Bitcoin Network Demand Model

Disclaimer: Your capital is at risk. This is not investment advice.

Week 50 2021

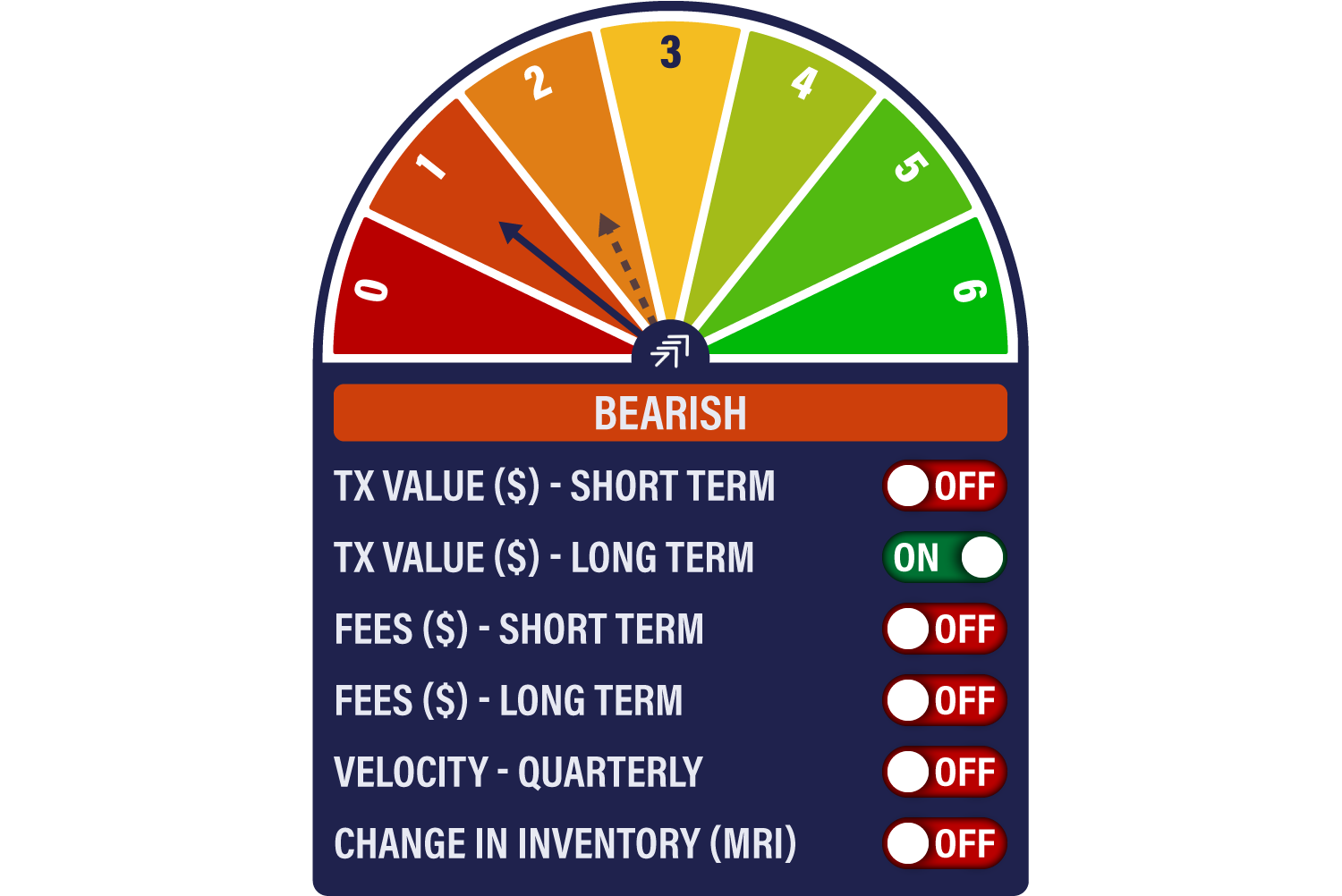

On-chain activity has weakened dramatically over the last week, and the Network Demand Model falls back to 1/6, with only the long-term spend series remaining on. Until we see renewed impetus in the ecosystem, the price outlook would seem perilous. The counterargument is that these quiet episodes represent some form of consolidation and are an opportunity to accumulate. That pre-supposes a renewed burst of activity, but further weakness would be of little surprise if that isn’t forthcoming.

To re-cap, the Network Demand Model (NDM) was designed to understand bitcoin as a “network effect” asset. Bitcoin is, at heart, a digital network for transferring value (from which it derives its more popular identity as a “store of value”). The more it is used, the more valuable it should be, and vice versa. The NDM is a slow-moving model designed to identify long term cycles and eliminate short term noise.

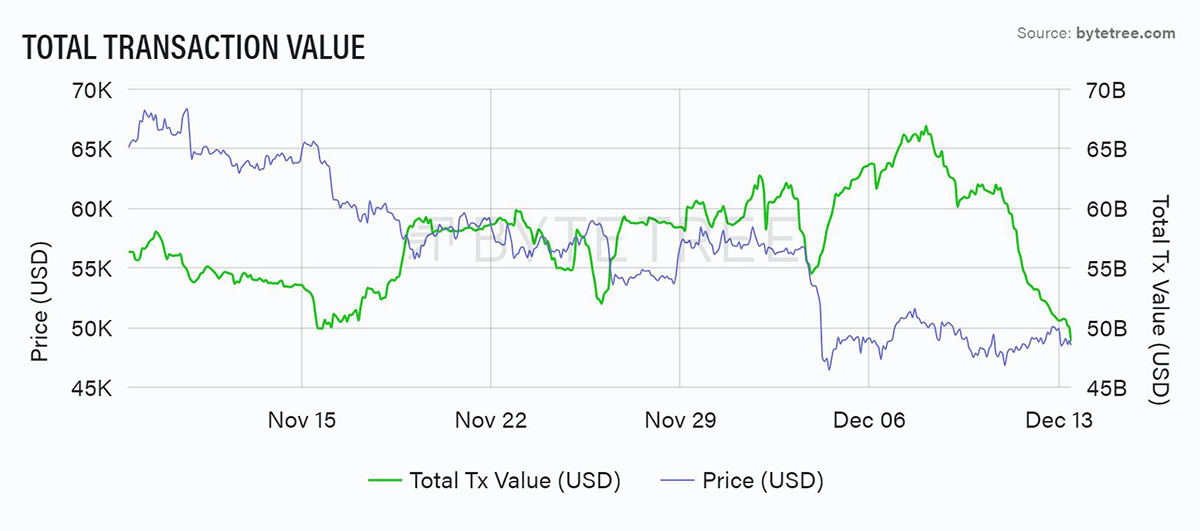

As we look across the blockchain, it is hard to discern much in the way of good news. Total transaction value has dropped sharply, as shown below.

While this is partially due to price, it’s noteworthy that this move has been accompanied by a similar drop in the number of transactions:

Unsurprisingly fees have headed in a similar direction:

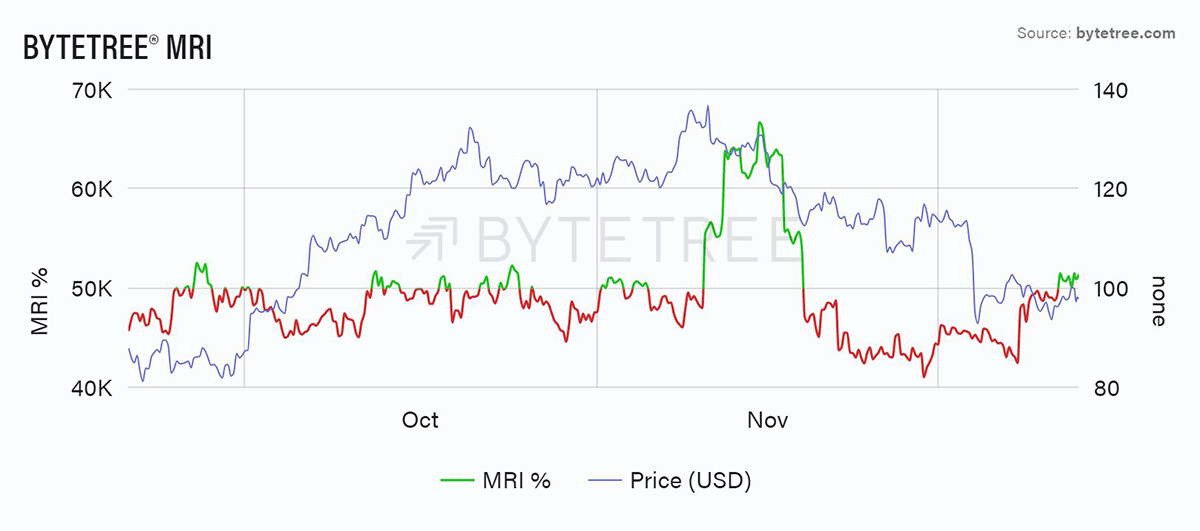

Falling fees aren’t great news for miners, of course. Over recent weeks we have written a lot about miner behaviour and wondered at what point they might be tempted to release inventory. They now appear to be increasingly willing to let go, shown by MRI creeping back into green territory.

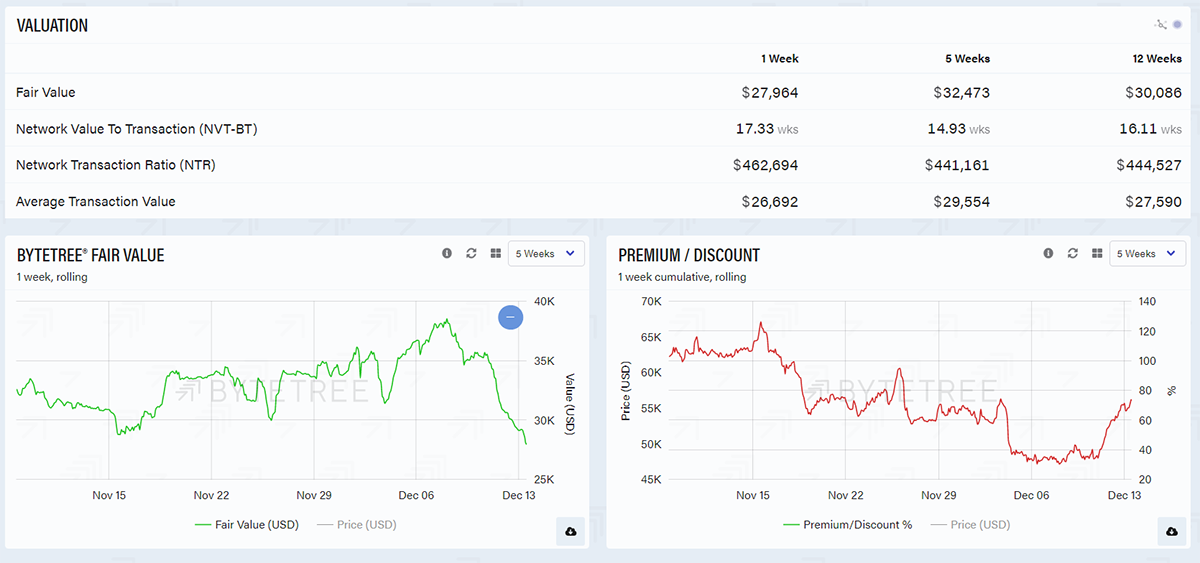

Finally, note how the short term (1-week) ByteTree valuation has collapsed over the last week. On 7 December, it was US$38,000, now we are back to US$28,000, breaking below the 5- and 12-week numbers respectively and driving up the premium.

For the price to justify remaining at current levels, we need to see a marked pick-up in network activity. This is far from impossible given bitcoin’s ability to move sharply on positive industry developments and good news. But without that, the risks to the upside, at least, are low. Proceed with caution.

Comments ()