Surviving the Smart Contract Avalanche

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: AVAX;

Digital asset investors probably have a love-hate relationship with the intense level of competition in the smart contracts sector. On the one hand, the competition has fostered a blinding rate of innovation, almost as if the rate of innovation is to match the promised throughputs of blockchains. On the other hand, it has made picking the winners incredibly difficult.

With that said, if one subscribes to the view that this industry is very much in its infancy, then one must also suppose that there is more than one winner. In my view, Ethereum’s success and Avalanche’s or Solana’s failure need not be a zero-sum relationship. Instead, it is important to emphasise the distinctiveness, as limited as it may be, of each blockchain to see whether a) it has a market to capture at all, and b) if it has the technological capability and durability to do so. If the industry is continuously expanding on long timeframes, then so will the total addressable market. Competition is an important consideration when analysing the investment case for individual assets, but assuming a monopolistic victor would betray that analysis.

Avalanche is very much a part of the smart contract herd. The extent of consumer appetite for Avalanche depends on its unique selling points and how they separate themselves from protocols such as Ethereum, Solana and NEAR. This week, I will consider the technological and architectural foundations of Avalanche.

Avalanche’s Architecture

Avalanche is a Proof-of-Stake blockchain platform for decentralised applications, founded by Emin Gün Sirer, an associate professor at Cornell University. Three main things differentiate Avalanche from Ethereum: its underlying architecture, consensus mechanism and ability to scale.

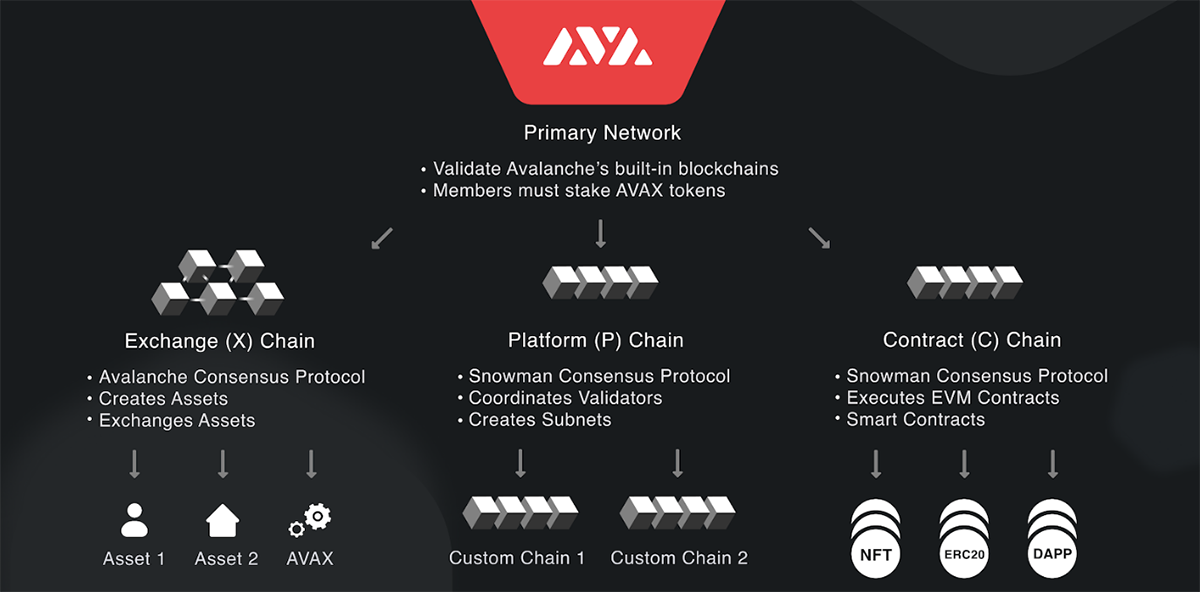

Avalanche consists of a Primary Network that validates its three built-in blockchains:

- Exchange (X) Chain - Where tokens are issued and exchanged, including the platform’s native AVAX.

- Platform (P) Chain - Where validators stake AVAX to secure the network. Also, making it possible to create custom blockchains (‘subnets’) that leverage these validators.

- Contract (C) Chain - Where smart contracts and dApps are deployed.

Each chain built within the Avalanche architecture represents its own virtual machine while maintaining support for custom virtual machines, such as the Ethereum Virtual Machine (EVM). In simpler terms, Avalanche is a ‘platform of platforms’ made up of a custom blockchain networkwith “a dynamic set of validators working together to establish consensus”.

Avalanche Consensus works by a method known as ‘repeated random subsampling’, wherein validator nodes randomly query other validators until the network agrees on whether to accept a transaction. The randomness of queries adds a layer of security, while each node queries its own sample of randomly selected nodes, which adds a degree of scalability.

Avalanche’s architecture optimises for scalability, decentralisation and latency. It is capable of 4,500 TPS per subnet, with over 1,000 validator nodes. The protocol aims to have a limitless number of subnets, all of which will be interoperable with each other. Moreover, it can scale to thousands of validators, and the greater the number of validators, the quicker the network becomes once the load is split between them. Finally, Avalanche has the fastest finality of transactions, currently standing at under 1 second. By comparison, Ethereum offers finality in one minute, Cosmos in 6 seconds. Avalanche offers one of the best scalability solutions out there - even the Bank of America agrees.

When talking about the so-called ETH-killers, we often consider high throughput and low fees. Perhaps what is under-discussed is the importance of security and decentralisation. A blockchain cannot be like a retail store that closes in times of bad weather, or indeed a ski resort that shuts down its ski lifts out of fear of an avalanche. Events such as Solana’s recent 48-hour outageare not good enough for the alleged future of finance. Similarly, decentralisation is the ideological foundation of this industry, and betraying it via handing the reigns to a handful of validators is nothing short of a shortcut. Avalanche’s extent of decentralisation is uncommon and admirable in this competitive arena. Crucially, the risk of a controlled attack is limited where control of a network is diversified.

Nevertheless, Avalanche is a new chain on the block, and compared to Ethereum, its track record remains unproven. Indeed, in February 2021, the network experienced a bug that caused validators to accept invalid transactions, permitting the generation of an extra 790 AVAX. Time will tell if Avalanche can become as decentralised and robust as it promises; a requirement to become the market leader.

The AVAX Token

AVAX is the native currency for all transactions on Avalanche, i.e. the fuel for the network. AVAX is also staked to secure the network. Transaction fees on the network are burnt, so validators only earn staking rewards, sitting at approximately 10% APY. There is a maximum supply of 720m AVAX, half of which has been set aside for staking rewards, 30% to Avalanche affiliates and the remaining sold across three ICOs.

One area Avalanche can certainly improve on is transparency. The Avalanche Foundation holds about 10% of AVAX’s total supply, yet there seems to be little to no public information about it. The info page on its website doesn’t even mention the initial distribution or vesting of AVAX, nor are founder wallet addresses even mentioned. It is difficult to ascertain how significant this is, but crypto is founded on principles of open source technology and transparency. If there is a community that would attach significance to a lack of transparency, it is this one.

Summary

Avalanche has a high potential to be a big player in the smart contracts sector. Having covered the underlying Avalanche architecture and AVAX token this week, I will delve into the protocol’s development, adoption, and funding next week. If the technology is as good as it seems to be, it is the current utility and expected future utility of Avalanche (as judged by developer activity) that should express its durability.

As mentioned in the opening paragraph, picking the winners is difficult. Realising that there may be multiple winners in future makes things slightly easier. Hopefully, next week’s edition of Token Takeaway will simplify things further still.

Comments ()