Generating A Yield in the Digital Asset Ecosystem

Disclaimer: Your capital is at risk. This is not investment advice.

How to Make Your Money Work for You

Typically, investors have several yield generating opportunities. From a high level, a yield is an income generated from an asset. Bonds are the most typical assets that generate yield for investors; these turn debt into an asset by adding an interest payment. The most accessible yield opportunities for retail participants are typically the interest rate attached to a current or savings account.

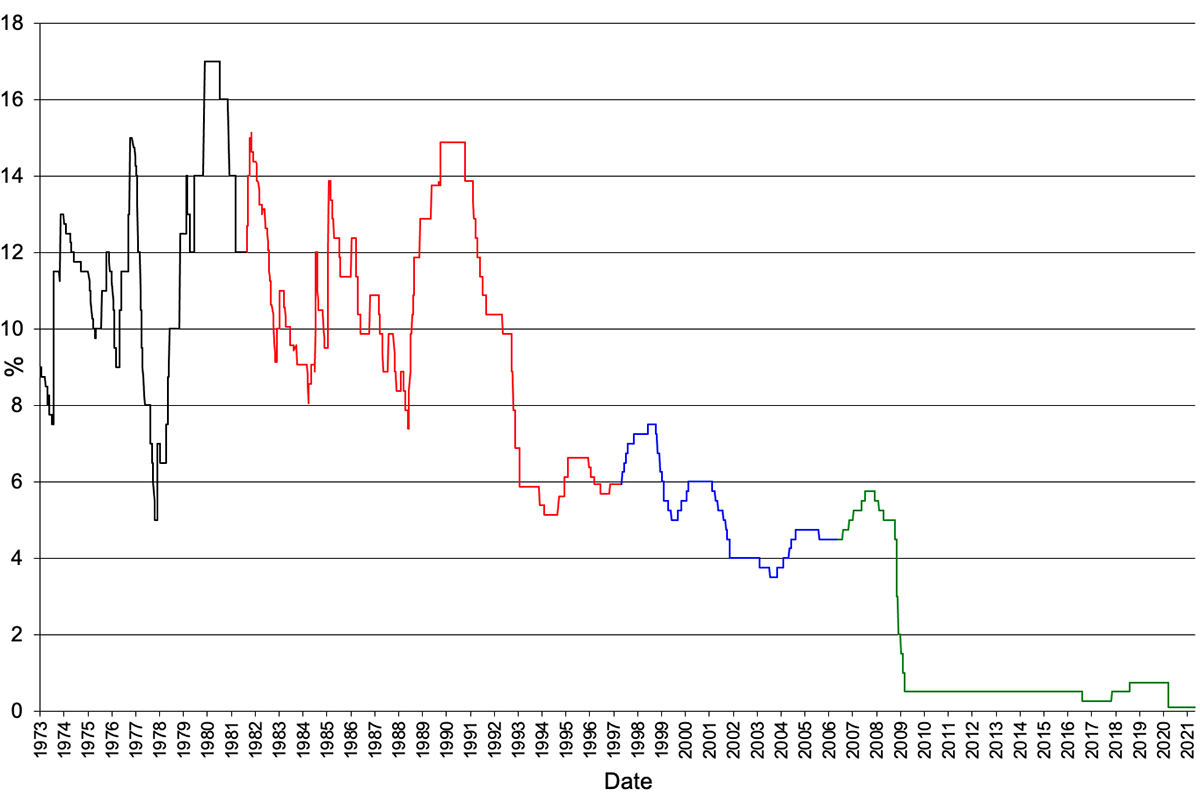

Traditional interest rates, which determine the income generated by these assets, have continued to fall since 2008. Illuminated by the excessive monetary stimulus in response to the pandemic, many countries in the European Union are likely to face further declines in interest rates and even negative interest rates. This leads to the question: is our FIAT money losing its value?

In the United Kingdom (see above), the bank rate, also known as the base rate, has fallen to a 10-year low. From a consumer perspective, the available yield for lending your money to banks has significantly diminished; nowadays, it barely generates value.

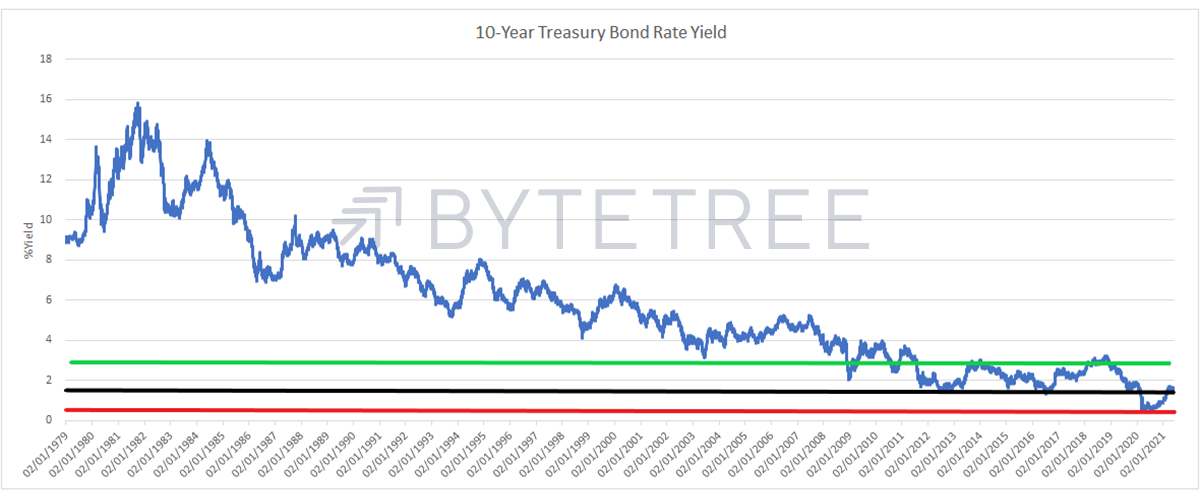

The End of Risk-Free Returns

The above chart highlights the issue further. Risk-free returns (bonds) have become unviable in the traditional investment world. An asset yield is key for a professional investor’s long-term portfolio. With the 10-year treasury rate sitting on the lowest band in nearly 50 years, investors must look to fill their portfolio with more lucrative but “risk-on” asset returns.

The Risk-Free Fallacy

Risk-free returns are a myth; simply holding an asset of any sort comes with an element of risk. For example, dividends are a yield generated by a share; this is not risk-free because you are exposed to the price action of the asset held. Decentralised Finance, or DeFi, is growing to become the sector that will empower its users to generate a generous reward for this risk. Although, let’s not get ahead of ourselves; DeFi protocols are incredibly risky. According to Messari, between 2019 and February 2021, nearly $300m was stolen in DeFi exploits.

DeFi is a new and innovative sector within the digital economy’s financial stack; it’s a complex sphere of niche sub-sectors that aim to disrupt traditional finance. It is positioned perfectly to improve traditional credit and lending, FIAT-alternatives, currency exchange and derivative sectors.

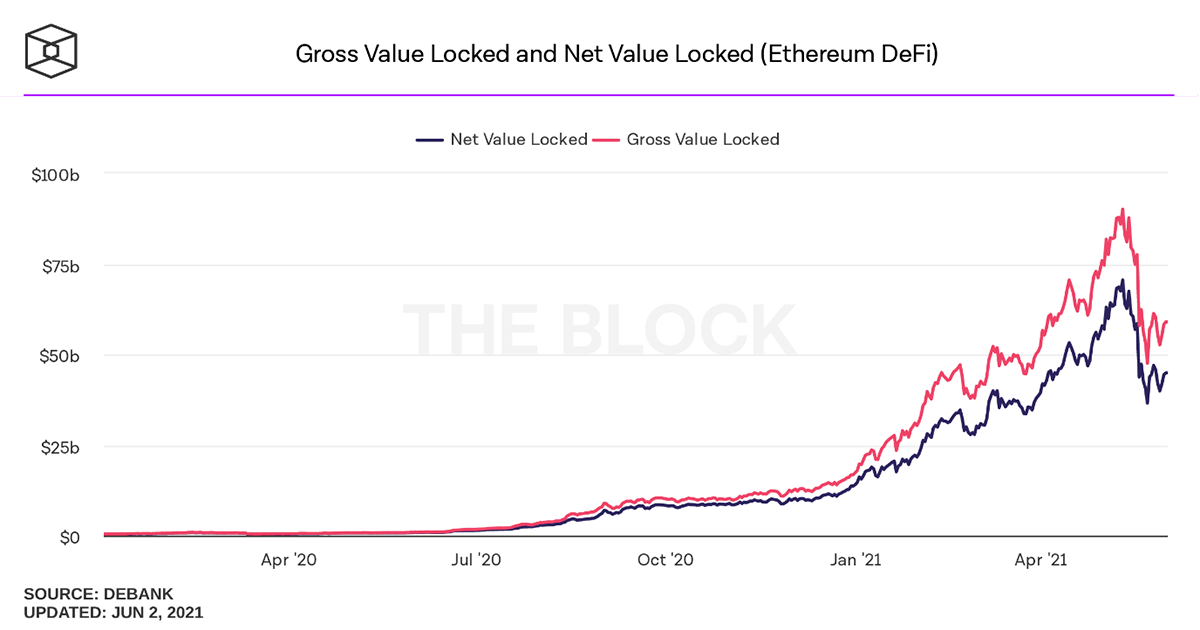

Total value locked, or TVL, relates to the number of digital assets operating within DeFi. Participants can put their assets to work by locking them into decentralised applications (dApps), which are essentially trustless “neo-neo” banks. In under 12 months, DeFi’s TVL has grown exponentially to over $50bn. This is minuscule in comparison to its traditional counterparts but remember, we are at the cutting edge. This sector has significant growth potential.

Within DeFi, protocols are the vessels that replicate traditional finance more transparently and without the need for users to trust centralised “middlemen”. In crypto, this concept is termed “trustless” or “decentralised” and is a backbone of DeFi ideology. Fabian Scharexpresses it perfectly:

“[DeFi’s] architecture can create an immutable and highly interoperable financial system with unprecedented transparency, equal access rights, and little need for custodians, central clearing houses, or escrow services, as most of these roles can be assumed by "smart contracts.”

Smart contracts equip dApps with the functionality they need to compete with the traditional world. Due to their coded structure, smart contracts excel in security and reliability (If they are set up correctly). A blockchain’s consensus ensures that any changes made by these contracts are valid and available for public scrutiny.

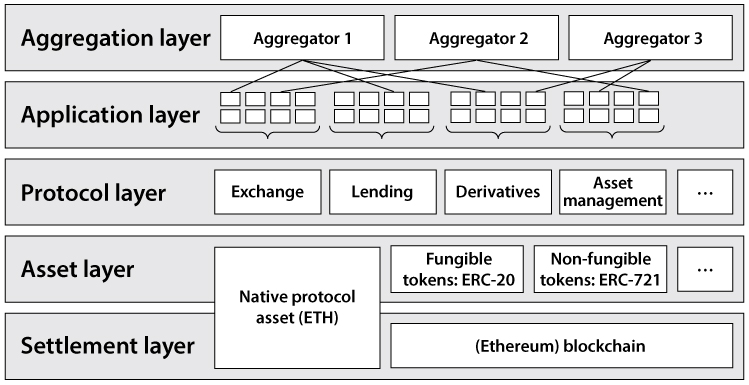

The DeFi Stack

Investors should start their DeFi journey by understanding the DeFi stack. This relates to the framework of the sector and how its “money legos” fit together.

The stack has systematic risks that are often overlooked as the layers are hierarchal. This means that if the Ethereum blockchain has an issue (i.e. the settlement layer), then each layer above will suffer as a result.

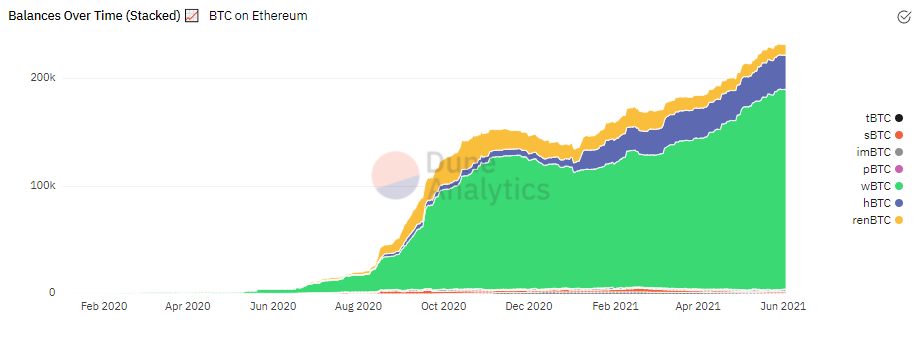

Tokens exist in the asset layer, and interestingly, this is where wrapped versions of Bitcoin reside. According to Dune Analytics, over 230,000 BTC flow within the Ethereum ecosystem, which equates to around 3% of Ethereum’s entire market cap. To answer one concern held by sceptics: yes, you can generate a yield on your Bitcoin.

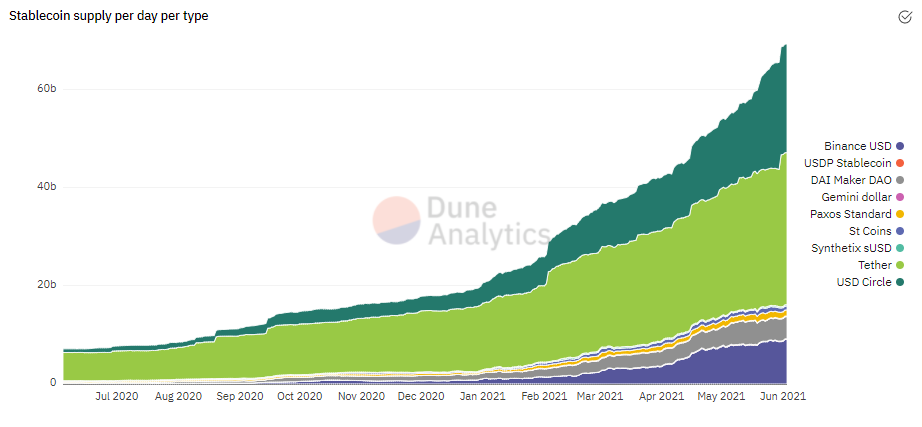

Digital USD-alternatives also exist in the token asset layers as “stablecoins” and are typically pegged one-to-one with the US dollar. Some have physical treasuries from which they issue stablecoins (USDC and USDT), while others are collateralised with digital assets (e.g. Maker’s DAI).

Over $70bn of stablecoins are in circulation on Ethereum, which is around the size of the BBVA Group’s Socially Responsible Investment Fund for Europe in 2020. This is still cutting edge, but not something to be dismissed.

Generating a Yield

Investors looking to generate a yield in the DeFi space must learn about the settlement and asset layers to be better equipped before utilising the protocol and application layers. Additionally, ETH (the native currency of Ethereum), stablecoins and Bitcoin “clones” make up the vast majority of the DeFi lending market.

This brings us to the most accessible way to generate a yield. Lending to a decentralised asset pool is a perfect example of a trustless process. Here, the traditional bank is cut out the process of matching two parties, which enables a global quasi peer-to-peer lending system. The lending rates are relatively positive, with the range for USD-stablecoin loans ranging between 3-11% over the last 30 days (according to DeFiRate).

Liquidity mining was the catalyst behind the DeFi boom, which quickly turned the space into a billion-dollar industry. Liquidity mining rewards are like stock warrants. From a high-level, stock warrants are issued by a company to an investor as a way to raise capital. Ownership of these warrants entitles their holders to shares at a certain price, exercisable typically within a year or two-year timeframe. It is not uncommon for stock warrants to accompany purchases of shares.

In DeFi, instead purchasing the additional reward at a set price in the future, participants are incentivised to hold their “warrants” over a longer period of time to increase the yield they generate. If you like, Ethereum gas is the price to realise the value generated. From a high level, liquidity mining changed the course of DeFi because it offered lenders and borrowers an opportunity to generate value in two ways.

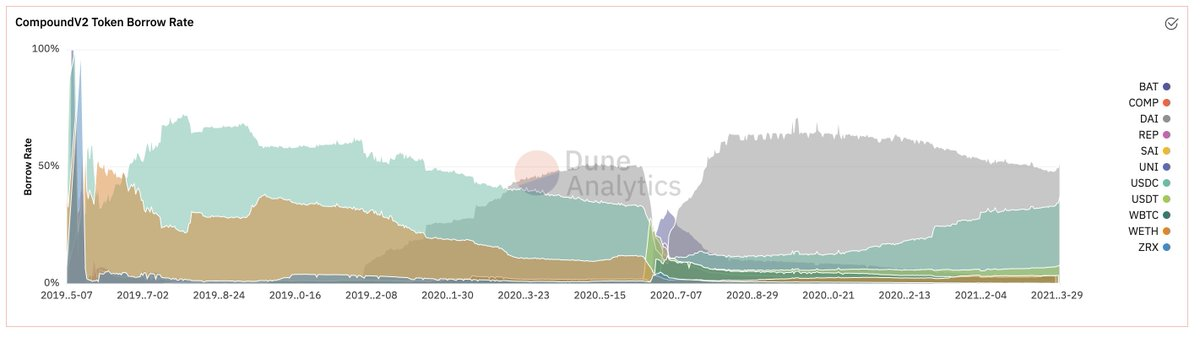

Compound.Finance, which is one of the top lending and borrowing protocols, incentivises its lenders by rewarding them with their governance token COMP on top of their credit yield (which is the equivalent to an interest rate in a current account). Borrowers are incentivised too. They receive the COMP token in exchange for being a “customer” of the protocol. They are literally being paid to borrow, which generates a yield to offset against part of the cost of the debt.

Yes, you are reading that correctly, borrowers of ETH are making 3.15% in annualised return. Investors should note that this is a variable rate algorithmically determined by the ongoing borrow vs lend spread in the protocol.

Market Distribution

| Market | COMP Per Day | COMP Supply APYt | Supply APY | COMP Borrow APY | Borrow APY | Total COMP Distributed |

|---|---|---|---|---|---|---|

| DAI | 880.38 | 2.17% | 2.79% | 2.88% | 4.39% | 496,130 |

| Ether | 141.25 | 0.31% | 0.12% | 6.06% | 2.91% | 30,450 |

| USD Coin | 880.38 | 2.29% | 2.06% | 3.71% | 3.61% | 198,154 |

| USDT | 126.8 | 1.68% | 2.49% | 2.47% | 3.97% | 45,092 |

| WBTC | 141.25 | 1.01% | 0.35% | 11.29% | 4.81% | 10,589 |

Source: Compound.Finance. Current rates for Compound.Finance.

Supply and Borrow rates are determined by the current supply and demand on the protocol’s money markets. As of 3rd June 2021, lending markets are highly saturated, meaning there is an excess of crypto depositors while borrowers are scarce. This is hardly surprising considering the record liquidations that the digital asset market has generally experienced recently. According to Coindesk, over $10bn of liquidations happened on Sunday 18th April 2021.

Collateralisation is a defining factor of DeFi, as each debt position needs to be verifiably backed up by assets. Suppose you want to lend your digital assets on Compound.Finance, you must lock them up as collateral. This enables you to borrow assets from the platform’s money markets. However, should an asset’s price fluctuate dramatically, a user’s position could be liquidated (i.e. stopped out).

Leverage your Debt position: Yield Farming.

If you consider yourself, or perhaps a section of your portfolio, as higher risk-taking, then yield farming may be for you.

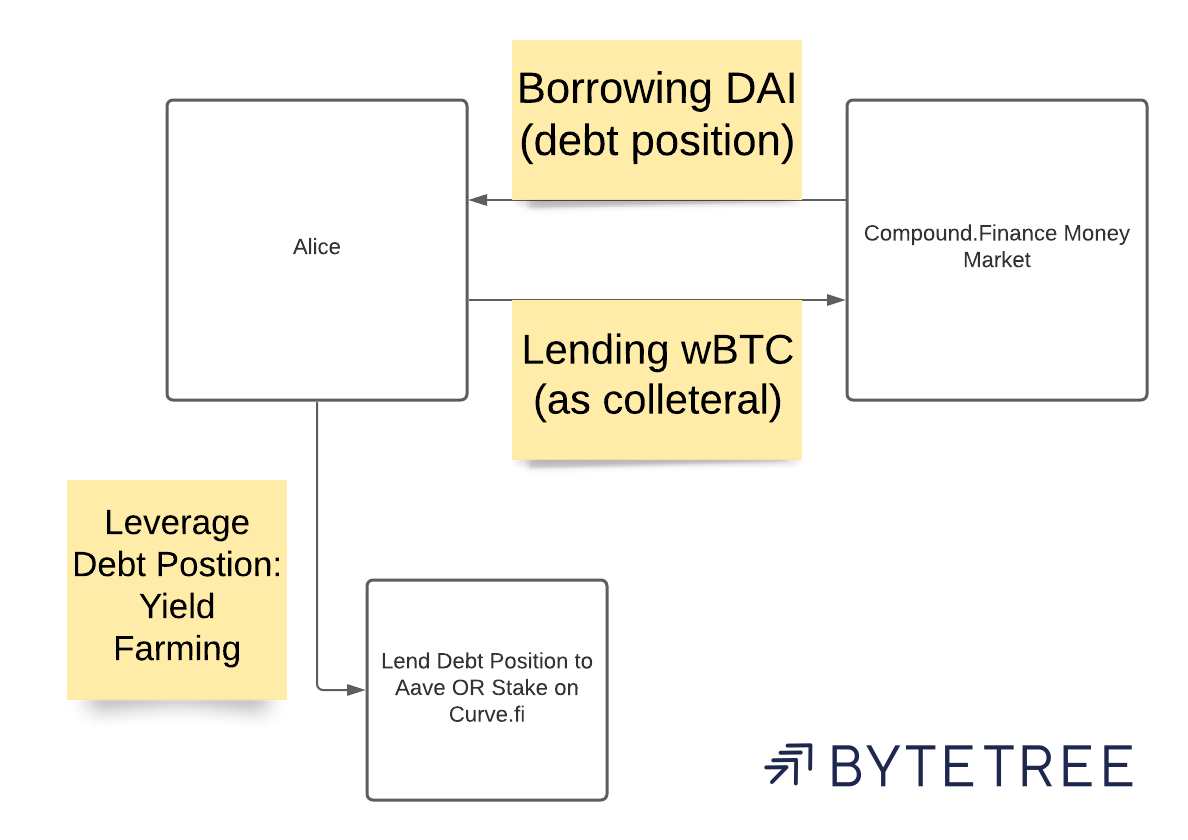

Yield farming is the act of continuously leveraging your position by lending borrowed assets on multiple different DeFi protocols. This can be an incredibly lucrative business if the market plays in your favour or if you use the right assets and have a large margin.

Let’s take a look at an example. Alice collateralises (i.e. lends) her wrapped Bitcoin on Compound.Finance, and borrows Dai against her collateral. Now she has a debt position which she can use as she wishes. If she wants to leverage her debt, she can take her borrowed Dai and lend in on Aave (a similar protocol to Compound.Finance) and earn a yield this way. She can go even further by borrowing from Aave and then take those borrowed assets to a staking platform like Curve.Fi and earn a reward for liquidity providing to an automated market maker. Staking and liquidity providing are outside the scope of this article, but they are part of a professional investor’s yield farming operation.

The risk of this chain of leveraged debt is immense, and the tiniest price fluctuations can cause a domino liquidation effect, which is bad news. Alternatively, many investors have made unfathomable returns because of a well-planned operation and, of course, with a boatload of luck.

Closing Thoughts

DeFi has a long way to go until it is adopted into the mainstream market. As the world of decentralised finance finds its place in the real world, there are countless opportunities for investors to generate a yield on their crypto.

In this article, we also touched on the high-risk vs high-reward mechanics of yield farming. Please note that this is no casual hobby, but a competent investor can boost overall return on their investment while staying long on their favourite crypto assets.

The future of DeFi, and the yield opportunities it presents, is promising for users and investors alike. The sector has gone from $1bn to $70Bn in collateral over the past 12 months and continues to grow fast. The journey has only just begun.

Comments ()