Bitcoin Above $30k? This Needs to Happen

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 86

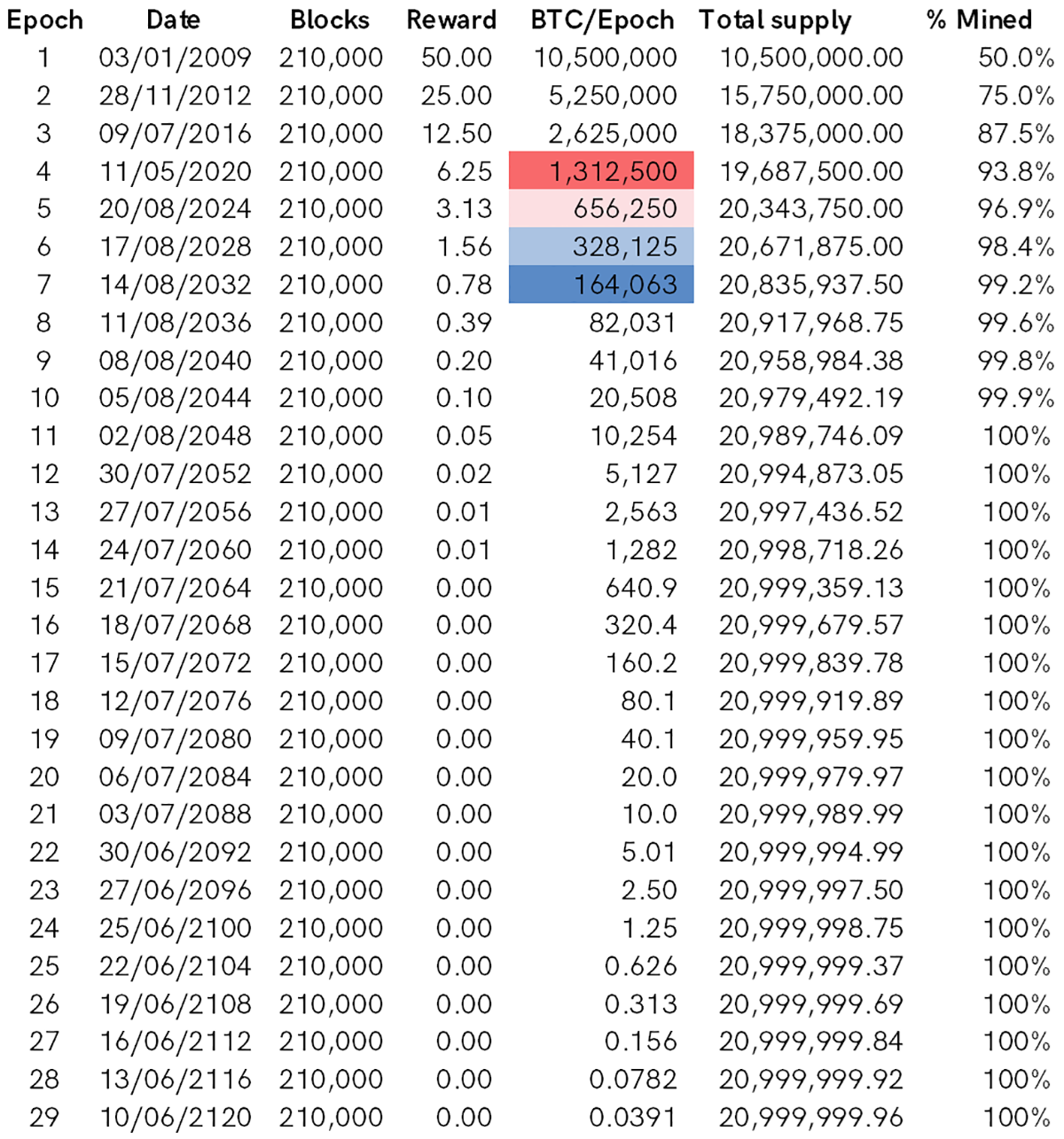

As of this morning, there are 148,012 blocks that will be mined ahead of the next halving. That was forecast to arrive in May 2024, but given the reduction of Chinese hashing power, halving looks likely to be delayed until 20 August 2024 (ByteTree forecast).

With 6.25 BTC per block (plus fees), that means 925,000 BTC are coming to market over the next three years. At that point, 19,687,500 BTC will have been mined, or 93.8% of the 21 million total.

Bitcoin doesn’t operate around the traditional calendar. It is split into epochs, which are approximately every four years but can vary. The bottom line is that halving is triggered by the code every 210,000 blocks. The average time between blocks is programmed to average 10 minutes, but that can vary, as we have recently seen.

The 21 million cap on the Bitcoin supply side has always been seen to be bullish, especially as we enter the gauntlet years. As of today, Bitcoin has been 89.3% mined, and will be 96.9% mined by 2028. Thereafter, the new supply dries up rapidly.

The Bitcoin Gauntlet

The ten-year bullish case is easy to make because this supply overhang eases off. But over the next three years, the challenge for Bitcoin will be to absorb the 925,000 BTC coming to market. At $30,000 per BTC, that amounts to $27.7bn of inflows.

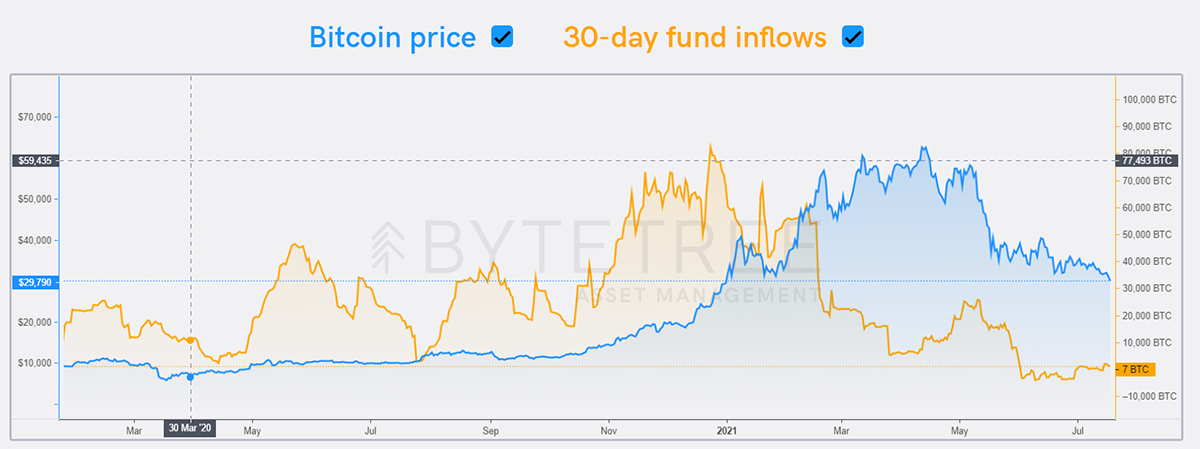

Last year, Bitcoin funds and ETFs saw $10bn of inflows. If that could be maintained, then $30,000 would provide a price floor. But recently, those flows have ground to a halt, which has likely contributed to the downward pressure on the Bitcoin price.

In past epochs, many more bitcoins had to be absorbed by the market, and they were. The network was smaller back then, and as a result, the average price over each epoch was lower yet made good progress over time.

| Epoch | Average Price ($) | BTC Mined |

|---|---|---|

| 1 | 5.40 | 10,500,000 |

| 2 | 340.70 | 5,250,000 |

| 3 | 5,733.23 | 2,625,000 |

| 4 | 27,431.48 | 388,788 (as of 20/07/2021) |

It is unknown how much of the past price appreciation can be attributed to limited supply, and how much to increased demand. At ByteTree, we have made the case that the future supply side is known, which is a positive. But limited supply does not create value, merely scarcity.

Scarcity can cause a price spike, such as we saw in silver in 1979 or lumber last year, but it doesn’t create lasting value. Spikes tend to be short-lived. True value creation lies on the demand side, and that is what makes us long-term bullish, notwithstanding recent price weakness.

We have little doubt that Bitcoin will be around for many years to come, and the broader crypto space will thrive. As more and more investors realise this, allocations will pick up because an army of bright young minds drives the innovation around us.

But when will this be? Investor interest could pick up quickly, or it could remain sluggish for many more months to come. I think that’s largely down to the macroeconomic forces at play, at least for the institutional investor.

If the world slows down and the central banks shift their focus to balanced budgets, debt repayment and interest normalisation, Bitcoin will be in for a tough ride, and 925,000 BTC will weigh on the market over the next three years.

If instead, investors realise that the chances of a “prudent Fed” scenario are close to zero, then demand will reassert itself quickly. Big structural deficits, growing debt and continued intervention will drive the case for alternative assets, of which Bitcoin is in a prime position to benefit.

925,000 BTC is a lot to shift with a prudent Fed slamming on the brakes. But as the purchasing power of FIAT money weakens at an ever-faster pace, that pile of BTC will be snapped up in a heartbeat. Should inflation prove not to be transitory, of which evidence is growing, then you shouldn’t have too long to wait.

Comments ()