Atlas Pulse Gold Report - Issue 68;

I keep hearing the same old arguments. Gold is unproductive and can’t be valued as it has no yield. Yet the smart money turns to it when things go wrong. In recent years, financial markets have been squeezed so hard that they have nothing more to give.

Highlights

| Regime | The equity bubble has popped |

| Macro | Real rates rise yet price holds |

| Valuation | Fair value |

| Flows and Sentiment | Bullish |

| Technical | Base building |

In our monthly gold and bitcoin webinar series, we were delighted to welcome Duncan MacInnes. Duncan is Ruffer’s bitcoin man, and you may recall they had a highly successful trade in late 2020, funded from their gold position. They believe bitcoin will not necessarily replace gold but has its place and will forever be part of the macro landscape. At ByteTree, we concur.

Ruffer sold their bitcoin a few months later as their multi-year forecast for institutional adoption came about much more quickly than they ever thought. They saw a high price and a hype cycle and took several billion dollars of profit. The latest factsheet states that Ruffer’s gold and gold equity exposure is back to 7.7%, which is roughly where it has remained over the years. The inference is the proceeds returned to gold.

We discussed the comparison between these two assets and how the macro-economic environment is likely to see lower returns for bonds and equities, greater volatility and a better environment for inflation-sensitive assets. Bitcoin and gold are both suitable candidates, but gold prefers risk-off conditions, which is where we are now.

With so much uncertainty, the case for gold is a strong one and you can watch the interview here. We thank Duncan for a thoughtful discussion and look forward to speaking to John Reade, Head of the World Gold Council, at the end of February. What he doesn’t know about the gold market isn’t worth knowing.

Regime

Historically gold has been a buy when two or more of the following have held true:

- Short-term real interest rates are below 1.8%. TRUE

- The gold price, measured in a basket of currencies, is rising, measured by a 35-month exponential moving average. TRUE

- The gold price relative to the S&P 500, measured by a 35-month exponential. FORECAST FOR 2022.

So many conventional thinkers have written off gold.

“Father, forgive them, for they do not know what they are doing” (Luke 23:34).

I keep hearing the same old arguments. Gold is unproductive and can’t be valued as it has no yield. Yet the smart money turns to it when things go wrong. In recent years, financial markets have been squeezed so hard that they have nothing more to give.

There is confusion as gold fell in 2008 and March 2020 during deflationary shocks. Investors are unrealistic in thinking gold should go up in a crisis. If that’s what they want, then buy an equity put option. But then don’t expect your put option to deliver respectable returns in the bull market that follows. Gold falls less when things go wrong and then behaves as a respectable long-term inflation hedge the rest of the time. And when real rates collapse, it surges. The smart money sees that.

From the last relative low (gold to the S&P) in late September 2018 to date, the returns from gold and the S&P 500 have been the same. Yet listening to people, you’d think gold has collapsed while equities have stormed. It’s merely a question of timing. As I said, they have been the same.

Gold’s Turn

The stock market bubble has burst. Widely owned companies such as PayPal -36%, Facebook -34% and Netflix -33% have been beaten down.

The remaining FAANGs have fared better, but it’s only a matter of time before they collapse too. They are simply mispriced, and no asset can swim against the tide forever, especially when the debt cycle is over.

Macro

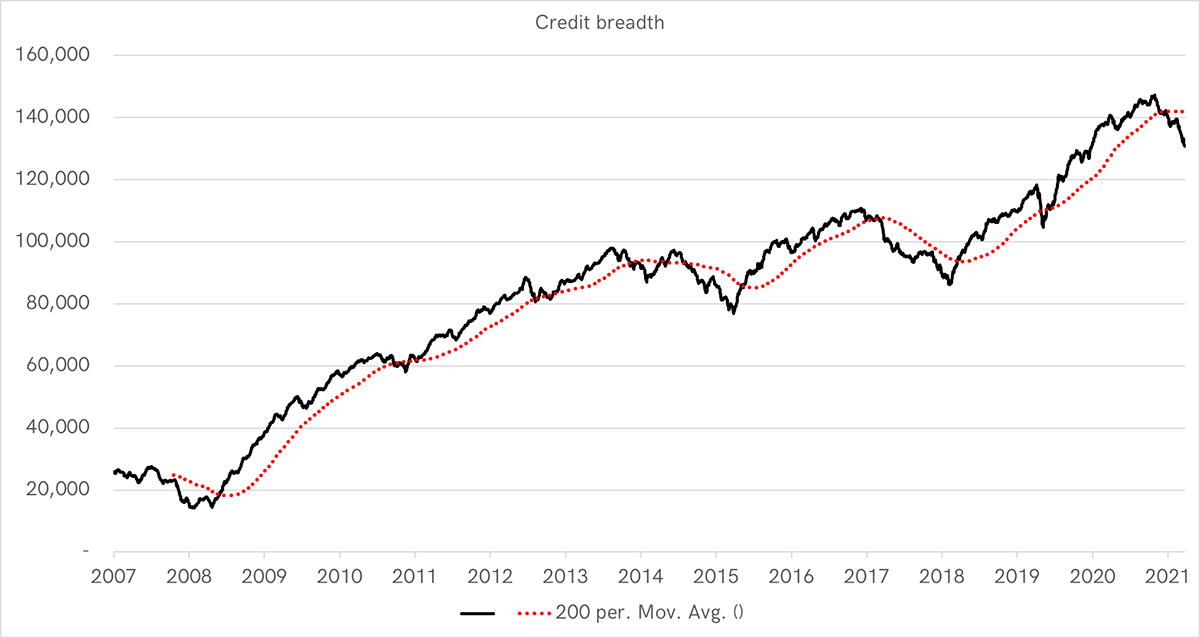

The breadth in the bond market has turned down, which means more bonds are falling than rising. If ever in doubt, just look at credit conditions and when they are deteriorating, run for cover. It is not just the rising bond yield but the emergence of a widening spread that will put the boot in sooner or later.

Falling bonds were painful in 2008, 2015 and 2018, and this time, they have the potential to be so much worse. Look no further than the eurozone, where the 10-year bond still yields 0.2%. Back in 2011, when the European bond market last blew up, it was over 3%. I feel investors underestimate how much room there is for things to change over the coming years.

Margin debt is falling and provides further evidence of the end of the good times. The recent peak follows the exemplary track record shown by prior peaks. All of these led to periods of significant dislocation in financial markets.

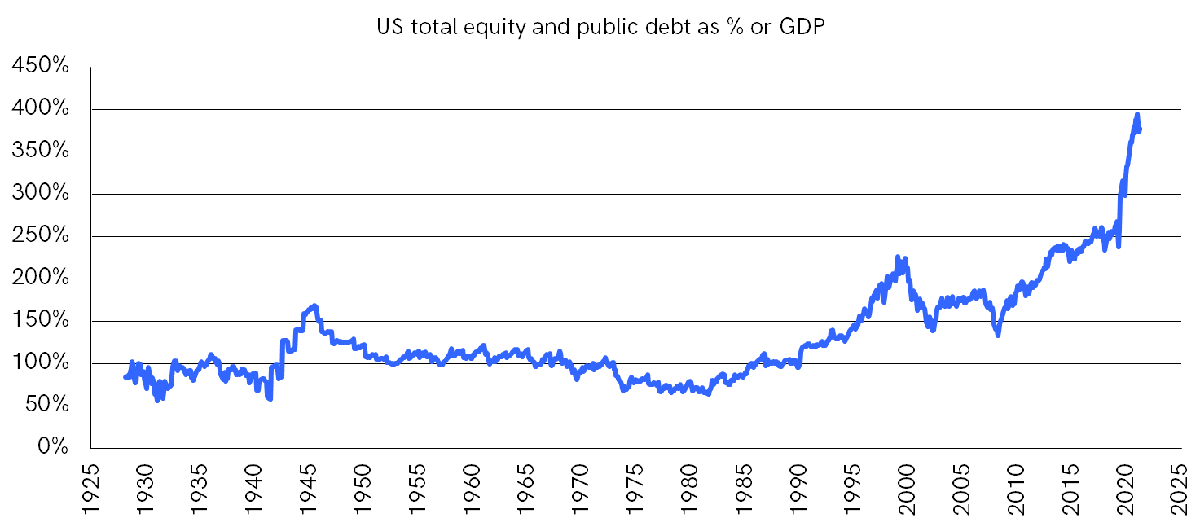

And then there’s the financialisation of the economy. Adding the total equity and public debt markets together and showing them as a percentage of the economy, makes it clear how far things have come. We used to think bubbles saw financial assets at 200% of the economy, yet today it is 400%. We have never previously been close to these levels, and pre-1980, the average was around 100%.

Financial markets are unreasonably complacent while evidence builds that the bear is here.

Valuation, Flows and Sentiment

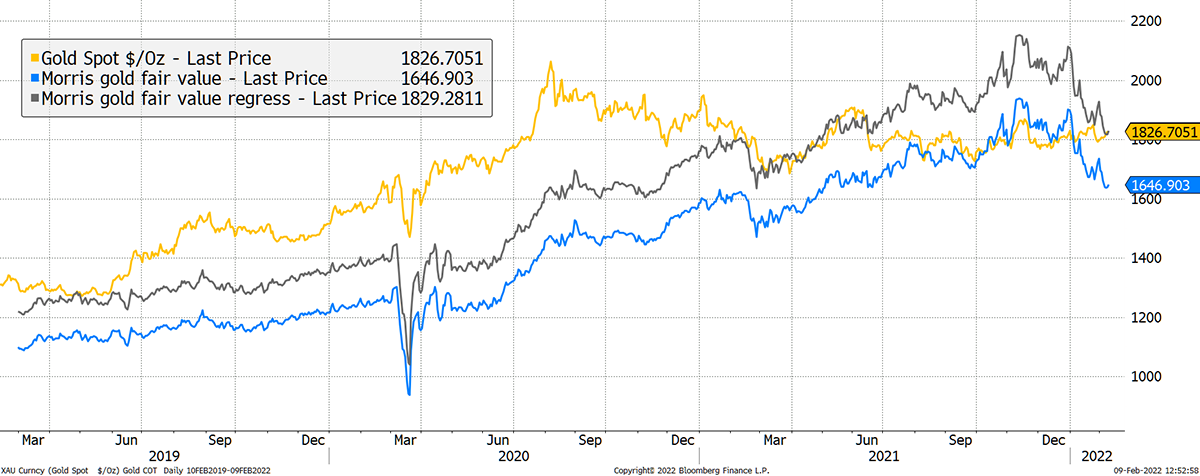

Gold’s valuation remains favourable but no longer cheap. In recent months, I have expanded the valuation methodology to include two types of best fit; a regression and an average. The difference between them is $180 or 10%, which is not too bad in the great scheme of things.

Gold Is Still in the Fair Value Range

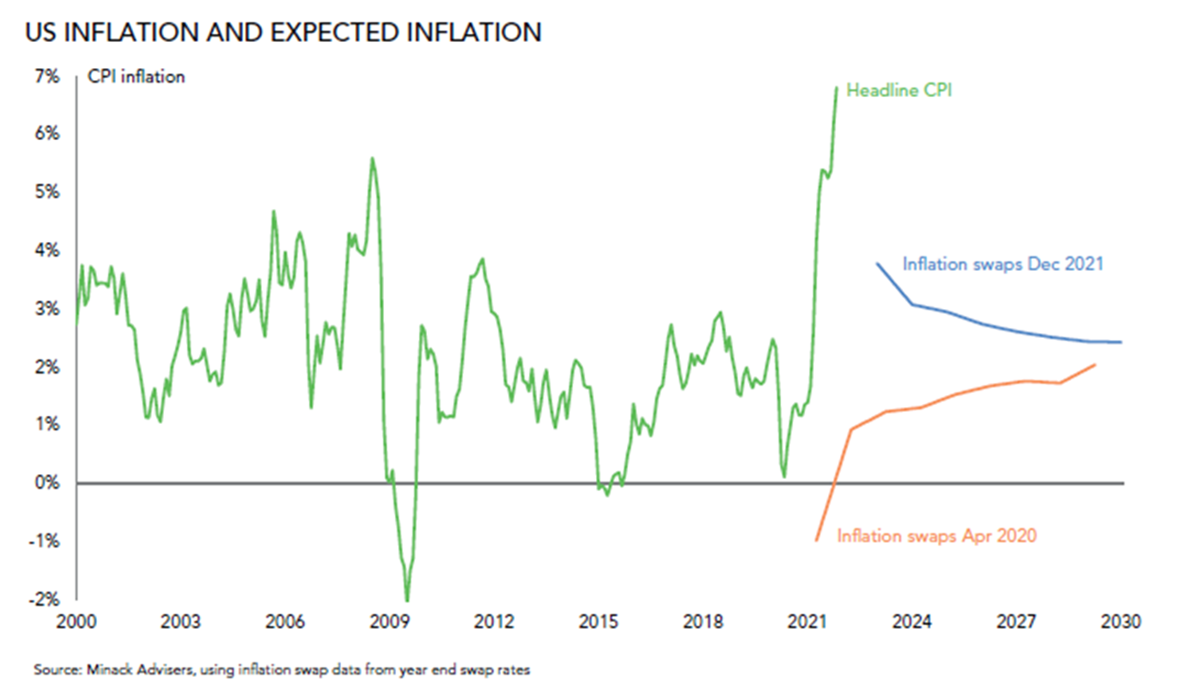

The issue is that bond yields are rising while inflation expectations are not. This dichotomy comes from the belief that things haven’t changed from the past. We’ve had a post-lockdown boom, where there were supply chain hotspots, but now lockdowns are over, things have returned to normal. That means inflation falls while bond yields rise to cool runaway growth. This is a widespread belief that we do not share.

This is optimistic, but it remains the mainstream view. In The Duncan MacInnes interview, he showed how the outlook for rates and inflation has often been spectacularly wrong. In April 2020, the popular view was that general price levels would collapse as we didn’t spend much money during lockdown. What actually happened? There were shortages, and prices spiked. Things change, and perhaps we shouldn’t trust the consensus market view.

Although richer than a month ago, gold is fairly valued and offers safety in a storm. If the views on inflation change, which in our view is looking likely, then any strength will be supported by fundamentals.

It won’t be difficult to see the gold price advance because positioning remains so low. ByteTree’s ETF flow data is improving, but better still are the lack of speculators in the market. We’re at the same levels seen in early 2016 when gold was just over $1,000, and no one cared.

No one Is Speculating on Gold Anymore

Summary

Ruffer played their cards well. They saw risk-on conditions return in late 2020, swapped a little gold for bitcoin, bagged the profits and bought back their gold. Spectacular.

It is rare for gold to do well during bull markets, and by holding it, investors risk underperformance. This is why gold beating the S&P 500 is key, as it gives investors the confidence they won’t underperform. It’s happening, and I believe this could go on for some time yet.

I’m bullish. Thank you for reading Atlas Pulse.

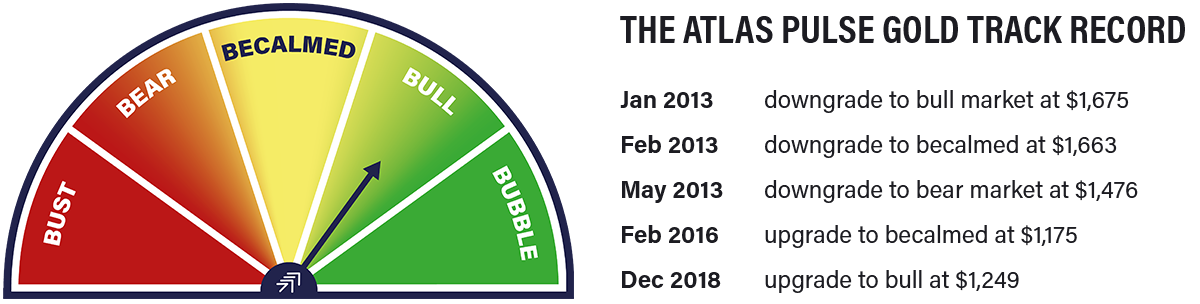

Thank you for reading Atlas Pulse. The Gold Dial Remains on Bull Market.

Charlie Morris is the Founder and Editor of the Atlas Pulse Gold Report, established in 2012. His pioneering gold valuation model, developed in 2012, was published by the London Mastels Bullion Association (LBMA) and the World Gold Council (WGC). It is widely regarded as a major contribution to understanding the behaviour of the gold price.

Please email charlie.morris@bytetree.com with your thoughts.