Bitcoin Network Demand Model

Disclaimer: Your capital is at risk. This is not investment advice.

Week 2 2022

“All models are wrong, but some are useful”. George Box, University of Wisconsin, 1978

Last week we warned that the bitcoin market was in urgent need of a catalyst. The patterns we are observing have worrying similarities to the price behaviour of 2018 when the price fell 40% after a long period of post-peak consolidation. In the middle of last week, the price cracked below the US$46,000 support line, and bitcoin now tries to defend US$41,000.

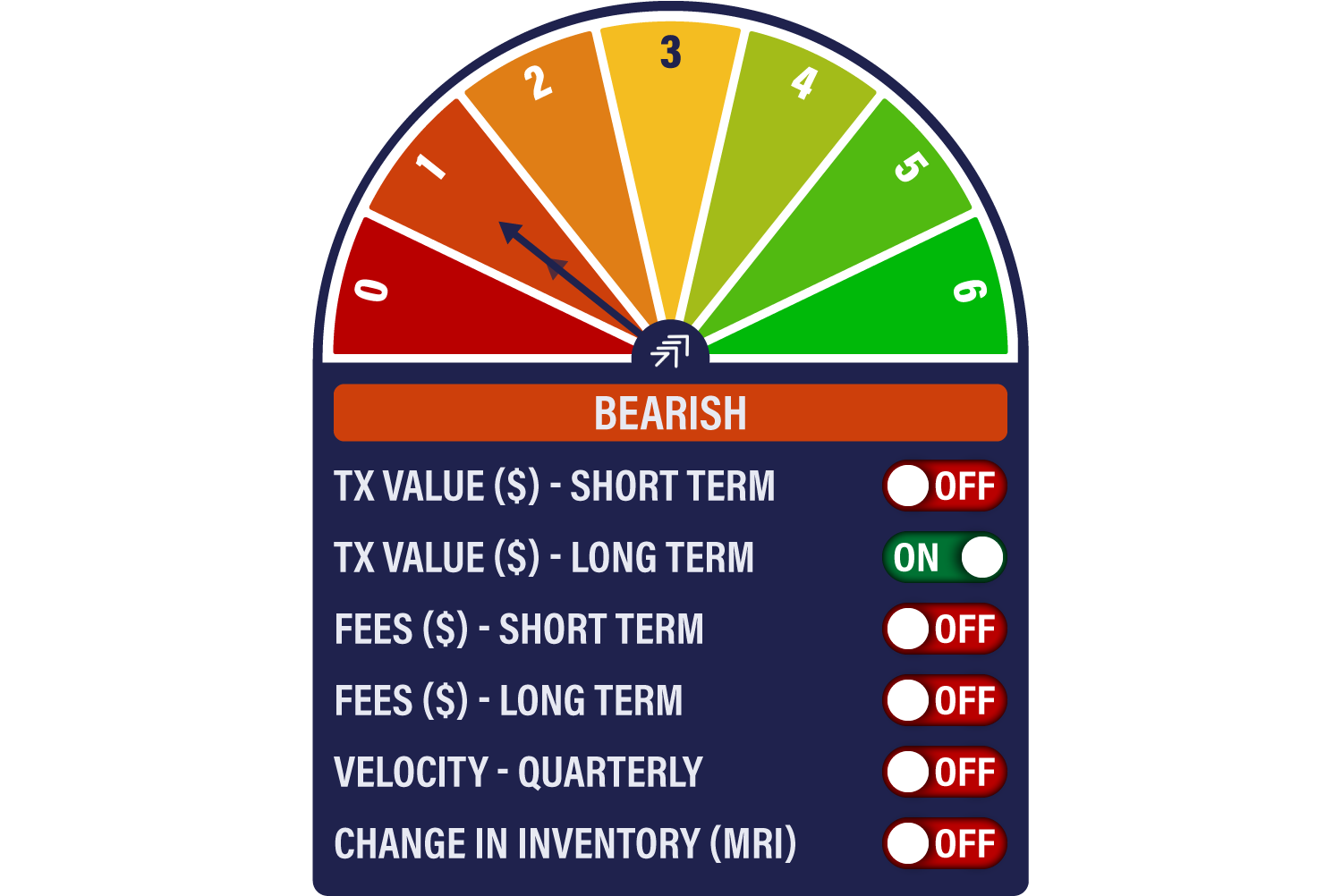

As far as the Network Demand Model is concerned, nothing much has altered. The score remains on 1/6, and there is no material change in the trajectory of any of the metrics. Transactions have had a mild bounce, but fees and miner behaviour all indicate subdued on-chain behaviour.

If bitcoin genuinely was digital gold, perhaps this wouldn’t matter. In fact, it would render the Network Demand Model both wrong and useless. But if bitcoin isn’t digital gold, and is, as per the opening sentence of Satoshi Nakamoto’s original white paper…

A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution

…then we have to look at its utility to derive some idea of its value. In other words, we have to measure it as a network effect asset. This is what the Network Demand Model was designed to do.

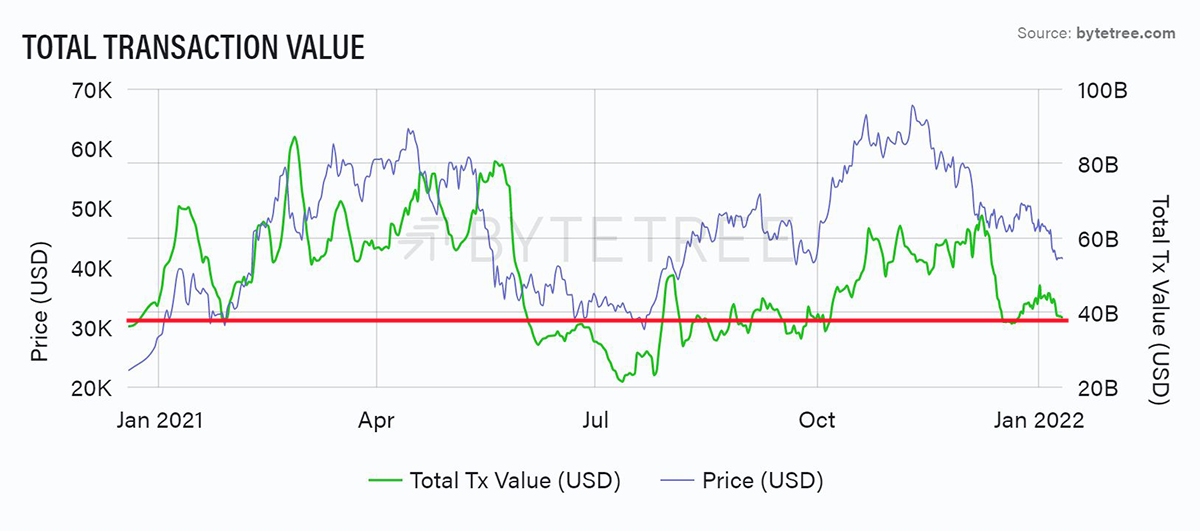

For all its grandstanding, bitcoin is going through a phase when its usage is not increasing. Rolling one-week transaction value, for instance, is back where it was a year ago, when the bitcoin price was in the low US$30,000s.

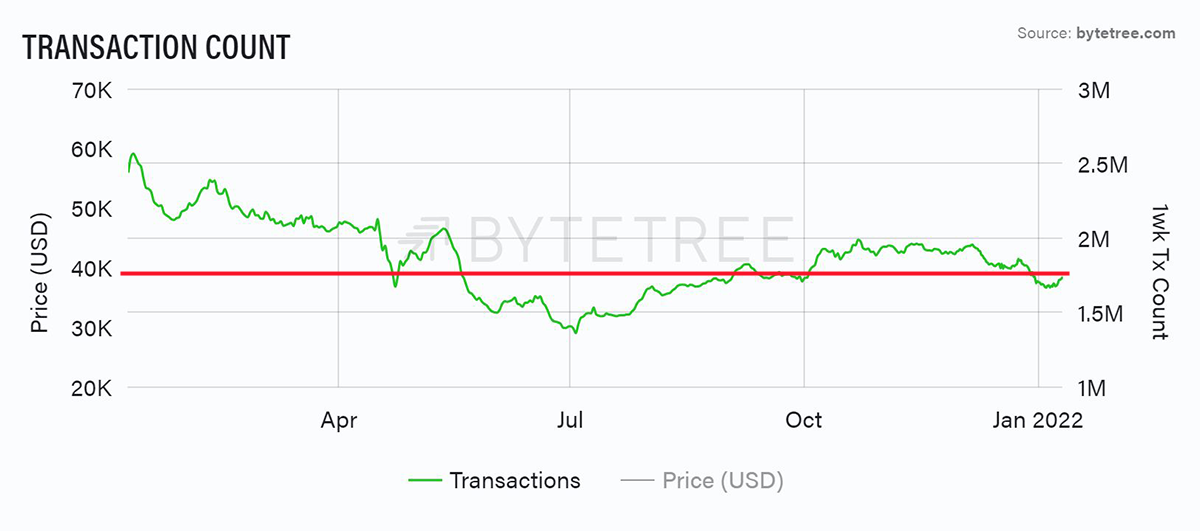

The number of transactions has fallen a long way from the peaks a year ago.

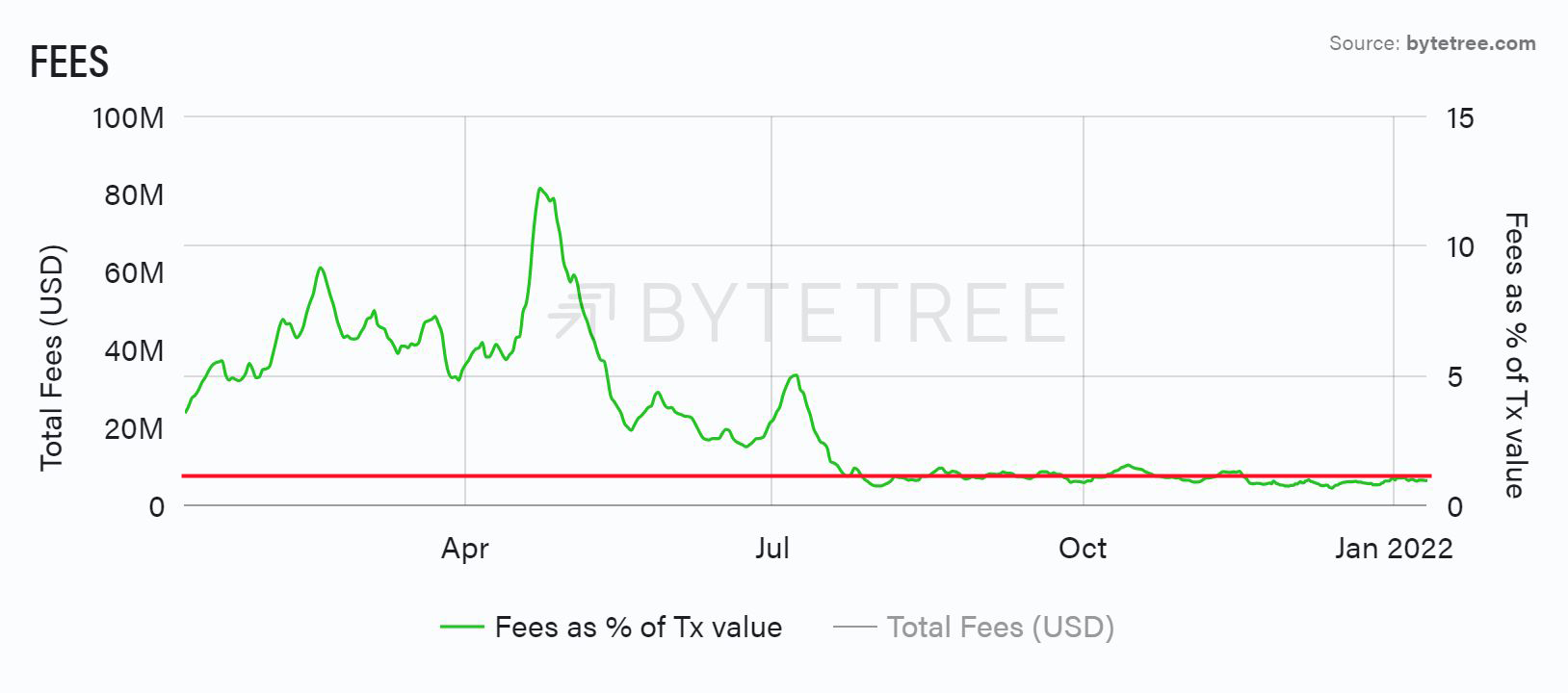

This is not because it’s expensive to transact. As shown below, fees as a percentage of transaction value are far lower than they were a year ago.

There might be more institutions starting to own bitcoin, but owning it and believing in its role in the investment firmament are separate things. Are these institutions motivated to promote its use as an alternative form of payment? Are they lobbying for its acceptance in everyday life? If not, their sole motivation is price appreciation. This begs the question; if the price doesn’t go up, will these new entrants have the necessary philosophical conviction in bitcoin’s long-term credentials to hold on? Will large hands also be strong hands?

If faith in bitcoin’s role as digital gold erodes, the spotlight will shift to its utility. In which case, the Network Demand Model, like all models, might be wrong, but it will be useful. And at this point, it still urges caution.

Comments ()