Bitcoin Network Demand Model Update

Disclaimer: Your capital is at risk. This is not investment advice.

Week 30 2021

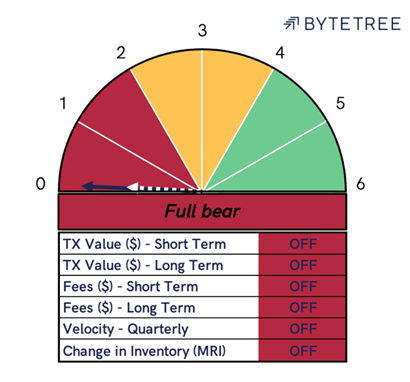

The Network Demand Model remains OFF this week, with the score remaining at 0/6. While the price of bitcoin has bounced sharply from the week’s lows of US$29,790.20 to close at US$35,226.95 on 25/7/21, the price action hasn’t so far been corroborated by a pick-up in network activity. This suggests shorter-term technical factors are at play rather than a change in underlying trend.

The model therefore remains in cash, as it has done since 2nd June at a price of US$36,706.

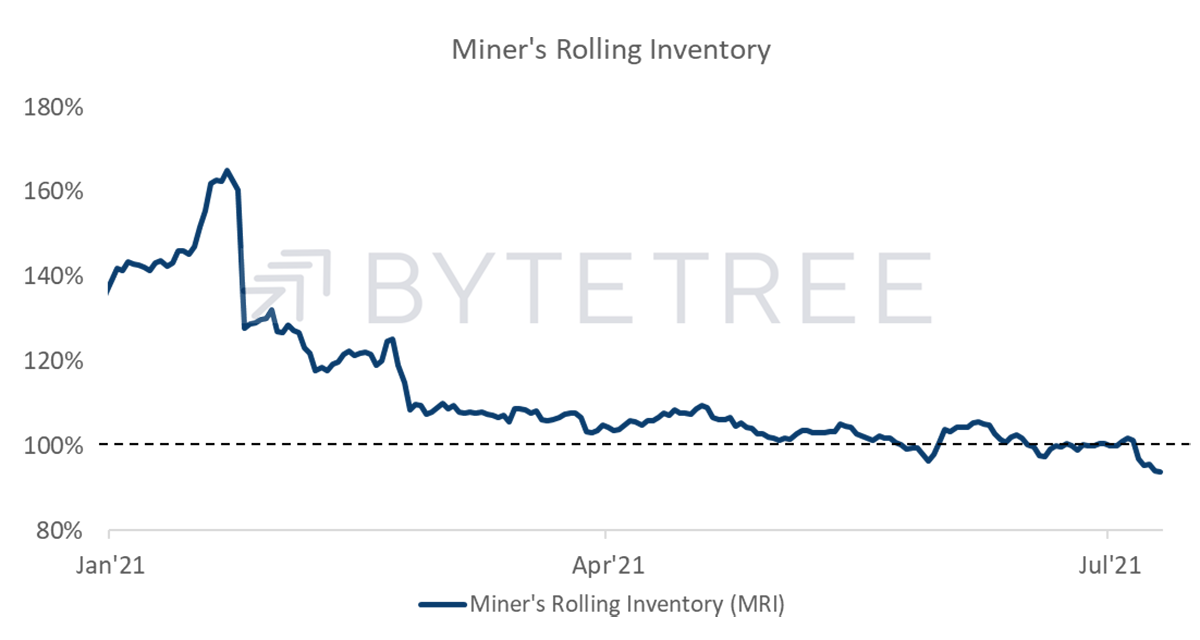

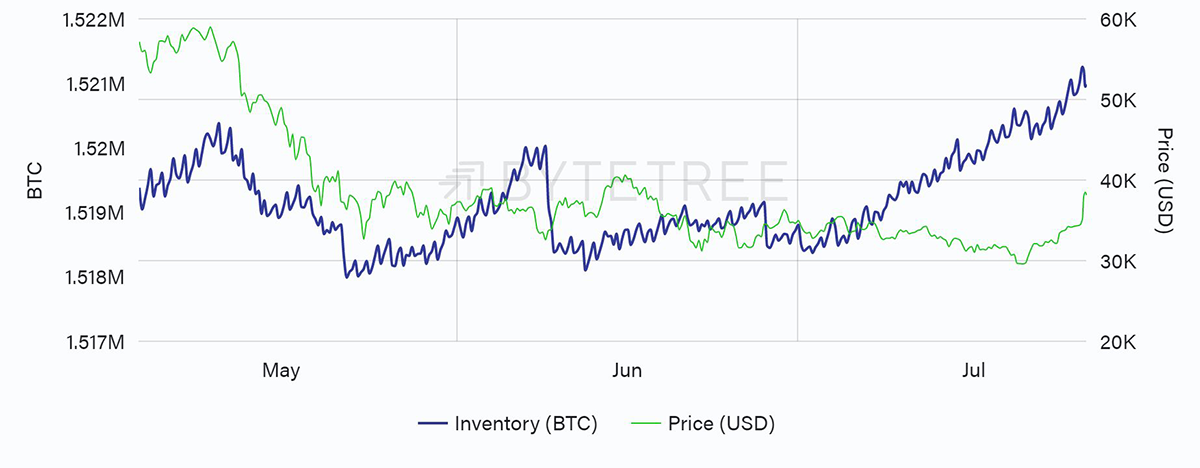

With the bitcoin price ranging between US$30-40,000 we are on the lookout for signs that the short-term indicators are starting to pick up. As of yet, there is scant evidence. The Miner’s Rolling Inventory metric is “OFF” and continues to decline, which means “unspent” inventory rises. This is a weak set-up for sustained positive price performance, unless there is a meaningful increase in demand.

The better news on the demand front is that while the short-term indicators are weak, they have at least stopped deteriorating. That said, the longer-term series are a long way from turning back on, suggesting the price remains rangebound for the time being.

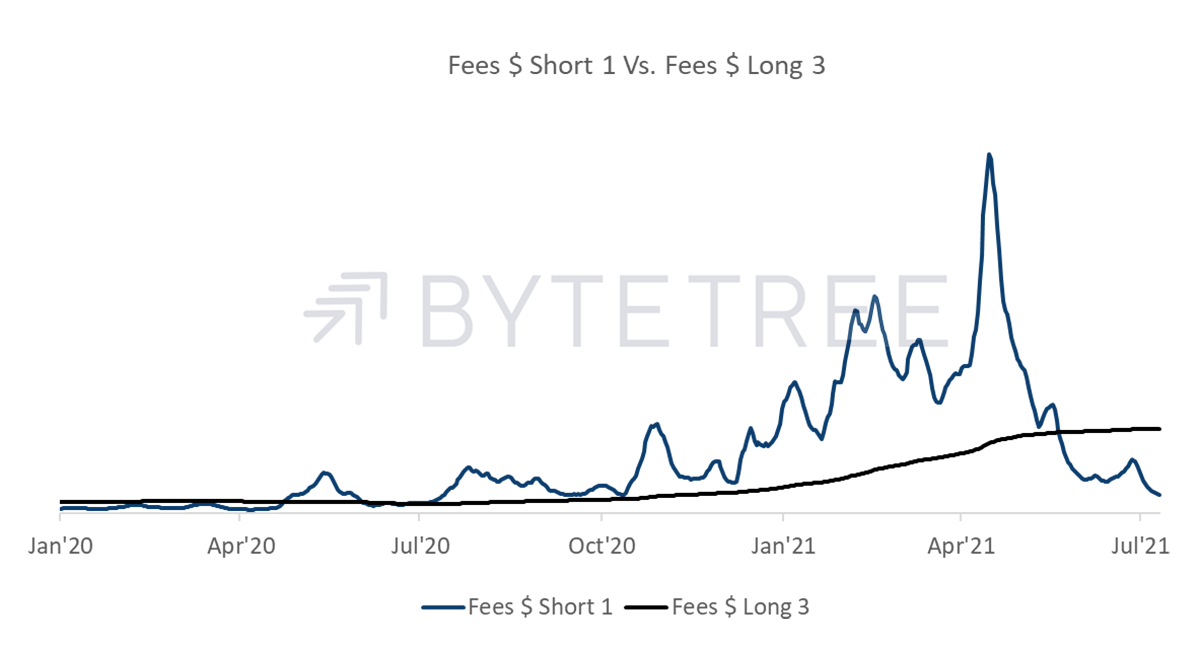

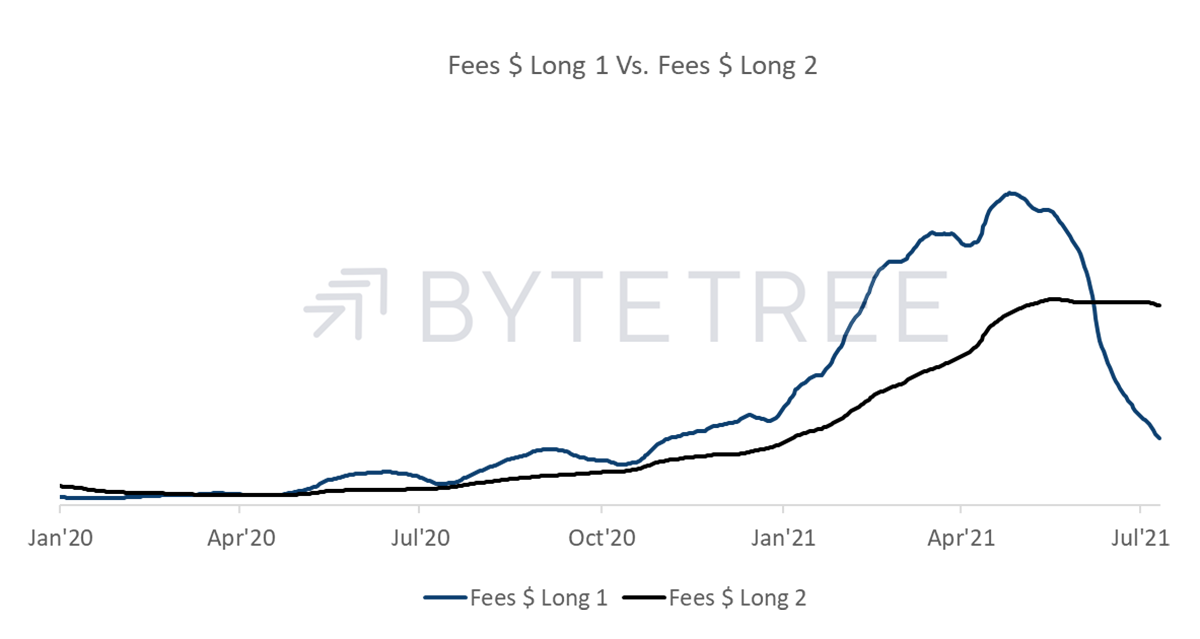

Meanwhile fees remain firmly in a slump. Assuming they have bills to pay, the miners must offload the inventory they’re building at some stage, which becomes more tempting as the price rises. As it stands, both shorter-term and longer-term fee indicators are “OFF”. For a dangerous overhang to be averted we would like to see a concerted recovery in on-chain transaction activity.