When the Wind Picks up, Even the Turkeys Fly

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 35

The crypto space has seen plenty of ByteTrend stars added over the past week. That’s generally a good thing, except that some come from the jump in the shitcoins. Non-crypto people think they are all shitcoins, but crypto people know better.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | Shitcoins bounce |

| On-chain | Sluggish |

| Investment Flows | Bullish |

| Macro | Tech breaks, euro surge |

| Crypto | NFT stats break new highs |

Technical

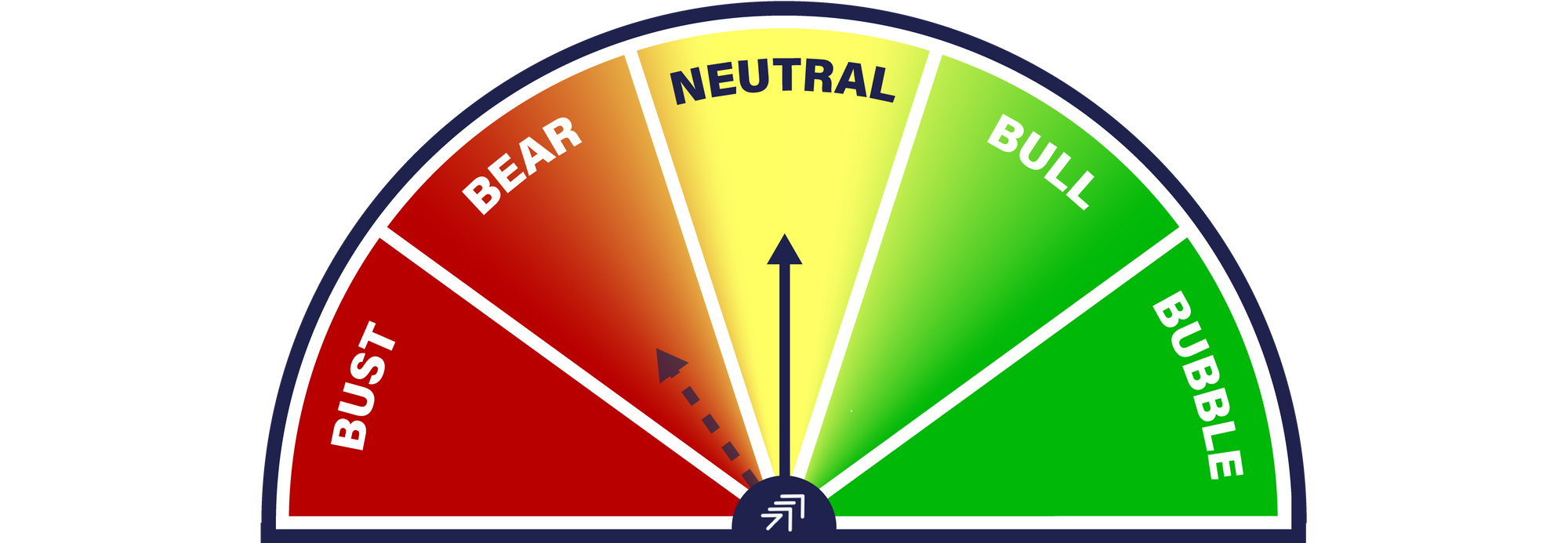

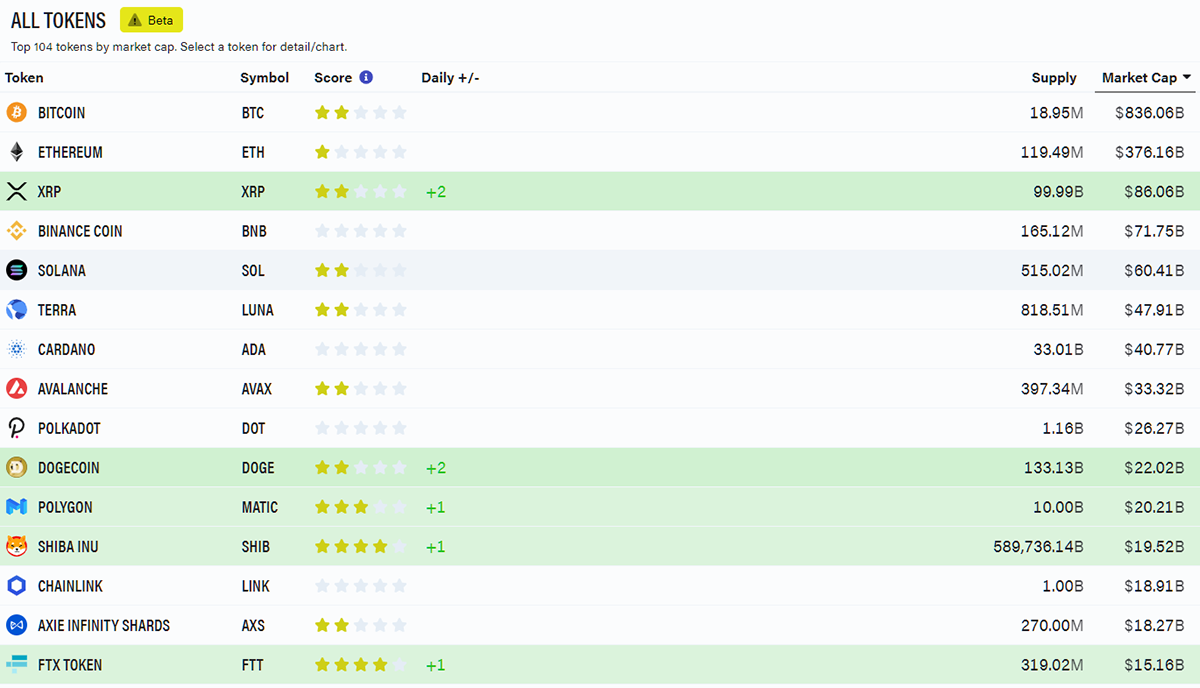

The crypto space has seen plenty of ByteTrend stars added over the past week. That’s generally a good thing, except that some come from the jump in the shitcoins. Non-crypto people think they are all shitcoins, but crypto people know better. There is a difference between coins with purpose and coins without. To see a day when XRP, DOGE and SHIB jump together tells you this rally has been discovered. As the saying goes, “when the wind picks up, even the turkeys fly”.

Source: ByteTrend

But the good news is that bitcoin saw two stars regained on its trend as it broke above the 20-day max and the 30-day moving average. Yet, it would bring comfort to see the moving averages turn up, as both are still downward sloping. That reminds us not to be overly hopeful in the short-term, as bears have a habit of building false hope.

Nevertheless, bitcoin’s progress is good and has broken above the -84% annualised trendline. Thank goodness for that!

Basically, provided $30k holds, bitcoin wins. The no-coiners believe it’s worthless and hold tech instead. Yet tech is not worthless but is massively overvalued and will fall by 50% to 90% depending on the asset. If bitcoin can manage to stay in the hover while that happens, there will be so much money headed this way that the eventual upside will be explosive.

Bitcoin escapes from the death roll

Source: Bloomberg. Bitcoin trends since Dec 2019 log scale.

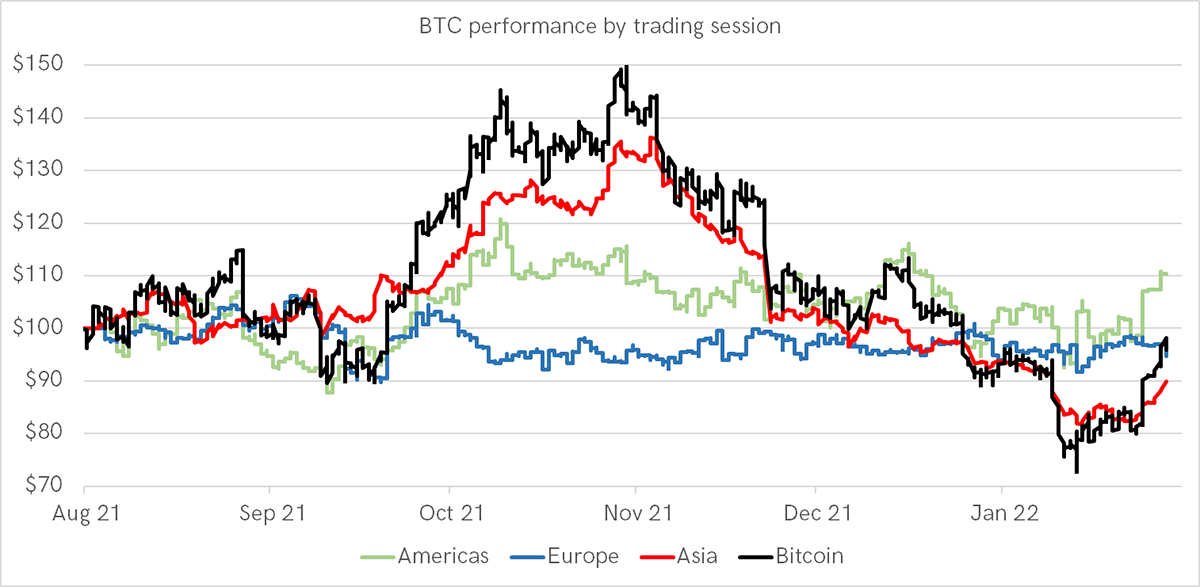

I last showed this chart two weeks ago. It is remarkable how stable bitcoin has been during European (0600 to 1400 GMT) and American hours (1400 to 2200 GMT), and how the price is set during Asian hours (2200 to 0600 GMT).

Bitcoin price is set during Asian hours

Source: Bloomberg. Bitcoin trend by time zone since Aug 2021.

This correlation keeps on growing. How can this be? Answers on a postcard please.

Investment flows

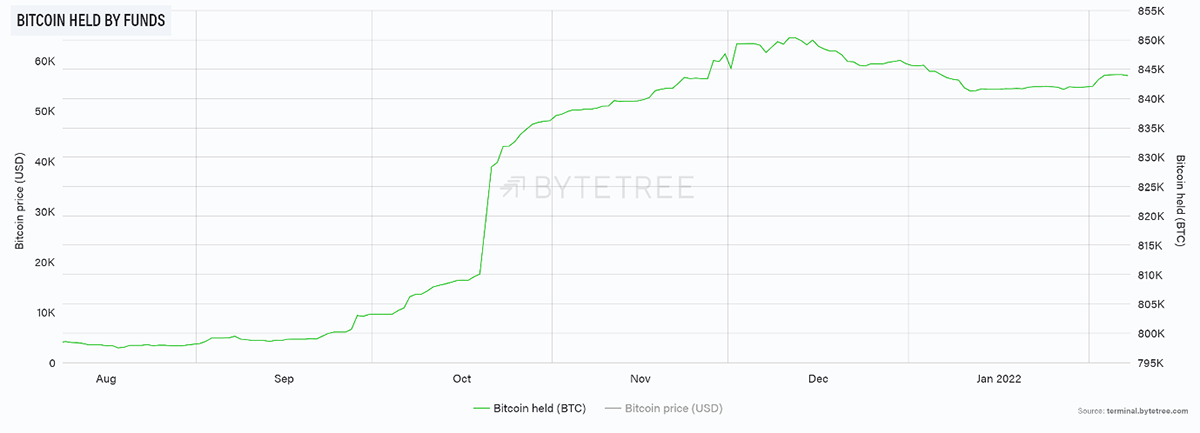

The flows are looking up for the anti-establishment trade. Allocations to bitcoin are rising slightly, as they are to gold and silver. It’s just ETH that remains sluggish.

Bitcoin flows stable

Source: ByteTree. Bitcoin held by funds over the past 6 months.

Gold inflows building

Source: ByteTree. Gold held by funds over the past 6 months.

Ethereum outflows slow

Source: ByteTree. Ethereum held by funds over the past 6 months.

Silver inflows - finally

Source: ByteTree. Silver held by funds over the past 6 months.

The great inflation debate rages on. The next US release comes this Thursday, and some see it cooling. If it does, the market might read too much into that and see inflation protection assets selloff. Don’t be despondent as inflation is always volatile. If the investor flows can keep rising, then the market will find the support it needs. What then? Start buying the dips.

On-chain

While velocity remains on the light side, it is pleasing to see the number of transactions turn higher. The recent low is convincingly higher than the July low. This confirms the longer-term post-China traffic build is on track.

Source: ByteTree. Bitcoin transaction count over the past year.

But the chain isn’t telling us much this week, other than traffic is a little soft. A fortnight ago, I highlighted that a jump in velocity would lead to a strong rally. Sadly, the traffic has subsequently cooled, but not materially so to be overly concerned - more of a hover, which I’ll gladly take.

Macro

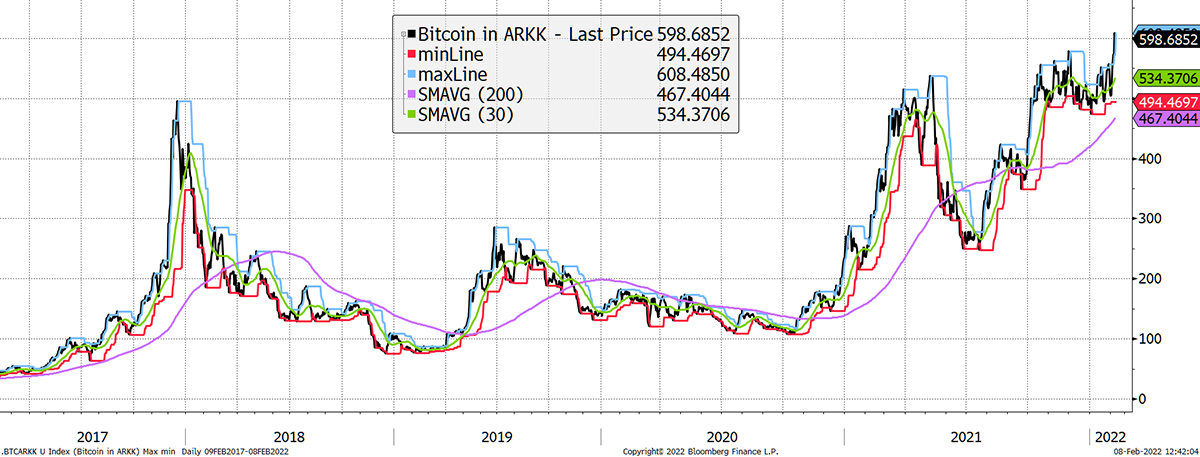

These market shake-ups enable us to measure asset quality. Outperformance in a bull market is one thing, but in a bear, it becomes real. There is no timeframe for when the popular ARKK tech ETF has been stronger than bitcoin. To my mind, this is further evidence that bitcoin is shifting closer towards being a monetary asset and away from speculation.

Bitcoin is more than a speculative, profitless tech stock 5/5 vs ARKK

Source: Bloomberg. Bitcoin in ARKK since 2017.

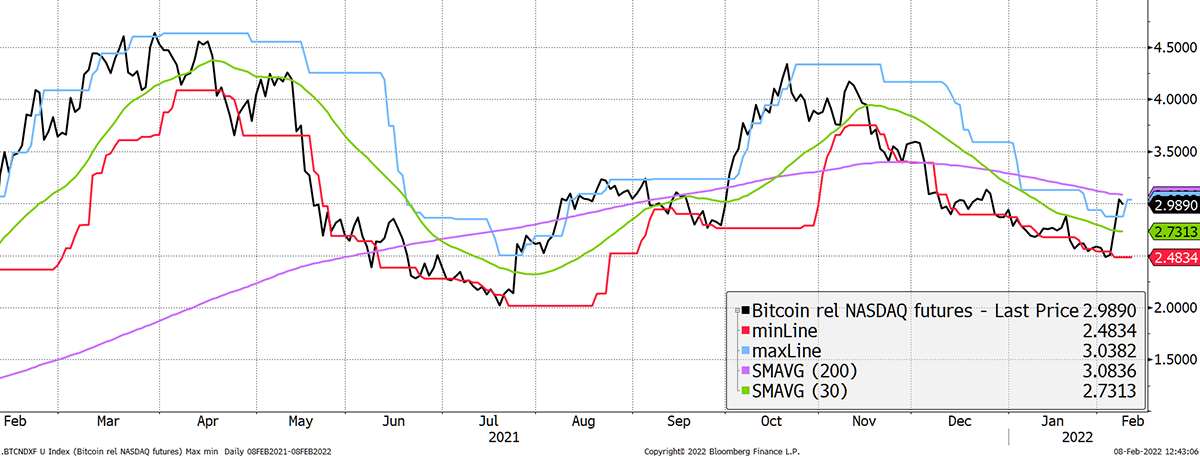

Against the NASDAQ, it’s not that bad, especially when you consider it is dominated by the world’s most valuable companies. I want to see a 5/5 here because that will force global investors to wake up.

Bitcoin lags tech 2/5 vs NASDAQ

Source: Bloomberg. Bitcoin in NASDAQ past year.

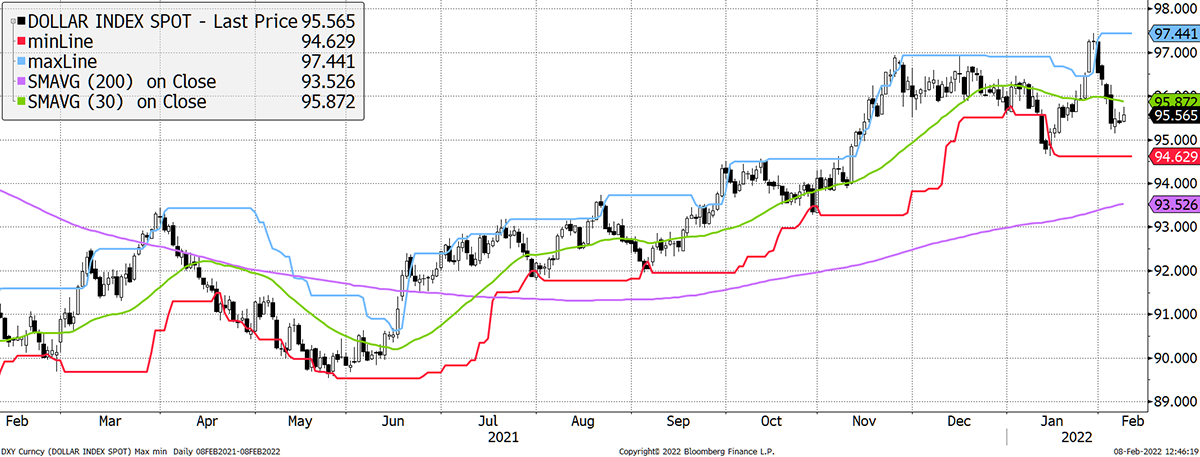

There’s one more thing worth mentioning. The dollar peaked on the last day of January and has since eased. This is always a tailwind for the likes of gold, bitcoin and commodities in general.

Dollar eases from 5/5 to 3/5

Source: Bloomberg. US dollar index past 6 months.

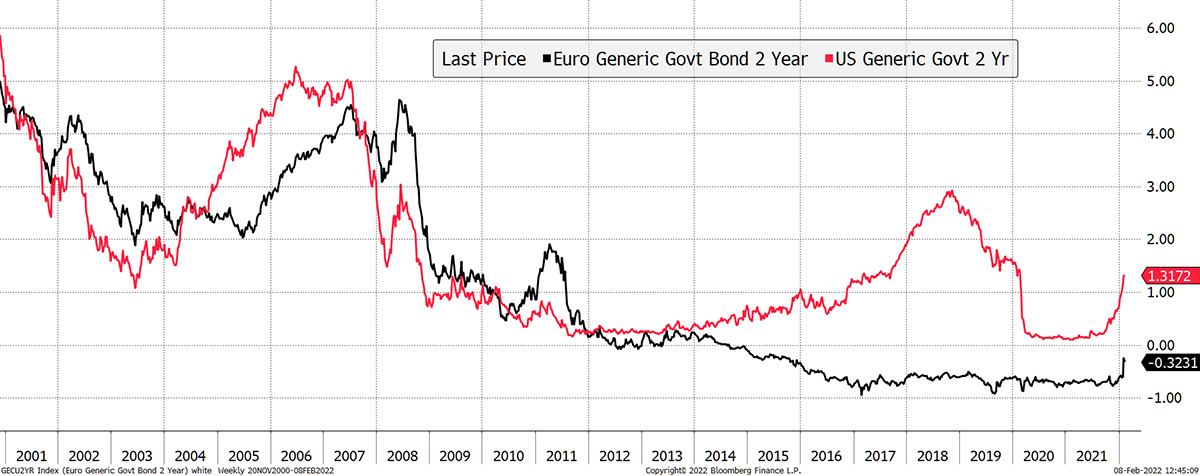

Why did the dollar ease? Because European rates jumped.

The ECB head, Christine Lagarde, is a Laggard. On 20 January, she rejected calls for the Eurozone to step up hikes to fight inflation, only to do just that 11 days later. This tells you that the biggest inflation doubters are buckling under the pressure.

The difference between US and EU rates has tended to have a strong impact on the exchange rate. The weak euro was largely a function of the rates gap. If this starts to close, we may get a tailwind from a weak dollar like we had in 2020. That would be nice.

European rates jump

Source: Bloomberg.

Cryptonomy

The positive sentiment around crypto continues this week with several tokens seeing improved scores on ByteTrend. The enthusiasm for NFTs remains strong, with OpenSea reporting record numbers of monthly active Ethereum-based traders in January.

Some of the recent success for Ethereum NFTs has seemingly spilled over into Solana, which recently hit an all-time-high of 10k unique daily NFT buyers. Meanwhile, blockchain gaming studio Gala Games confirmed that it was allocating $5bn in an effort to expand its NFT offerings.

Polygon, currently a 3/5 on ByteTrend, has also seen recent success in the NFT space with the total number of OpenSea Polygon users exceeding 1 million, quickly catching up with the 1.2m Ethereum users on the platform. Furthermore, Polygon made headlines after raising $450m in a new venture financing round, led by Sequoia Capital India. The success in the funding round indicates that investors see promising potential in Layer-2 solutions tackling the scalability problem that hangs over Ethereum.

Last week, Wormhole experienced the second largest DeFi hack to date, with $320 million stolen. The protocol allows users to bridge their assets using wrapped ether (wETH) to transfer across six supported blockchains, Terra, Solana, Ethereum, Binance Smart Chain, Avalanche and Polygon. The hack only affected wETH tokens, highlighting the vulnerabilities that come with bridging protocols, and making a stronger case for Layer-2 solutions vs bridges connecting different blockchains.

Finally, the Indian government announced a flat rate of 30% tax on profits made on digital assets, which has added a degree of certainty for investors. Considering that last year India indicated plans around banning crypto, the tax regulation could be seen as confirmation that the country has softened its stance towards crypto. The hopes are that the hefty taxation will curb speculation and open the doors for institutional investing in the space.

Summary

Despite a weak price start to 2022, bitcoin is already showing itself to be more resilient than the doubters can bear. I find myself getting ever more structurally bullish.

Comments ()