Newsletter Issue 113

Our congratulations to Fidelity for being the latest ETF issuer to launch a bitcoin fund in Germany under the ticker FBTC. They see future client demand, and if there isn’t much today, there soon will be. There aren’t many assets that will protect you at the end of a 40-year boom in debt, yet bitcoin is one of them.

Most financial institutions are unprepared, and the proof is all around us. The great post-financial crisis bull market in everything, fuelled by cheap money, is over.

Major asset bubbles are rare, and having followed stockmarkets since the early 1990s, I have only seen two: dotcom and the current everything bubble. Sure, there have been plenty of times when a country or sector showed excesses, but a proper bubble brings in the masses just ahead of a seismic macro shift. No one is listening, and everyone who isn’t prepared loses.

2021 saw record inward investment into equities and crypto, and prices ballooned. Those compelling new technologies ranging from clean energy to space travel have already lost half of their money as the bubble in dreams has burst. At least the first halving is already behind us.

Crypto was very much a part of that too, and already the likes of DOGE, the future money for Mars, have already fallen by 80%. If you are waiting for the bounce, don’t hold your breath. Yet it is important to distinguish between bitcoin and crypto. DOGE is worth zero, some crypto projects have great potential in computing and finance, and bitcoin has become a macro asset that is here to stay.

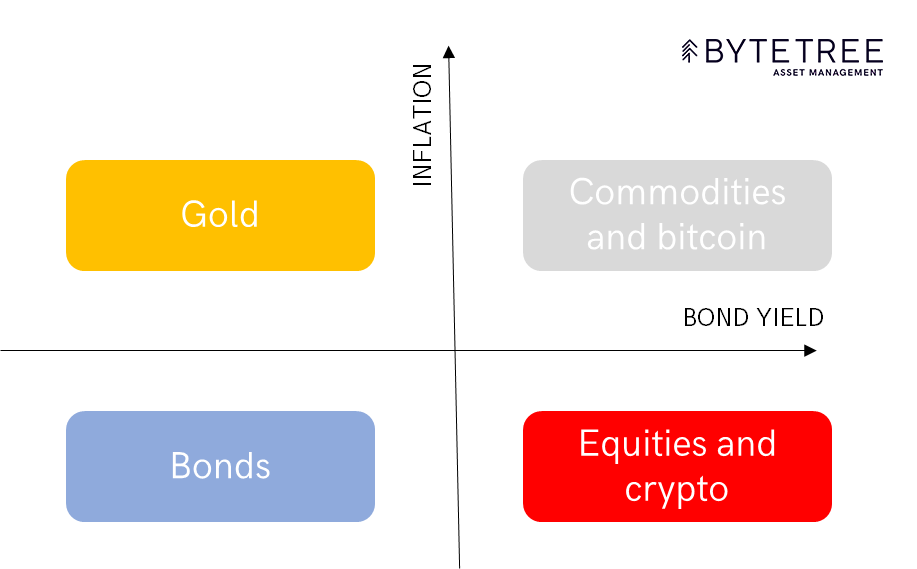

My Money Map strives to place assets within a simple framework based on interest rates and inflation. Bonds and equities, aka financial assets, prefer low rates and inflation - the so-called Goldilocks scenario that has fueled the bull market since the early 1980s. In contrast, inflation sees hard assets perform, just as it harms financial assets.

The Money Map

Just a modest burst of inflation of 10.1% total since May 2020 has brought great changes. The US long-bond, a “risk-free” asset, has already fallen by 32% since its peak, and the debt for the grandkids, the 100-year Austrian bond, is down by 45%.

The impact of higher inflation is already putting downward pressure on equities, starting with the speculative themes (clean tech, space etc.) and is spreading. Big tech is under pressure, and the equity group most insulated has been related to commodities and other hard assets.

Just as some equities are more inflation sensitive, others such as Procter and Gamble or Nestle are more bond-like. Yet the majority of domestically orientated growth companies live in the bottom right. They don’t like the economy to slow (yield falls), and they don’t like inflation to rise (pricing power and risk to company valuation).

The assets that actually benefit from inflation are remarkably few. Gold is the king because it not only protects from inflation but is globally respected and accepted regardless of the state of the economy. Commodities are similar but only perform when the economy is doing well – when there is demand.

Bitcoin on the Money Map

Bitcoin and crypto sit in different places on the Money Map. Crypto is much more speculative and makes no claim of having inflation-proof credentials. It’s all about the tech. Bitcoin, on the other hand, was designed to be digital gold, which is what first interested me several years ago. Like many, I have followed bitcoin’s evolution with my eyes open.

It has been plain for the eye to see that the majority of bitcoin’s progress has coincided with risk-on market conditions, which typically sees the bond yield rising or stable, and where inflation has also been rising and stable.

The inflation sensitivity is easy to understand because bitcoin has a limited supply, and the future production will keep on slowing. Put simply, 90% of the bitcoin that will ever exist already does, and so if things really get going, there’s not much to go around.

The risk-on credentials are also obvious because bitcoin stirs the animal spirits within financial markets. If the economy was collapsing, we’d focus on putting food on the table and leave wealth creation for another day.

Bitcoin is happy in its top right box because it looks and smells like a commodity as it is volatile and cyclical. Commodities repeatedly swing between boom and bust cycles and seem to smile while they’re doing it. It’s expected, and that’s fine, yet we assume the price of commodities will rise over the very long term as the purchasing power of money falls. In that sense, bitcoin is very much a digital commodity with a use case linked to finance and the internet.

The price of bitcoin has fallen since November, but not catastrophically in the great scheme of things as the speculative excesses evaporated. Of more interest is its resilience against highly speculative assets and its ability to attract capital during harsh market conditions. In recent weeks, bitcoin has seen inward investment flows into the bitcoin ETFs, such as the one recently launched by Fidelity. This happened during a time of market stress, which is impressive.

Bitcoin is more resilient than ARKK

Having launched in 2009, bitcoin is no spring chicken. Each year it proves its sceptics wrong just by surviving. Every now and then, it lurches forward, bringing millions of investors with it. Those people come from Nigeria and Ukraine, just as they do Germany or Japan. Bitcoin is a truly global phenomenon that is well understood by the many.

Summary

The great bull market in bonds and equities is over, and this great asset bubble is bursting. Those who recognise this and think differently will financially survive. Those who don’t will see their wealth evaporate along with the long bond and clean tech stocks.

Evidence keeps on growing that bitcoin is an inflation-sensitive asset, just as it becomes increasingly clear that inflation is here to stay. That means bitcoin is one of the lifeboats as opposed to being the Titanic. We welcome Fidelity into the European Bitcoin ETF issuer club - a fine organisation that enables the institutional investor to be on the right side of history.