Avalanche - a Force to Be Reckoned With?

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: AVAX;

Last week, I considered Avalanche’s underlying technological architecture and how it differentiates itself from other Layer-1 protocols. This week, I will focus more on the development, ecosystem and funding backing this promising protocol.

2021 has been, among other things, the year of Ethereum alternatives. Ethereum has, in some respects, rolled out the red carpet for competitors as a result of its network congestion and consequent exorbitance. There will be those who don’t mind the high fees, but thinking that no one minds would be highly presumptuous. A crisis in Ethereum has meant an opportunity elsewhere; enter Solana, NEAR, Fantom and Avalanche.

The way that protocols like Avalanche can realise this opportunity is through the proliferation of funding, attracting development and developers, and constructing a vibrant ecosystem. So, how does Avalanche fair?

Funding

In September last year, Avalanche raised $230m from a dozen investors, including the likes of Polychain and Three Arrows Capital. These funds will be used to accelerate the growth of DeFi, as well as other enterprise applications, on Avalanche. The injection of these funds followed a $180m program called Avalanche Rush, which aims to bring blue-chip DeFi applications to Avalanche. Avalanche Rush has been responsible for the introduction of AAVE - a leading lending protocol - and Curve - a decentralised exchange and automated market maker - on Avalanche.

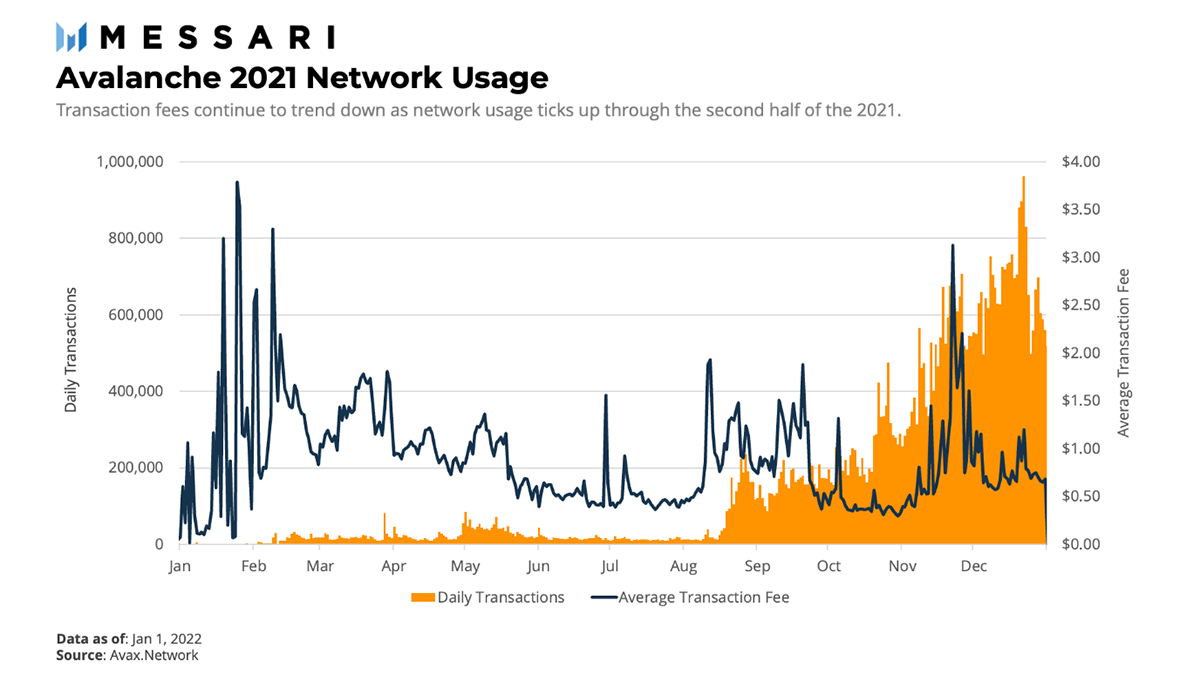

AAVE and Curve were launched in mid-October and hence are likely to be at least partially responsible for the spike in daily transactions since. What is brilliant is the stability of the Average Transaction Fees, or even a slight downtrend, despite the increase in network activity.

In November 2021, Avalanche launched Blizzard, yet another fund worth $200m, which aims to facilitate innovation within the ecosystem for developers and users alike.

As stated by Avalanche founder Emin Gün Sirer:

“To make anything at Avalanche scale, you need large scale capital”

This magnitude of funding is reassuring and certainly fits the category of ‘large scale capital’. Whatever the future holds for Avalanche, we can quite confidently say that a lack of capital will not be a primary constrain on its growth, or reason for its failings.

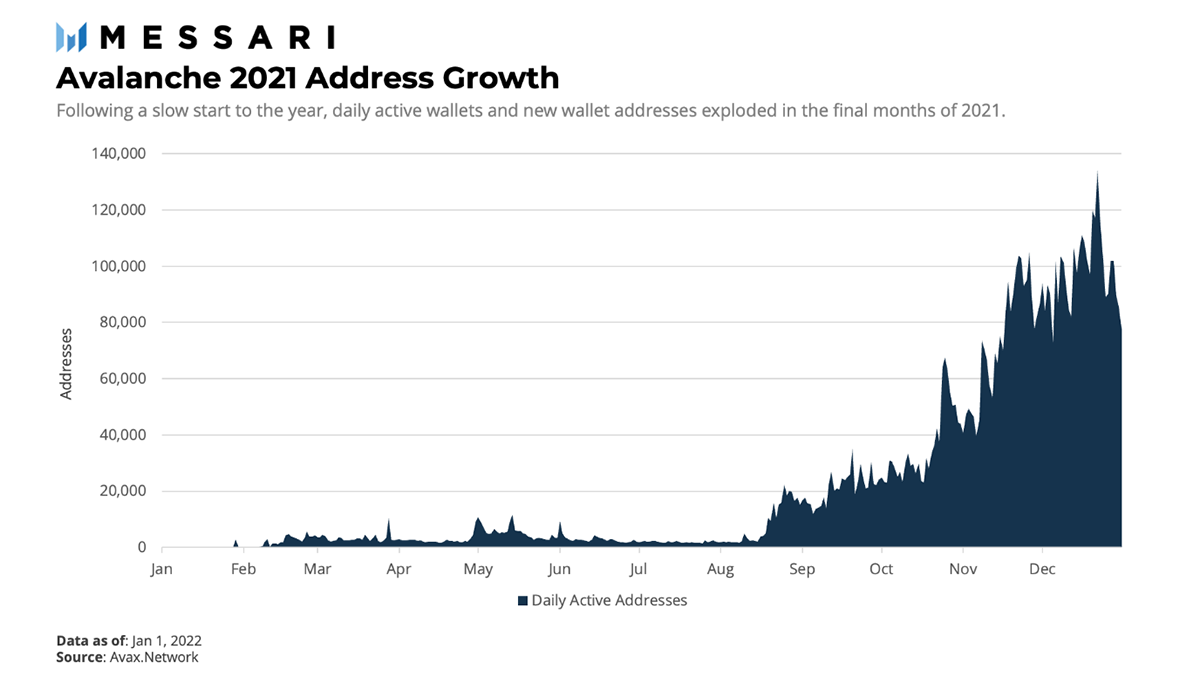

Network

On top of the finances accrued by Avalanche, various events have resulted in this protocol becoming one of the biggest; including, but not limited to, being listed on US exchanges Coinbase and FTX, USDT and USDC launching on Avalanche, Fireblocks adding support for Avalanche – giving over 650 institutions investment access to AVAX – and the ongoing Apricot upgrade. The Apricot upgrade has many phases, though most recently, upgrades have lowered Avalanche’s transaction fees and have facilitated asset transfers between its three blockchains. Furthermore, Celsius – one of the most popular digital asset platforms – also supports AVAX. It is no surprise that the daily active wallets have risen exponentially.

This begs the question of whether we are late to the party. The answer to this depends on what Avalanche’s future plans look like. There are various milestones that Avalanche has to meet this year which are a cause for optimism. Note that some of these were due for completion in 2021, but they are more likely to be finalised this year.

Digital Wallets

First, Avalanche will be releasing additional wallets as browser extensions and mobile apps. Its current web wallet is not very secure, and while Avalanche is compatible with MetaMask, the user experience is clunky at best. The wallets compatible with a blockchain make a marked difference in user experience and can have a direct impact on adoption. For example, one could argue that Solana’s adoption is at least partly influenced by the usability of Phantom, its leading wallet.

Pruning

‘Pruning’ is a feature that will make it possible to reduce the size of the Avalanche blockchain where it becomes too large. Pruning is important because where a blockchain grows too large, it becomes difficult for more than a few validator nodes to store its full transaction history. This would compromise decentralisation and security.

To put this into perspective, consider a family tree, where my existence is evidenced by my parents’ presence on that family tree. It would be difficult, and not to mention inefficient, to require evidence of my entire family tree in order to prove my existence. Very few people have that information, if any, while fewer still have the capacity to provide it. Pruning, or using a snapshot of my parents, would enable more people to validate my existence – say, my sister, cousin or partner. Similarly, pruning would enable more validators to validate the network in a more efficient way, furthering the ends of decentralisation and network efficiency.

Additional Bridges & Integration with Cosmos’s Interblockchain Communication (IBC) Protocol

Readers will know that interoperability is the glue that we hope will bind the fragmented digital asset space together. Avalanche bridges will provide access to capital pools across the space, whereas IBC-compatibility will offer access to most of Cosmos’s ecosystem.

Development

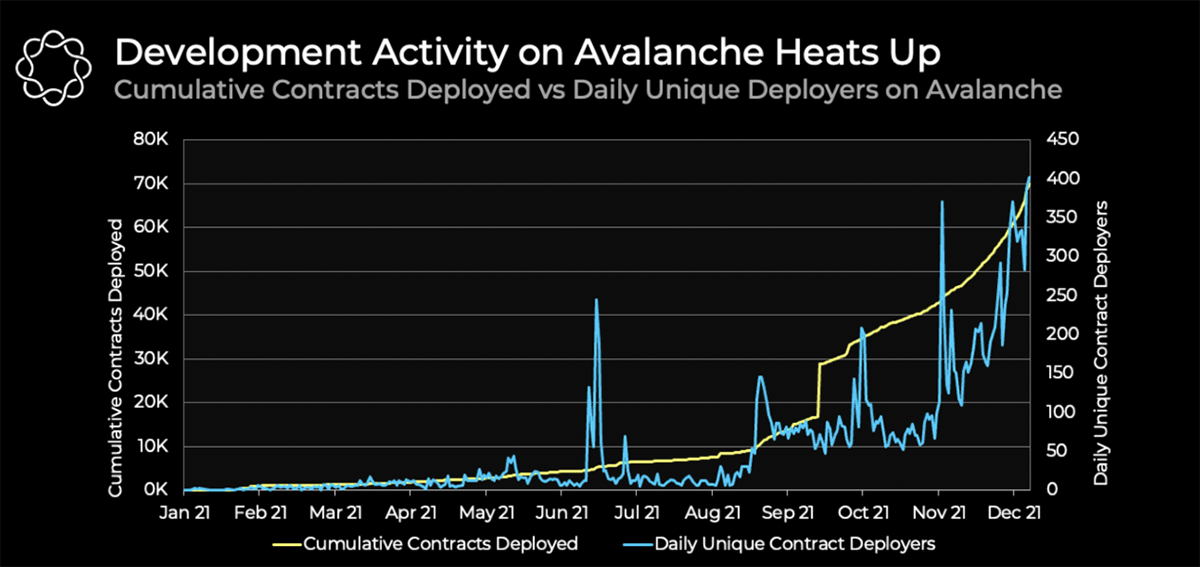

The Total Value Locked (TVL) on Avalanche has risen sharply since the second half of 2021.

While dominant contributors to this TVL are AAVE and Curve, domestic developer activity has mirrored this increase in TVL.

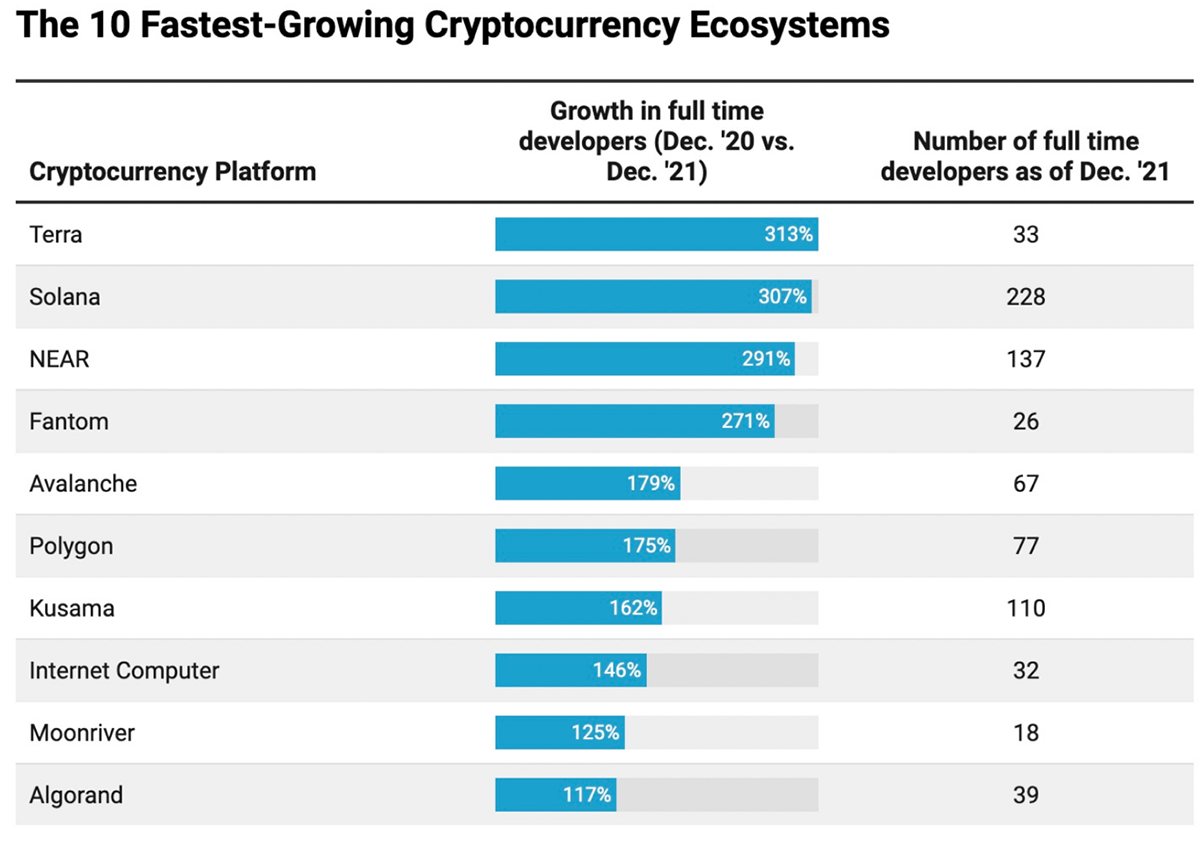

Development activity is a good indicator of the future potential and durability of a protocol. Indeed, the Electric Capital Developer Report highlighted that protocols such as Avalanche, Terra, NEAR and Solana are all growing at faster rates than Ethereum did at similar points in its own history.

But perhaps that is exactly the issue? Terra, NEAR and Solana are also on that list. All three protocols also have the developers, similar levels of funding (even the VCs backing them seem to be the same), and vibrant ecosystems. In fact, it may be argued that protocols such as NEAR and Terra have been more aggressive in procuring developers than Avalanche.

In this specific sector, competition is king. What’s more, the recent Wormhole Hack worth $320m demonstrates the vulnerabilities of bridges between blockchains, while making a case for Layer-2 solutions on Ethereum, such as Arbitrum and Metis, as well as interoperability-focused chains, such as Cosmos. Perhaps a crisis on Ethereum equals an opportunity for Ethereum?

However, as mentioned in part I, while there are many competitors, there will likely be multiple winners. In fact, the very emphasis on interoperability and the development of bridges between blockchains demonstrate that protocols in this space can derive mutual benefit from each other’s success. Smart contract platforms can co-exist for different use cases. For example, Avalanche’s instant finality of transactions may make it a more viable destination for gaming applications that require constant transacting. Indeed, Crabada and DeFi Kingdoms are actual examples of Play-to-Earn protocols developing on Avalanche.

Moreover, Ava Labs’ strategic alliance with Deloitte is an example of a real-world use case for Avalanche’s blockchain, that is, being used to streamline disaster reimbursements following natural disasters and public health emergencies.

Summary

The reality is that the well-funded, growing ecosystems are unlikely to wither away in the same way as most of the top 20 cryptocurrencies of 2016. Avalanche has the funding, growth and development of a robust and vibrant ecosystem. All things being equal, the metrics largely suggest that there is more reason to be optimistic than not. Whether that optimism extends to Avalanche being the market leader is a different story.

Comments ()