the end of a block they have generated. The consensus must be reached within the current difficulty adjustment period (every 2016 blocks), or it will reset at the next adjustment. Like all other aspects of Bitcoin, this is a highly decentralised approach and would undoubtedly be positive for the entire Bitcoin Network if a consensus is reached in time and the Taproot deployment can go ahead.

The Taproot Upgrade Process

The graphic above shows the activation process that Taproot would take if the miner network can agree on a consensus by August. For the more discerning readers, the official BIP-0341 states:

“For Bitcoin mainnet, the starttime is epoch timestamp 1619222400 (midnight 24 April 2021 UTC), timeout is epoch timestamp 1628640000 (midnight 11 August 2021 UTC), the threshold is 1815 blocks (90%) instead of 1916 blocks (95%), and the min_activation_height is block 709632 (expected approximately 12 November 2021).”

If Taproot does not achieve consensus in time, then it is back to the drawing board. Should this happen, I would argue that it would not be too long before the Bitcoin community tries to implement the upgrade proposal soon thereafter; the sentiment around BIP-0341 is very bullish.

Conclusion

Many write off Bitcoin due to its lower transaction throughput, if compared to more application-based blockchains like Ethereum. However, the two types of blockchain play a different role in the digital asset ecosystem. Taproot and other BIPs should not be viewed as a catch-up. Instead, investors should consider the value-generating aspects of a more efficient Bitcoin, especially with an emphasis on how innovative Bitcoin will become in comparison to other stores of value (e.g. gold).

Overall, readers should not fear Taproot as its intentions will make Bitcoin significantly more efficient and identity preserving. These features will improve Bitcoin’s valuation and scalability as more transaction capacity and lower fees are crucial to growing the network effect.

Comments ()