Ethereum's Layer 2 Solutions

Ethereum has dominated innovation within digital finance, tokens, art, music and gaming through utilising its decentralised applications (dApps) and universal token standards (ERC-20, ERC-721, ERC-1155). However, this popularity has created two core problems: scalability issues and a loss of market share to “Ethereum Killers”. This article will focus on “layer 2” solutions, which aim to significantly improve Ethereum’s user experience.

The Scalability Problem: Ethereum’s Double-Edged Sword

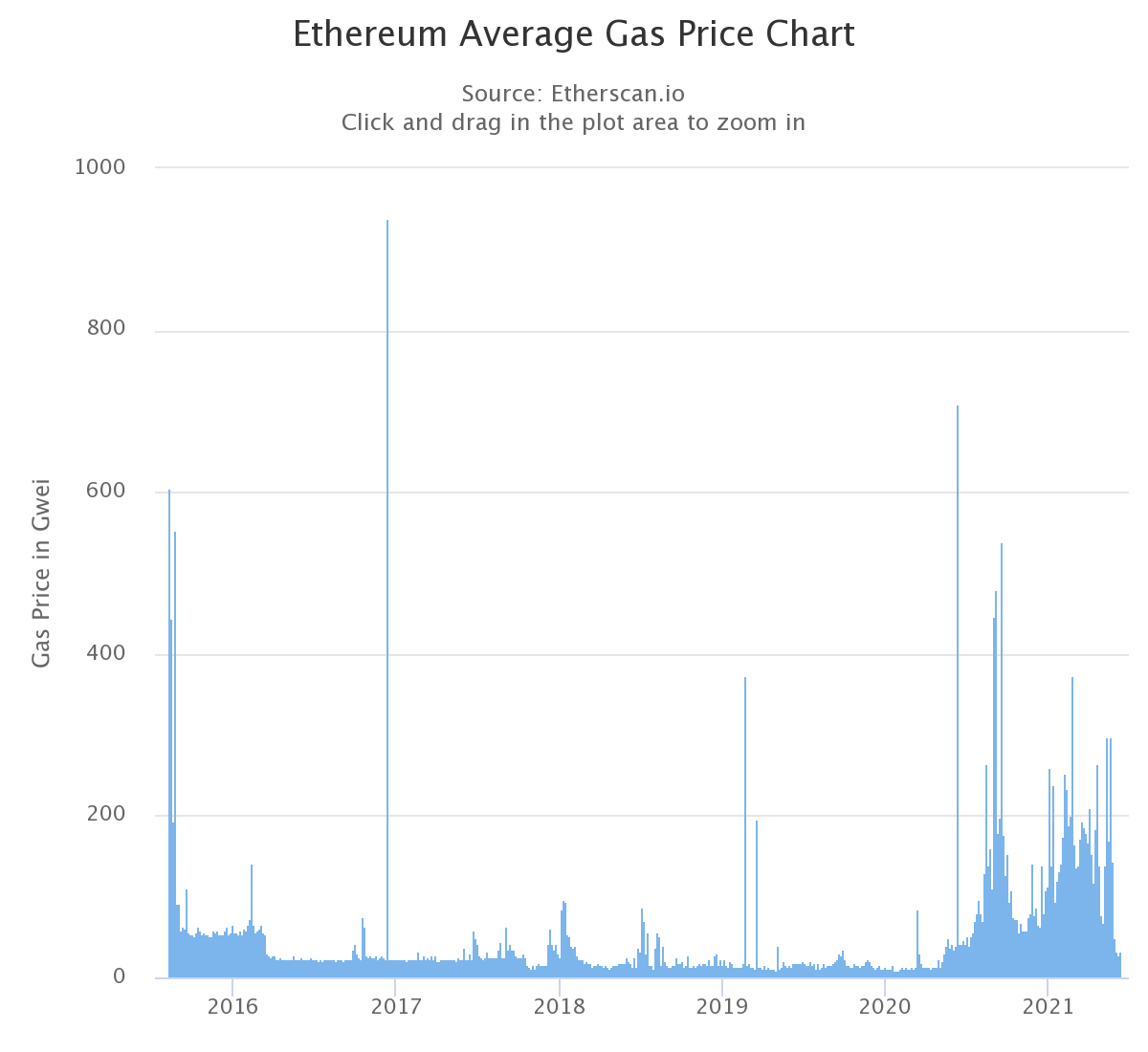

Scalability issues refer to a blockchain’s inability to accommodate pending transactions at a stable transaction cost. Block space is like a commodity; it is scarce and highly sought after. “Gas” is the transaction fee on Ethereum, which plays a fundamental role in compensating miners for their computational power used to secure Ethereum’s current proof-of-work model.

Transactions tend to outweigh the block space available, which can lead to high transaction fees. This creates a “pick-and-choose” situation on behalf of the miners. Practically, this means that users who want to process their transaction quickly would have to pay more in gas than other users. Consequently, periods of high network usage can cause gas prices to skyrocket.

Since the boom of decentralised finance (DeFi) in July 2020, Ethereum’s users have endured a prolonged period of high network costs. Historically, this has been the most expensive year to use the Ethereum network. On the other hand, it has arguably been the most opportunity-bearing year, with the rise of DeFi, NFTs and tokens.

There is a definite causal link between opportunities arising and the cost of the network. Meaning, the more money-making opportunities, the more transactions. This causal chain is the main contributor to Ethereum’s scalability issues.

The other side to Ethereum’s gas issues relates to MEV, or Miner Extractable Value. Essentially, miners choose the contents that fill each transaction block, which creates a “bad actor” situation. It’s bad because miners can choose the most profitable ways to fill a block at the detriment of market users (there is always two sides to a trade). I realise this issue is not quite that simple, but the bare bones are outside the scope of this article. Instead, I’ll refer interested readers to this fantastic research piece: “Flash Boys 2.0”.

Scalability Issues Threaten Ethereum’s Market Dominance

Ethereum is a smart contract blockchain from a high level, meaning that its primary use case is to harbour protocol-based innovation. Smart contracts are highly complex operations and tend to involve several transactions at once. This can cause a high-cost network, which has been a long-standing problem for Ethereum ever since the ICO and CryptoKitties boom in 2017, although it remains the dominant blockchain for smart contracts and protocols (for now).

Protocols are better known as decentralised applications (dApps) and rely on smart contracts to generate opportunities for market participates. For example, the dApp Compound.Finance is built on Ethereum and enables users to call certain functions to generate a yield through utilising smart contracts. It’s important to note that dApps do not solely exist on Ethereum. Over the past year, we have witnessed the rise of “Ethereum Killers”, which could potentially challenge Ethereum’s dominance in the space.

The Binance Smart Chain (BSC) has proven that other blockchains can take on Ethereum. Essentially, BSC copied how Ethereum works but tweaked its scalability trilemma, which looks at the technical makeup of a blockchain (find out more). Consequently, BSC accommodates four times more daily transactions, a staggering 4.3m, in comparison to Ethereum’s 1.1m (as of 15/06/21).

It’s likely that Ethereum’s dApp sectors (credit, staking, insurance, NFTs, DeFi etc.) will continue to fragment to other chains, ultimately causing a multi-chain paradigm. This means that smart contract blockchains will have a much more competitive landscape, where each chain will try to entice users with their respective dApps.

Off-Chain Scaling is Key

The Ethereum community is very ambitious in its attempts to mitigate the issues caused by high network fees. There are three main solutions; Layer 2, EIP-1559 and ETH 2.0. Whilst we acknowledge that EIP-1559 and ETH 2.0 are important, we have covered them previously, and therefore this article will focus on Layer 2.

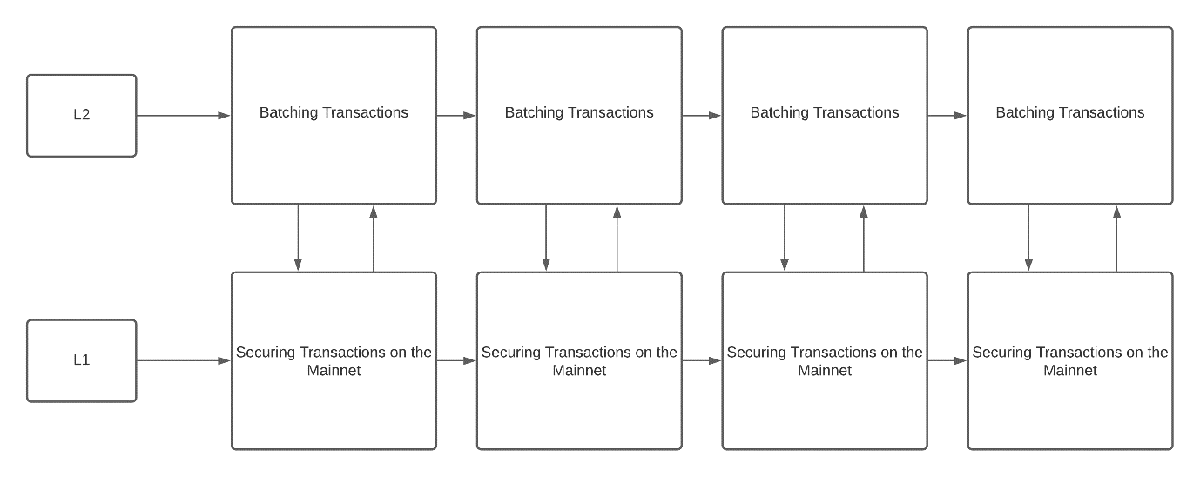

From a high level, Layer 2 (L2) solutions aim to scale applications on the mainchain by handling transactions separately from Layer 1 (L1). Some solutions broadcast transaction data on-chain (Rollups), while others create a bridge to another chain, i.e., Ethereum Virtual Machine* (EVM) compatible. Both increase transaction throughput speed while reducing cost. Moreover, the security of the L1 blockchain is not compromised because all transactions remain secure on a mainchain or sidechain.

*The EVM is a virtual computer that exists on the Ethereum blockchain. Essentially, this computer is responsible for memory, storage, and processing the execution of smart contracts on the mainchain. From a high level, it is an essential part of running Ethereum. Each of its processes requires external computational power, which carries costs to its operators that are paid in gas.

As previously mentioned, high demand on the Ethereum mainchain often causes two things: an expensive-to-use network and slow transactions. Currently, the solutions that aim to help scale L1 are either far away from completion (ETH 2.0) or are unlikely to fix the issue entirely (EIP-1559). Therefore, Ethereum must find a way to settle transactions outside of its main chain; this is where L2 solutions come in.

Layer 2 solutions aim to increase the transaction throughput without sacrificing decentralisation, security, or viable transaction costs. Typically, transactions are transmitted to a server or node that does not require block capacity from L1. Instead, the transactions are batched into groups on L2 and then broadcast to L1. Once transmitted, these transactions are secured on Layer 1 and made unalterable.

Rollups

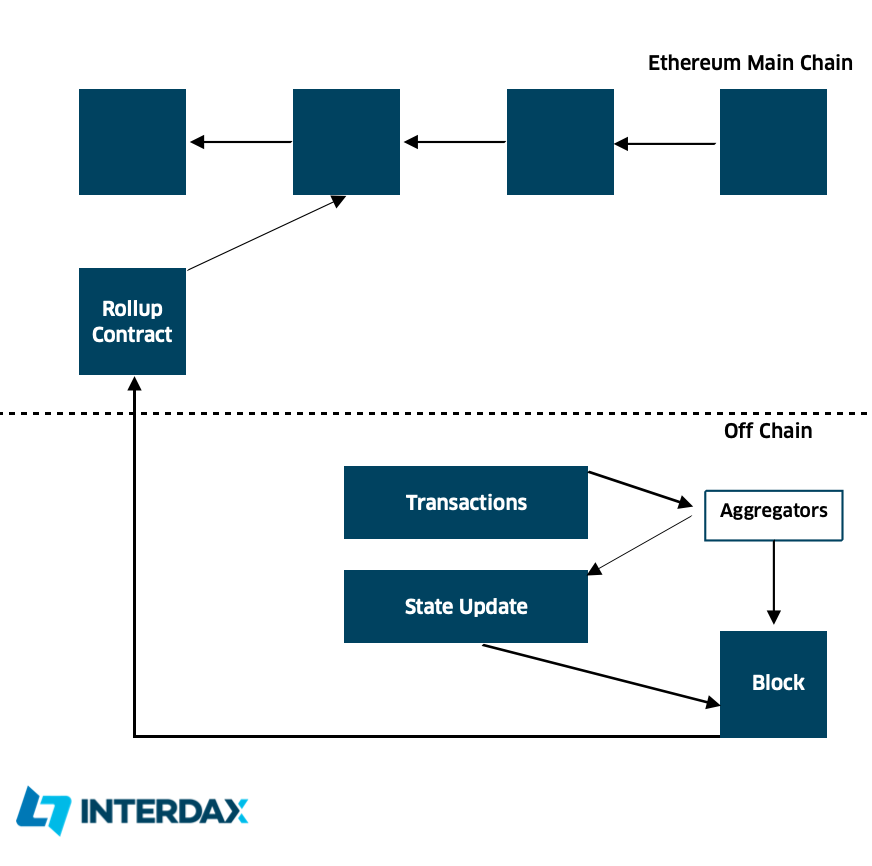

A Rollup is a type of L2 scalability solution, which has been under media attention in recent months because of two things: costly network fees and the long-awaited release of Abritrum and Optimism protocols. From a high level, Rollups are solutions that perform transaction execution outside of the L1 block space; Rollups keep the transaction data (and security) on L1 but remove the data-intensive side of a transaction.

This article will focus on two types of rollups: ZK-Rollups and Optimistic Rollups. These scalability solutions essentially offer three features: transaction execution off-chain, data broadcast on-chain, and a smart contract that links L1 and L2. Notably, an operator/entity is required to run the connecting smart contracts, and an incentive must be available for this job.

Option 1: Zero-Knowledge-Rollups (ZK-rollups)

ZK-rollups batch vast quantities of transactions off-chain and then generate cryptographic proofs. These validity proofs (also known as SNARKs) are then broadcasted on L1, which enables an added layer of security and validates the transactions.

| Pros | Cons |

|---|---|

| Faster finality time since the state is instantly verified once the proofs are sent to the main chain. | Some don’t have EVM support. |

| Not vulnerable to the economic attacks that Optimistic rollups can be vulnerable to. | Validity proofs are intense to compute – not worth it for applications with little on-chain activity. |

| Secure and decentralised, since the data that is needed to recover the state is stored on the Layer 1 chain. |

Source: Ethereum.org. Pros and Cons of ZK-rollups.

Ultimately, this explanation from InterDaxsummarises the key points for ZK-rollups:

“In short, ZK-Rollup is an L2 scaling solution in which all funds are held by a smart contract on the main chain, while it performs computation and storage off-chain where validity of the side chains is ensured by zero-knowledge proofs.”

Overall, ZK-Rollups take the strain off the Ethereum mainnet, which significantly improves Ethereum’s scalability.

Option 2: Optimistic Rollups (ORs)

Optimistic Rollups are Layer 2 solutions that can run in parallel with Ethereum and process everything running on L1 by harnessing the Optimistic Virtual Machine (OMV), which is also EVM compatible. ORs are significantly better on a larger scale due to transaction aggregators only publishing the bare minimum data (and without proofs) to broadcast a transaction.

When aggregators broadcast rolled-up transactions to the mainchains, ORs assume no fraudulent actions have been committed and thereby require no proofs to say otherwise. This is partly why ORs have the ability to scale the Ethereum transaction throughput to between 200 and 2000 TPS, according to ETHHub; typically, mainnet Ethereum can accommodate 15 TPS. However, a disadvantage of ORs centres around the fact that they assume no fraud. If a Rollup is challenged, then a long process of unrolling and re-certifying happens, which is both costly and slow.

| Pros | Cons |

|---|---|

| Anything you can do on Ethereum Layer 1, you can do with Optimistic rollups as it’s EVM and Solidity compatible. | Long wait times for on-chain transaction due to potential fraud challenges. |

| All transaction data is stored on the Layer 1 chain, meaning it’s secure and decentralised. |

Source: Ethereum.org. Pros and Cons of Optimistic rollups.

Since computational power is not used to batch and secure the transactions, ORs, if left unchallenged, can provide a near-instant settlement with basically no gas fee; this is very bullish.

Closing Statement

Rollups are currently considered to be one of the best fixes to Ethereum’s scalability issues. They enable Ethereum to have an instant solution to the ever-growing competitive smart contract blockchain ecosystem. Rollups will also put Ethereum in a key position to pick the most lucrative sectors in the future multi-chain paradigm.

Overall, the technical nature of rollups seems capable of significantly changing the fee landscape on Ethereum. However, readers should understand that these are ultimately unproven concepts and might not be as effective as promised.

On a final note, sidechains and L1-compatible chains are also part of the ever-growing attempts by the ETH community to fix Ethereum’s capacity issues. However, since these solutions are much broader ecosystems and not specific scalability solutions, they will be covered in a future article. More actionable pieces will be available on ByteTree Premium, so look out for those.