Bullish Macro Conditions Overwhelmed by Crash in Tech

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 31

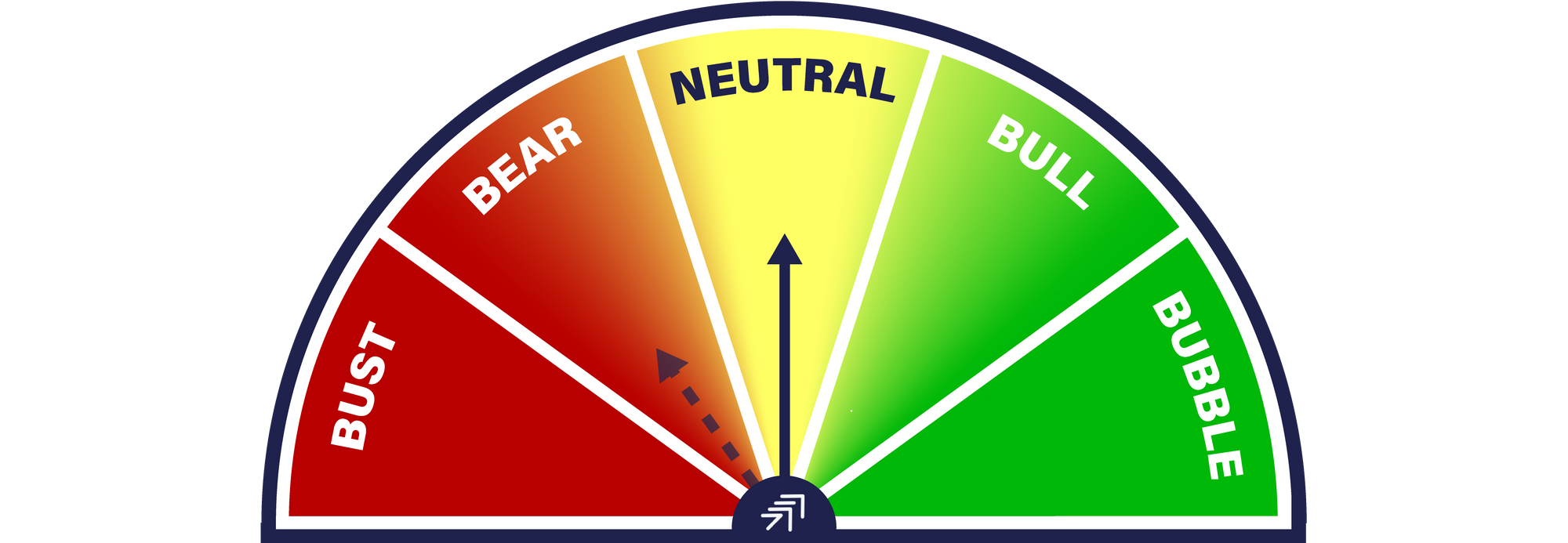

The dial has not been downgraded to bear because while the network is weak, the macro environment is supportive. All in all, it is time for caution.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | Weak |

| On-chain | Back to sleep |

| Investment Flows | Money is leaving |

| Macro | Bullish |

| Crypto | Carnage |

Technical

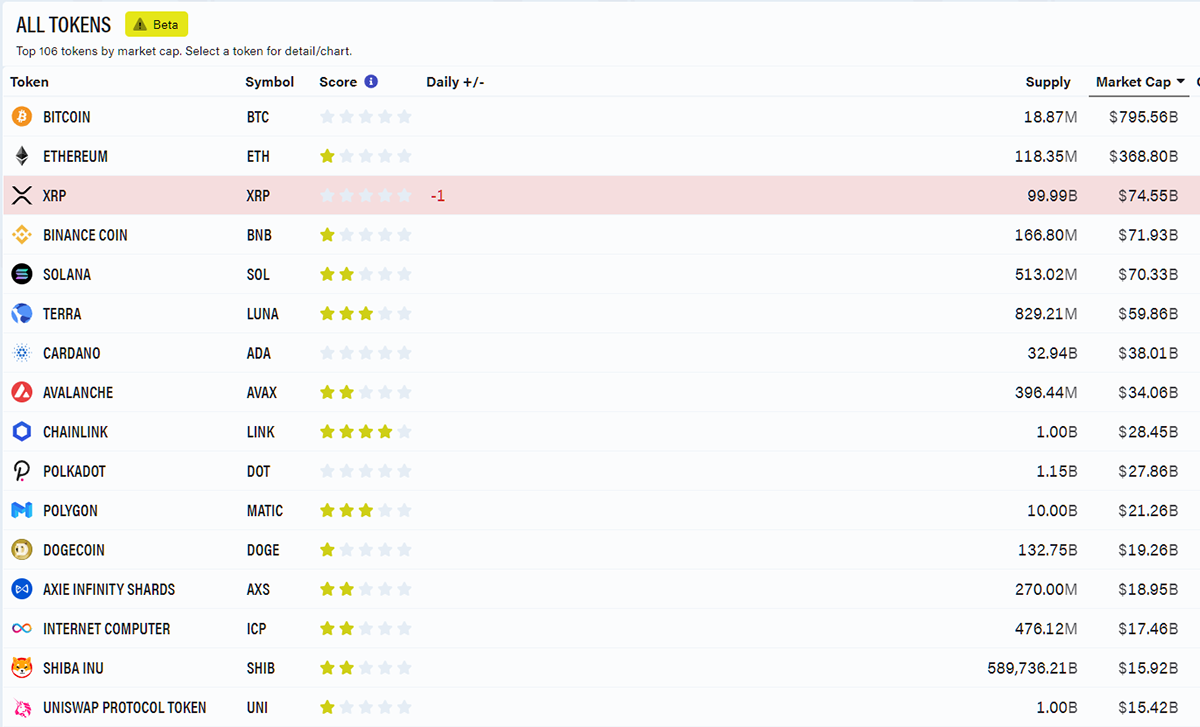

The ByteTrend scores are deteriorating. BTC at 0 means the price is in a downtrend on all measures. ETH at 1 means only the 280-day (equivalent of the 200-day in traditional finance) is still rising, but ETH fails on other measures. Worst yet, is that the great names of 2021 have stalled, with only a few, such as Chainlink, showing strength.

Source: ByteTrend

ETH has had enough and has so far failed to make the high versus bitcoin. The relative trend has fallen to a 2/5.

ETH (priced in BTC) score 2/5

Source: Bloomberg. ETH in BTC with ByteTrend moving averages past year.

Investment flows

8,500 BTC have left the funds since the December high in ETF holdings, which is 1,500 BTC more than last week. Looking at the ETF flows against the miner sales, things are back to May 2021 levels which was a rough period for the price. On a 30-day rolling basis, both the funds and the miners are extracting money from the network at an unsustainable rate.

Source: ByteTree. Bitcoin fund flows less miner selling (30-day cumulative) since April 2019.

The one saving grace is that bitcoin happily survived 2019 on much lower inflows relative to the higher miner sales at the time (block reward was 12.5 BTC back then). There was typically a 50,000 BTC monthly deficit. But prices were lower, and the network was yet to become a big money affair. Now that it is, I suspect the money equation (inflows less outflows) matters more than it did back then.

Naturally, the funds do not represent all of the money as the impact of retail investors is huge in crypto. So many apps and exchanges are impossible to track, but the implication is that if the funds and the miners are selling, then retail must pick up the slack. If they don’t, then prices fall until they do. In the end, the market must balance.

ETH is also seeing outflows

Source: ByteTree. Ether held by funds and price, since July 2021.

On-chain

Fees and transaction value remain weak, but we are not witnessing new lows in the data. That means it could still just be a soft patch. We are in the first quarter, which is typically a weak period for bitcoin. 2021 was a notable exception, driven by Mr Musk’s tweets.

Yet one clue would come from velocity, which looks at the number of coins circulating in the network. Normally, when the price falls, but velocity rises, the market is poised to jump. We saw this in May, which led to a strong rally in July. This time, we are not seeing a jump in velocity, which means this market remains soft.

Source: ByteTree. Bitcoin velocity (%) over the past year.

Macro

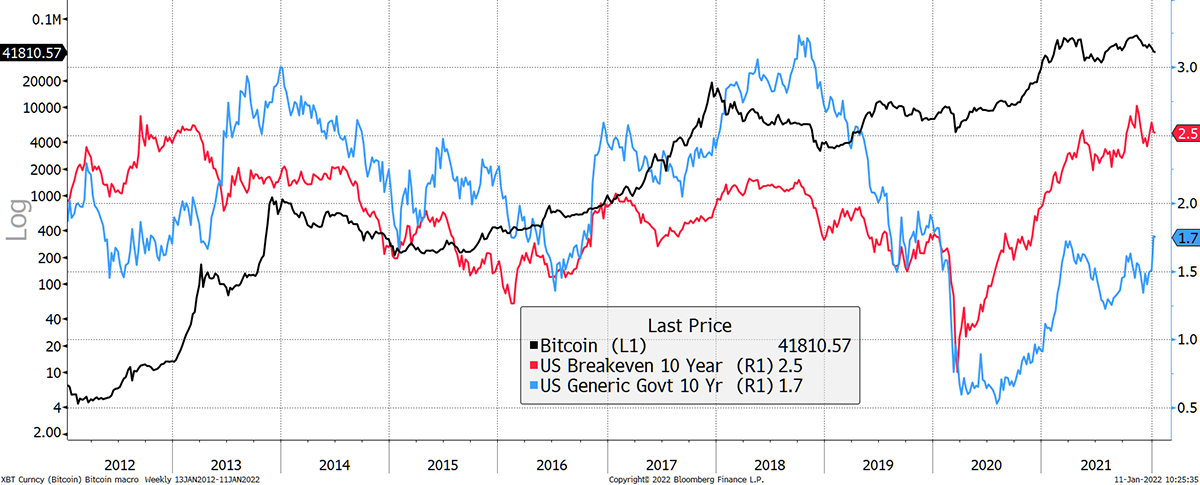

But it would be odd to give up when the macro tailwind remains as Bitcoin likes rising rates and inflation. Historically this has been a favourable environment. The chart shows the data for the 10-year US treasuries.

Rising rates and inflation

Source: Bloomberg.

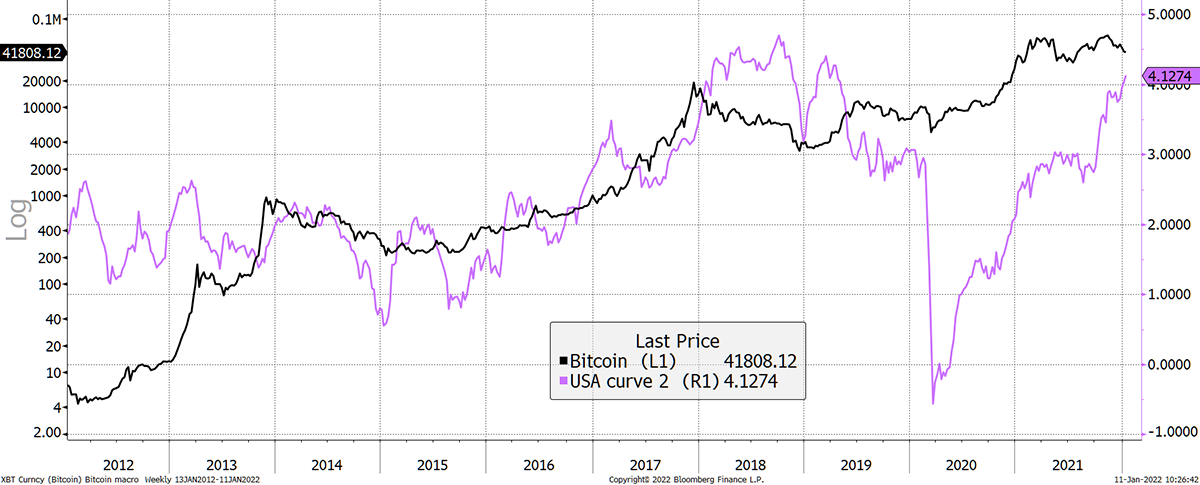

I believe gold responds to longer-term indicators, such as the 20-year bond yield and inflation expectation. Bitcoin, being younger and more excitable, responds to shorter-term data. Here I have shown the 2-year “curve”. This is the 2-year yield added to the 2-year inflation expectation. The historical fit has been remarkable given that US government bonds would rarely come into the crypto conversation.

Reflation is a positive force

Source: Bloomberg.

The historic link has been clear in terms of trend direction rather than level, but there is room for error as it is unreasonable to assume one factor, such as the curve, can explain everything. Many other things are happening, and it is the weight of evidence that wins the day.

While the 2013 price high was aligned with the curve, the 2017 high wasn’t. I can only assume that the 2018 bear was postponed as the bitcoin price settled at $6k for much of the year. It was when the curve collapsed in November 2018 that the price broke to $3k.

To put that into the current thinking, the risk of a brutal price collapse from here is reduced while the curve stays high. The flows and network indicate price weakness, but the macro environment is supportive. The risk would be that the curve turns down while other factors are weak. Then you’d see real pain in crypto.

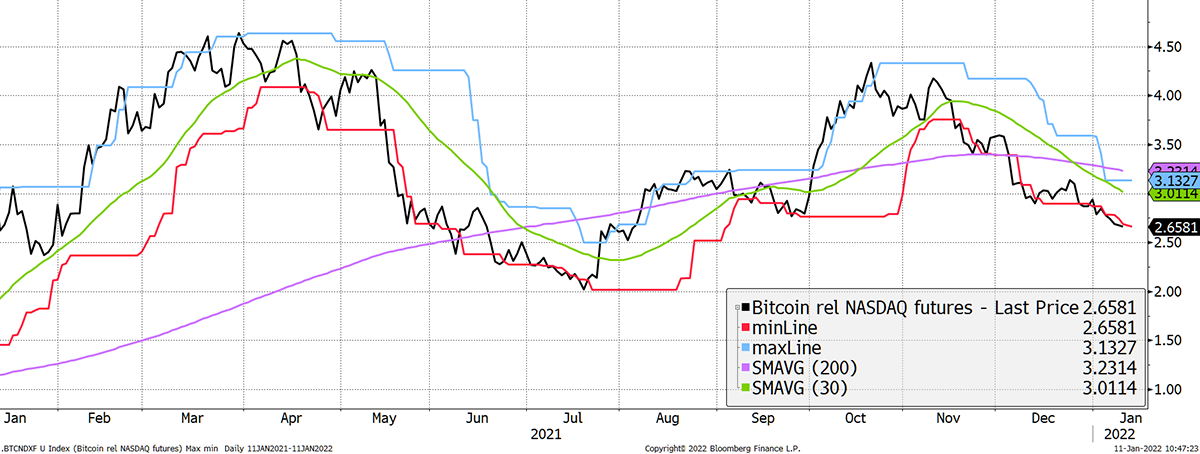

But looking further afield, tech is under pressure, and you can’t fight it. Bitcoin compared to the NASDAQ has a ByteTrend score of 0/5 here. Bitcoin is weaker than tech, which is itself under pressure.

Bitcoin lags tech

Source: Bloomberg. BTC relative to the NASDAQ futures ByteTrend past year.

The Cryptonomy

- by Aun Abbas

In moments of market weakness, it is worth identifying the protocols and sub-sectors within the cryptonomy that either defy the market trend or are its disproportionate victims.

XRP’s ByteTrend score has degraded to a 0/5. Originally, this token was meant for cross-border payments. SEC scrutiny and the invention of stablecoins seem to have taken the wind out of its sails.

ETH competitors such as SOL and AVAX haven’t been immune to the market trend as they score 2/5, and ALGO, another ‘ETH-killer’, goes down by 2 to a score of 1/5 on ByteTrend.

Until the end of last week, Terra (LUNA) had been scoring full marks on ByteTrend but has now naturally calmed to a 3/5. The Terra platform hosts more than a dozen (truly) decentralised stablecoins and maintains their peg via a novel zero-sum relationship with the protocol’s governance token, LUNA. The value of LUNA is almost linearly linked to the demand for these stablecoins. Terra is built using Cosmos’s (ATOM) Software Development Kit (SDK). Cosmos, a layer-0 platform on which other blockchains can be created, maintains a 5/5 ByteTrend score for almost the second week running, showing immense strength in a faltering market.

Chainlink (LINK) has outperformed the market and scores a 4/5 ByteTrend score. This protocol is known as an ‘Oracle’ and provides off-chain data, such as price feeds, to smart contract blockchains such as Ethereum. Chainlink acts as a conduit between the blockchain-world and real-world, providing information to confirm or deny the occurrence of events to trigger the transfer of value. This protocol crossed 1000 projects at the start of the year and is dominant in the oracles sub-sector. More on Chainlink in this week’s Token Takeaway.

Summary

The dial has not been downgraded to bear because while the network is weak, the macro environment is supportive. All in all, it is time for caution.

Comments ()