Quant(itative) Analysis

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: QNT;

From a high level, the Quant and Overledger networks have highly ambitious targets. With regards to QNT, it has performed incredibly well as an investment.

Company

QNT and Overledger are overseen by the Quant Network, an incorporated company in Switzerland (since 2017) and the United Kingdom (since 2015). Quant’s vision is predominately centred around the Overledger, which enables developers and enterprises to generate value for ecosystem users by creating multi-chain communicating applications (mApps).

Team

The Quant team has an impressive repertoire, in particular Gilbert Verdian, the CEO. He has worked at PWC, HSBC and in government roles, such as the European Commission, US Federal Reserve and the Bank of England. In his previous job, he was the Chief Information Officer for Vocalink (Mastercard), managing around $6trn (according to CryptoSeq).

The product manager, Martin Hargreaves, was previously the Vice President of Vocalink (Mastercard). Guy Dietrich, the Managing Director of Rockefeller Capital ($30bn AUM), is on the board of directors. As far as the team goes, it is credible.

Partnerships

Quant has several valuable partnerships with the likes of Oracle, Nvidia, Hyperledger, Amazon Web Services, AUCloud, AllianceBlock and SIA. However, as an investor, I would like to see this list grow. The ambition of the Quant Network certainly needs a broader plethora of partnerships. With the team’s credibility, I am surprised that there are not more active and public partnerships.

Funding and Companies House

According to Crunchbase, Quant first raised capital through an ICO in 2018, and since then they have performed a Venture Round in July 2020 at an undisclosed amount. Upon further reviewing their Companies House, we found three company names (one dissolved) under the same address. With their most recent audit (year ending September 2019) showing a depleted balance sheet, I would expect another funding round is needed in the near term.

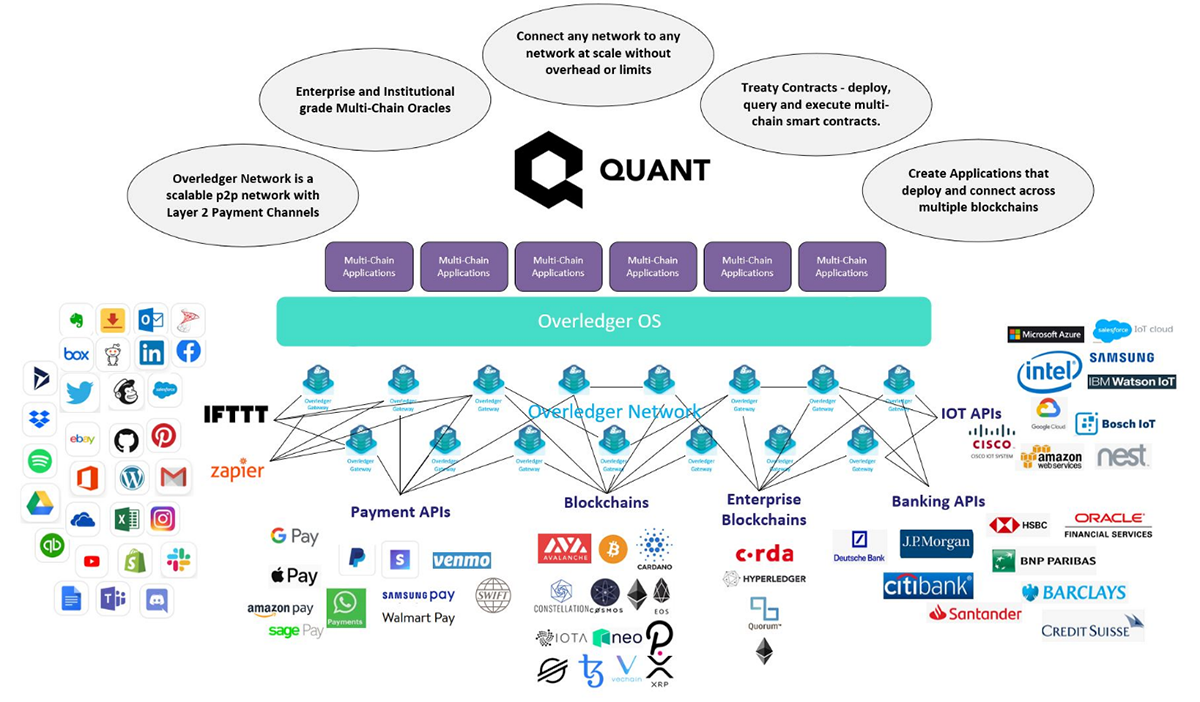

The Ecosystem

Readers need to understand the aim of the Overledger network to realise where QNT fits in. In a nutshell, Quant’s Overledger is an enterprise distributed ledger operating system. Overledger connects DLT and API blockchains across the entire digital asset space, thus providing a scalable and interoperable system. In essence, it is acting as a one-stop app store to connect blockchains and their applications to enterprises, developers and retail customers.

The Overledger Network is made up of many “gateways”. These gateways enable access to a resource (i.e., a DLT, data, mApp or API) at a cost to the user (e.g., a license).

The Token, QNT

The token, QNT, is an Ethereum-Based ERC-20 token that acts as the utility token for the wider Quant and Overledger Network. The table below outlines the different utility factors for QNT in more detail.

| QNTs Utility | Explanation |

|---|---|

| Licenses | To use the Quant platform, developers, gateway operators, and enterprises must buy an annual license with FIAT. Users will also need to hold QNT to run mApps and access the Overledger ecosystem. |

| Network Fees | Just like ETH, all Quant users will be required to have QNT to pay for using the network. |

| Platform Fee | A platform fee, which is calculated as a percentage of the license fee, must be paid by the enterprise. |

| Add-on Services | Additional features and services (charged) have not been announced. |

| Community Treasury | See: How the Overledger Network Community Treasury powers the Network of Networks, Overledger Network Treasury, and Github: Overledger Treasury Community [technical] |

| Centralised Quant Treasury | This enables enterprises/off-chain participants to pay for licenses in FIAT to receive a locked balance of QNT, which depletes over time. |

| Marketplaces | The Oveledger aims to mimic Apple’s AppStore revenue model and ranges from: free, paid, subscription and in-mApp purchases. |

Source: CryptoSeq. See more of QNTs utility here.

Overall, QNT is needed in the Quant ecosystem and is essential for the success of Overledger. Therefore, potential should be viewed as fairly unilateral.

Recent News

In the past six months, there have been several catalyst worthy events. Most notably, the released upgrade of Overledger and CCS G-Cloud 12 framework.

17 June 21 - Overledger 2.0.1 Live

27 April 21 - Overledger 2.0 launch

19 April 21 - Quant partners with LCX to advance CBDC Settlement Implementation

31 March 21 - Quant partners with LACChain

25 February 21 - Naiad Angel appointed as new CMO

29 January 21 - Overledger 1.5 released – Enabling Mainnet Interoperability

29 September 20 - Quant names a supplier on UK Government’s Crown Commercial Service (CCS) G-Cloud 12 Framework

21 July 2020 - Alpha Sigma Capital invests in Quant

Technical Analysis

May saw a sharp rise for QNT, with a consequent breakout just before June. At the moment, there is quite a lot of air beneath QNT, and investors should expect to see a base form (i.e., consolidation).

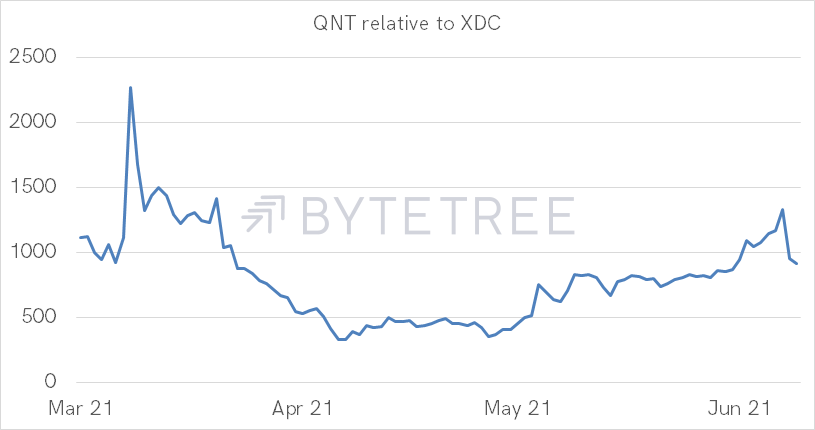

Closest Competitor Analysis, XDC token

ByteTree’s momentum models identified XDC alongside QNT (as of 18/06/21); the blockchains are similar as they focus on interoperable networks. Over the last two months, QNT has outperformed XDC relatively. However, in June, the performance gap is tightening.

What is interesting to us is that a new theme may be developing, as these are currently the only two tokens showing strength. There are no guarantees that will last, but if the mainstream adoption of their technology flourishes, that strength will only grow.

| General | |

| Token Ranking (by Market Cap) | 84 |

| Market Cap | $922,196,354 |

| Price | $71.41 |

| 24hr Exchange Volume | $18,066,608 |

| Token Analysis | |

| Total Supply | 14,612,493 QNT |

| Minted Supply | 14,612,493 QNT |

| Circulating Supply | 12,874,667 |

| Supply Held by Top 100 Holders | Over 75% |

| Total Holders | 18,471 |

| Comparative | |

| Traditional App Market Size | Android and IOS app revenue reached $111 billion in 2020 |

| Apple App Store Revenue, 2020 | $21.5bn |

| Google Play Store Revenue, 2020 | $10.4bn |

| Traditional Gaming Sector App Revenue, 2020 | $79.5bn |

Source: BusinessOfApps; CoinGecko; Etherscan. Stats table for QNT.

The QNT token has not yet breached the top 75 tokens, which indicates growth potential. QNT currently has one of the lowest volumes in the top 100 and needs to see a higher exchange-traded volume to progress. The low exchange volume is most likely due to the second-tier centralised exchanges (and Uniswap) that it is listed on. Watch out for a listing on a major exchange, like Binance, as this would significantly impact QNT’s price.

From a token supply and distribution perspective, the ownership is centralised. This needs to widen as small holdings could be at risk of a liquidity drain. However, there is a small total supply, around 14m tokens, and with no inflation (due to no minting), it looks to be scarce; this could make QNT an asset in the future.

Furthermore, readers should understand that once a developer or enterprise purchases a license, the amount of QNT needed to pay the license is locked up in the Quant Treasury for the contracted period. Essentially, this vests a proportion of QNTs supply by taking it out of circulation. Consequently, short-term deflationary aspects can create a positive supply-and-demand scenario.

Lastly, we have decided to include a “Comparative” section, due to the lack of data available. This looks at the sector which QNT is likely to disrupt, i.e. traditional app stores. The market is significant, and even if QNT was a drop in the ocean, disrupting the traditional app store sector would make a huge difference to its price; QNT has the potential to generate one of the largest revenues in the digital asset space.

QNT Conviction Summary:

- Crypto market: Currently high risk as network data is soft.

- Hype vs Reality: Good potential, needs actualisation.

- Trade or Trend: Trade but needs to create a base.

- Market Outperformance: Short-term, yes.

- Competitive Advantage: Relatively, yes.

Token Takeaway Score: 3.5/5

Comments ()