ATOMIC 26

Bitcoin has come too far to ignore, and the world is crying out for alternative assets. Michael Saylor is doing his bit. If mainstream wealth managers joined him, the sky would be the limit.

Highlights

| Technicals | BTC holds 2, ETH +1 to 3 |

| On-chain | Peak difficulty |

| Macro | Lockdowns are disinflationary |

| Investment Flows | MicroStrategy scoops up 7,002 BTC |

| Crypto | Ether College - part 4 |

ByteTree ATOMIC

Analysis of Technical. On-chain, Macro, Investment Flows and Crypto.

Last Friday, the Omicron variant caused an 8.2% selloff in Bitcoin, which was worse than the stockmarket but not as bad as oil. Given the price was close to $60k on Thursday, that’s not a bad result.

Remember last time. On 12 February 2020, bitcoin was trading at $10,389, only to drop to $3,984 (intraday) a month later. The worst single daily fall was a staggering 27.2% - how things have changed. Consider the current price action a good result.

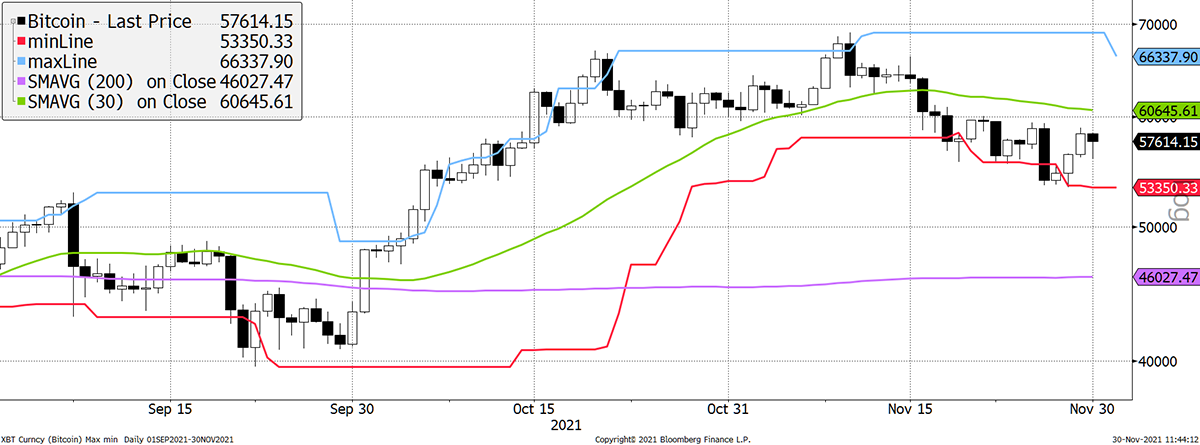

Technical

There is no change to the score since last week, which is good. The recovery over the weekend was also good. $60k will now provide some overhead resistance, which is where the max line will be this time next week.

BTC ByteTrend score 2/5

Source: Bloomberg. Bitcoin with 20-day max and min lines, 30-day and 200-day moving averages past six months.

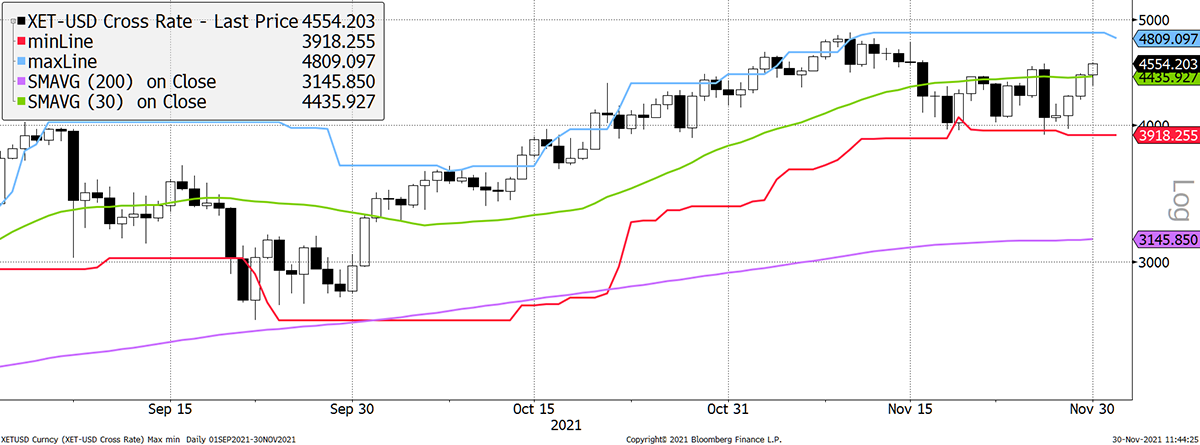

ETH was straight back above its 30-day moving average, which remains upward sloping, taking its trend score to 4. This is strong.

ETH ByteTrend score +1 to 4/5

Source: Bloomberg. Ethereum with 20-day max and min lines, 30-day and 200-day moving averages past six months.

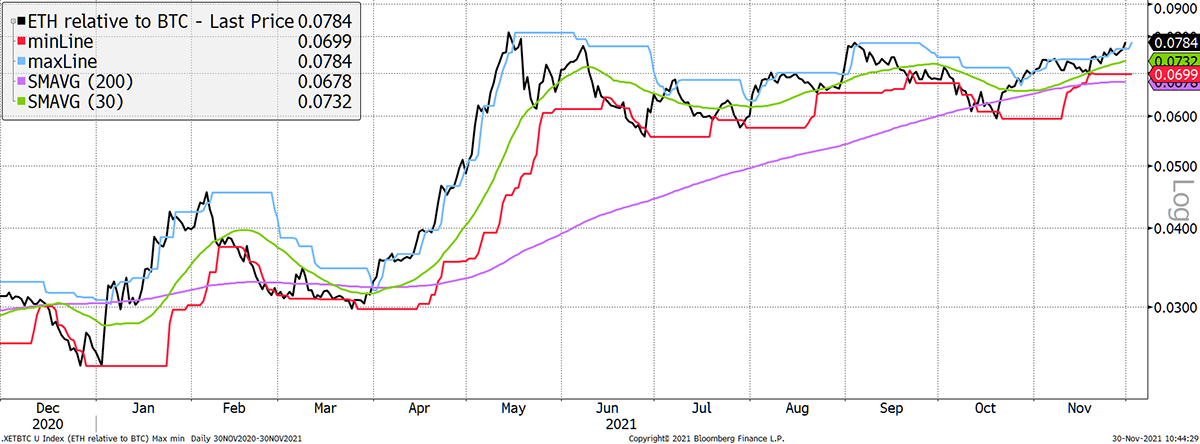

The relative chart has been rooting for ETH for much of this year. ETH is now challenging the 0.08 BTC level once again, a level ETH has not challenged since June 2018.

ETH (priced in BTC) score 5/5

Source: Bloomberg. ETH in BTC with 20-day max and min lines, 30-day and 200-day moving averages past six months.

ETH in BTC has stayed at a 5 for a few weeks now. The new high looks increasingly likely.

On-chain

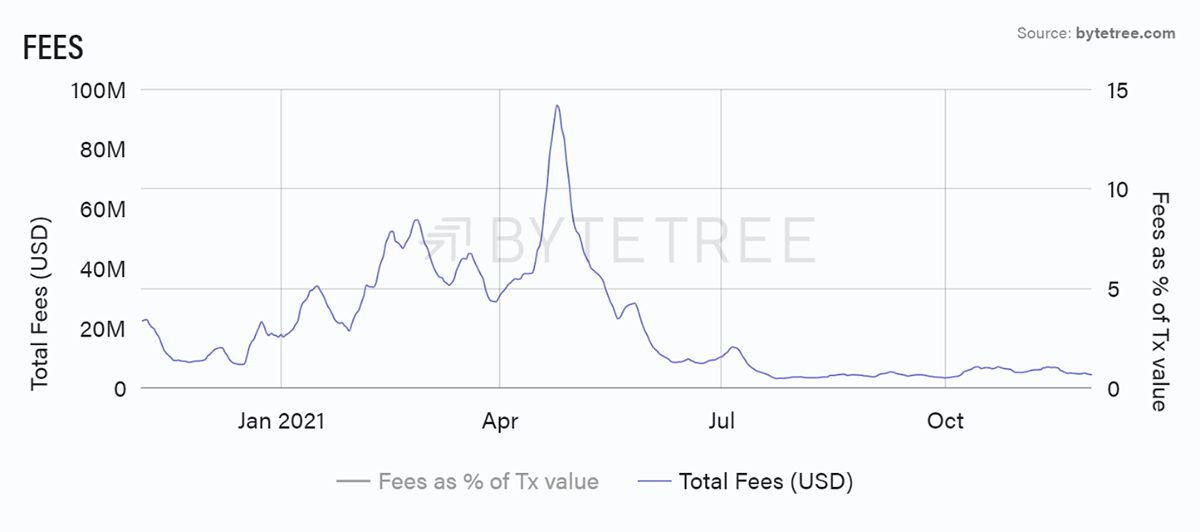

Fees have been falling again, but this time it is something to celebrate. Normally lower fees reflect a lack of demand, but now that Taproot is up and running, the recent drop is down to greater efficiency.

Fees have been the single best cycle indicator since the beginning. That is until this year when they have been thrown all over the place. Historically, a fee collapse has preceded a price collapse. Not this time, and maybe never again. Things have changed for the better.

Source: ByteTree. Bitcoin Total Fees (USD) over the past year.

Fees spiked in April, as there was a shortage of blocks following the Chinese mining ban. That slowed down the blockchain and saw the average block interval spike to 1,000 seconds. Things didn’t recover until August when the miners plugged their equipment back in somewhere else – probably Texas or Kazakhstan. Once they did, the chain sped up again, and the fees calmed down.

Source: ByteTree. Bitcoin block interval (secs) over the past year.

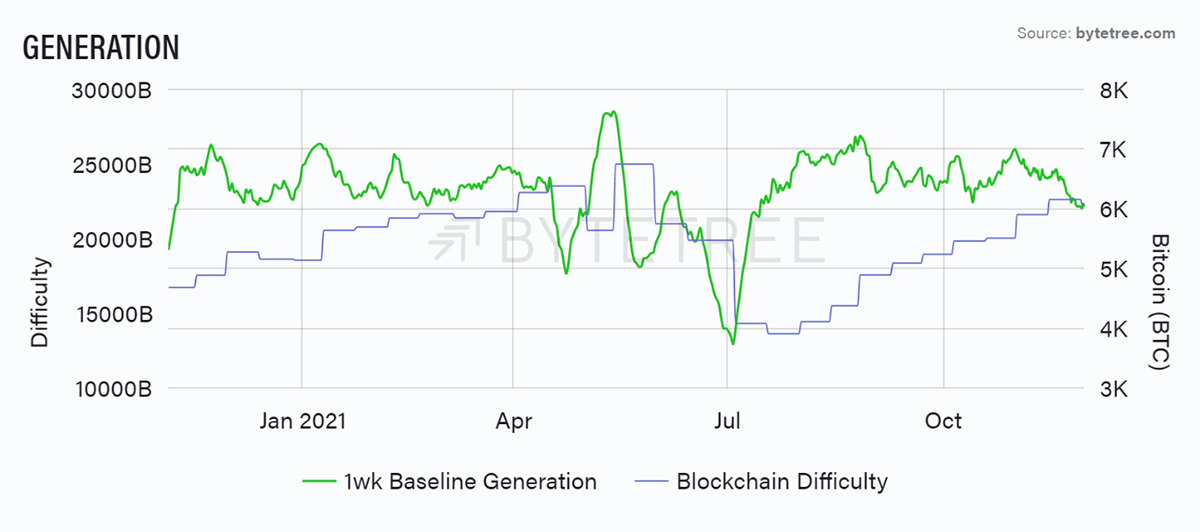

In the last two weeks, the hashing power is back at equilibrium, and we’ve seen the first downward difficulty adjustment since July. This is neither bullish nor bearish but likely means the whole post-China mining disruption is well and truly over. Difficulty has settled close to peak levels seen six months ago. As higher prices are sustained, expect this to move higher.

Source: ByteTree. Bitcoin 1-week generation and blockchain difficulty over the past year.

Investment Flows

Invesco launched a Bitcoin ETF in Germany on Friday (BTIC GY), which now has $193m under management, having bought an estimated 3,017 BTC. Well done them, although it was a quiet launch. Is Invesco embarrassed to be heading digital? I bet you someone in a suit wanted to keep it a low-key affair.

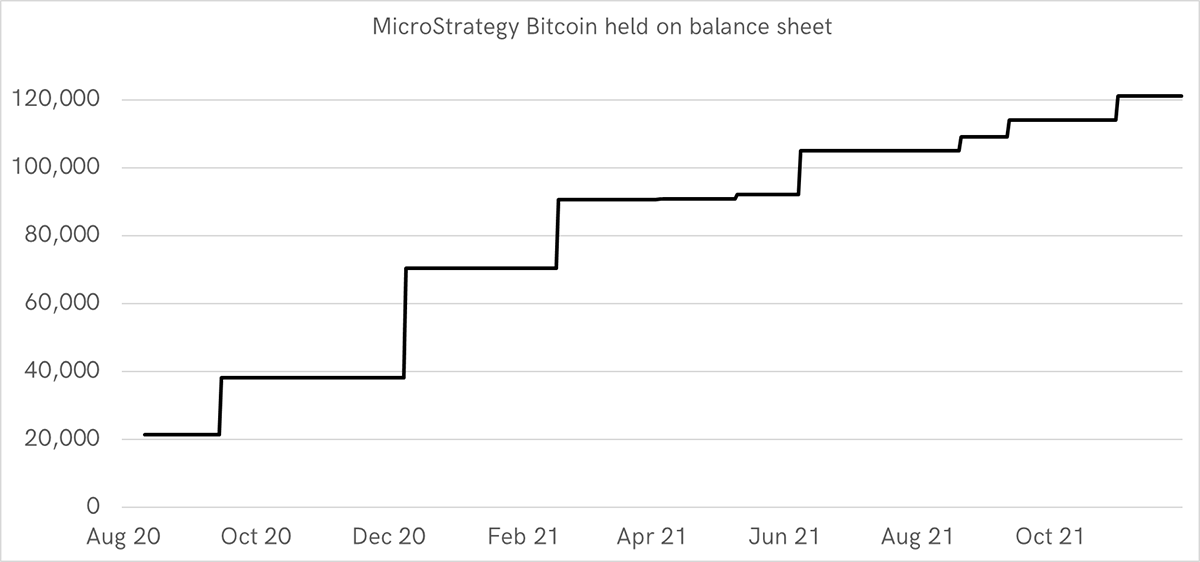

Then comes Michael Saylor, who this time has announced he has bought 7,002 BTC since 1st October, paid for by issuing shares at a modest premium.

That brings the MSTR total bitcoin holdings to 121,044 BTC. That is 4.5x larger than the biggest ETF (Bitcoin Tracker Euro). Only Grayscale (GBTC) is ahead.

Bitcoin holdings keep on growing

Source: Bloomberg, ByteTree. MicroStrategy bitcoin held on balance sheet.

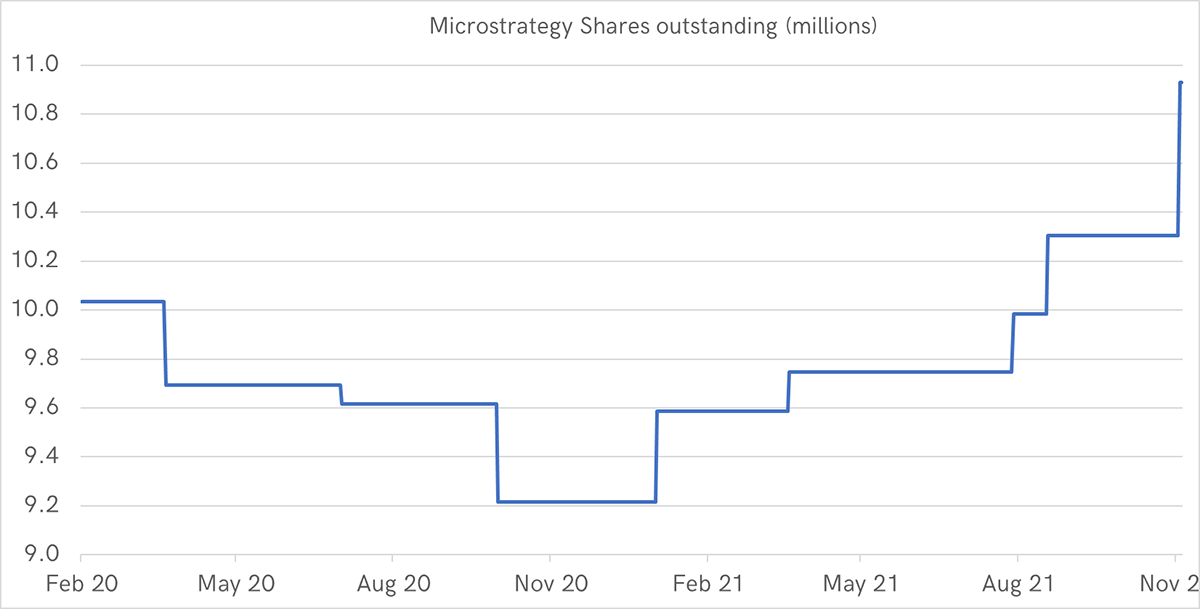

The purchase was funded by issuing around 571,001 new shares at an average price of $732 per share, raising $414 million. That’s how MSTR paid for the bitcoin.

Issuing shares for bitcoin

Source: Bloomberg, ByteTree. MicroStrategy shares outstanding (millions).

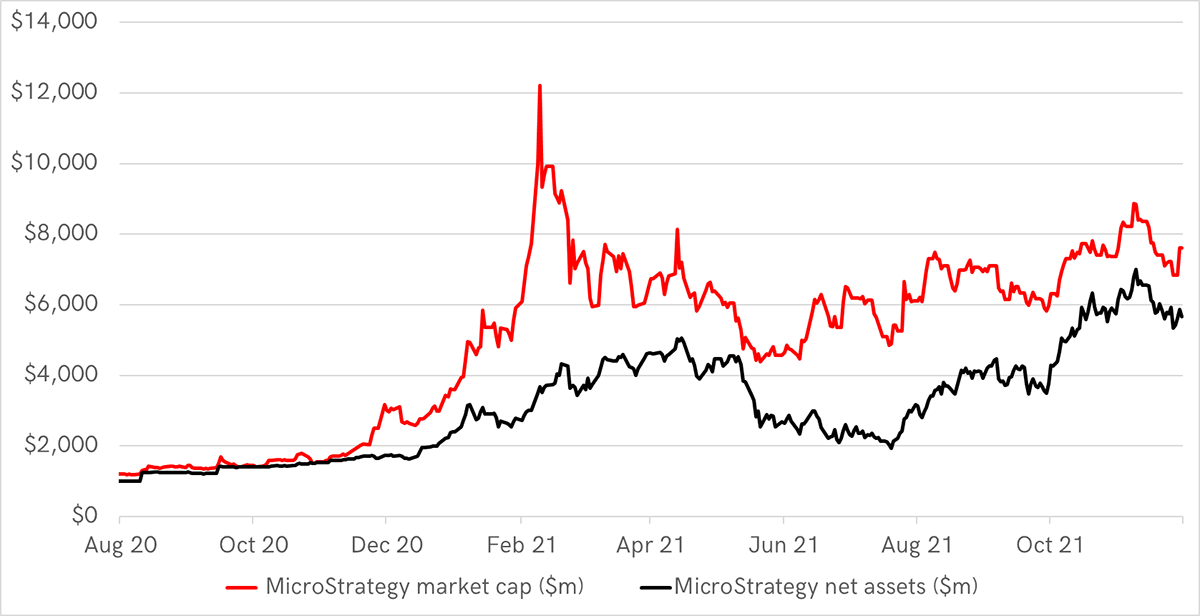

New shares boost the market cap, which can be seen below. The net assets haven’t changed because the price of bitcoin has fallen in recent weeks. But if the price heads back to $68k, then that would jump too.

Market cap up, net assets flat

Source: Bloomberg, ByteTree. MicroStrategy market cap (red) and net assets (black).

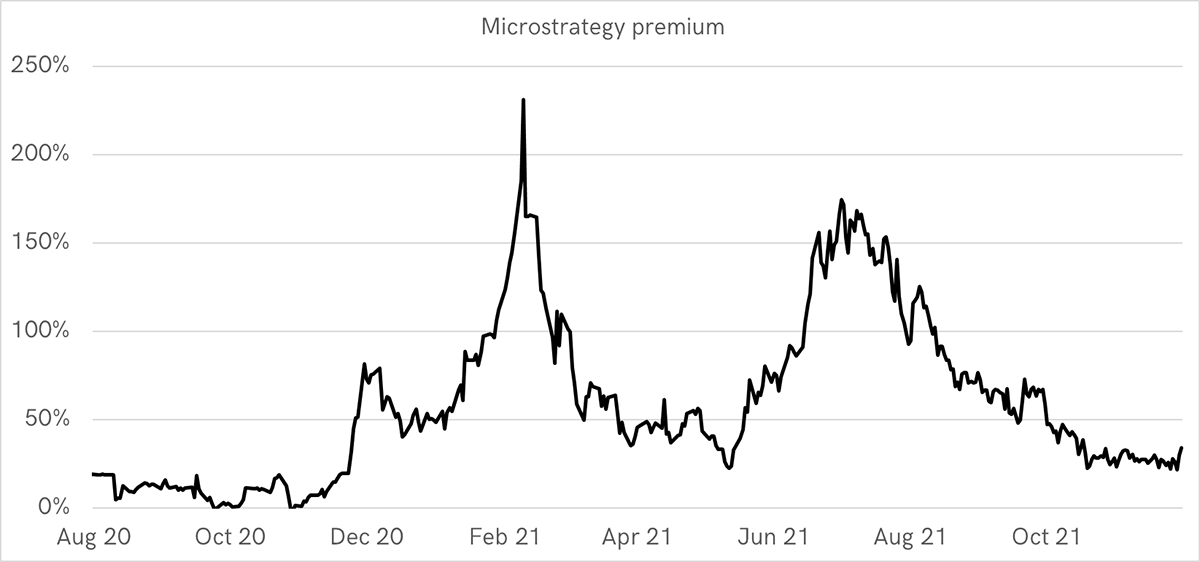

The increased number of shares would be dilutive but aren’t because the new investors were willing to pay a premium. The premium was 22% on Thursday and jumped to 30% yesterday. The market likes MSTR issuing shares. If that holds, then expect more purchases to follow.

Source: Bloomberg, ByteTree. MicroStrategy premium.

The lack of a spot ETF in the US underpins the MSTR premium. Now that it is no longer so high, MSTR shares are a more viable option, but investors are still paying 30% more than they need to access bitcoin. They get some leverage, which will close the gap if the price surges.

But against that, they run the risk of a price slump should bitcoin head south. MSTR has paid an average price of $29,534 per BTC. If it ever gets on the wrong side of that again, this company will evaporate.

What’s interesting here is how Grayscale (GBTC) has also seen an improved bid. Its discount has narrowed, which presumably reflects stronger US demand.

Macro

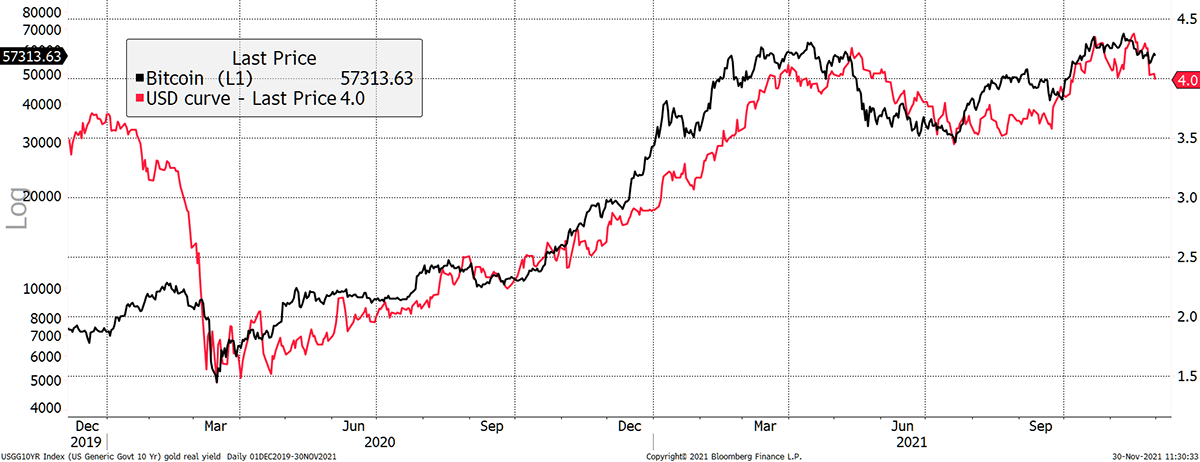

Generally, we are seeing a positive message this week except for the macro. Omicron is disinflationary. Bond yields and inflation down is never fun for bitcoin.

Lower rates and inflation are bad for Bitcoin

Source: Bloomberg. US 10-year rates + US 10-year breakeven, and bitcoin over the past two years.

Yet we know this is only temporary because Jay will turn those printers back on if this persists.

Ether College

- by Tom Salter and Aun Abbas

Layer-2 solutions, which aim to relieve Ethereum’s congested network, typically come from third-party protocols such as Polygon or Loopring. However, they are not the only potential fixes. “ETH-builders” and more localised solutions, such as EIP-1559 and ETH 2.0, are a two-pronged solution to Ethereum’s increasingly expensive network. This week, we will investigate EIP-1559.

EIP-1559

EIP-1559 aims to alleviate the Ethereum Network’s extortionate gas fees by fixing its fee pricing mechanism. The localised solution was implemented on the 5th of August 2021 and included three main changes:

Addition of a Base Fee

- This change brings a base fee for each transaction block, aiming to bring a flat market price for gas. This is a variable base fee based on the available capacity of Ethereum’s network

- <50% capacity = decreasing base fee, >50% capacity = increasing base fee.

Change In Block Size

- EIP-1559 implemented a higher 25m gas limit per transaction block, meaning each block has the potential to house more transactions/more gas. The target gas per block is 12.5m and is variable based on how much of the block’s capacity was used.

- >12.5m gas target = Increase in block size, <12.5m gas target = decrease in block size.

Special Treatment or Miner Bribe

- Considering miners must charge a market price for their fees, there needs to be a way for network users to fast-track their transactions. Therefore, EIP-1559 introduces a “fee tip”, which enables a quasi-miner-bribe to incentivise miners to pick the most valuable transactions.

On the surface, EIP-1559’s changes might seem to be the answer that Ethereum needed. However, we are yet to see the second-biggest digital asset escape its gas fee rut. Gas fees are still extortionate, but on the other hand, EIP-1559 is responsible for making ETH deflationary at points where network fees are burned instead of being distributed to miners.

We will cover ETH 2.0 next week, Ethereum’s long-awaited conversion to proof-of-stake.

Summary

The dip was bad, but the outlook is better. More and more investors feel less comfortable with ignoring bitcoin. It has come too far to ignore, and the world is crying out for alternative assets. Michael Saylor is doing his bit. If mainstream wealth managers joined him, the sky would be the limit.