Does Precedent Take Precedence in DeFi?

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: DeFi

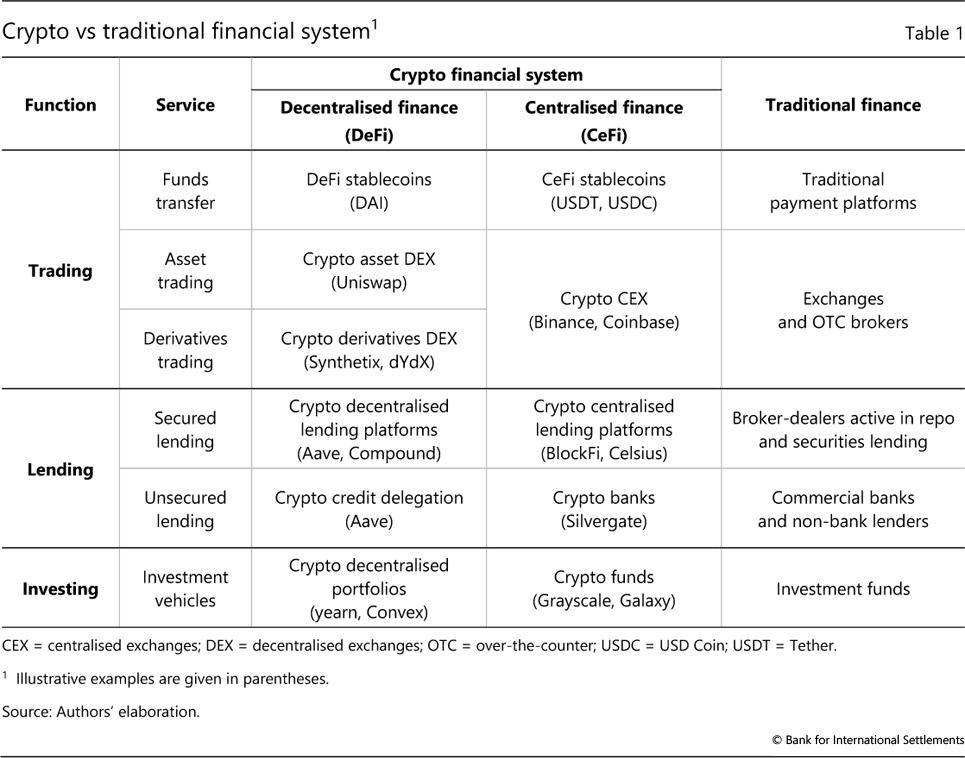

Last week, we considered the disruptive force and value propositions of DeFi. This week, we further evaluate the discrepancies between DeFi and TradFi, while highlighting the regulatory risks that burden DeFi and how they may shape the future of finance.

How does DeFi work

Decentralised Finance (DeFi) is the blockchain-based disruption of the traditional financial sector (TradFi). The advent of DeFi promises to be an upgrade to TradFi in three main ways:

- It enables a trustless system through self-executing smart contracts.

- It incorporates billions into the global economy.

- Its inherent transparency means that anyone can check and audit on-chain transactions.

The disruption caused by DeFi comes from stablecoins and the automated protocols running on blockchains. These two systems form the scaffolding of the intermediary-independent lending, investing, and trading of digital assets.

Regulatory Risks in DeFi and Stablecoins

Disrupting the traditional financial system is no easy feat. Indeed, there are many pre-conditions that DeFi needs to fulfil to challenge financial intermediaries properly. A good start would be a solution for the infamous blockchain trilemma, which is the zero-sum interdependence between scalability, security, and decentralisation. DeFi cannot effectively disrupt traditional financial institutions if it costs more to the individual than TradFi. More relevant to this article is the issue of regulation. DeFi needs the right regulation to fulfil its potential. While some consider it heresy to call for more regulation in the uncharted digital asset territory, we are of the belief that regulation adds a sense of direction to the unmapped digital asset and DeFi ecosystems.

The problem isn’t so much the law itself, but perhaps more the regulators penning the legislation. For instance, the tax requirements imposed on the broadly-defined ‘brokers’ under the U.S. Infrastructure Bill is indicative of regulatory ignorance at best, and ill-intention or incompetence at worst. Trying to reconcile the evolutionary nature of the law with the revolutionary fabric of disruptive technology is difficult, and one size does-not-fit-all. With that said, there are some intrinsic risks in finance, whether traditional or decentralised, which can be mitigated in similar ways.

If DeFi intends to disrupt and/or impersonate TradFi, it will naturally inherit some of its vulnerabilities and weaknesses. For example, some lending and trading DeFi protocols are characterised by high leverage. Though lending in leading DeFi protocols is executed through over-collateralised loans, or Collateralised Debt Positions (CDPs), borrowed funds can themselves be re-employed as collateral in different transactions on other protocols. This leads to a multiplier effect of excess leverage usage relative to the initial collateral input and an interconnectedness cross-protocol that resembles market contagion effects in the traditional financial system. Similarly, derivatives trading on Decentralised Exchanges (DEXs) allow for higher permitted margins than regulated exchanges within the traditional financial system. There is regulatory room for improvement here.

Contrary to popular opinion, banks often absorb risk during pressured periods in the traditional financial system. For instance, they issue loans or purchase distressed assets by issuing deposits (or money) via access to central bank balance sheets. DeFi’s over-reliance on collateral and disproportionate leverage involvement means that it is currently vulnerable to cyclicality. For its ecosystem to mature, the right regulation would need to implement safeguards on intermediaries, be they Centralised Exchanges, DEXs or the governance mechanisms that dictate the future of any given protocol. To prevent illegal transactions on DeFi protocols, stricter and more sophisticated Anti-Money Laundering (AML) and Know-Your-Customer (KYC) rules need to be enacted. The aforementioned U.S. bill is not a good start.

Furthermore, stablecoins, at least those backed by reserve assets, need to be more stringently reviewed to prevent liquidity mismatches. The situation around Tether is an example of retrospective regulatory scrutiny rather than proactive prevention of risk. On the other hand, stablecoins minted through collateralised digital assets are vulnerable to market risks, given the volatility of prices. Lack of regulation here is crucial as stablecoins are structurally imperative for DeFi. The opacity in this space threatens to instil a lack of trust in DeFi as a whole.

The Future of DeFi

Still, DeFi has a long and exciting future ahead. While predicting prices of individual tokens might spark investors interests, I think it’s more valuable to look at four of the future potential trends in DeFi.

Firstly, the Ethereum blockchain dominates the DeFi space, and this will continue to be the case. Although the ETH Killers are experiencing great returns, they are still behind in developing actual financial ecosystems. However, Ethereum continues to temporarily lose market share due to its gas fee issues, and this bottleneck brings two main future themes for the network:

- The Growth of Layer-2 Solutions

- The Launch of ETH 2.0, which had its testnet released recently.

Secondly, the continued growth of DeFi will see three main trends emerge:

- An increase deepening of market liquidity as “new-money” enters.

- A blanket increase in Total Value Locked (TVL) as DeFi applications gain more credibility and trust, leading to greater demand and growth.

- The continued growth of tokenised Bitcoin in DeFi.

On the third point, there are 330,000 tokenised BTC used in DeFi Protocols on Ethereum. As Bitcoin continues to grow, tokenised Bitcoin will follow suit, also benefitting DeFi.

Thirdly, due to the crypto market being open 24/7, it is likely that DeFi trading platforms will eclipse the volumes garnered by traditional finance. Furthermore, DeFi can trade any assets available to TradFi, as well as all digital assets, making it the most versatile solution to trading.

Finally, the continued tokenisation of assets will grow within the DeFi space. Bringing real-world assets into DeFi, where protocols like Centrifuge, Tinlake, and Maker are leading the tokenisation movement, will trigger the largest growth the sector has experienced. This will naturally happen as the crypto space moves away from its contrarian ideology.

Conclusion

DeFi at present is big, and in the future can be bigger still. The current limiting factors are those that are expected in an embryonic technology: volatility, regulatory unclarity and excess cyclicality. Effective regulation will provide direction to DeFi and the wider digital asset ecosystem.

The wheel may have been well and truly reinvented, the hope now is that the overall vehicle travels in the right direction.

Comments ()