Terra: The Rising Star in Crypto?

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: LUNA;

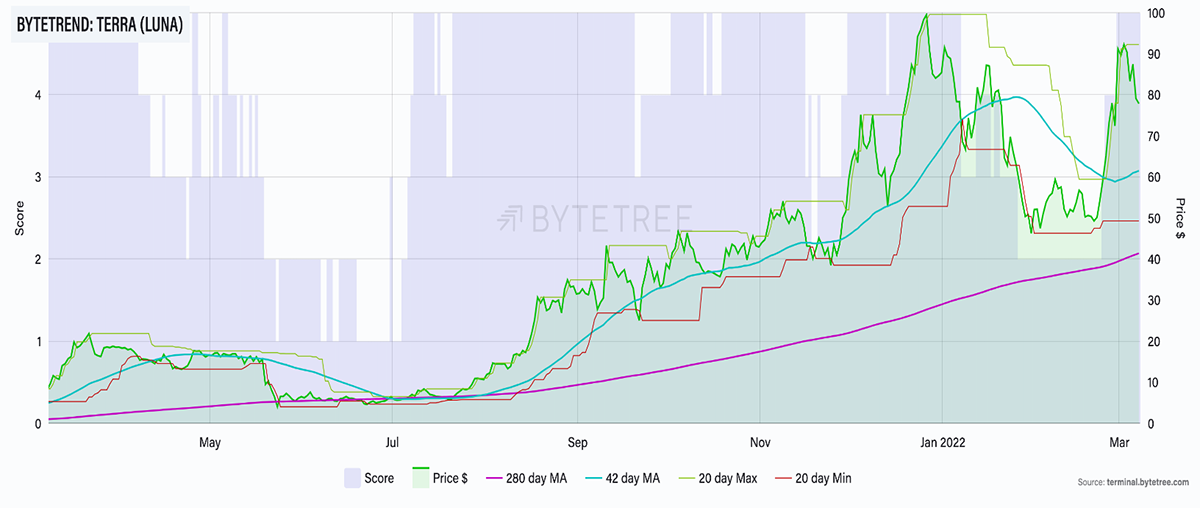

The crypto market has fallen sharply since November. At their lows, Bitcoin and Ethereum were down over 50% from their highs, and Terra around 40%. However, Terra has surged almost 75% in the last month against a 12.3% and 8.8% rise in Bitcoin and Ethereum, respectively. Terra has consistently given a 5-star rating on ByteTrend, demonstrating a very strong absolute and relative price trend.

Terra is one of the fastest-growing cryptos in the market. In a short period of time, Terra’s LUNA has established itself in the top 10 cryptocurrencies, overtaking other popular cryptos like Solana, Cardano, Avalanche and Polkadot. It is now the 6th largest cryptocurrency by market cap.

What is behind this growth? In this piece, we will touch on all the growth drivers.

Overview

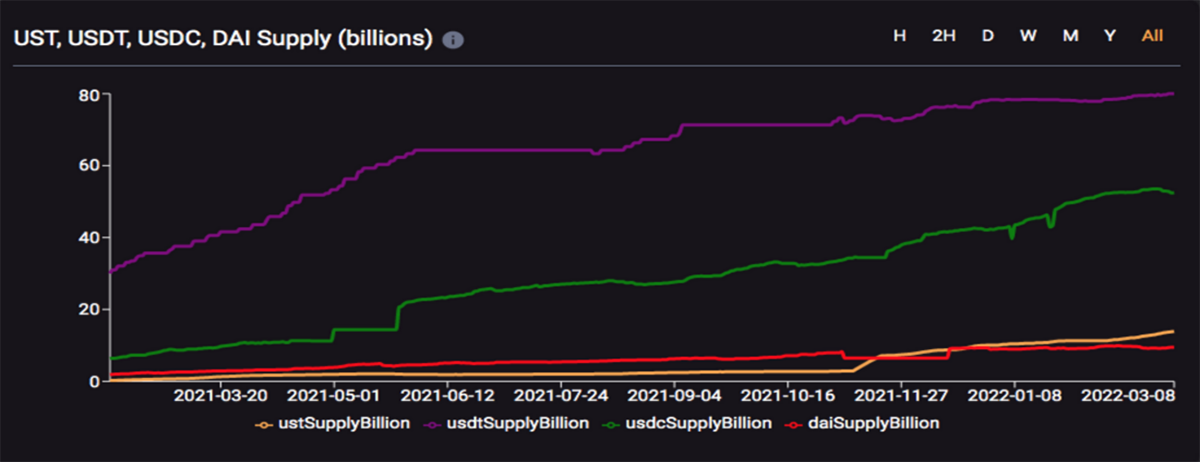

Terra seeks to address the shortcomings of the dominant stablecoins in the market. For one, Terra seeks to be as decentralised as possible, which, combined with its permissionless nature, makes it ideal for the digital economy. For instance, USDT is the largest centralised stablecoin and was created by Tether Limited and backed by Bitfinex, which was accused of using $850 million of its reserve funds to cover up a major Bitfinex loss back in 2019 and was investigated by the New York Attorney General (NYAG). The company can issue as many USDT tokens as it wants, and it dictates the reserves as well. Decentralised stablecoins like TerraUSD (UST), on the other hand, are secure and favourable for users and investors.

The two largest stablecoins are USDT (Tether) and USDC (Circle), with $80bn and $52.3bn in market cap, respectively. They are also both highly centralised. Unlike these, Terra’s UST is a decentralised stablecoin, meaning that there is no central authority. With $14.2bn in market cap, it is now the largest decentralised stablecoin.

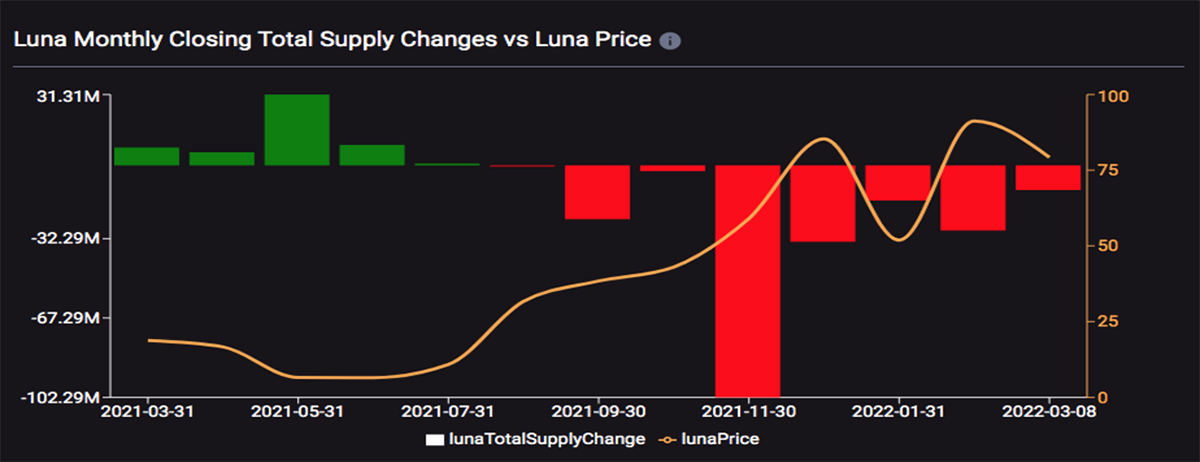

The mechanism that keeps Terra's decentralised stablecoin UST stable is ingenious. Unlike other centralised stablecoins, UST isn't backed by U.S. dollars but is pegged to the U.S. dollar via a minting and burning process of LUNA (the Terra token). If the price of UST falls off its peg and goes lower than $1 per token, UST can be swapped and sold for $1 through minting LUNA, providing basic arbitrage gains for investors. The inverse is also true on the upside. If the price of UST goes above its peg, and goes higher than $1 per token, the higher demand for UST means more LUNA is burned, reducing LUNA's supply and increasing its price (basic supply and demand model).

Nearly 29m Terra tokens were burned in February 2022.

Data from analytics platform Smart Stake shows that the Terra protocol recently burned nearly 29 million LUNA tokens worth almost $2.57 billion. That happened as the supply of UST increased from around 11.26 million on 1 February 2022 to almost 12.92 million on 28 February, marking an increase of nearly 14.7%. However, when the UST supply contracts and it falls off of its peg, LUNA’s valuation may decrease due to a slowdown in the burning and increase in the minting mechanism, making LUNA's valuation highly dependent on UST’s supply.

Recent Developments

The Luna Foundation Guard (LFG) is a Singapore based non-profit organisation supporting the growth of the Terra ecosystem. It recently unveiled the closing of a $1bn private token sale, one of the industry’s largest, to establish a UST Forex Reserve denominated in Bitcoin. The sale was led by Jump Crypto and Three Arrows Capital (3AC), with participation from DeFiance Capital, Republic Capital, GSR, Tribe Capital, and others.

One of the common criticisms of algorithmic stablecoins is their reflexive nature during extreme volatility, where the arbitrage incentives to bring the peg back to a normal state can potentially deteriorate, as seen in December 2020 and May 2021. Since bitcoin is less correlated with Terra's ecosystem and arbitrageurs can swap UST to bitcoin to support UST's peg, the bitcoin reserve is expected to mitigate that risk to some extent. In a press release, the Luna Foundation Guard said that it might introduce other major non-correlated assets within the market to the reserve.

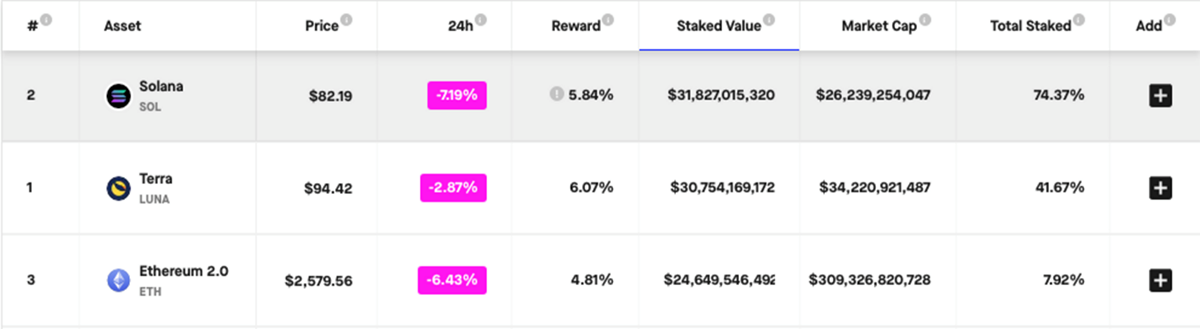

Out of $34.2bn of the total market cap, almost $30.7bn of LUNA is staked on various platforms. This makes LUNA the second largest crypto in total staked value.

Furthermore, according to data from Defi Llama, Terra is the second largest crypto behind Ethereum in terms of total value locked (TVL). Over the past week, Terra registered multiple all-time highs in dollar terms, currently at $25.9bn, and continues to rise. Its TVL remains volatile due to the sharp price movements of Terra (Luna). For instance, its TVL gained over $3bn on 9 March alone.

Anchor Protocol

Anchor Protocol (ANC) is a lending and borrowing protocol on the Terra (LUNA) blockchain that governs $12.7bn in TVL, which is just under 50% of Terra’s total TVL. Data from CoinMarketCapshows ANC has surged almost 126% in February 2022 alone. Its TVL also surged around 60% in the same month.

Anchor aims to provide low-volatile yields on Terra stablecoin deposits with a rate powered by a diversified stream of staking rewards from other major blockchains, currently offering 19.5% APY. Borrowers are also treated with incentives in the form of ANC tokens, with 40% of Anchor’s one billion tokens set aside. Rewards vary depending on how much borrowing activity needs to be stimulated - no wonder the ANC rally continues.

The Anchor Protocol is currently exploring the idea of upgrading its tokenomics, as highlighted in a recent Twitter thread. According to the proposal, those who lock up their ANC tokens between one and four years will receive increased voting power and more ANC emissions. Basically, the longer the lock-up period, the higher the voting power and ANC distribution.

Mirror

Out of numerous future potential dApps that exist on the platform, Mirroris very interesting. The Mirror protocol allows investors to buy and sell synthetic assets that track (or mirror) the price of real-world assets. That could be anything from stocks and ETFs to other cryptocurrencies. For instance, mAAPL is one of the most popular synthetic assets on Mirror, and it tracks the price of Apple stock. It makes traditional investing easier, decentralised and cheaper by removing the middle-man.

Exposure to Traditional Investing

DeFi Technologies’ subsidiary Valour Inc. recently launched a Terra Exchange Traded Product ETP. The ETP will enable retail and institutional investors to gain easy exposure to the LUNA tokens simply and securely via their bank or broker. The product is currently offered on the Nordic Growth Market stock exchange. With other exchanges to follow, the constituency of potential LUNA investors continues to expand.

Marketing and Sponsorships

Terraform Labs founder Do Kwon floated a funding proposal for $40 million from the Terra Community Treasury to sponsor a major American sports league team. The funding would be in the form of TerraUSD (UST) stablecoins, i.e. tokens pegged on a 1:1 basis with U.S. dollars. This proposal involves a legendary sports franchise and a household name in one of the major four American professional sports leagues - the NFL, NBA, NHL and MLB. This should create substantial awareness for the brand while creating more utility for UST and increasing its demand.

Conclusion

The dApps on the Terra blockchain solve particular issues and, directly or indirectly, increase the demand and use cases for its stablecoin UST, pushing it higher than its peg. While this is the case, more LUNA will be burnt, making it a deflationary asset. However, if the reverse happens, more LUNA will have to be minted, increasing its supply and driving down the price.

In bear markets or huge retracements, when all the cryptos are down due to heavy market selling and profit booking, sellers usually swap their earlier investments to stablecoins until the volatility dilutes. This includes TerraUSD (UST), which indirectly makes LUNA more valuable, giving Terra (LUNA) a competitive advantage in these market conditions. In comparison with USDT and USDC, TerraUSD (UST) is still in its early stages and has a long way to go. But the opportunity is substantial if it continues to take market share.

Comments ()