Central Banks Question US Treasuries

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 40

Whatever your personal feelings for Putin, the financial system will change. The list of countries that would gladly opt for Star Alliance over One World is growing. Why would China buy treasuries now, knowing they can be weaponised at a later date?

BYTETREE ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | Neutral |

| On-chain | Neutral |

| Investment Flows | No outflows is remarkable |

| Macro | Central banks question US treasuries |

| Crypto | Web3 wins |

I’m still standing by the bullish call despite things looking precarious for obvious reasons. There is so much happening, and in the search for a new world order, crypto is punching above its weight.

Technical

The ByteTrend star count for the top 15 has eased back from 30 stars last week to 18 stars this week. This is quite bad for crypto in general, but not so for bitcoin. Just as the blood leaves the limbs and retreats to the centre of the body in the cold, so do markets. Crypto is being dumped for bitcoin.

If all 15 coins had a 5-star trend, that would be 75 stars, which would reflect the max bullish technical conditions. This will be available in a historical chart in due course.

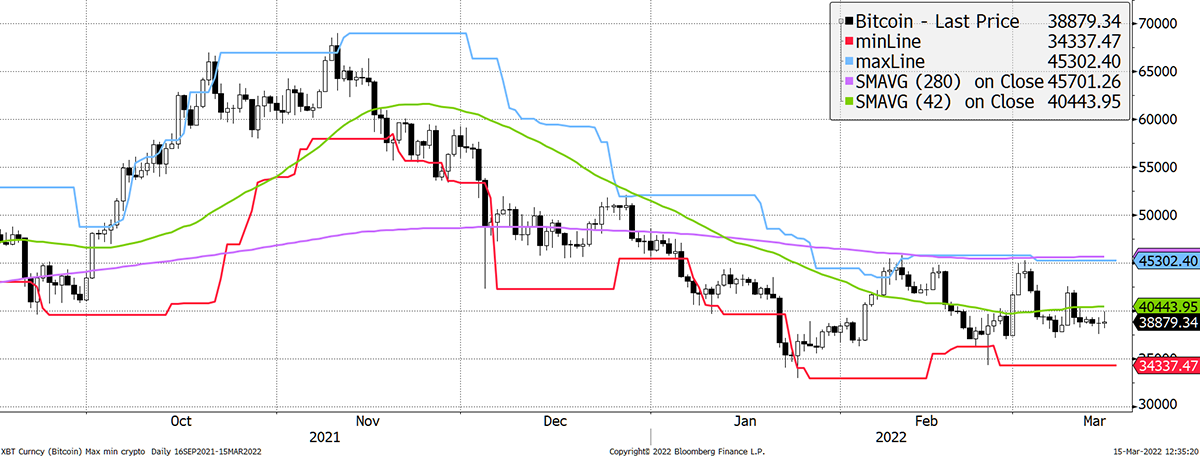

Bitcoin holds 3/5, which is remarkable given the NASDAQ scores zero along with Amazon, ARKK, Nike, Starbucks, Meta, Netflix, PayPal, Salesforce, Accenture and Adobe. The list is growing, and bitcoin’s resilience is underappreciated by the institutional investors. I know I have harped on about this but have been right to do so. It is the single most important point.

Bitcoin 3/5

Source: Bloomberg. Bitcoin with 20-day max and min lines, 42-day and 280-day moving averages past six months.

Investment flows

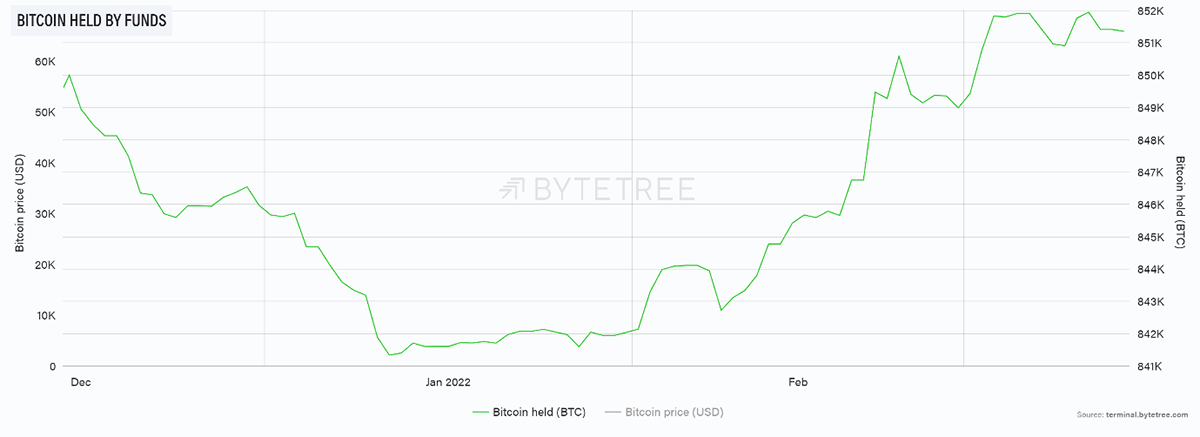

There have been no inflows into bitcoin funds this week, but I’m pleased to see no outflows, which we’re seeing in ETH.

Source: ByteTree. Bitcoin held by funds over the past three months.

Many that saw bitcoin as a safe haven and believed it to be the new gold were hoping for panic buying at times like this. An asset that has such a strong reputation that it draws in capital during a crisis isn’t something that happens overnight. Gold took its time gaining this trust, and bitcoin still has work to do. But even so, bitcoin flows are remarkably stable given the circumstances. Brand bitcoin is stronger than many realise.

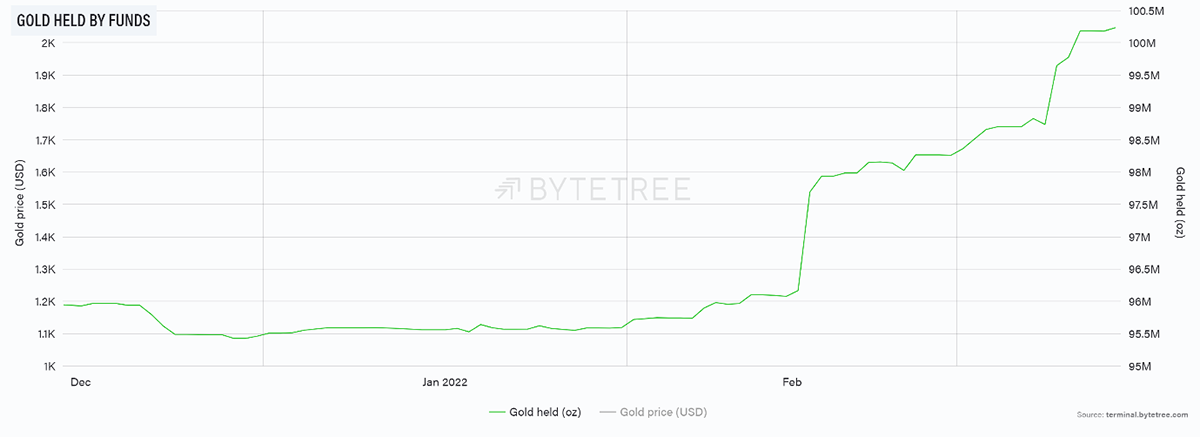

Gold has received inflows of around 5 million ounces this year, or around $10 billion. Recall in 2019/20, this number nearly touched $50 billion. Could that be exceeded this time, given the lack of credible alternatives?

Source: ByteTree. Gold held by funds over the past three months.

Bitcoiners should hope so because back then, $50bn for gold equated to $10bn for bitcoin.

They’re in this together, and I suspect the next time risk cools, perhaps due to a ceasefire, then bitcoin will fly. This is the bullish argument of why you should be positioned today, as the price moves quickly when the stars align. Right now, all bitcoin needs is a risk-on environment to move higher. The rest of it is more or less in place.

On-chain

The network remains neutral, neither growing nor contracting. This is unlike 2014 or 2018 when we would have seen a sharp contraction in on chain activity. Stability is very good news.

Source: ByteTree. Bitcoin transaction count over the past year.

Macro

I’m still standing by the bullish call despite things looking precarious for obvious reasons. There is so much happening, and in the search for a new world order and crypto is punching above its weight.

Over the weekend, I listed to a Grant Williams podcast, which featured the macro guru Luke Gromen. It was a great conversation that summarised the post WW2 monetary system. In a nutshell:

- The dollar was pegged to gold; currencies were pegged to the dollar, which could be redeemed for gold.

- Post WW2, the world economy grew rapidly, and there wasn’t enough gold.

- In 1971, US devalued against gold (more dollars for same gold) with a pledge to maintain purchasing power against oil instead, via US monetary policy.

- Countries amass reserves in US treasuries as they are globally accepted, liquid and can be exchanged for energy in the future.

- In 2005, oil breaks out, making the dollar no longer a useful store of value to purchase future oil. There are oil supply shortages due to geological realities and a boom in Chinese demand.

- In 2006, President Bush embraces shale, which buys time. Cheap oil post-2014 creates deflation illusion, enabling zero interest rate policy and QE, resulting in the greatest asset bubble in history.

- Covid-19 lockdowns distort supply chains. Oil slumps as transport stalls. Reopening of the economy highlights structural shortages and European dependence on Russian gas.

- Putin smells an opportunity and invades Ukraine resulting in a commodity price spike. West retaliates with sanctions, uses payment system Swift as a weapon and confiscates Russia’s reserves.

If you were a central banker, might you now think twice about how you would allocate your reserves? They no longer buy oil throughout the cycle, and at times of stress, they can be confiscated.

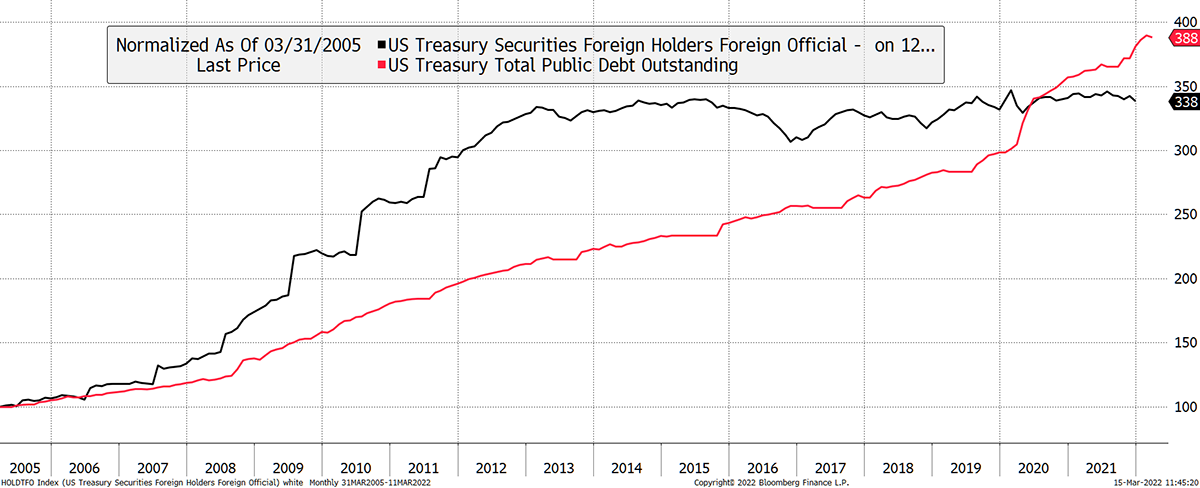

Central bankers have been thinking this way for some time. Their holdings of treasuries plateaued in 2012, despite the treasury market nearly doubling in size ever since. To put it another way, back in 2012, foreigners owned 25% of treasuries, and today they own just 13.7%. It is going to get harder to fund large deficits.

Foreigners no longer favour treasuries

Source: Bloomberg. As described.

Whatever your personal feelings for Putin, the financial system will change. The list of countries that would gladly opt for “Star Alliance” over the current “One World” is growing. Why would China buy treasuries now, knowing they can be weaponised at a later date? They won’t.

With government bonds offering negative real yields, it is a mystery why anyone buys treasuries in the first place when they could opt for universally accepted gold and even sprinkle a little bitcoin on top of it. But they do because at least they have enjoyed a reputation for being a safe haven.

Yet that’s no longer true as interest rates are rising during a crisis, which is something we haven’t seen since the 1990s. We have become so used to bonds being a risk-off asset that institutional investors have designed their industry around them.

Treasury yield rises during risk-off

Source: Bloomberg. As described.

The key point is that gold and bitcoin are aligned. They are universally accepted, liquid and come under no one’s control. Those who follow my work understand their differences, as gold is risk-off and bitcoin risk-on. The next time there’s a glimmer of hope, bitcoin is ideally placed to shine, and I believe more people will see the penny drop.

Cryptonomy

Yesterday, the European Parliament voted 31 to 4 in favour of the latest draft of the Markets in Crypto Assets (MiCA) framework, moving it one step closer to ratification. Thankfully, the banning of Proof-of-Work blockchains like Bitcoin was removed from the proposal. Instead, a suggestion to include crypto assets in the EU Taxonomy regulationwas put forward, which would classify blockchains based on their impact on the climate. German MEP Stefan Berger stated that:

“By adopting the MiCA report, the European Parliament has paved the way for an innovation-friendly crypto-regulation that can set standards worldwide. The regulation being created is pioneering in terms of innovation, consumer protection, legal certainty and the establishment of reliable supervisory structures in the field of crypto-assets. Many countries around the world will now take a close look at MiCA.”

The committee will now start negotiations with EU governments, shaping the final version of the bill.

There was big news on the NFT front last week as Yuga Labs, the creator of Bored Ape Yacht Club (BAYC), acquired the rights to CryptoPunks and Meebitsfrom Larva Labs. The acquisition included “the brands, copyright in the art, and other IP rights for both collections, along with 423 CryptoPunks and 1711 Meebits”, with the future aim to incorporate these collections in Web3 projects.

As one of the earliest examples of NFT collectables, CryptoPunks are legendary in the crypto space. While BAYC is less than a year old, the project used the CryptoPunks model and quickly gained popularity after celebrities like Snoop Dogg bought BAYC NFTs.

BAYC has also been applauded for its clear approach to ownership as it allows for the images to be commercialised by the owner and used in product marketing and for original merchandise. In the announcement, Yuga Labs stated that the same ownership rights will be extended to both CryptoPunks and Meebit holders. Larva Labs had previously failed to confirm the extent of ownership rights, so there is little doubt that this announcement contributed to the spike in CryptoPunks secondary market sales over the weekend.

Another company that has recognised opportunities in Web3 projects is the financial services giant Stripe. After ending their support for Bitcoin payments in 2018, the global payments provider is now back in the crypto space after announcing support for crypto payouts, KYC, identity verification, fraud prevention and more. These Web3 services will be facilitated through partnerships with several external companies, including FTX and Blockchain.com, and are currently only available to businesses in the US, UK and EU.

Summary

The new crisis is geopolitical, which is so much bigger than merely economic. Chinese equities are collapsing. The reason could be another lockdown, or it could be something else.

We are seeing a change in the world order, and bitcoin might be one of the few bridges between the two sides.

Comments ()