Connecting the DOTs on Polkadot

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: DOT;

The primary issue surrounding blockchains relates to scalability. Blockchains are not like Facebook or Google, which can add a theoretically infinite number of users to their networks without much difficulty. Blockchains lack the literal capability to scale infinitely. It is no wonder that scalability solutions are the talk of the town.

If blockchains cannot scale infinitely, it follows that the market needs more than one. If we need more blockchains, it stands to reason that each chain can gain real value by connecting with other chains. Like international trade, there is a comparative advantage that can be realised through effective resource allocation. After all, the US cannot produce all the textile or crude oil in the world. It needs India, Bangladesh and Saudi Arabia to make up for the shortfall while it focuses more efficiently on auto parts or industrial machines. The rising popularity of layer-2s, rollups, alternate layer-1s and interoperability-focused protocols is the crypto attempt at building the infrastructure for its version of international trade: no blockchain wants to be North Korea.

Crucially, blockchains also rely on Network Effects (Metcalfe’s Law). If you limit the size of your network, you limit its value. Imagine London without a transport network; you could get a flat in Knightsbridge for pennies on the dollar. Polkadot is a recognition of this very fact.

The Polkadot goal is a multi-chain universe where individual sub-chains - or Parachains - can speak and access each other seamlessly, cheaply and efficiently. The simple goal is to increase access and expand the size of its network. The ideology is sound, but is the execution?

Polkadot’s Architecture

Gavin Wood, former CTO of Ethereum and the founder of Polkadot, likened the role of Polkadot to that of an office environment. In offices, employees carry on with their own tasks autonomously for most of the day, while the rest of the day is filled with synchronised meetings or phone calls made possible by the office building. This analogy underpins Polkadot’s underlying architecture.

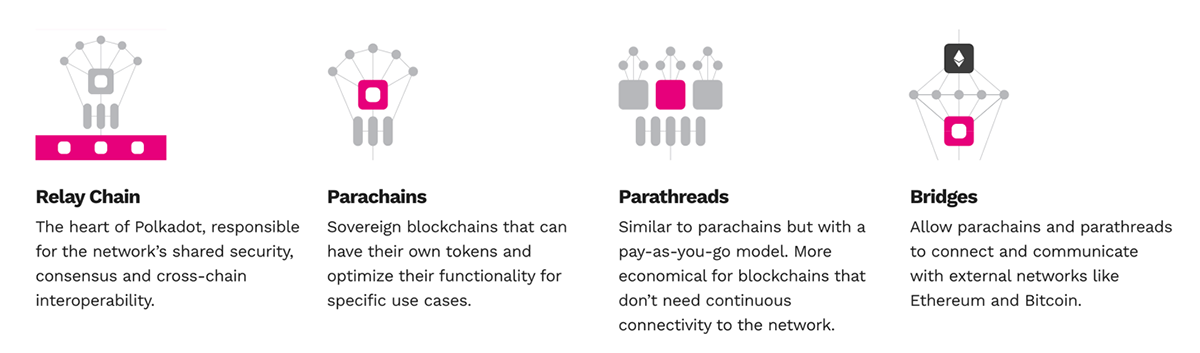

Polkadot is a layer-0 blockchain, consisting of the Relay Chain and Parachains, presenting itself as a solution for interoperability. Drawing on the office analogy mentioned above, the Relay Chain is the office, while the Parachains are the employees. The Relay Chain is Polkadot’s core chain, providing shared security, consensus and cross-chain interoperability to the network. However, it is not compatible with smart contracts. On the other hand, Parachains are layer-1 smart contract-compatible sovereign blockchains that can host their own tokens, functionalities and use cases – just like how employees have their own functions, value propositions and work methods. Parachains run parallel to the Relay Chain, easing the burden on the main chain and optimising scalability and access to security.

The image above is the perfect depiction of the Polkadot Network and its ultimate goal. The focus on interoperability is prominent in every component of its underlying architecture. What’s more, the individual Parachains can communicate with each other through a feature called Cross-Consensus Message Format (XCM). Inter-blockchain communication opens up a trove of application possibilities, possibly connecting DeFi to NFTs, or GameFi to decentralised social media networks. True interoperability.

There is a total of 100 Parachain slots on the Polkadot Network. While this demonstrates an impressive ability to scale (approx. 1,000 transactions per second), it begs the question of how these slots are allocated to different developers or projects. The answer is simple: auctions. Developers have to enter an auction and outbid competitors to secure slots that last for a fixed time period. Those who lack the funds to win auctions can use a crowdfunding system known as Parachain Loan Offerings (PLOs). Contrary to ICOs, contributors who bid their DOT in favour of prospective developers maintain full ownership of their tokens, and do not at any point trade their token sets for another.

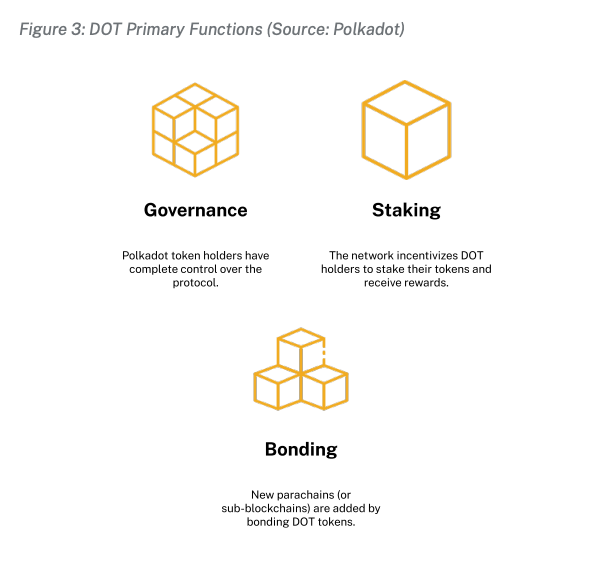

The whole system is held together by DOT, Polkadot’s native token. DOT is used for staking, governing the network and bonding. There is a natural demand for DOT for those transacting on the network, or indeed developing on it. Furthermore, successful PLO participants lock their DOT tokens for the total time period that a parachain slot is leased by a developer. With one hundred Parachains, and significant network engagement, one could hazard a guess that this could lead to quite a healthy supply shock – though caveat this with DOT’s higher than normal rate of inflation and unlimited supply.

Polkadot’s consensus mechanism is the novel Nominated Proof-of-Stake (NPoS). Here, Nominators elect Validators to validate transactions. Without getting too technical, the goal is to maximise decentralisation and fair representation while enhancing security and resilience to attacks.

Developers and Applications

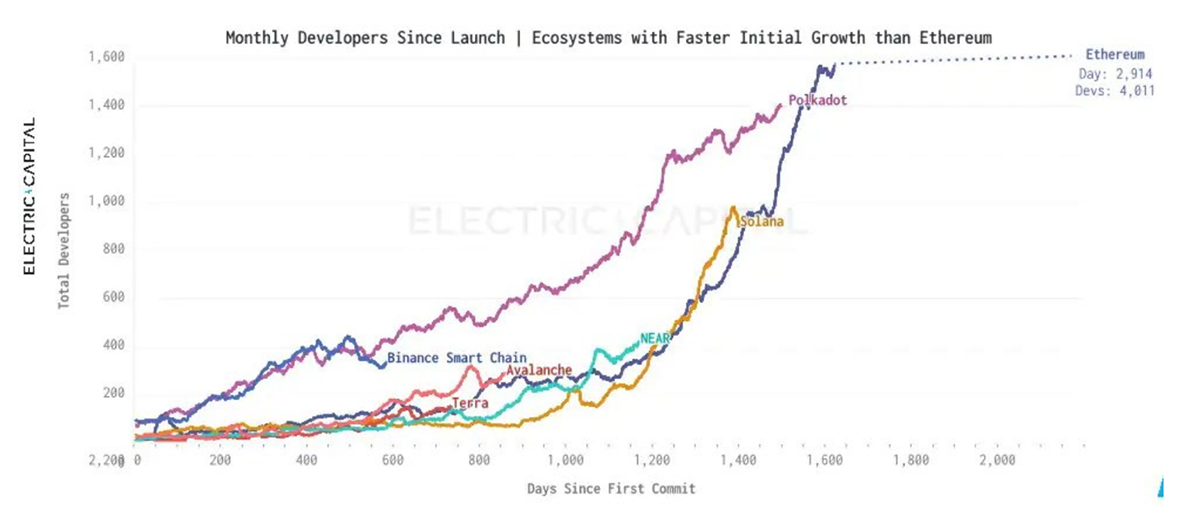

According to the recent Electric Capital Report, Polkadot is a hub for development, second only to Ethereum.

Procuring developers and development in this space is no easy feat. The amount of development on a given protocol is a good indicator of its longevity and developer-usability. If the developers are happy and stick around, then we can expect a vibrant ecosystem in the future.

Speaking of network vibrancy, there are various applications that have successfully secured Parachain slots. For instance, Moonbeam is a Parachain that recognises the multi-chain future. Indeed, its main purpose is to enable smooth interoperability between Ethereum and Polkadot. Moonbeam is likely to take advantage of the growing set of developers who want to stretch Ethereum’s capabilities to realise the benefits of other blockchains, namely quicker and cheaper transactions.

Furthermore, Polkadot’s DeFi ecosystem is set to kick off with the Acala Network. The Acala Network aims to be the DeFi hub on Polkadot and is responsible for launching the Acala Dollar (aUSD), a decentralised stablecoin touted to fuel the Polkadot Network. Given inter-parachain communication, aUSD is likely to benefit many applications launched in the Polkadot ecosystem. Moreover, aUSD’s decentralised nature is healthy since centralised stablecoin issuers like Tether and Circle are contrary to the decentralised philosophy of crypto and are regulatory risks. The Acala DeFi economy will also constitute a decentralised exchange and a liquid staking protocol known as Homa. Through Acala’s EVM+, Ethereum dApps can leverage aUSD and the liquidity housed in the Acala network and vice versa.

There seems to be an elegant homogeneity between the Polkadot Network and the applications rolling out on it. The great thing about this space is that ‘competitors’ here recognise each other’s value. There are fewer sharp elbows than there are sharp minds.

Some may have noticed that there are clear similarities between Polkadot and Cosmos, though they are beyond the scope of this article. We look forward to writing an article specifically considering the Layer-0 competitive landscape in the near future.

Summary

While Polkadot’s price action has been less exciting than its competitors, increasing compatibility with the Ethereum Virtual Machine will likely foster momentum within the ecosystem. In this industry, success begets success. What has so far held Polkadot back is lateness, as the Parachain auctions missed 2021. While blockchains aren’t infinitely scalable, the rate of innovation within the sector is. One year seems to equal ten. Nevertheless, the Parachains are now alive and kicking and will start drinking from the crypto hosepipe in 2022.

Comments ()