Introducing ByteFolio

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree's Crypto Model Portfolio

I am pleased to announce that from next week, ByteTree will launch its long-awaited crypto Model Portfolio, to be known as ByteFolio. This is a great time to kick off because the market is strong, and few seem to have noticed. Having built an array of tools and a good deal of knowledge, ByteFolio is ready to roll.

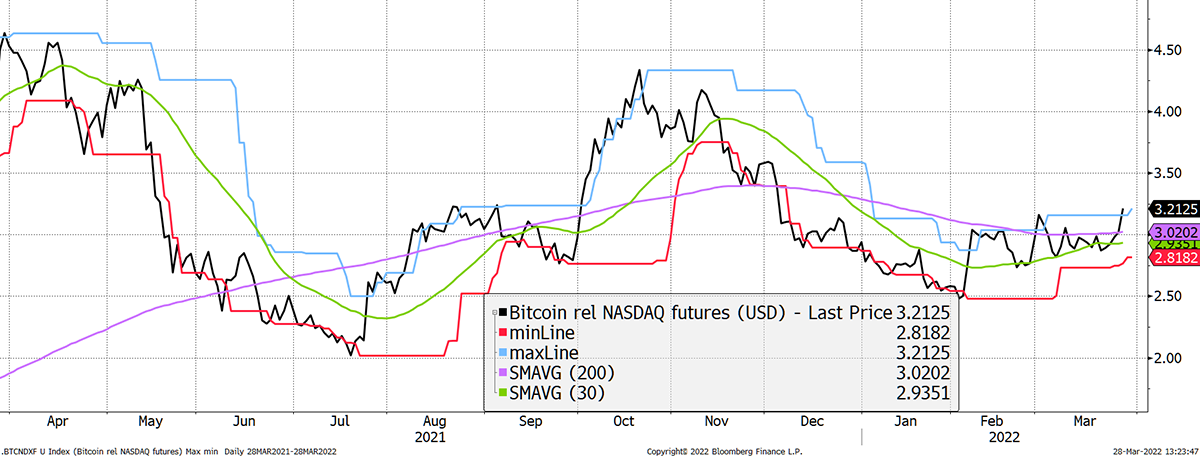

Seeing crypto behave so well this year, in the face of war, a collapsing bond market and a surging oil price, made me realise just how resilient crypto has become as an asset class. This story is simply told through the relationship between Bitcoin and NASDAQ futures. Bitcoin has outperformed the world’s leading tech stocks since December – in a falling market.

Bitcoin credibility balloons as 5/5 versus NASDAQ

This is remarkable stuff and sets the tone for a bull market in crypto credibility. We know institutional investors have barely started their journey, and ByteFolio will lead the way.

We have taken our time to cover the broader crypto space, as there was work to do. We had to hire analysts to comb through the tokens, one at a time, and build processes and tools to assist them.

ByteTree is ready.

The ByteFolio Process

I have been writing about bitcoin for years but recently shared my views in a weekly piece called ATOMIC, which provides analysis of:

- Technicals

- On-chain

- Macro

- Investment flows

- Crypto space

This logical framework has helped us understand bitcoin better, which remains the leader in crypto. Understanding bitcoin has shaped our views of the wider crypto space.

We hired analysts and launched Token Takeaway last June to wade through the projects, one at a time. There have already been some remarkable successes, such as a 440% gain from Quant and 900% from Axie Infinity. While highlighted as interesting ideas, they were never formally put in a portfolio.

From next week, ByteFolio will seek some of the best opportunities we can find to continue educating our readers about the opportunities in this space.

Behind the scenes is a process known as LITMUS, which analyses crypto projects from a qualitative perspective and looks at four key areas:

- Legitimacy

- Technology

- Marketability

- Sustainability

We look at the project founders, the funding, the tech, the economic case and the risks. The aim is simple, to kick the tires and identify projects that can succeed over time while rejecting those that can’t.

Then comes ByteTrend, which organises prices by trend strength not only in USD, but in BTC, ETH and our own measure, the ByteTree Crypto Average (BCA).

I have always struggled with these long lists of prices on crypto sites. They are covered in performance data that seemingly moves together. ByteTrend solves this as it organises the data into clear trends. What is rising and falling? What is leading and lagging?

The whole point of buying tokens is to beat bitcoin; otherwise, you’d just own bitcoin. Until recently, serious investors could stick with bitcoin and not venture out. That was rational as most tokens were likely to replicate bitcoin’s erratic behaviour seen in the devastating bear markets of 2014 and 2018.

As we have recently seen, crypto has moved onwards and upwards. The weaker projects have collapsed, but many have shown resilience. Whether it be smart contracts, crypto exchanges, stablecoins, tokenisation, NFTs or gaming and the metaverse, these things are real, and the world needs them.

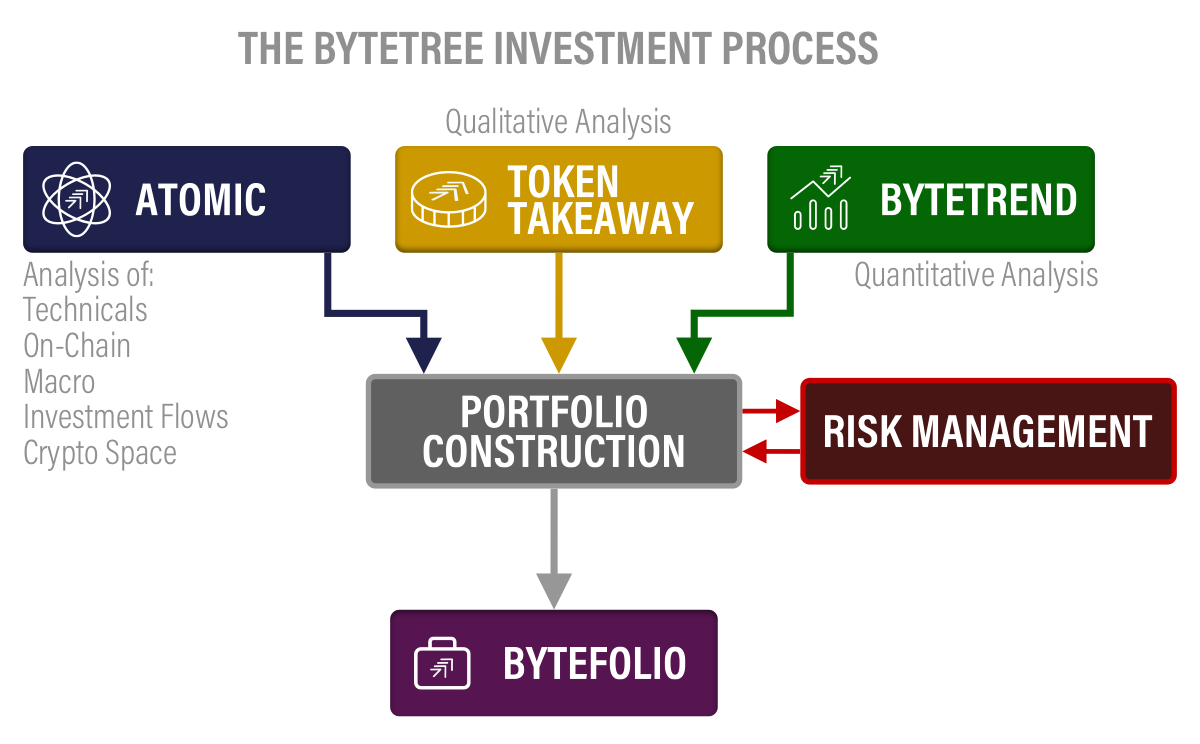

ByteFolio brings together ATOMIC, ByteTrend and Token Takeaway and constructs a portfolio. This will select a small group of 6 to 12 tokens, which will sit alongside a core holding in bitcoin.

The opinion from ATOMIC will drive portfolio exposure. While the portfolio will generally be fully invested, that could change if the evidence suggests the risks are high.

Another way to manage risk is to own more bitcoin and more defensive coins (such as exchange coins) at times of stress. Conversely, expect a higher weight in more volatile tokens during the good times.

The aim is to outperform bitcoin, and we can achieve this by selecting tokens that generate higher returns and taking less risk when times are tough. Both of those options will help you to grow your crypto portfolio.

ByteTrend will help us to discover new opportunities and what to avoid. Not only can we use the data in search of the established leadership, but for new trends, and in certain circumstances, distressed trades. If there’s something we like that has significantly lagged the market, it can pay to start building a position.

Position sizing is key in risk management. We’ll be looking at volatility to understand how much a token can move. We’ll also look at correlation to ensure we can capture the benefits of diversification, as there is little point in holding tokens that merely mimic bitcoin, with more risk.

We’ll also be looking at how far a token has come. If the ByteTrend score is 5/5 against bitcoin, I’ll want to know it hasn’t already moved 10-fold at the time of purchase. We’ll be keeping a level head.

The final piece is Token Takeaway. Knowing that a project has been scrutinised will give us confidence in making decisions. From time to time, Dogecoin may shoot past us. You can bet that I’ll ignore it when it happens.

Having been hooked on crypto since 2013, it is my belief that this new digital asset class has proven itself. The infrastructure gets better by the day, and a wide range of tools are available for investors. Managing a crypto portfolio has never been simpler or safer.

After much preparation, it is exciting to announce the launch of ByteFolio. If you want to join our journey, then please upgrade to ByteTree Premium.

Comments ()