Why Bitcoin's Four-Year Cycle Is Not 'Yet' Dead

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 108

Some believe the four-year bitcoin price cycle is over. I have no doubt that one day it will be, but not yet. What is clear is that the amplitude of the four-year cycle is falling as other drivers take over.

The root cause of the four-year cycle comes from the bitcoin block reward claimed by the miners. Pre-2012, they received 50 BTC for each block they mined every ten minutes. Then every 210,000 blocks, which takes approximately four years, the block reward halves, thus ensuring the supply never exceeds the 21 million cap. Today, they receive 6.25 BTC per block.

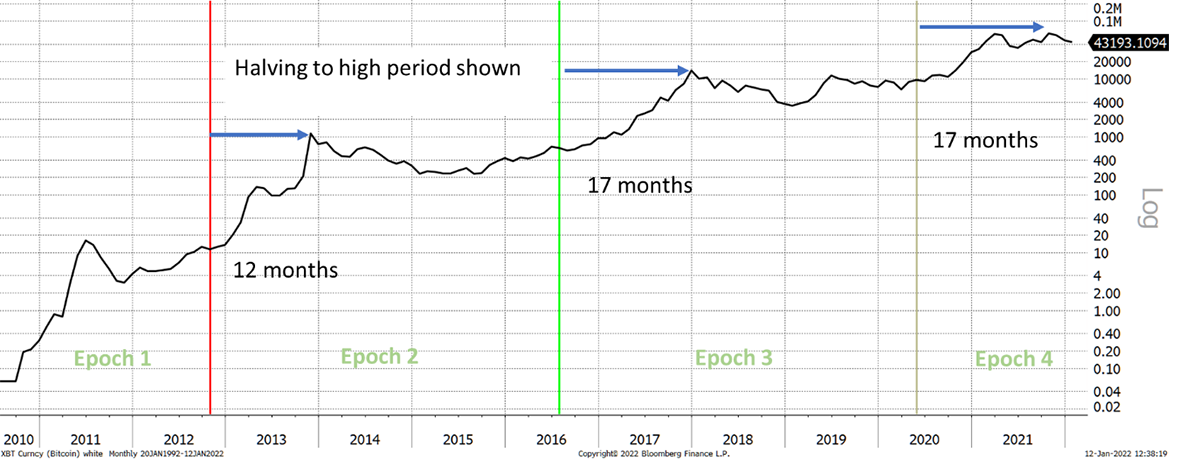

The first halving took place in November 2012, with the price high coming a year later. That brought an end to the first “epoch”. The second halving took place in July 2016, with a price peak 17 months later in November 2017. More recently, the third halving took place in May 2020, paving the way for the current fourth epoch.

If the price high last November at $67,734 turns out to be the high for this epoch, that gap will have also been 17 months. Admittedly, there aren’t many epochs to prove there is a cycle at all, but it is logical as the miners drive the new supply of bitcoin. If they sell less, while demand remains constant, it stands to reason that the price would rise.

The chart shows each of the past four bitcoin epochs separated by vertical lines when the halving took place. The blue arrows show the time taken to reach the price high in each epoch.

Bitcoin by epoch

The first epoch didn’t have a halving so we can’t count that, but the others have all seen spectacular returns.

| Epoch 2 | 9,106% |

| Epoch 3 | 2,782% |

| Epoch 4 | 667% |

The return from halving to high has been roughly a quarter of the prior epoch. If this trend continues, expect the next halving in 2024 to see a 166% jump, and in 2028, 41%.

This is not to say bitcoin can only appreciate by 41% in the sixth epoch (2028 to 2032), just that it will be the contribution from the reduction in new supply. The price could still move higher, but that would be as a result of higher demand, as the future supply will have already been heavily constrained – and therefore priced in.

Most bitcoin projection models are much more bullish than this, but they would be as it goes with the territory. It makes sense that the four-year cycle flattens as the size of the market grows. After all, if you were looking for 9,106% returns today, then bitcoin would soon be larger than global real estate.

The point is that the impact of falling supply is what gave rise to the four-year cycle, and as this tends towards zero, the cycle will flatten. This is a sign of asset maturity.

We can’t yet be sure that the high for the fourth epoch is in place, but the evidence is mounting. For example, institutional investors who buy ETFs were excited by the prospect of the third halving and bought more bitcoins than the miners could supply, as seen by the monthly net flows. The green patch highlights this and triggered the greatest price surge in recent history. This is what happens when demand exceeds supply.

Since the spring, the institutions have shown a lesser appetite for bitcoin, and the tightness in the market has eased. This doesn’t mean the price must fall, as there are other sources of demand, but with this large source resting, a renewed price surge looks less likely.

Then there is the link to tech. It has been clear for years that the links with internet stocks have been strong. After a decade plus boom in tech, many experienced investors see disappointment ahead as the pricing is so high that investors can only be disappointed.

On that basis, bitcoin is unlikely to remain unscathed in 2022, as it has been correlated with tech in the past. In fact, the last bitcoin down year was in 2018, and before that, 2014. We can put that down to the post-boom hangover, but it just so happens that social media stocks lost money in those same years with similarly aligned booms in 2013, 2017 and 2021.

There is no claim that bitcoin mining drives a four-year cycle in tech stocks, but the past bitcoin bear markets were undoubtedly made worse as sentiment around technology was negative. This is a coincidence likely to be repeated in 2022.

Let none of this put you off a long-term bullish view on bitcoin. Despite high volatility and a reputation for boom and bust, it keeps on gaining ground. The chart shows bitcoin against social media stocks, where the trend outperformance has been 40% per annum. That means despite the boom and bust, the underlying trend has been strong, relaying how crypto is gaining ground in the fight for the internet.

Bitcoin is beating social media stocks

Ask the young bright minds why they are fascinated by crypto, and they will tell you this is the future of the internet. The networks of tomorrow will embrace blockchain and eventually drag down today’s tech monopolies.

So many bright minds still harp on about tulips and bubbles, saying there is no intrinsic value in crypto as there are no cashflows. They are wrong as networks are hugely valuable, and they don’t need cashflow because investors are rewarded by owning a share of those valuable networks. Crypto is highly speculative, but new technologies always are.

Summary

Bitcoin may have peaked in the fourth epoch, or it may not. But the impact of the four-year cycle will be much lesser in future than in times past. A 2022 dip seems likely, as the inescapable link with technology means short-term pain. But once that calms, investors that bought in 2022 will be glad they did.

Comments ()