Chainlink: The Missing LINK

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: LINK;

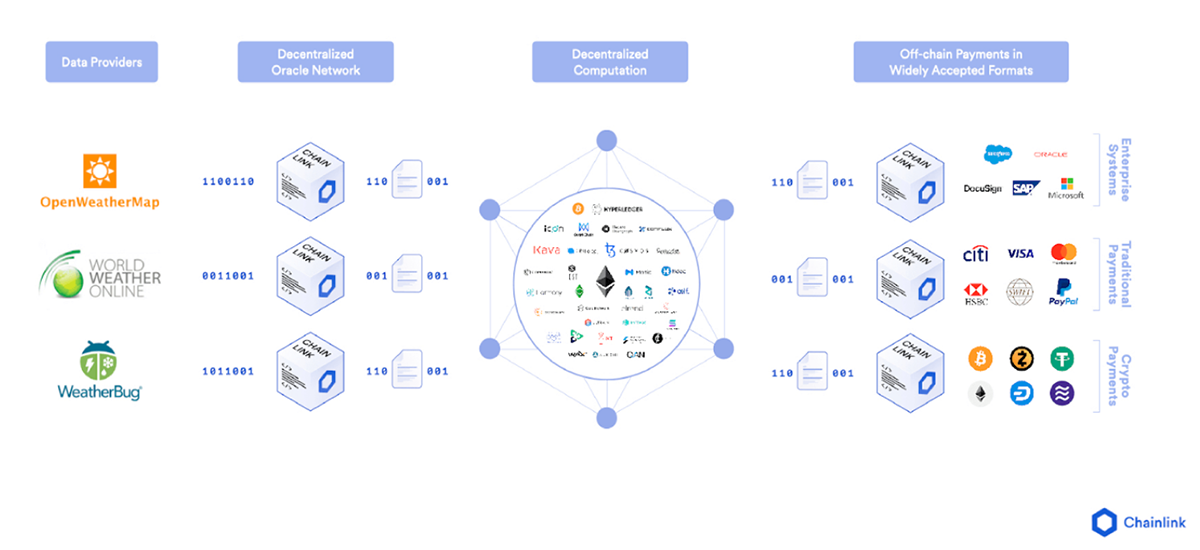

Chainlink is a Decentralised Oracle Network (DON). Historically, oracles were individuals who delivered authoritative and well-regarded counsel or information. Whereas their wisdom was born out of a centralised entity (namely, God), Chainlink’s wisdom is founded upon multiple decentralised sources.

This begs the questions ‘What information is needed?’ and ‘Who needs this information?’. The answer to these questions relates to the proper functionality of smart contracts.

The Real-World Bridge Problem

Last week, I talked about the lack of an ‘out-to-in’ approach that many crypto protocols have. On a more granular level, this characteristic can be analogised to smart contracts.

Digital agreements that have no connection to the outside world do not have real utility. Indeed, a smart contract programmed to release funds to my friend, Harry, once he mows my lawn could not operate as it would never know when my lawn has actually been mown; nor could a smart contract automatically release coupon payments to bondholders should it not know the going interest rate. This is the problem that Chainlink solves.

Chainlink’s purpose is to bridge the on-chain world with the real world and enable agreements that are codified on-chain and backed by off-chain proofs or evidence to trigger the transfer of value. This is where an oracle comes in. Ethereum itself does not actually know what the current price of bitcoin is or indeed who the prime minister of the United Kingdom is. It is Chainlink that can act as the conduit between the Ethereum-world and the real world, offering information to confirm or deny the occurrence of events to add meaning to the transfer of value.

The adoption of smart contracts connected to the real world requires accurate data feeds that are external to a blockchain. Also, these pieces of data must be kept private once incorporated into a smart contract.

To summarise, these are the problems that need solving:

- Blockchains cannot fetch external data by themselves.

- Centralised oracles contradict the nature of digital assets and represent single points of failure.

- The transparency of blockchains means data requests transmitted through them are publicly available, limiting the use of sensitive information in smart contracts.

How does Chainlink solve them?

Chainlink operates in a similar way to blockchains. A decentralised network of independent entities collate data collectively, aggregate it and provide a final, validated single data point to the smart contract. It is crucial that Chainlink is decentralised for two reasons. Firstly, by offering a variety of data sources it eliminates single points of failure. Secondly, its decentralisation means that it is an attractive protocol for digital asset platforms to partner with, as partnering with a centralised oracle would betray the decentralised philosophy of digital assets.

Chainlink employs a reputation-based system to uphold data integrity, ensuring that data providers are good actors and data purchasers get what they pay for. So, consider a request by a data purchaser for data on a given bank’s interest rate to pay coupon payments to bondholders. The purchaser will set the relevant parameters (e.g. number of data providers, minimum reputation score required to participate). Once enough providers submit their data responses, depending on the nature of the request, they are either aggregated or the majority response is used, while anomalies are removed. The reputation system is used to aggregate and determine the quality of data. Should everything go well, providers are paid, and purchasers receive accurate data in return. The prices for providing data are decided on by providers during the bidding process.

Partnerships and Ecosystem

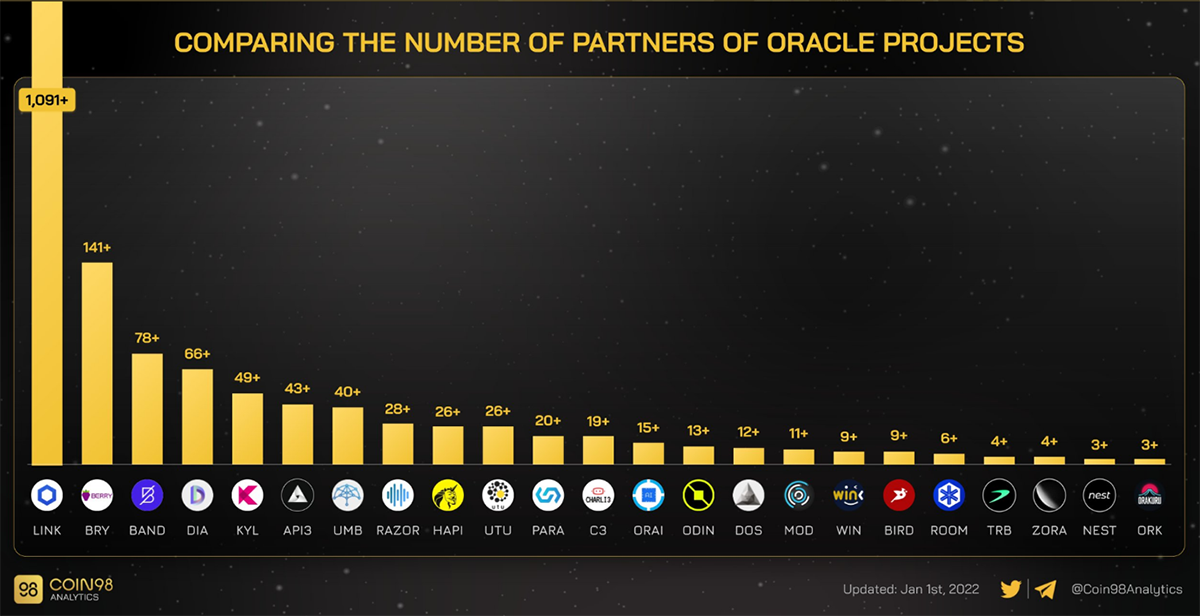

Chainlink is by and large the dominant decentralised oracle network in the digital assets space – off-the-chart (literally).

By way of examples, Synthetix and AAVE have formed partnerships with Chainlink. Synthetix, requires Chainlink’s price feeds of real-world assets to maintain an accurate price feed of synthetic versions of those assets. Similarly, AAVE obtains accurate digital asset price data via Chainlink.

Chainlink has a monopoly here and has partnered with almost every protocol worth knowing. In 2021 alone, Chainlink integrated with Solana, Fantom, Arbitrum and even Cardano – who initially wanted to develop an in-house oracle solution.

Chainlink boasts an incredible CV of business partnerships. For example, the protocol partnered with AWS to create Quickstart. Quickstart makes it possible for any individual or institution to set up an oracle node within seconds. Additionally, Chainlink has formed collaborations with giants such as AccuWeather, Swisscom, and Deustche Telecom for high quality weather and telecommunications data. Even the former CEO of Google, Eric Schmidt, is a strategic advisor to Chainlink labs!

The LINK Token and Future Growth

This paints a rather rosy picture of Chainlink. However, the reality is that the LINK token has underperformed many DeFi protocols since the beginning of 2021, posting a relatively low return (in this industry at least) of approximately 52% over the last year.

As there is no doubt that Chainlink is utilised across the board, perhaps it stands to reason that the utility of the LINK token is limited? The LINK token is used to compensate data feed providers. So, in our example, those providing accurate interest rates for coupon payments to the data purchaser would be compensated in LINK. Furthermore, LINK is fundamental to maintaining the reputation-system that Chainlink relies on. LINK tokens are taken away from bad actors, or simply inaccurate data providers, as an incentivising mechanism to provide the best possible data.

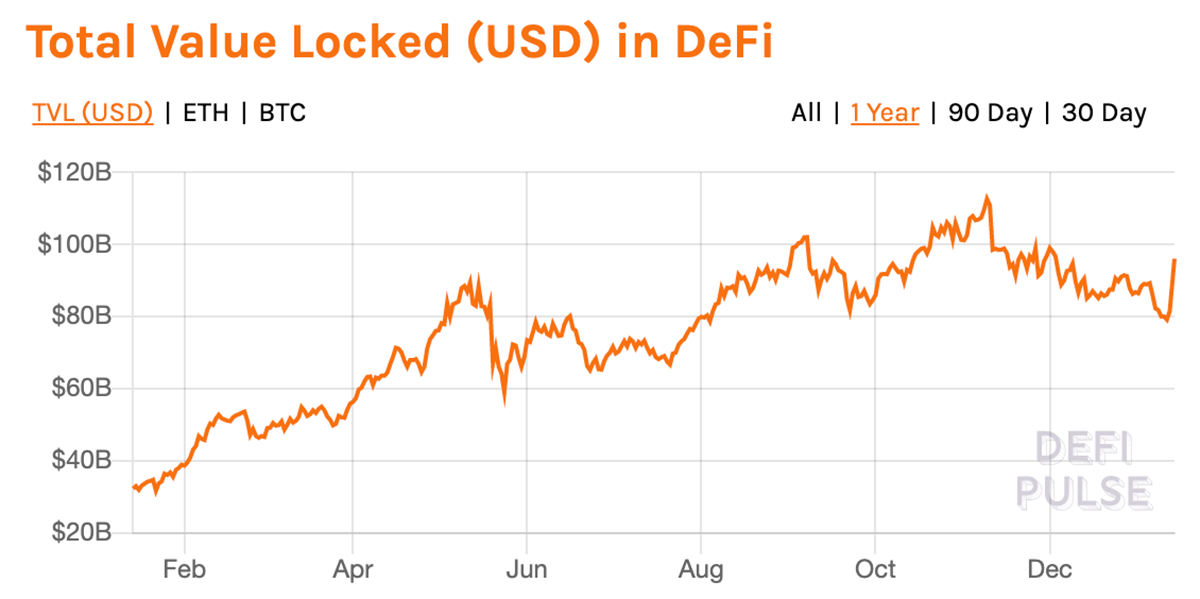

The Total Value Locked in DeFi currently sits at $95.98 billion. It is Chainlink that provides accurate data to almost every DeFi smart contract; without it, smart contracts would be crippled. So why the limited price appreciation?

One argument is that Chainlink Labs have been selling significant amounts of LINK to fund its various future partnerships, funds and grants.

As can be seen by the chart above, there is certainly evidence that Chainlink Labs has been off-loading LINK tokens to support the funding of grants and partnerships. Demand for the LINK token is therefore offset by the selling pressure. With that said, the Polygon (MATIC) team has been acquiring businesses left, right and centre in the last year, and its price hasn’t been stunted in the same way.

The issue with LINK is arguably linked to the absence of its staking mechanism. Fortunately, we are not far away from this release. Currently, however, network participants rewarded in LINK have a higher propensity to sell, rather than hold, due to the lack of yield-bearing opportunities. As things stand, LINK is only a payment token for node operators or a quick buy-and-sell for speculators. This is unlikely to remain the case once Chainlink’s staking feature goes live since LINK will transform into a coordination mechanism on top of its contributions to payments and reputation-maintenance across the network.

Summary

Chainlink retains over 1000 integrations that secure more than $75 billion in value. Today, Chainlink chiefly provides price data to DeFi smart contracts. Tomorrow, in light of partnerships such as those with AccuWeather and Swisscom, the protocol will have a more diverse offering once a greater diversity of dApps are founded within the digital assets ecosystem. Last but certainly not least, Chainlink’s Cross-Chain Interoperability Protocol (CCIP) promises to enable communication between blockchains, furthering LINK’s application in the process.

Comments ()