Bitcoin ETF Investors Buy the Dip

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 80

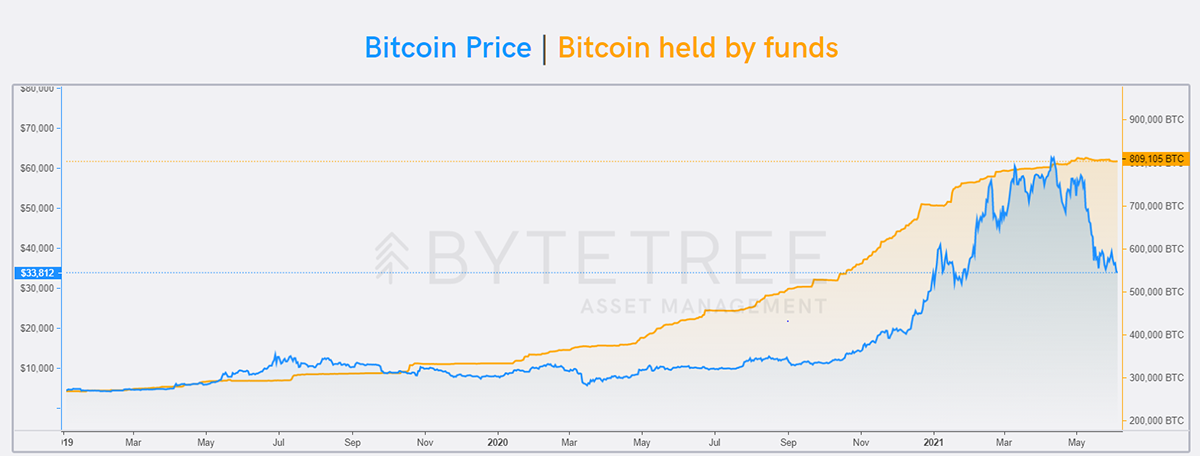

This past year has seen $9.3bn invested in Bitcoin via the ETFs (and funds), and they now collectively own 809,105 BTC between them. That is 4.7% of the known active total Bitcoin supply and has become the single most important, measurable source of demand.

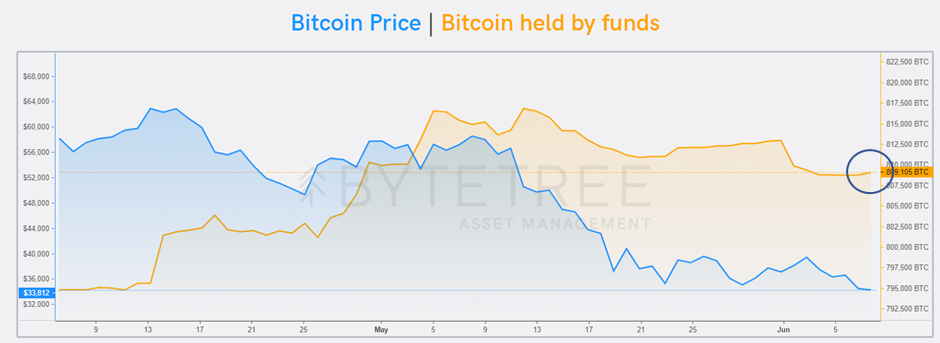

More so than ever before, the money flowing into Bitcoin from ETFs has been the main driver of the recent bull market. The funds saw peak BTC holdings on 12 May 2021, with 8,000 BTC leaving over the rest of the month. That wasn’t the only factor for a weak May, but it was certainly high on the list.

The good news is that we have just seen an inflow of 325 BTC, which isn’t vast. But it’s not an outflow and could mean those institutional investors are buying the dip.

They would have been smart to wait for the Musk months (February to April) to pass. They brought unwelcome hype, which was followed by misery. It could be that the institutions see the value and will accumulate Bitcoin whenever it tests the $30,000 area.

I can’t be sure they will, but what has surprised me the most is how only 8,000 BTC was sold in May, given the 50% price fall. I’d have expected more panic selling. That there wasn’t really does suggest the 809,105 BTC are in pretty strong hands.

It’s all ETFs now

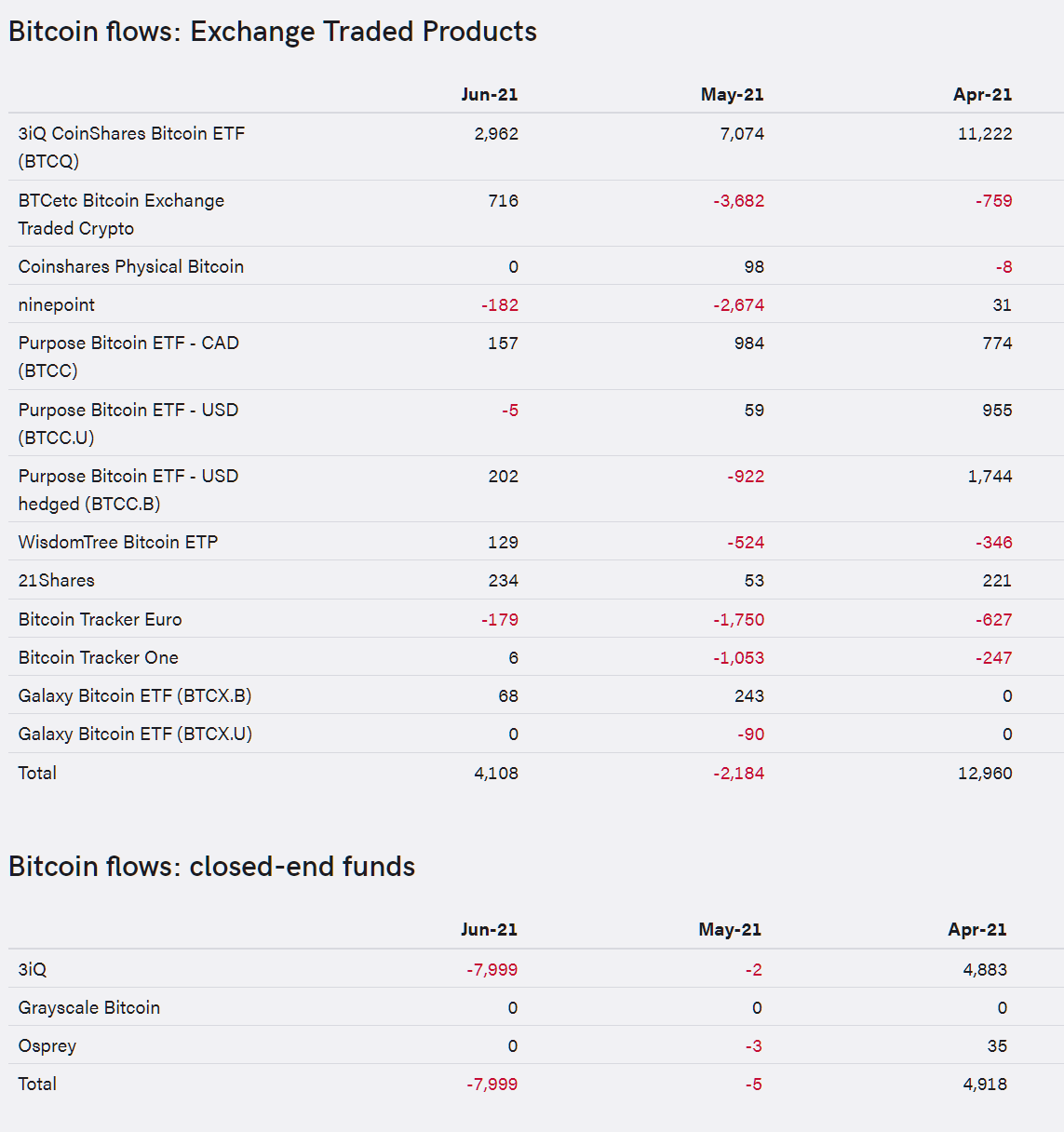

The other point I’d like to make about the fund universe is how closed-ended funds have rapidly morphed into ETFs. The latest example comes from 3iQ (QBTC).

In recent days, a third of the fund was redeemed (approx. 7,999 BTC). Yet rather than the money leaving Bitcoin, 2,963 BTC immediately showed up in the 3iQ CoinShares ETF (BTCQ).

3iQ, Galaxy, Purpose and ninepoint have all taken advantage of Canadian ETF rules that allow them to create and redeem shares at net asset value, without the risk of the shares trading at a discount, as seen by Grayscale (GBTC). Investors have lapped up the opportunity to switch from a closed-ended fund to an ETF structure, given the chance.

GBTC have stated their intent to change their structure into an ETF in the future, but it remains unclear when that will be allowed to pass.

The good news for Bitcoiners is that ETFs are a much better option for investors than closed-ended funds. In Europe, we have only ever had ETFs, and now North America is shifting across, with Canada taking the lead.

There are several ETFs out there, and each one has a motivated sales force. More ETFs are coming too, and I see this continued institutionalisation as supportive.

You can see why $32,000 seems to have some support given this eight-year lookback. I started the regression at the 2013 peak. The annualised trend is a very convenient 100% per annum, with $32,000 BTC, bang in the middle of the range.

Bitcoin still doubling

I do not know how long 100% per annum can last. For a few more years perhaps, but not forever.

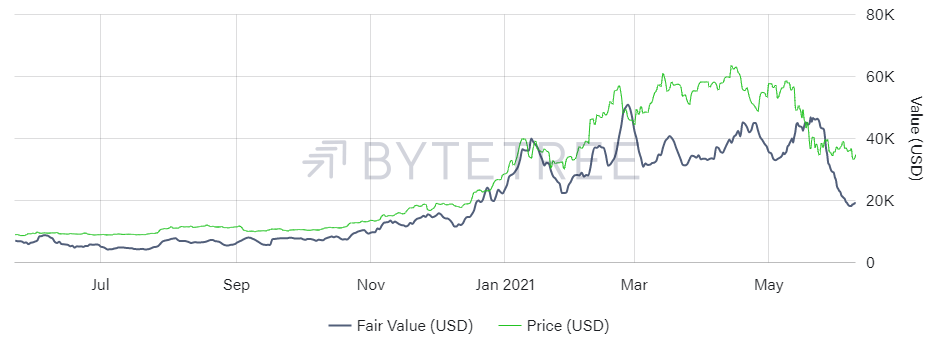

The funny thing is that ByteTree’s Fair Valuemethodology has consistently remained in the $30k to $40k range this year. That brought some criticism when the price was $60,000, but my take would be that price didn’t deserve to be there. To be worth that much, more networks activity would be required, and it didn’t come.

Fair Value was right, while price was wrong.

Price duly obeyed ByteTree’s model and has drifted back towards our target. The bad news is that our target has shifted lower since, as network activity has dried up. The short-term indicator now sits at a miserable $19,277 Fair Value target.

For a sustained Bitcoin recovery, we need to see more network activity; it’s as simple as that. In the meantime, I am more inclined to preserve capital than to buy the dip.

Comments ()