Atlas Pulse Gold Report - Issue 67;

If broad money growth stabilises above 10% per annum, then Napier doesn’t have a problem saying inflation stabilises above 4%. That was music to my ears because I wrote a piece for the LBMA in 2018 called The Rational Case For $7,000 Gold By 2030.

Highlights

| Regime | Growth over value vertigo |

| Macro | Oil surge on top of a lending boom |

| Valuation | Fair value in an everything bubble |

| Flows and Sentiment | The sellers stall |

| Technical | A ByteTrend score of 5/5 |

Russell Napier Webinar

Happy New Year. Over the holidays, we hosted a webinar with the financial historian Russell Napier, author of the Solid Ground Newsletter.

Russell Napier began writing his Solid Ground global macro strategy report for CLSA in 1995 where he was voted Asia’s No.1 equity strategist. He is a financial historian with two outstanding books under his belt, Anatomy of The Bear (2006) and The Asian Financial Crisis 1995–98: Birth of the Age of Debt (2021). He is also the founder of the Library of Mistakes, and runs a course called the Advanced Valuation in Financial Markets, which is now available online.

Napier has been in the deflation camp for years and has been right. That is why it is all the more interesting that he switched sides in 2020. It was not the vast stimulus packages that caused the change of heart, but the explosion in bank lending.

Bank Lending Causes Inflation

He pointed out how these surges in bank lending are normally found at the top of asset bubbles and not during recessions. He can’t find examples where this has happened before, meaning the surge in lending in 2020 was truly exceptional. It is abnormal for banks to lend on such a scale during times of economic turmoil, and they only did so because the government took on the risk. It is the commercial banks, not the central banks, that have created 80% of the money throughout history. This is new money creation and, therefore, inflationary. In 2020, Napier believed the OECD average inflation rate would rise above 4% simply because broad money growth was above 10%. He was right.

In Napier’s view, the central banks have become irrelevant. The government is now firmly in control while the central banks have limited room to move interest rates, and let’s face it, any move less than a percent is neither here nor there in the big scheme of things. These bank credit guarantees were used in the Covid-19 emergency, but those who think this financial support is temporary are missing the climate emergency. The green movement will consume huge amounts of capital, which the commercial banks will supply, while the governments will underwrite the risk.

Repression

Most people think we live in a free market economy. In times past, that has held true, but with the bond market suppressed for so long, it has become an exaggeration. You can suspend a market economy by separating the element of “choice” in owning fixed interest securities with the element of “compulsion”. This is how interest rates remain below the rate of inflation - what we call negative real interest rates - for long periods of time.

In the short run, there are supply-side constraints that have caused inflation to rise, but if broad money growth stabilises above 10% per annum, then Napier doesn’t have a problem saying inflation stabilises above 4%. That was music to my ears because I wrote a piece for the LBMA in 2018 called The Rational Case For $7,000 Gold By 2030. At the heart of my argument was that inflation expectations would rise to 4%, while interest rates stayed low. If so, a $7,000 gold price is a perfectly rational outcome.

Radical Assets with Radical Weightings

Napier told us that evading financial repression in the 1970s was relatively simple as you just owned Swiss government bonds, a country outside repression, and gold. These were not risky asset choices, yet the required weightings were. Napier stresses there is little point in having modest exposure in these assets as investors need to base their portfolios around them. Other asset choices he mentioned included value equities (industry and commodities), Japanese equities (which tend to hold significant “real assets”) and selective emerging markets (he mentioned Indonesia and India, which have low debt).

Avoiding financial repression is not difficult but requires decisive action. These assets that Napier proposes make up less than 15% of the global total, and he advises they make up 100% of your portfolio. I described this as short career risk and long common sense, which struck a nerve. How the financial services industry defines risk (what are my competitors doing?) compared to common sense (will I lose money?) is poles apart. In a world of financial repression, Napier sides with common sense.

In the case of bitcoin, Napier said it was “too good” for its ability to evade capital controls due to its outstanding mobility, and therefore was at risk of heavy regulation. We can agree to disagree on that point, but I liked the fact that bitcoin/crypto was “too good”. Today, gold is small compared to the mainstream, financialised asset classes, meaning the risks of it being banned or confiscated by the government has receded compared to its prominent role in the 1930s. There are so many easier targets meaning that the risk of owning gold is modest.

We thank Russell for an excellent discussion.

Regime

A reminder for new readers; historically, gold has been a buy when two or more of the following have held true:

- Short-term real interest rates are below 1.8%. TRUE

- The gold price, measured in a basket of currencies is rising, measured by a 35-month exponential moving average. TRUE

- The gold price relative to the S&P 500, measured by a 35-month exponential. SOON

As I keep saying, this equity bull market is long in the tooth and based solely upon rerating as opposed to growth. In other words, equities are becoming more expensive rather than their underlying operations improving.

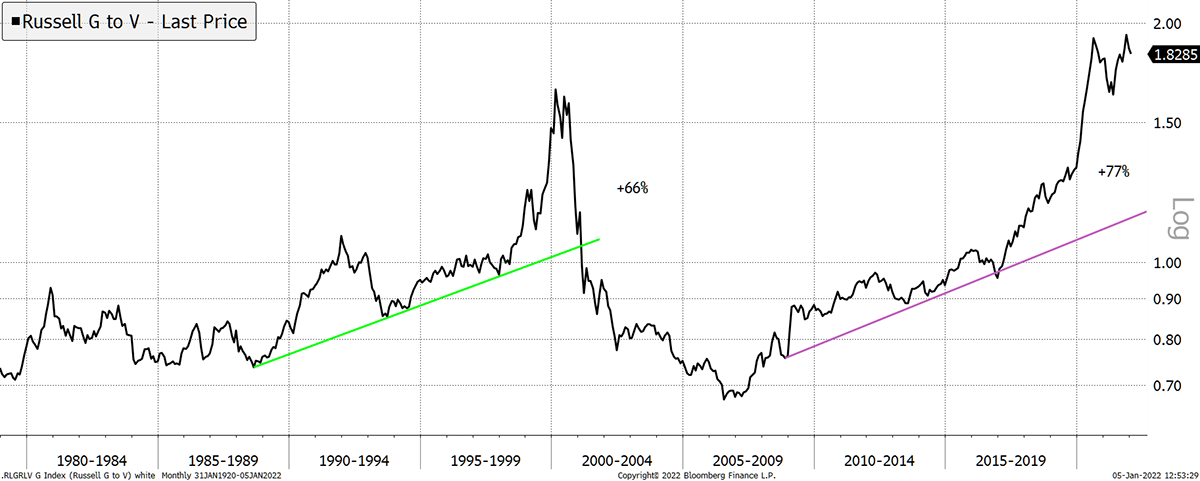

Since Professor Napier has been so helpful, I thought I’d stick with the Russell Indices for the next point. I show the US Russell Growth versus Value Indices over four decades. There have been two +10-year moves where growth materially beat value. In both cases, the outperformance trend was around 3% per annum prior to the final exponential move. Thereafter, the rallies saw moves of 66% and 77% above these 3% annualised trendlines. They say history repeats.

Growth Beats Value

I mean, who would bother owning gold when there’s a boom in growth stocks? The point here is that booms eventually come to an end, and the last time this happened in March 2000, gold enjoyed one hell of a run thereafter. It has been obvious for some time that tech valuations have become unsustainable. We have already seen low-quality growth stocks collapse in 2021, which tells me that a bear market has already started. But it’s when the high-quality growth stocks join them that things get really interesting.

Don’t fear value stocks as they are part of the solution. They may not surge, but more importantly, they will not go up in a puff of smoke. Besides, they tend to prefer inflation.

Macro

The price of oil is the proxy for energy - the single most important input into the economy. With oil’s ByteTrend score jumping from a 1 to a 4 over the past month, the energy squeeze is back.

Oil Rallies

If the chart confuses you, have a look at the introduction to ByteTrend.

Oil, or energy prices in general, have always had a significant influence on inflation. They are the other major influence beyond Napier’s money supply. If energy prices are rising at the same time the banks are lending, then it is certainly worth paying attention.

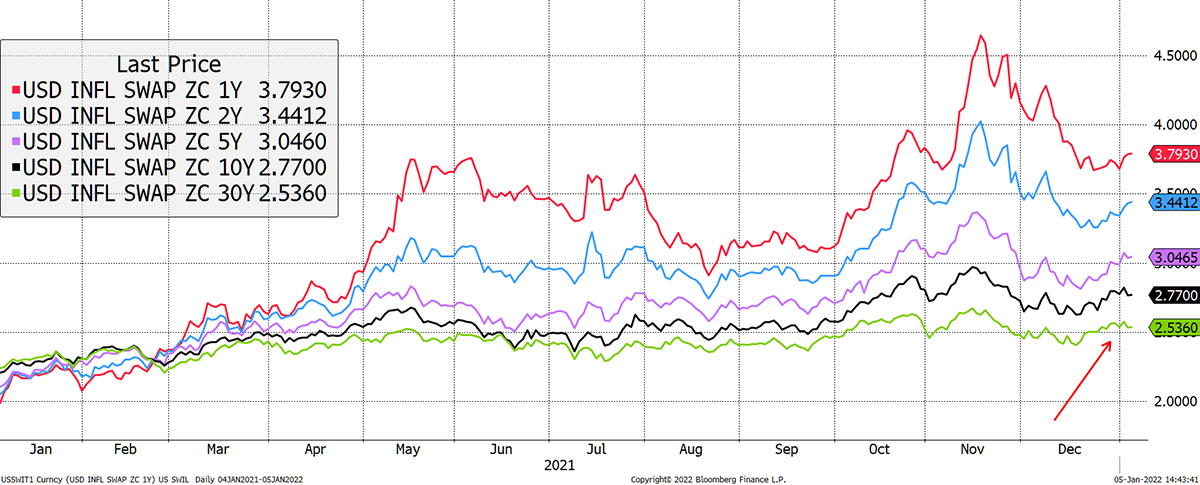

Having seen inflation expectations cool since mid-November, they have started to rise behind oil, albeit with a lag. Recall that long-term real interest rates are the most important driver of the gold price. And the most important driver of real rates during financial repression, where rates are held down, is inflation.

Inflation still Upward

It is the green and black lines (10- and 30-year inflation expectations) that are critical for gold. Slowly but surely, they budge higher, and each time they do, it is powerful for gold.

Valuation, Flows and Sentiment

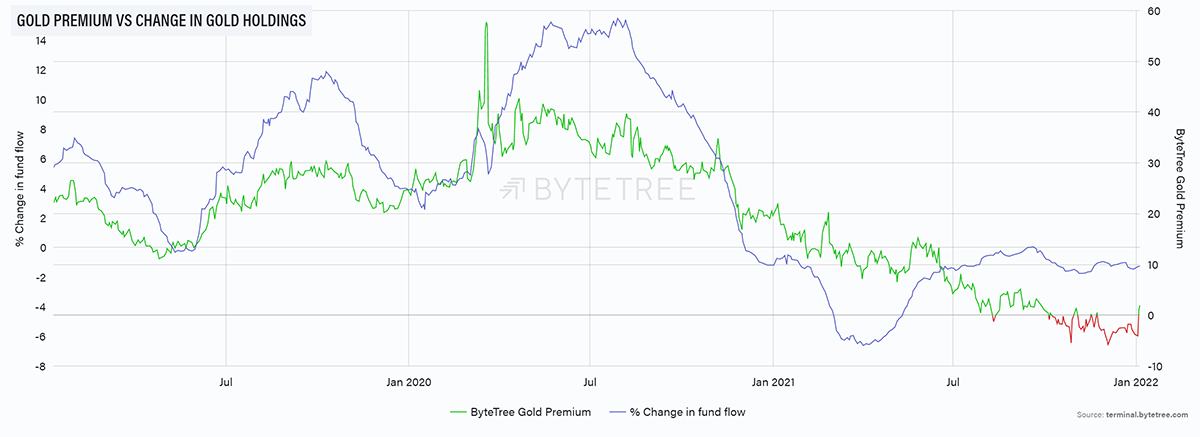

Gold trades at fair value, as shown by the premium, which is close to zero. The change in ETF flows has improved in recent months but remains light. With volatility and sentiment so low, modest inflows will see significant upside in the gold price.

ByteTree’s gold models are updated daily, and the regression model will be added in due course.

Technical

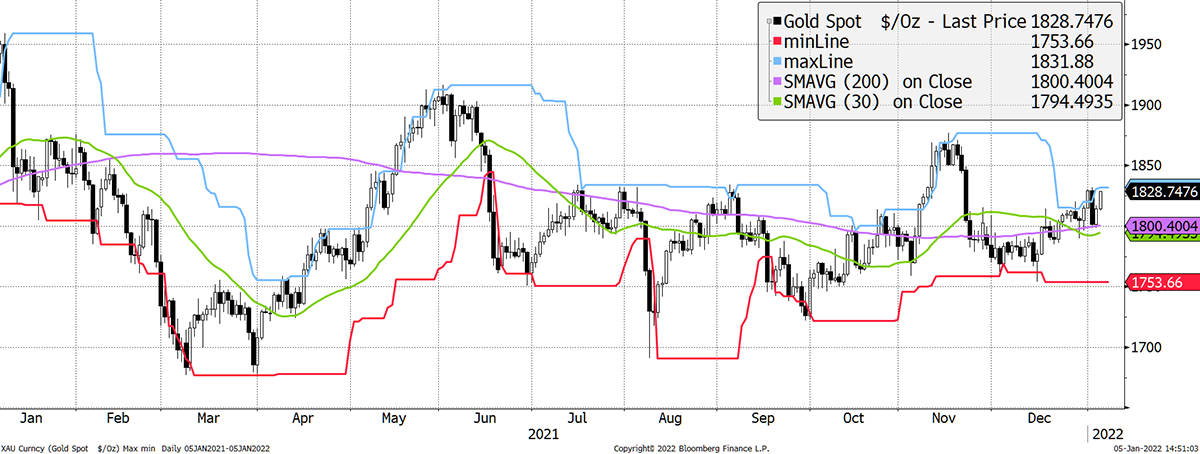

How many have noticed that the gold price in USD now scores 5 out of 5 on ByteTrend. That’s the first time since 2020!

Gold Is Starting to Trend

Summary

Just as investors were confused by gold’s weak 2021, they will be surprised by its buoyant 2022. Too many have written it off, which is ridiculous when you come to think of it. Hundreds of years of human economic history, yet investors get bored when it takes a short break.

Thanks again to Russell for his time over the holidays. I attended his financial history course over a decade ago - a must for all professional money managers. It was excellent and I recommend it, as I do his other ventures.

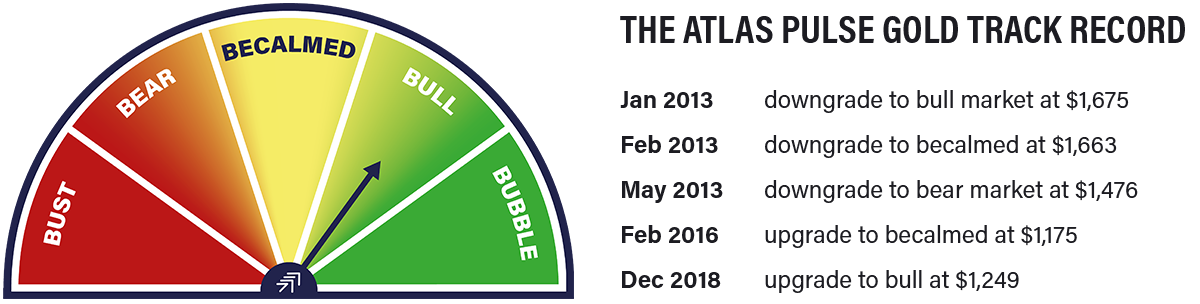

Thank you for reading Atlas Pulse. The Gold Dial Remains on Bull Market.

Charlie Morris is the Founder and Editor of the Atlas Pulse Gold Report, established in 2012. His pioneering gold valuation model, developed in 2012, was published by the London Mastels Bullion Association (LBMA) and the World Gold Council (WGC). It is widely regarded as a major contribution to understanding the behaviour of the gold price.

Please email charlie.morris@bytetree.com with your thoughts.