Taproot and the Fees Conundrum

Disclaimer: Your capital is at risk. This is not investment advice.

Week 6 2022

As far as the Network Demand Model is concerned, the recent bounce in bitcoin should be treated with caution. But it may be that the interpretation of the data needs to change. This week we take a closer look at the moribund fees signal and examine the possible impact of “Taproot”.

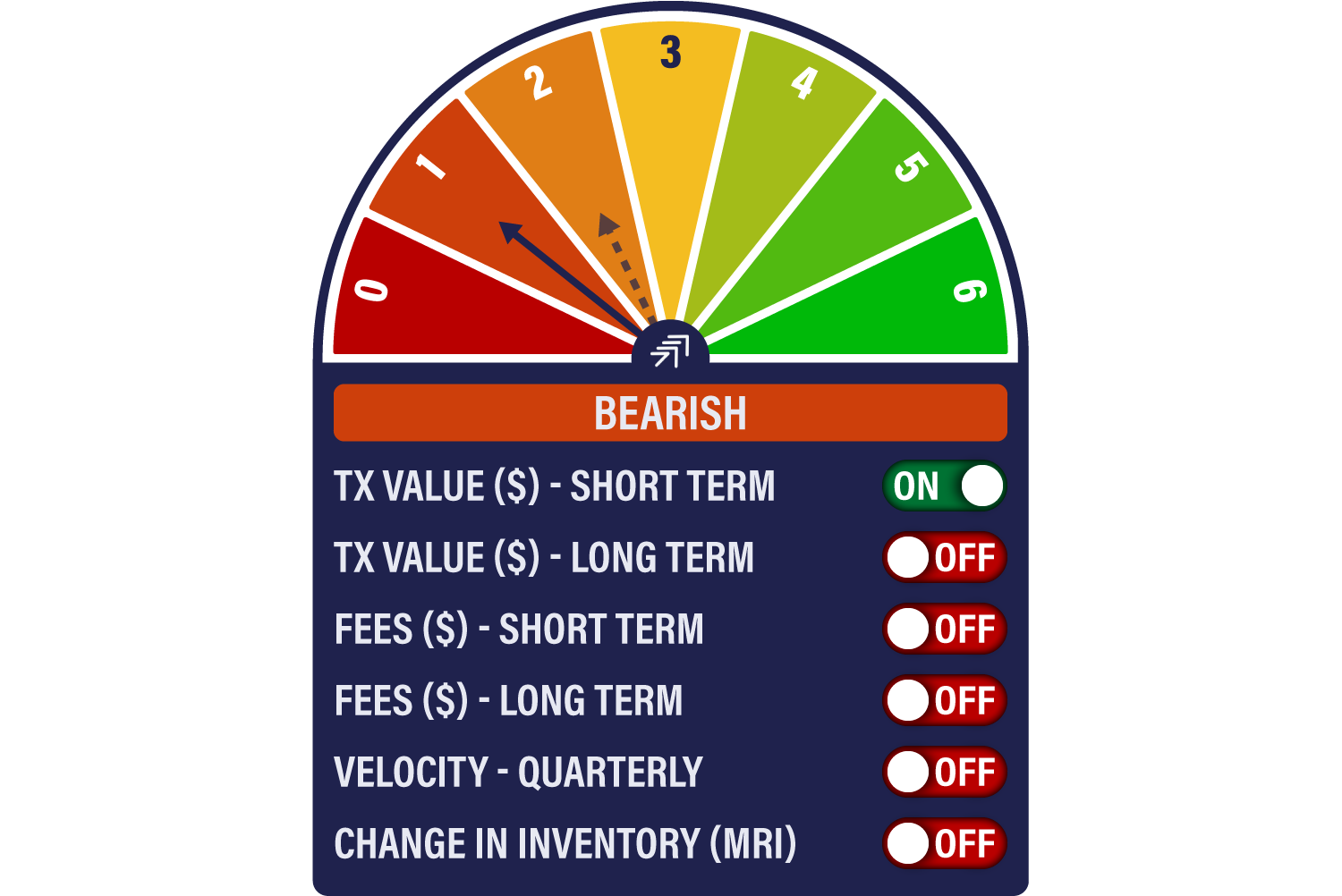

Despite bitcoin’s robust price action over the last four days, the Network Demand Model slips back to a score of 1/6 this week. Short-term transactions remain on, but MRI has turned off.

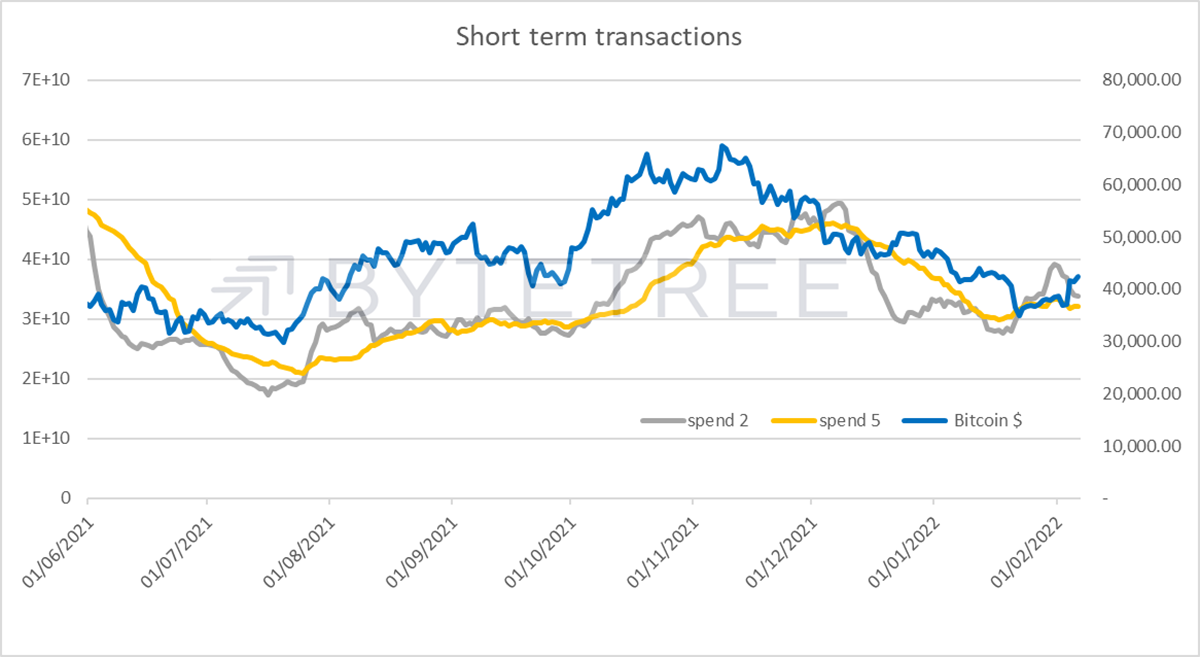

The short-term transaction series remains the only signal that is turned on. The recent rise in transaction activity is consistent with the sort of selling climax we saw in January, but it would be reassuring to see the activity remain at an elevated level. The important line in the chart below is the grey 2-week series, which needs to push higher from here to confirm the sort of sustainable price performance that we saw back in October.

We’re not overly troubled by the reversal of the MRI signal. For the time being, the series remains healthily above 100%, so the miners are finding a decent bid to sell into. The first quarter has often been a poor one for bitcoin, perhaps related to miners’ need to fork out for tax and year-end bonuses. As long as we see a system broadly in equilibrium, we can rest easy.

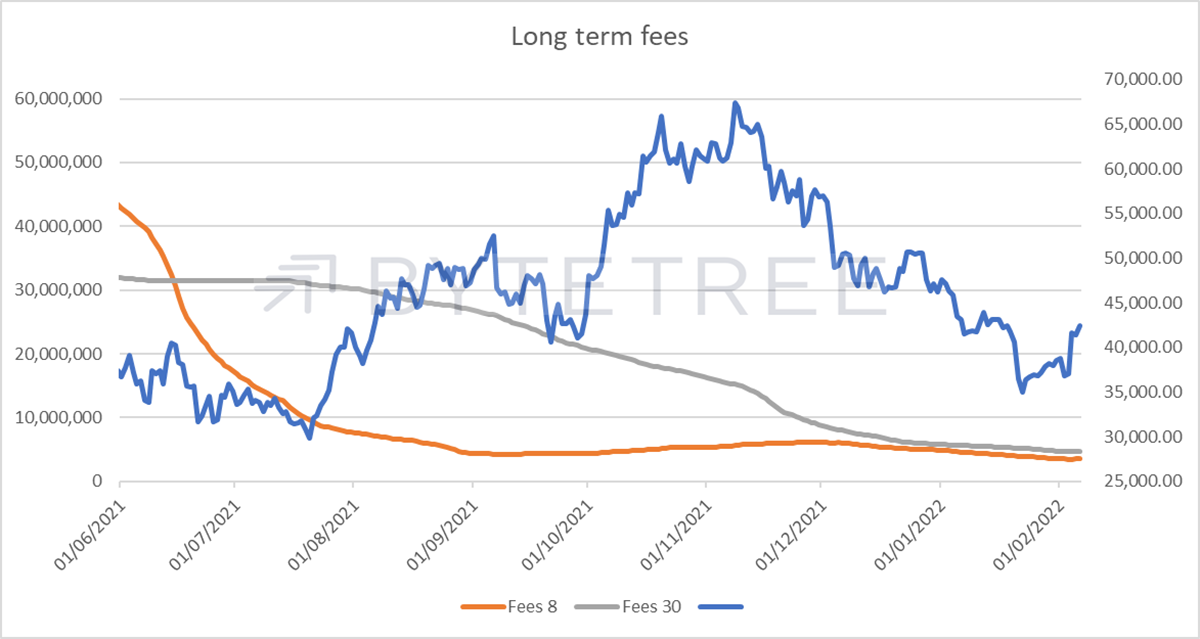

We remain somewhat fixated by the paucity of fees, partly because they’ve given us the best indication of system health over the years. What we’re looking for in the chart below is for the orange line (8-week rolling average) to cross back above the grey line (30-week).

The last time that this signal turned on was when bitcoin was US$6,200 back in March 2020. As shown above, it turned off in June 2021 at a price of around US$40,400, not a million miles from where we are today. That delivered a gain of 6.5x, not bad.

The recent weakness of fees is arguably down to two things: a structural improvement in the efficiency of the network and lower trading value.

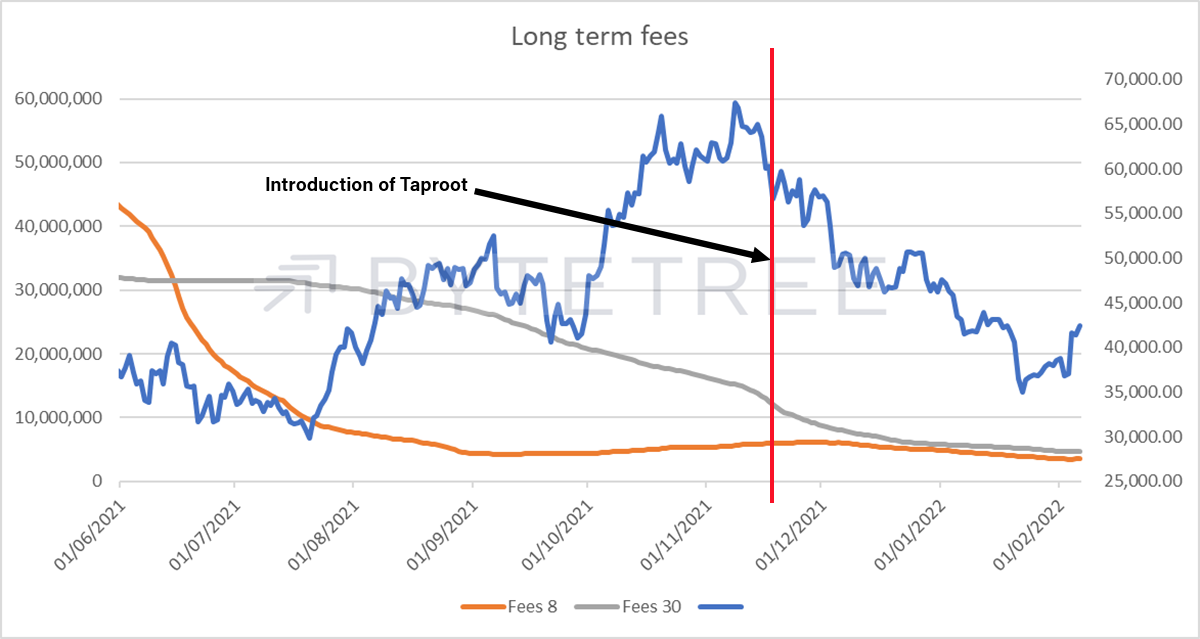

The Taproot upgrade, which went live on 14th November last year, seems to have had an impact. The intended changes were four-fold:

- Reduced transaction sizes. This reduces transactions per block, thus reducing transaction fees per transaction.

- Anonymised “multisig” transactions, resulting in more security for those using smart contracts to transact. This could attract those wanting more privacy in their financial affairs.

- The ability to enable “discreet log contracts”. This should attract entrepreneurs to bitcoin for smart-contract based ventures.

- Improved connectivity with “Layer-2” interfaces, the most well-known at the moment being the Lighting Network. This would enable more transactions per second, but these won’t be seen on the blockchain itself.

In the simplest terms, Taproot was designed to improve bitcoin’s functionality while also reducing fees via greater efficiencies. As can be seen on the chart below, Taproot’s introduction does seem to have coincided with the start of the recent downward channel in fees.

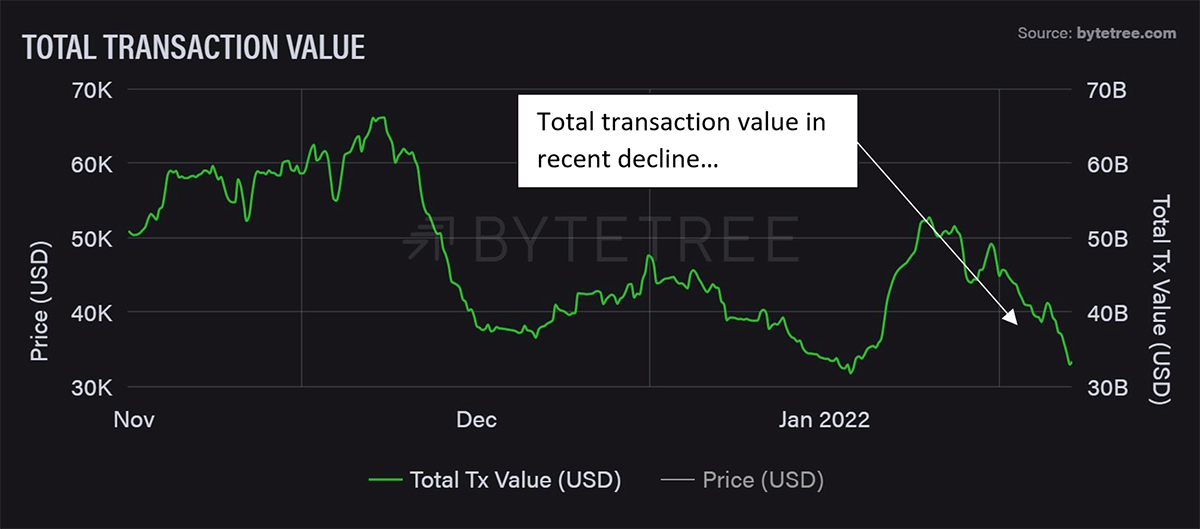

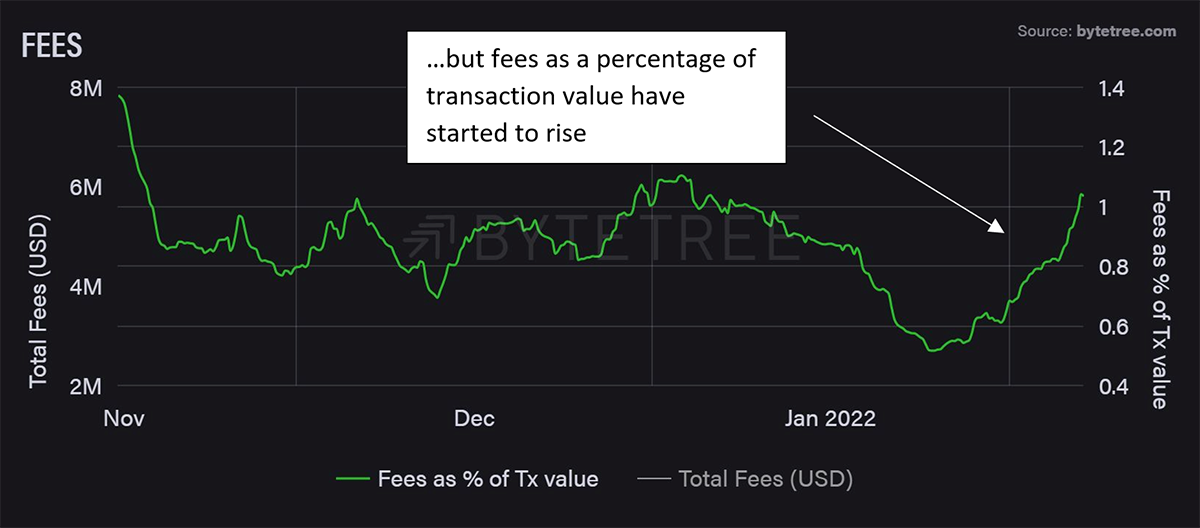

Admittedly, this is hard to disentangle from bitcoin’s price fall over the period. But there is an intriguing recent divergence, as shown in the two charts below. Fees as a percentage of transaction value have started to rise, even as total transaction value has been falling.

We can’t pretend to be certain of the reason behind this (answers on a postcard, please!), but we can speculate that this means that the drop in on-chain transactions may be hiding the true picture and that there is more activity in the bitcoin ecosystem than meets the eye.

Not only might fees have reset to a lower level, but the recent uptick may be telling us that the network is healthier than at face value. If this is the case, it will be notable when the Network Demand Model gives a signal that fees are back on an uptrend. If the recent trend continues that might not be far away.

Comments ()