Get Rich with Crypto, Stay Rich with Gold

Disclaimer: Your capital is at risk. This is not investment advice.

Atlas Pulse Gold Report - Issue 63;

Until recently, ByteTree has been a crypto research and fund management company I founded some years ago. Gold will play a much bigger role in the future as we aim to offer the expertise to blend the old world with the new.

Highlights

| Regime | Gold fights back |

| Macro | Long-term rates could catch down |

| Valuation | Undervalued in a bull market |

| Flows and Sentiment | Flows stable, sentiment prefers bitcoin |

| Technical | Consolidation period coming to an end |

There was a strange selloff on Friday 6 August, which carried on into Monday. It was a $100 collapse attributed to buoyant jobs data. The conspiratory theories came out in force, and for good reason. A small uptick in the US dollar didn’t justify the crash. It was a repeat of the June $150 selloff following the Fed minutes.

What’s interesting is that both falls saw the price fight back, and neither managed to break the $1,683 low seen in March. The last all-time high occurred over a year ago, on 6 August 2020, at $2,063. Back then, gold was 23% rich versus our fair value model, whereas today, it is 8% cheap. Better still, fair value back then was $1,667, whereas today, it is a whopping $1,959.

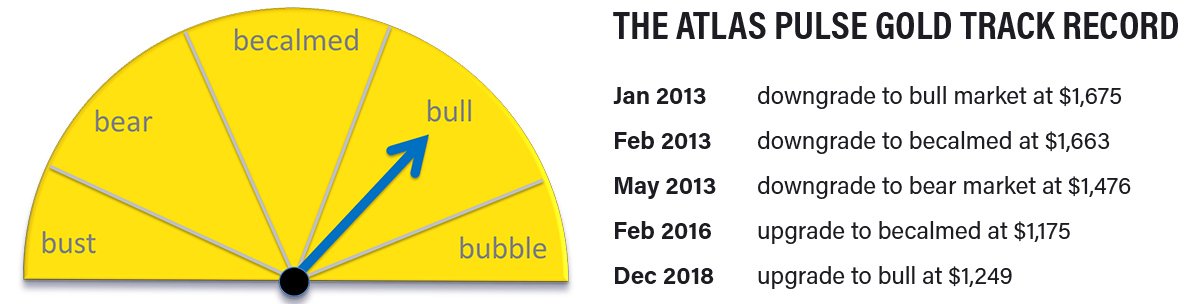

Regime

Out of the three criteria of the gold regime model, two remain bullish and have been most of the time for two decades. The third criterium remains elusive:

- Short-term real interest rates are below 1.8%. TRUE

- The gold price, measured in a basket of currencies, is rising, measured by a 35-month exponential moving average. TRUE

- The gold price relative to the S&P 500, measured by a 35-month exponential moving average. FALSE - but there’s a fight coming

Gold Fights Back

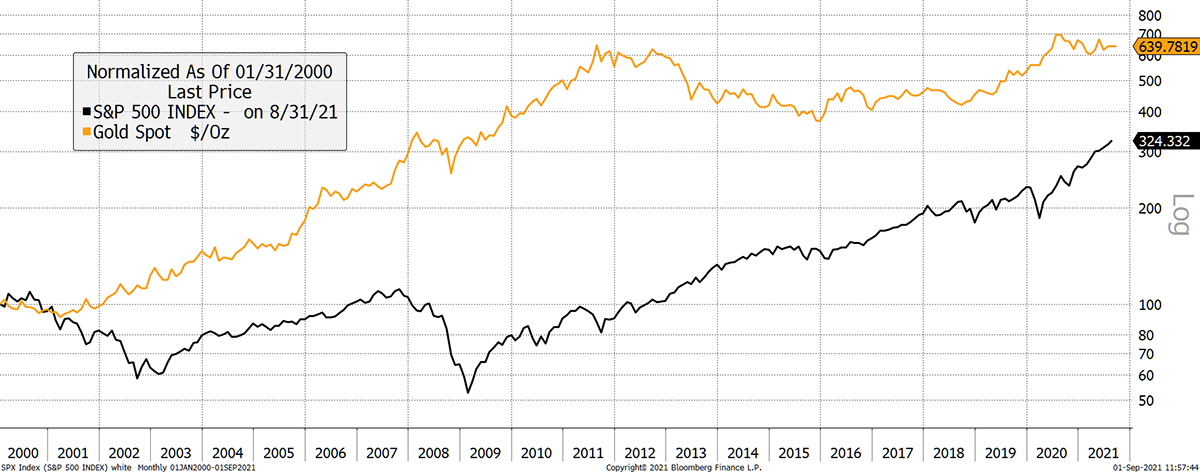

Few people acknowledge that gold remains the superior asset of the 21st century, nearly twice as profitable as the S&P 500. But it was a game of two halves with gold obliterating equities in the first and the S&P smashing gold in the second. Still, gold wins overall.

I can’t help but think the next decade will belong to gold. After all, the S&P 500 trades at a lofty valuation by historic standards, while gold doesn’t. The main reason I have confidence that gold will win the 2020s is that this almighty asset bubble all around us will implode, and the crowded trades will disappoint the most. Gold is far from being crowded.

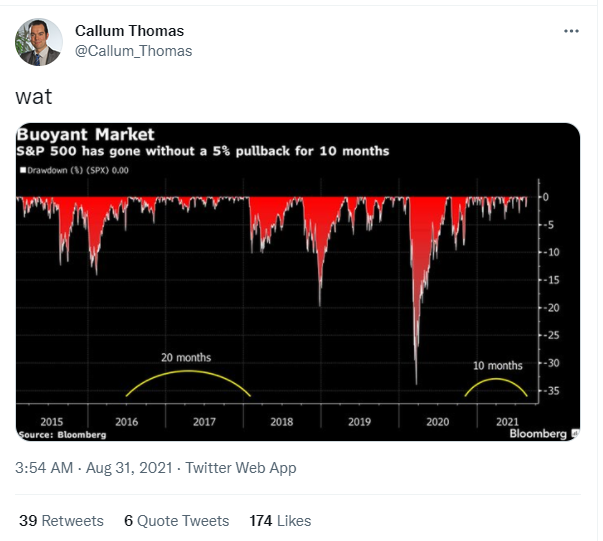

The gold low in March seems to have legs, and at the same time, the S&P will disappoint. A 5% drawdown didn’t used to be very much in old money; now it’s becoming a rare phenomenon.

Macro

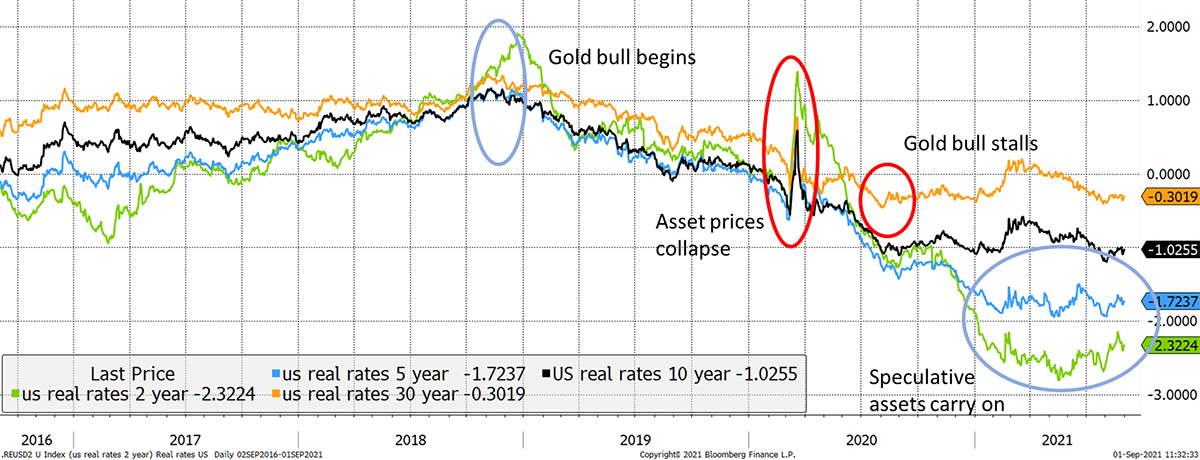

There are many ways to describe the current cycle in asset prices. In Atlas Pulse, I normally hang my hat on real interest rates.

The 10-year US real rate is the 10-year US bond yield less the 10-year breakeven rate (expected inflation rate derives from TIPS). Gold likes falling long-term real rates and dislikes it when they rise.

The recent gold bull market (gold price $1,174) began in late 2018 when real rates peaked. Gold hit a wall during the Covid crisis in March 2020 (gold price $1,471) when real rates spiked. Crucially, gold fell 13% in the market crash when the S&P 500 fell 34%, and some other assets by much more.

As real rates collapsed, gold surged to an all-time high in August (gold price $2,063). Thereafter, long-term real rates stabilised in contrast to short-term real rates that continued to fall to levels rarely seen - bubble time.

The gold peak was followed by a surge in risky assets (no-profit tech, crypto, SPACs etc.), and gold fell back (gold price $1,683) as long-term real rates briefly rose above zero. That marked the low in both long-term real rates and the gold price. With the gold price back above $1,800, gold has done pretty well for something that has been widely written off.

The Gold and Real Rates Story

The Fed has more control over short-term real rates than long-term. They have driven down the former, creating an asset bubble. If the Fed were to reverse course, the impact on risky assets would be devastating. In contrast, the impact on gold would be slight (see Covid-19 crash).

Moreover, should the Fed carry on printing, which seems to be the path of least resistance, then expect long-term real rates to drift down to short-term levels, as they tend to lag. What would that mean for gold? Lift off.

The 2-year yield is 0.2%, and the breakeven is 2.5%. If the 20-year bonds could match that, then expect to see a gold price of $2,842. With inflation likely to march higher, it doesn’t have to end there. Gold is very much in a pause within a wider bull market.

Valuation

My gold valuation methodology places the fair value at close to $1,952 while the price sits just above $1,800. What is most striking is how the fair value has kept marching ahead while the price has lagged.

Gold’s Fair Value Keeps on Rising

It seems likely that the majority of asset allocators buy the equity story and are shy of alternatives. Career risk wins the day, and the world will return to normal. Honestly, many professional investors actually believe that.

That Puts Gold 8% Cheap in Comparison

This is the greatest gold valuation methodology ever created, and it is available to the public on the ByteTree Terminal, along with ETF flows.

Flows and Sentiment

Price and flows remained joined at the hip. The futures market, as always, follows the price chart, which is improving. The asset allocations drive the ETFs, which remain stable. It really wouldn’t take much to see investors return.

Price and Fund Flows

Until recently, ByteTree has been a crypto research and fund management company I founded some years ago. Gold will play a much bigger role in the future as we aim to offer the expertise to blend the old world with the new.

I’m a huge fan of crypto for many reasons, which I write about each week in ATOMIC. After all this time, I still don’t understand why the crypto space sees gold as the enemy. Surely that should be the Fed, the stockmarket, the establishment, fiat currencies and so on. You’d think.

After all, bitcoin was designed to be digital gold, which is the highest compliment. Here is an example of the anti-gold sentiment, which seems to go down so well.

As a fan of both gold and bitcoin, I find this strange. Of course, bitcoin has more potential upside, but it comes with a ton of risk. Gold isn’t fighting bitcoin; it merely provides a proven store of value when things go horribly wrong.

It would make more sense to me if the whole crypto architecture was priced in gold rather than dollars. After all, both claim to be hard assets, which the dollar doesn’t. The gold vs crypto conversation is confused. They are both wonderful, but they are inherently different.

Buy crypto to get rich. Buy gold to stay rich.

Technical

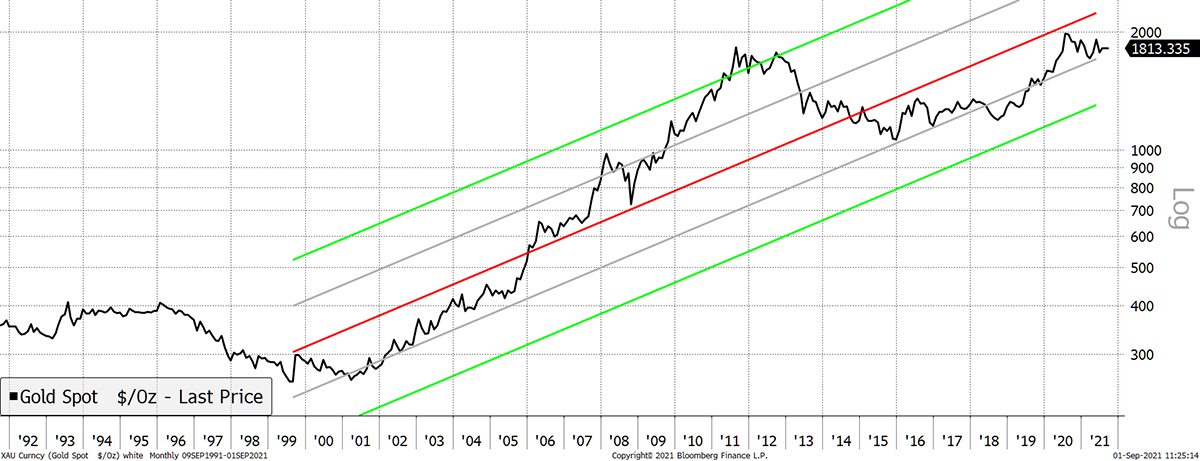

The post-2000 “secular” gold bull market has seen a trend growth of 9.6% per annum. On this basis, 2005 to 2011 was excitable, and gold now trades one deviation below trend. Not a bad time for a long-term investor to allocate.

Gold Trends at 9.6% Per Annum

I recall the last bull market (2000 to 2011) being a series of rallies to new highs followed by 12 to 18-month corrections. It kept on happening. This time, with the last major high 13 months ago, the best bit is just around the corner. I suspect the rest of 2021 will see better times for the yellow one.

Summary

Investment is an asymmetric puzzle. That means one should own things that may go up much more than they may go down. When you line up bonds, equities and real estate against gold, crypto and commodities, I know which side I’d rather be on.

If you wish to receive Atlas Pulse from ByteTree, then please sign up to our mailing list. I write Atlas Pulse monthly (free to view), with other pieces ranging from Bitcoin to central bank digital currencies. ByteTree ATOMIC, Token Takeaway and the Bitcoin Network Demand Model are available on our paid subscription tiers.

I remain bullish. Thank you for reading Atlas Pulse.

Thank you for reading Atlas Pulse. The Gold Dial Remains on Bull Market.

Charlie Morris is the Founder and Editor of the Atlas Pulse Gold Report, established in 2012. His pioneering gold valuation model, developed in 2012, was published by the London Mastels Bullion Association (LBMA) and the World Gold Council (WGC). It is widely regarded as a major contribution to understanding the behaviour of the gold price.

Please email charlie.morris@bytetree.com with your thoughts.

Comments ()