Where's the Bitcoin floor?

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 77

It has been a miserable month for Bitcoin, especially the last ten days. While these down days have been tough, the worst ones have been linked to events.

Recent key events

18 May - China bans financial, payment institutions from cryptocurrency business.

18 May - OCC to review crypto-related guidance issued under former Acting Comptroller Brian Brooks, who is now the Head of Binance US.

13 May - Musk says crypto energy use “insane” and Binance under investigation by Justice Department and the IRS.

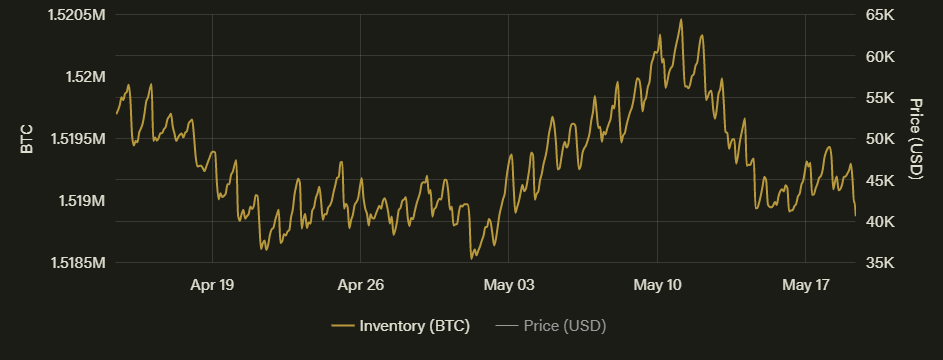

11 May - Bitcoin miners reduce their inventories. They normally take advantage of market strength, but they break the lines and sell an additional 1,000 BTC into a soft market.

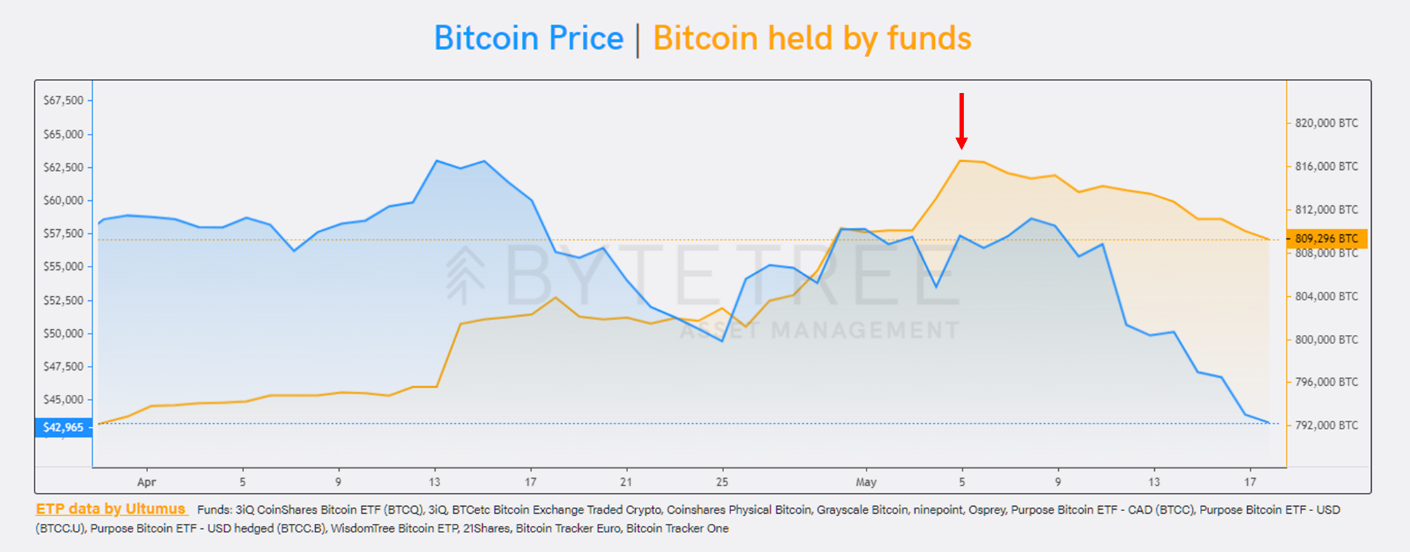

5 May – Bitcoin funds peak. Outflows follow and the funds start to sell over 7,000 BTC.

27 April - Musk announces the sale of 10% of Tesla’s BTC holding “to test liquidity”.

With the market having to absorb an additional 8,000 BTC, the bad news has weighed on the price. Who knows, but the likelihood is that Musk has sold some more, or perhaps even all, of Tesla’s estimated 43,200 BTC holding. If he hasn’t yet, he probably will.

As I have written many times this year, institutional flows have become extremely important in Bitcoin analysis. That is a change from previous cycles.

Recall that Tesla exacerbated Bitcoin’s recent hype cycle on 29 January when he came out as a Bitcoin bull. All he did was tag his Twitter account with “#Bitcoin”. The price duly soared.

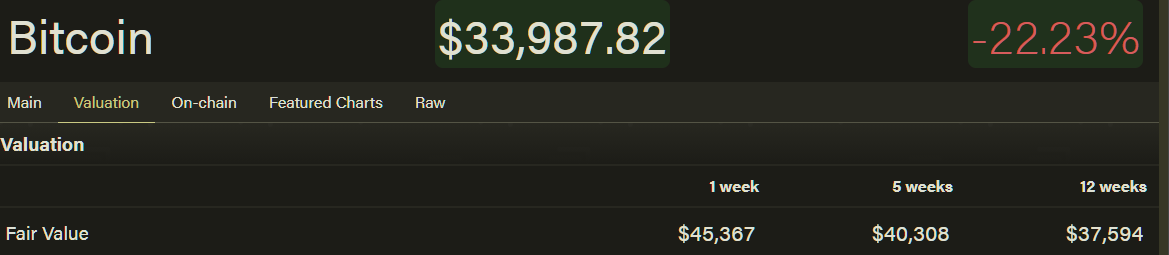

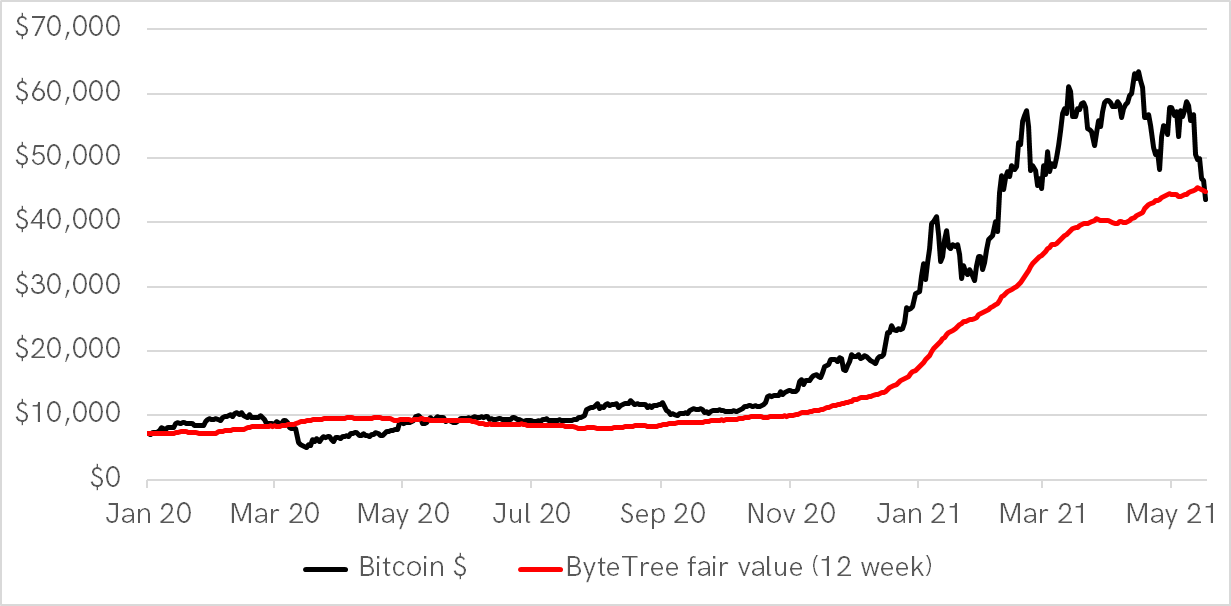

Fair Value

ByteTree data hasn’t seen the price this close to fair value since the breakout last October. It is now slightly undervalued relative to the level implied by the size of the network.

Fundamentals realigned

This is a positive takeaway on this miserable day, but better still, the underlying network activity is still growing, even if at a slower pace.

While that is positive, we have no idea how the network will hold up over the coming months, but we can track it in real-time.

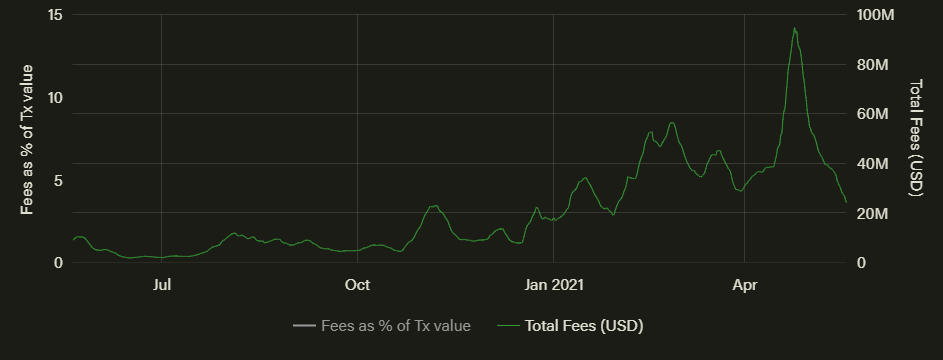

Network fees are a proxy for network demand. They normally spike when there is heavy demand for “space” on the blockchain, i.e. the ability to transact. They can also spike due to mining outages, which stall blockchain capacity, as we last saw in November and April. These dislocations soon pass, as the system is designed to self-correct. But it takes time.

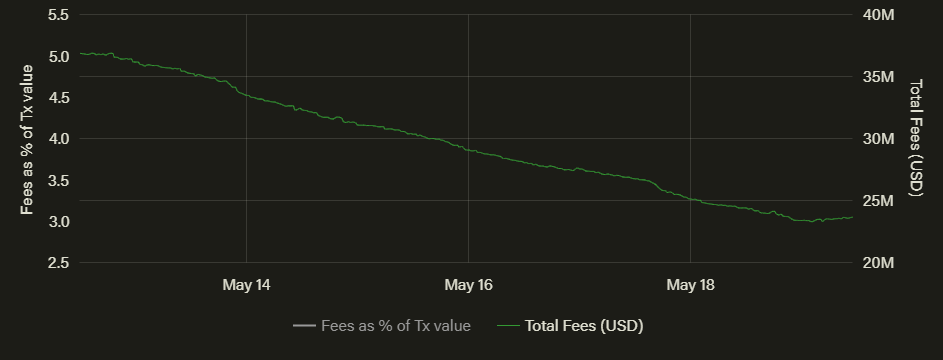

Fees have been dropping like a stone over the past month, back to January levels, when the price was in the $30,000 to $40,000 zone. A further drop below $20m per week may signal a change in trend, which would be unwelcome.

Yet just today, they have started to stabilise, and this will be a key chart to watch over the coming days. I very much suspect that if fees can hold these levels, the Bitcoin price will bounce.

Technicals

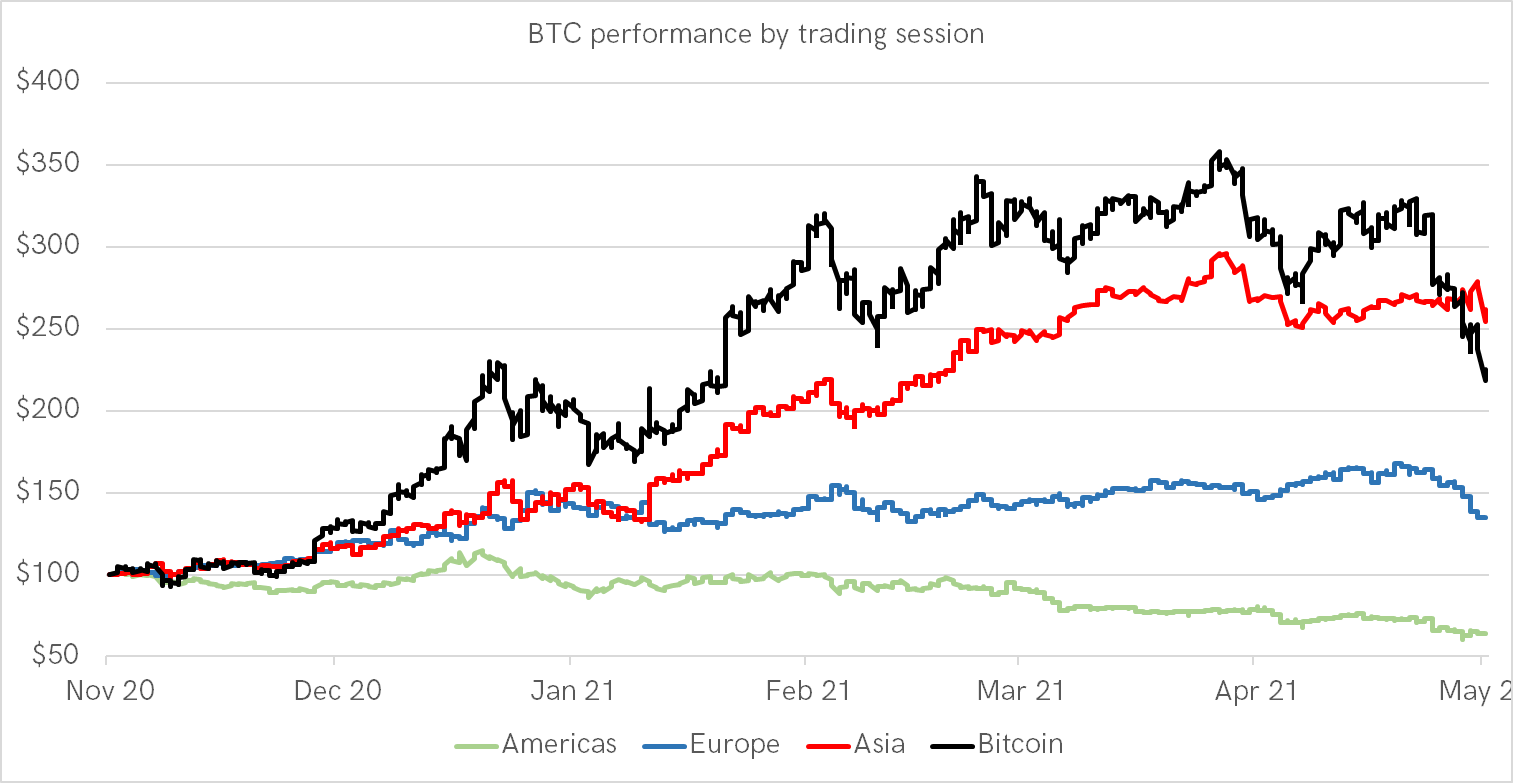

BTC trades 24/7, but patterns have emerged as if there were separate trading sessions, just like the old financial markets. Since November, Bitcoin’s 124% gains (over the period) have been surpassed during Asian trading hours, where gains of 162% have been seen. This contrasts with a 34% return during European hours and losses during American hours of -36%. Who’d have thought?

Bitcoin price weakness has come from the American trading session

There are a couple of other notable things to digest. The Asian high occurred on 14 April, in line with the price high. The European high set in on 15 May, while the American high occurred way back on 7 January. This makes me want to launch a strategy that avoids American hours. In any event, all three sessions have started to ease, with Asia still holding up the most.

Looking at the 24/7 price, it has slumped 26% below its 90-day moving average. That is extreme, and the fundamentals don’t appear to be weak enough to justify much more.

Bitcoin is heavily oversold

Longer-term, this five-year regression model has seen the bitcoin price double each year. It is currently close to the middle of the range, which should bring some comfort.

Middle of the range

The red line will touch $150,000 by the next halving in May 2024. Even the lowest green line will see $55,000.

The central bank balance sheets continue to grow, the dollar remains weak, and inflation is rising. The case for hard assets remains, although I would agree this isn’t true at any price. There must be a rational framework.

There can be no doubt that the January to May Bitcoin hype cycle has been closely linked to Musk. Hopefully, he’ll find a new hobby, preferably on Mars, and the crypto world can get back to work.

Comments ()