Hidden Capitulation?

Disclaimer: Your capital is at risk. This is not investment advice.

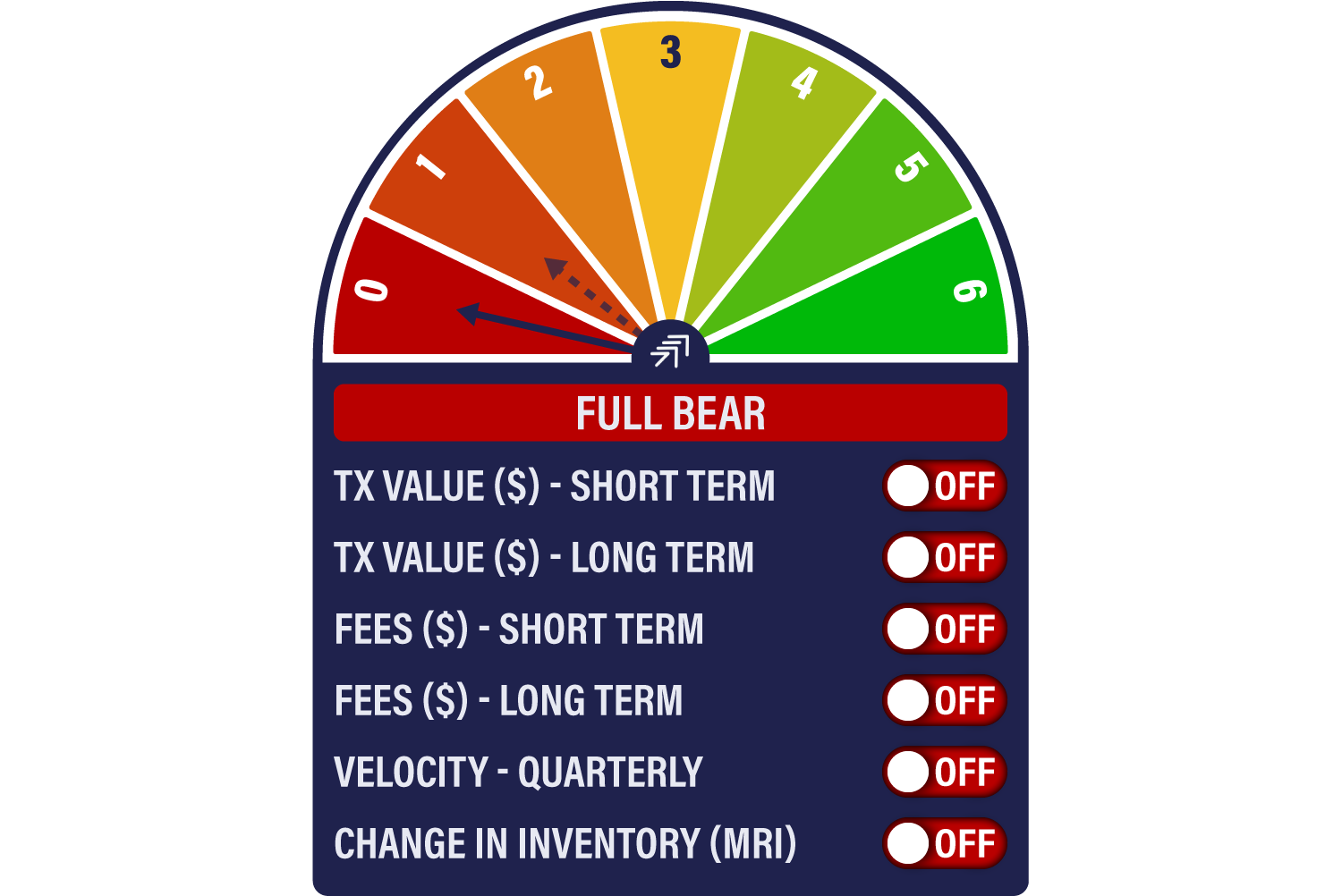

Bitcoin Network Demand Model

No good news from the Network Demand Model this week, but we’re at a point where “no news is good news”. The short-term transaction signal has switched off again, but it’s very noisy at this stage. It does look like fees have found a bottom of sorts, however. If there was going to be a repeat of the 2018 November collapse, then based on fees it should have happened by now. Or has capitulation already happened; we just didn’t notice because the set-up was different?

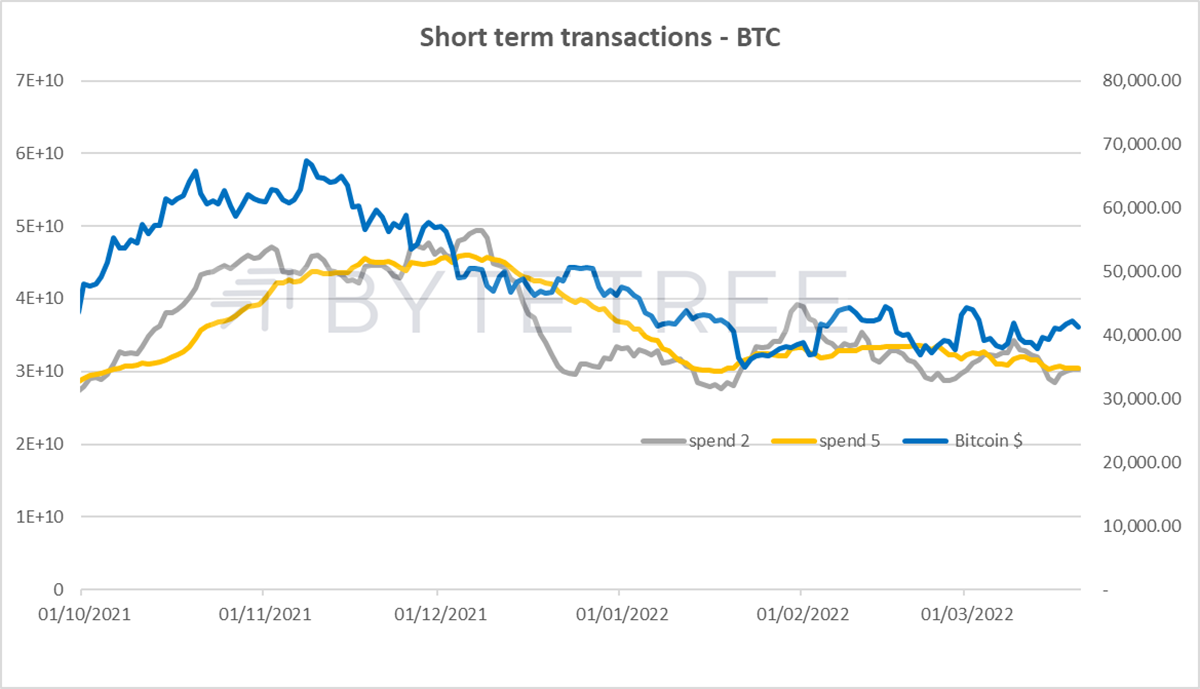

Short-term transactions turn off but are tracing in a low range. Until we see a meaningful break one way or the other, the signal will flicker on and off.

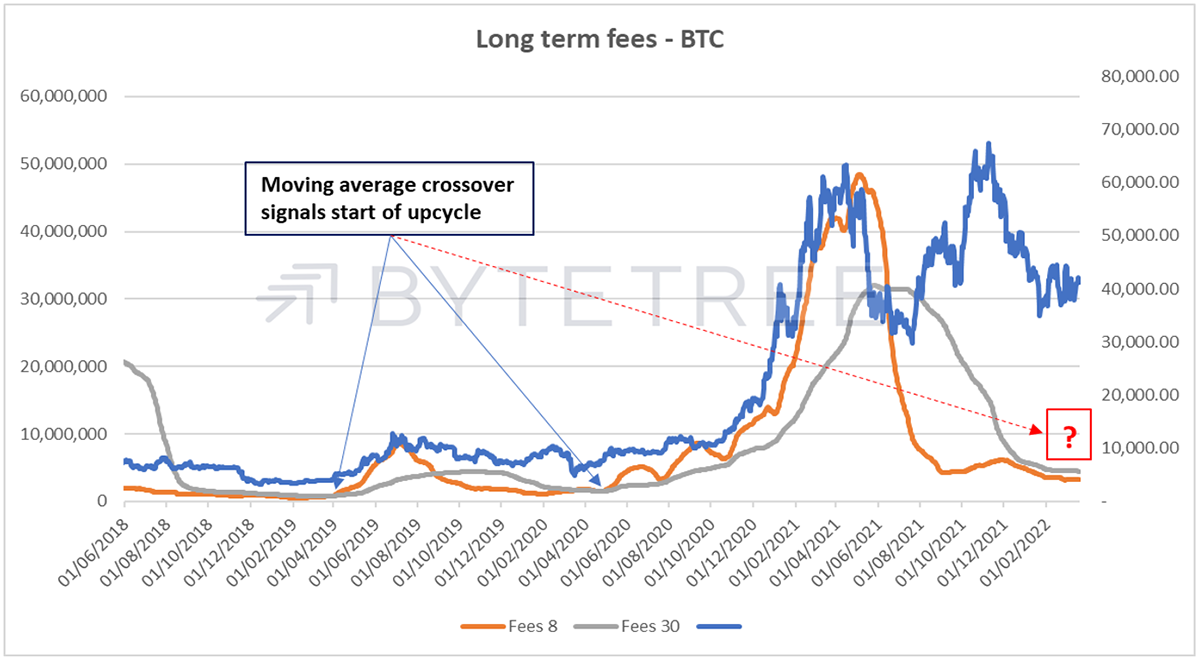

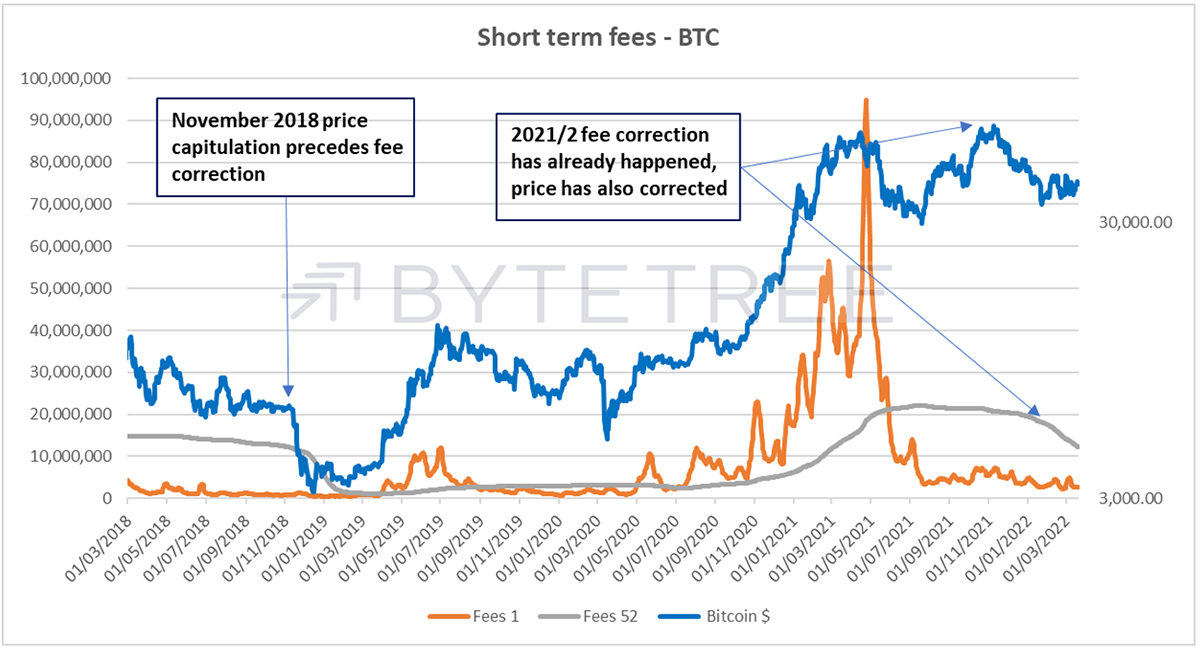

Fees have also started to bottom out, a sign that things are unlikely to deteriorate further. This has been a powerful indicator in the past, with previous crossovers signalling a bull market resumption. As with transactions, we’re not there yet, but investors should keep a careful eye on this metric and prepare for an upturn.

Readers will know that I’ve been nervous about late capitulation in this cycle, much as we saw in November 2018, when after a period of low-level consolidation, the price suddenly fell a further 40% (see below). (Note: although this was painful, the price recovered within 6 months or so, showing the value of hodling).

However, as the long-term fee structure rebases this worries me less. As seen on the chart below, we have also seen a major price correction, the difference this time being that it has corrected from a secondary peak, which didn’t happen in 2018. In other words, it could be that the capitulation I’ve been worried about has already happened, just this time from a much higher base.

A price holding in this range is also consistent with our valuation work and lends support to the idea that market depth and greater institutional participation is dampening volatility.

Comments ()