Liquidity and Leverage: Why MicroStrategy Trades at a 100% Premium

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 81

Over the past 30 trading days, MicroStrategy (MSTR) has seen an average daily trading volume of $450m. With a market cap of $6.1bn, the company sees 7.3% of its stocks change hands each day.

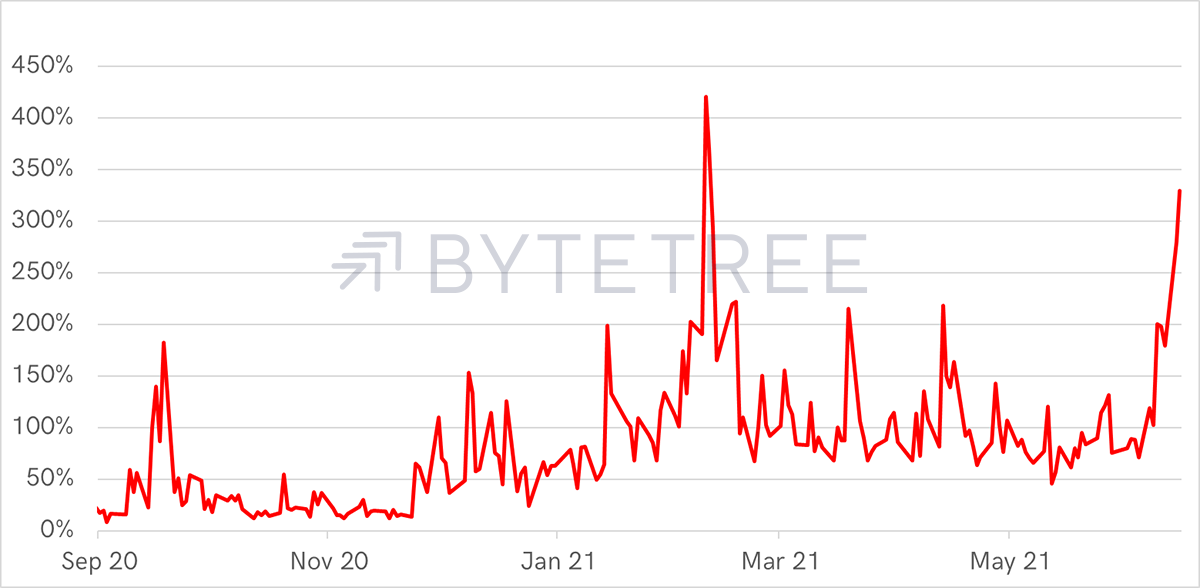

Contrast that to the $23bn Grayscale Bitcoin Trust (GBTC), which trades $350m per day or 1.5% of its stock. I compare the value traded of MSTR and GBTC below. Yesterday MSTR’s value traded was 329% greater than GBTC.

MicroStrategy value traded compared to Grayscale Bitcoin Trust

MSTR is cementing itself as the number one Bitcoin trading vehicle.

Liquidity is said to command a premium. The knowledge that you can trade in large size has value. In the case of MSTR, that value is currently 100% above the value of the company’s Bitcoin stash, as I will illustrate.

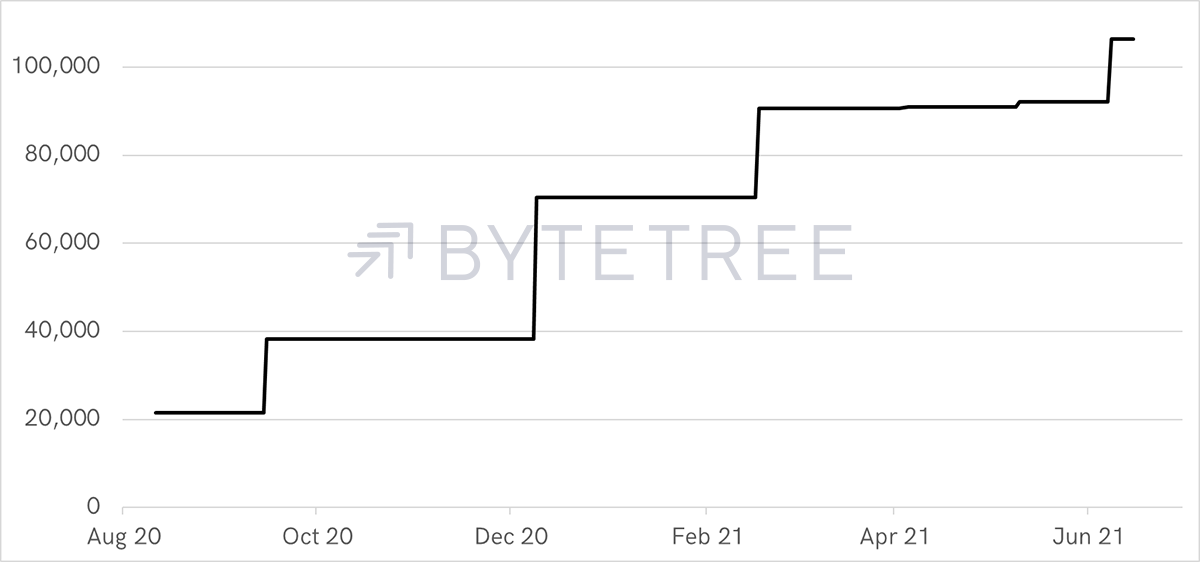

It all began last summer when MSTR’s CEO, Michael Saylor, went on a spending spree. First, he invested the company’s cash pile into Bitcoin, accumulating 38,250 BTC. Not satisfied with that, Saylor issued a convertible bond in September for $650m, boosting the holding to 70,470 BTC. Another convertible followed in February, increasing the holdings to 90,531 BTC.

There were two modest additions paid for from MSTR’s cashflow, followed by the latest $500m bond issue last week. I estimate MSTR today hold 106,365 BTC. The exact number will no doubt be released shortly.

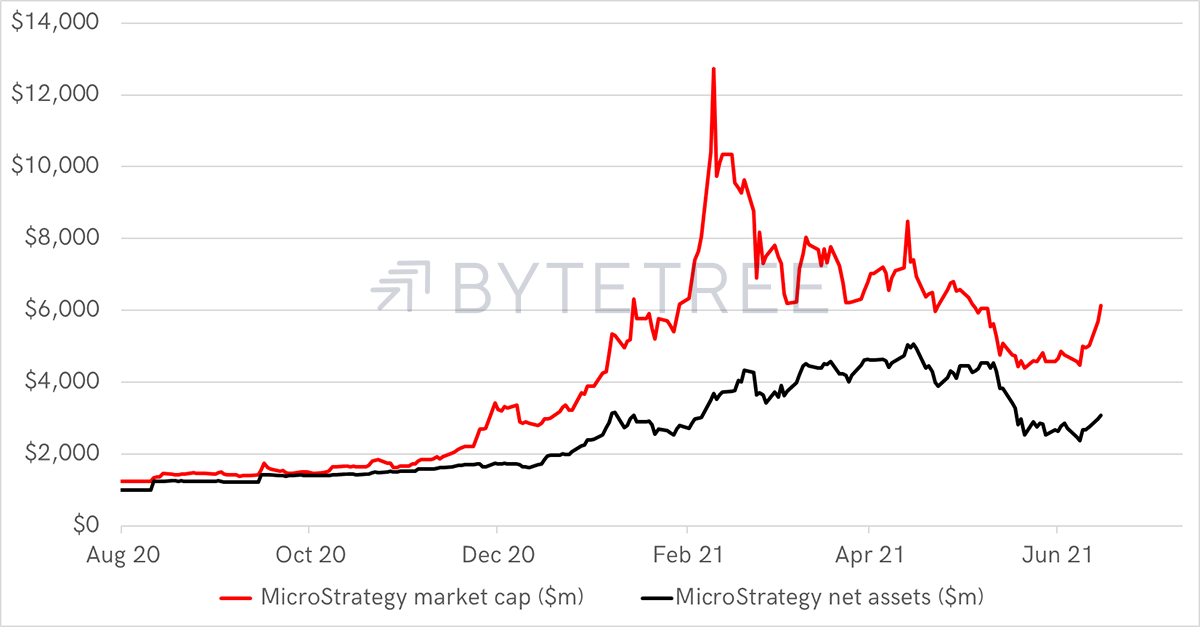

The chart shows the company’s market value and the value of its underlying assets. MSTR’s net assets fell from $5.1bn in mid-April to $3.07bn today, yet the company is still valued at $6.15bn, which is 100% above fair value.

MicroStrategy shrugs off a lower Bitcoin price

The difference between the lines is the premium. 0% would mean MSTR trades at fair value. It is currently 100% or twice fair value. Notice how that spiked in February around the time Tesla caused all the excitement. That was a whopping 250%.

The MicroStrategy Premium is 100%

The premium dipped to 22% on 12 May when Bitcoin traded at $55,000. Since then, Bitcoin is down by 26%, while MSTR shares have risen 16%. This truly is remarkable stuff.

Why has GBTC seen its premium disappear while MSTR’s has ballooned?

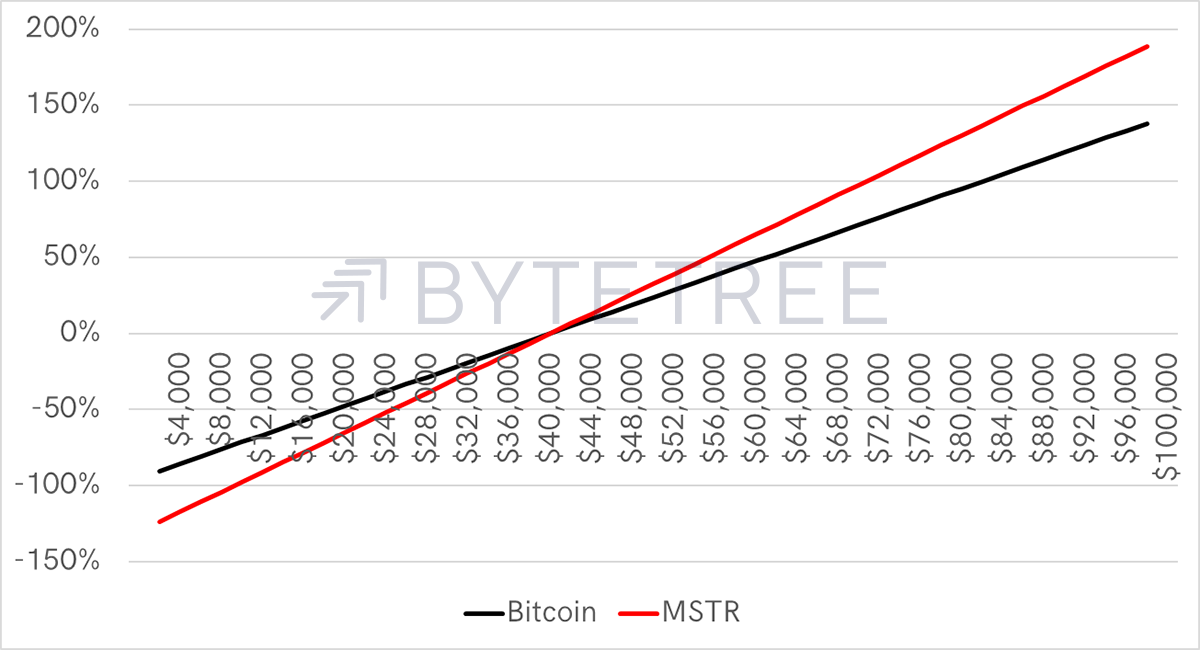

I think the answer is the lure of leverage. MSTR’s balance sheet is geared toward $2.2bn of debt. The result is that the value of MSTR stock rises 1.4x faster than the price of Bitcoin, offering investors leverage.

Should Bitcoin rally to $100,000, a BTC investor would see a 138% return from the current $40,000 price. In contrast, an MSTR investor would theoretically make 188%.

The trouble is that MSTR trades at a 100% premium, and so much of the return is already priced in. Also, premiums are risky and they will not always exist. How can I be sure? Because premiums have never lasted, and GBTC is a recent example. Buying MSTR at a 100% premium effectively means you are paying $58,000 for Bitcoin, which is currently worth $40,000.

MSTR trades at $630 per share, but the shares are worth $393. There’s a GameStop (GME) thing going on here, and by the way, GME shares are still through the roof.

Not only will MSTR’s balance sheet rise 1.4x faster than BTC, but it also works in reverse. It will fall 1.4x too. At a $12,000 BTC price, MSTR’s equity (software company and BTC) will match its debt. Below that level, its equity becomes negative, and I suspect the shares would hover close to zero.

But that’s unlikely because Saylor is smart. His bonds start to mature from 2025, where he will have to refinance. 2025 is a year after the next Bitcoin halving. He is betting that the halving will lead to a much higher BTC price, which will make refinancing a piece of cake.

I can see the attraction for the bulls who want free 1.4x leverage, but the benefits are only fully felt if the shares trade at fair value. Otherwise, you give up that leverage entirely and expose yourself to the risk of the premium collapsing. It was 22% just a month ago!

Issuing more stock

How to benefit from a premium? Issue more stock and buy more Bitcoin.

MSTR has announced that it will issue $1bn of stock, and those proceeds will keep on gobbling up that Bitcoin.

Regular readers know that the miners sell around 28,000 BTC each month, worth around $1.1bn. I think Saylor wants to buy the lot, and so long as his premium lasts, he can keep issuing stock and keep on buying Bitcoin.

Maybe the MSTR premium is telling us something. It was 22% on 12 May, just before the price of Bitcoin collapsed to $30,000. Was the collapse in the premium predictive?

Today it is 100%. Maybe, just maybe, the MSTR premium is sending us a message that the price of Bitcoin is going up. Alternatively, it’s just another sentiment indicator and the market is too hot to trot.

Comments ()