Musk Hands the Airwaves to Crypto

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 46

The killer chart that I am glued to continues to be bitcoin in NASDAQ. Quite simply, if it can hold, bitcoin will soon be deemed to be a highly credible asset, and the institutions will come in droves. There aren’t many ways to sidestep the broader global macro pressures, but if bitcoin proves itself to be on the right side of history, then it is massively undervalued.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | Sluggish |

| On-chain | Resilient |

| Investment Flows | Narrowing GBTC discount |

| Macro | Shitstorm |

| Crypto | Shadowbanning |

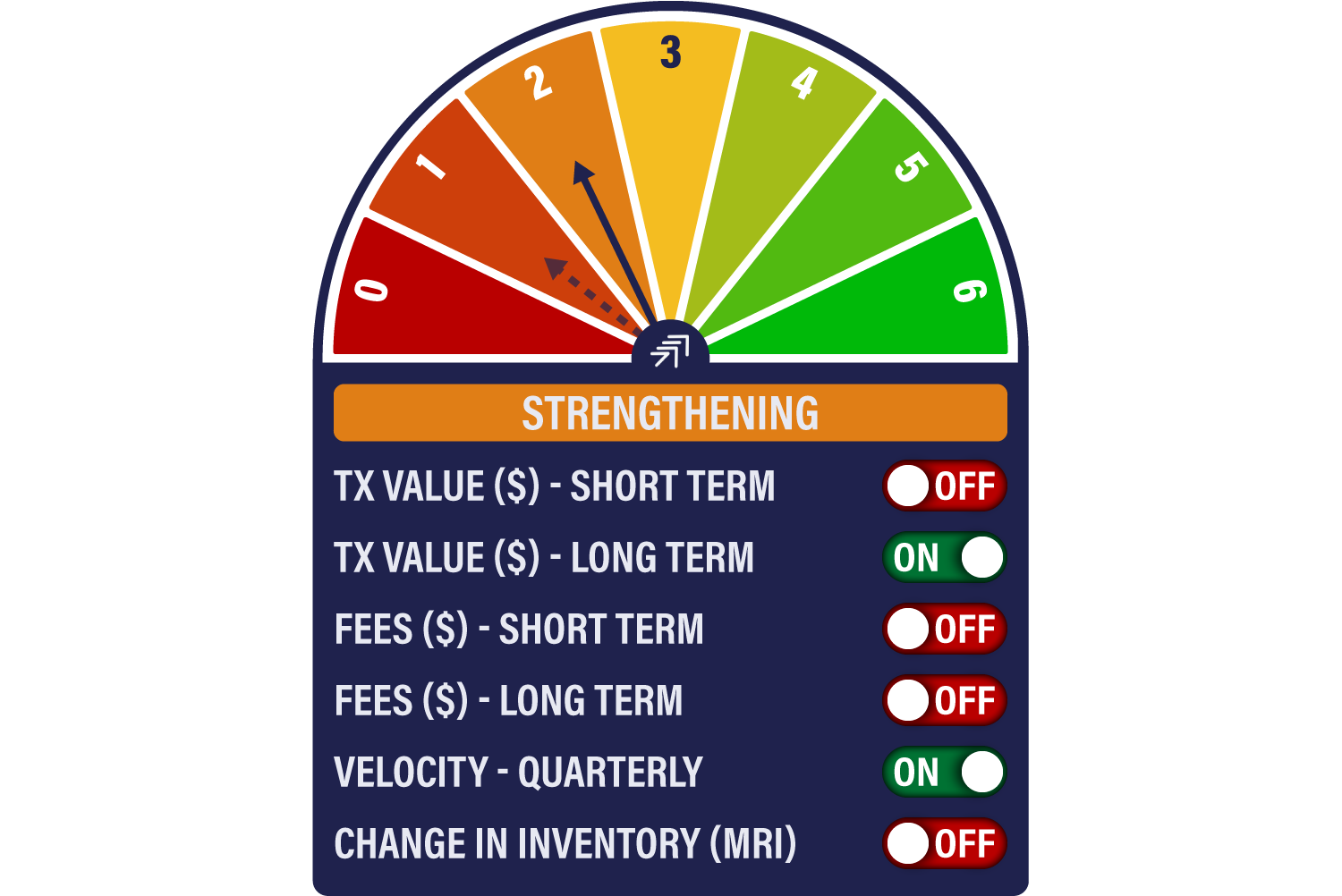

As I mentioned in ByteFolio yesterday, my interpretation of the dial is as follows:

• Bull means prices are rising, hopefully substantially.

• Neutral means prices are treading water. In the case of bitcoin, that currently implies bitcoin does not fall below $30,000, which was the low of 2021.

• Bear would mean I felt there was a risk of a significant fall, below $30,000.

The dial is neutral, which currently means the market is soft, but I believe $30,000 BTC holds. It goes without saying that things change.

But behind that, the deal for Musk to buy Twitter was agreed, and whatever it means for free speech, it’ll be good for crypto. I can’t put it better than Danny Masters, Chairman of CoinShares, and a ByteTree board member.

Technical

The ByteTrend star count for the top 15 tokens fell again from 39/75 to 30/75. DOGE dutifully rallied 30% on the Musk news.

If all 15 coins had a 5-star trend, that would be 75 stars, which would reflect the max bullish technical conditions.

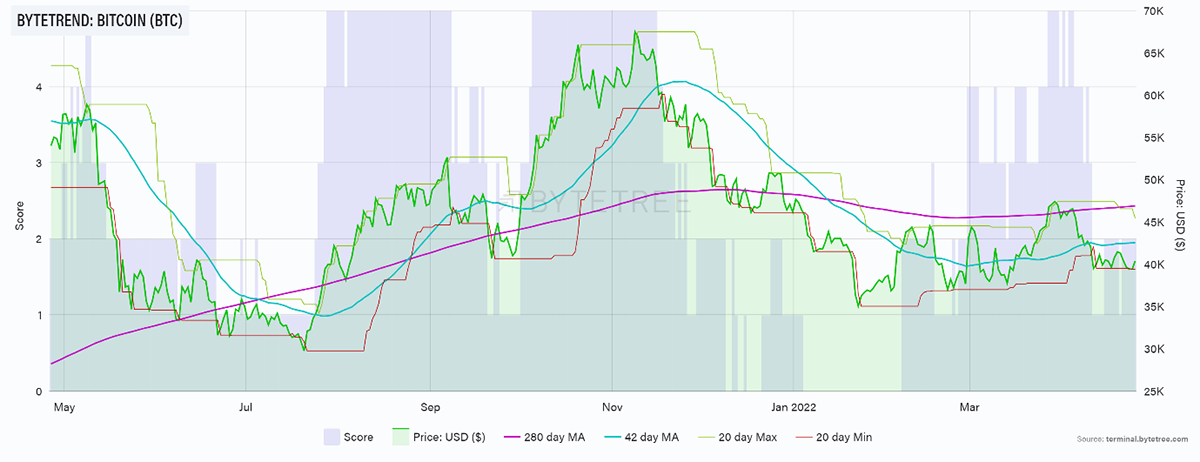

Bitcoin holds 2/5

Source: ByteTrend. ByteTrend for BTC, measured in USD, over the past year.

The one thing I would highlight is that the 280-day moving average is still ascending, which gives some comfort. But I remain obsessed about the BTC/NASDAQ relationship, which I’ll cover later in macro.

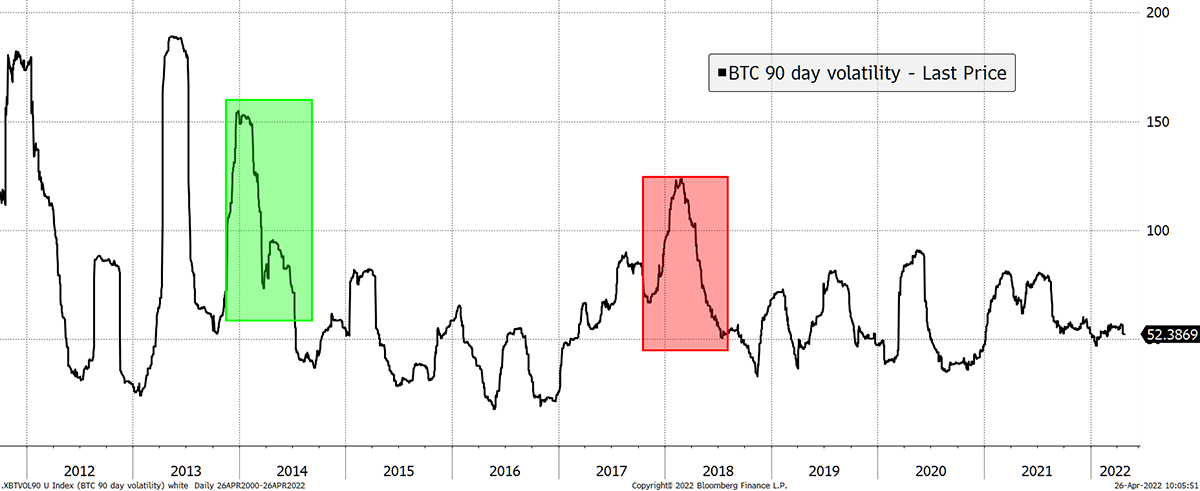

The other comfort comes from bitcoin’s price volatility. Notice how volatility surged in the 2014 and 2018 bear markets. While still high, 52% is looking increasingly respectable.

Source: Bloomberg

In finance, respect earns you money, as the more credible an asset is, the more investors want it. Structurally falling volatility is a bonus.

On-chain

Network Demand Model - by Charlie Erith

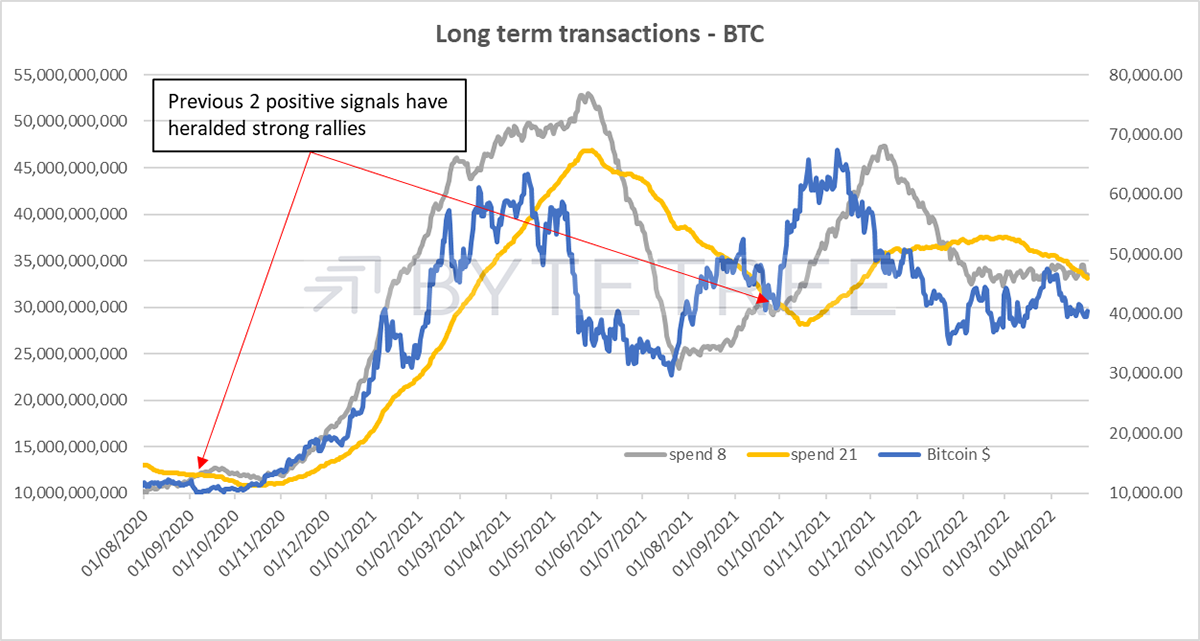

The Network Demand Model rises to 2/6 this week. The big news is that long term spend has turned on again, for the first time since 21stJanuary. It joins the velocity indicator in the “on” camp. We like to see the longer-term trends starting to turn, although short-term activity weakness may make it fleeting. Nonetheless, it suggests that we’re scraping around at the bottom.

Source: ByteTree

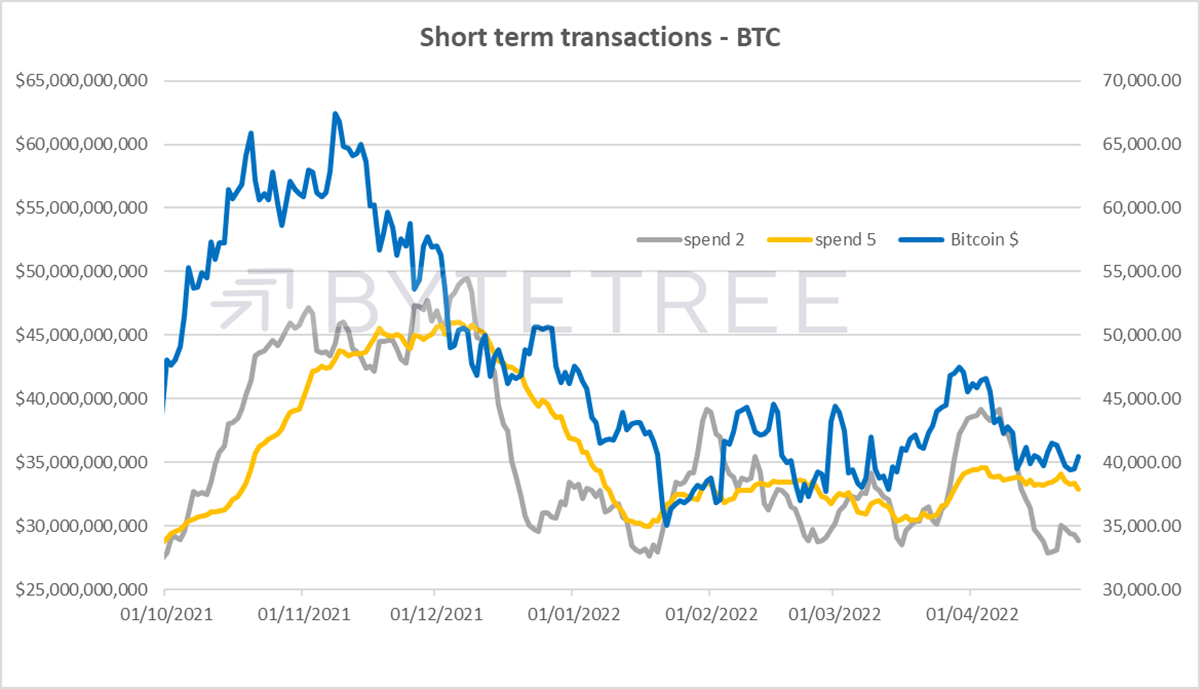

Short term transactions, however, remain unexciting.

Source: ByteTree

Investment flows

By Charlie Erith

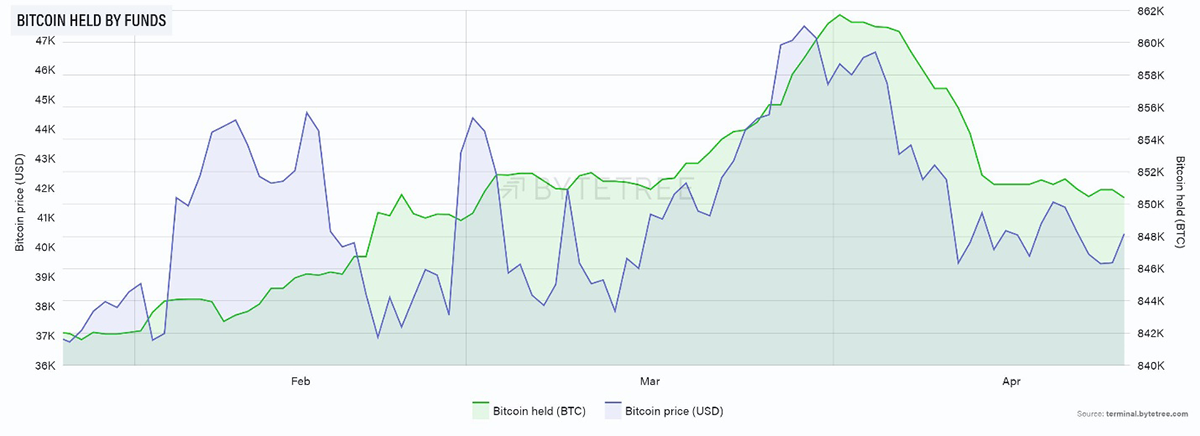

With so much pressure on risk assets in general, it’s of little surprise that BTC fund holdings have flattened out of late. March overall has so far seen a reduction of around 10,800 BTC, worth around US$450m at a price of US$42,000. Worth noting that short term flows tend to lag price movements.

Source: ByteTree. Bitcoin held by funds and price in USD over the past three months.

Has some of this money been redeployed in the Investment Trusts? It is notable that the discount to NAV of the Grayscale Bitcoin Trust has recently been narrowing, perhaps as the market gives greater credibility to the possibility that one day it will convert to an ETP.

Source: ByteTree. Premium/discount of the Grayscale Bitcoin Trust (GBTC).

Macro

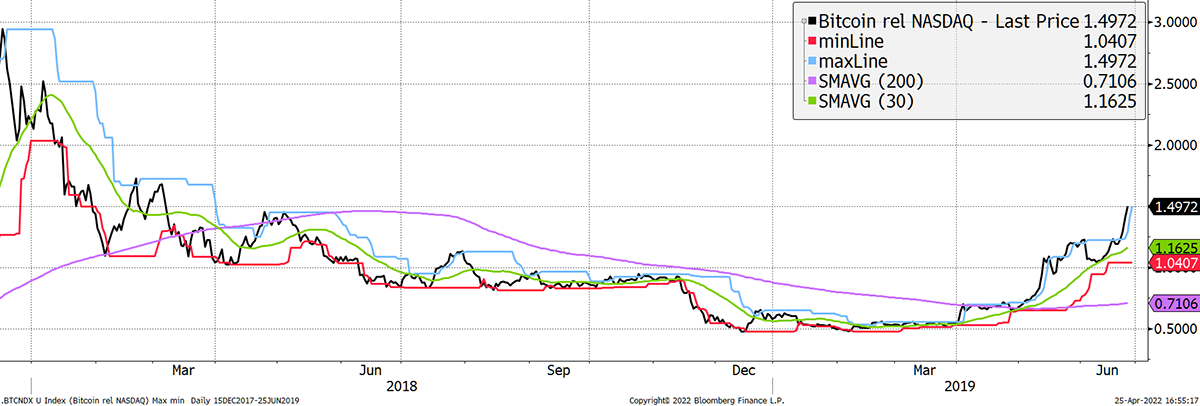

The killer chart that I am glued to continues to be bitcoin in NASDAQ. Quite simply, if it can hold, bitcoin will soon be deemed to be a highly credible asset, and the institutions will come in droves. There aren’t many ways to sidestep the broader global macro pressures, but if bitcoin proves itself to be on the right side of history, then it is massively undervalued.

Bitcoin in NASDAQ 2/5

Source: Bloomberg

I want to see 5/5, and so 2/5 isn’t much to write home about, but it wouldn’t take much, given the tight range. Even if it doesn’t, the BTC NASDAQ relationship is stronger than ever before, as past bear markets would have seen it much lower.

To remind you what the 2018 bust looked like, the 200-day moving average turned south in July, spending the rest of the year at 0/5.

2018 was harsh

Source: Bloomberg

It isn’t just the price relative relationship that matters, but the volatility between these assets. In 2018, that peaked at 120% and is now closer to 40%. However you look at it, bitcoin has grown up a great deal and continues to do so. Vol hasn’t only fallen in USD, but in NASDAQ too. This helps investors see it as an acceptable alternative.

BTC in NASDAQ 90-day volatility is on a downward path

Source: Bloomberg

I would readily become more bearish if the 2018 scenario looked more likely, and indeed that was my view last summer. The risk of the price falling along with mainstream assets remains high, but the risk of a 2018 style wipe-out seems to be greatly reduced.

Stockmarket risk

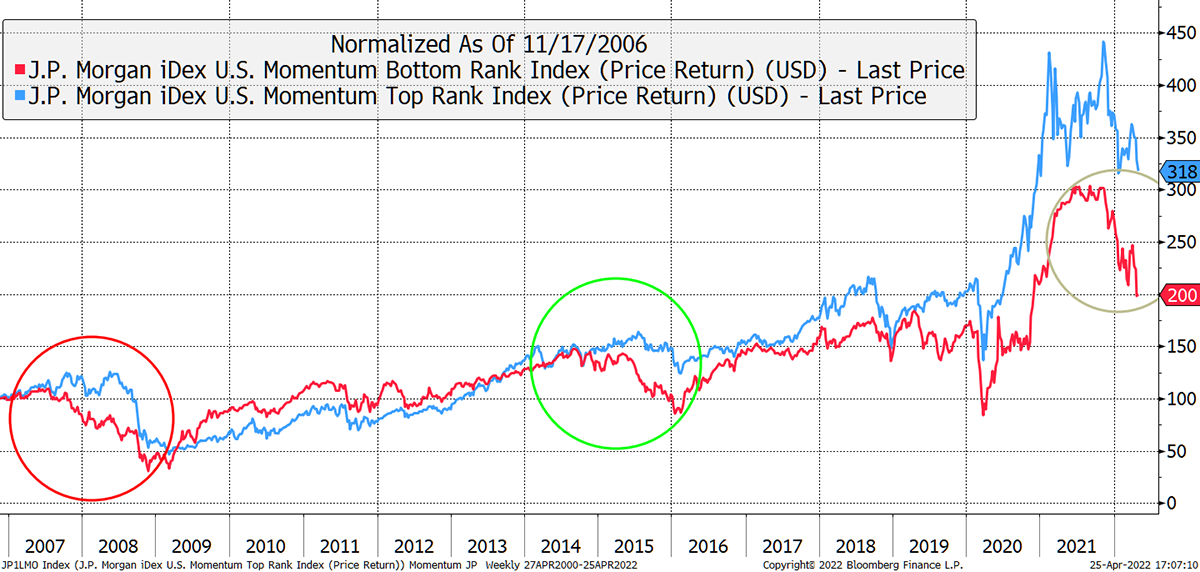

The rising dollar, driven by Federal Reserve rate hikes, is painful for asset prices, but there is something else – we have “downward leadership” in US equity markets.

When the stockmarket rises, you need a leading group that makes loads of money and pleases the crowd. The same is true in reverse. Bear markets need a large group of losers to drag prices down.

The chart shows the momentum stocks (past best performers) in blue, and the laggards (past worst performers) in red. When the losers are making new lows, that’s bad, as highlighted.

Leadership to the downside

Source: Bloomberg

The losers fell in 2007, when they were populated by banks, nearly 18 months before the Lehman collapse. That happened again in 2015, this time with commodities in the doghouse. Now it’s failing tech stocks such as Block (SQ), Zillow (Z) and FuelCell Energy (FCEL).

No doubt these are great companies, but their prices are falling and seemingly have a way to go. This negative leadership is what drives bear markets, and that tells me things will get worse before they get better. They are the most important group of stocks to watch because when they stop falling, we can have confidence that the worst is behind us. That could even be soon, at least tactically, as they are already quite oversold.

Take the lead from the losers

Source: Bloomberg

I digress into equities because crypto does not live in isolation and cannot escape the macro storm. But it can outperform, and I’ll gladly take that.

Further reading for the multi-asset geeks

If you fancy reading up on inflation and which asset classes work and don’t work, here is an excellent note from Man Group, who are sophisticated quant traders. They look back on past inflationary times going back many years.

Their conclusion on bitcoin towards the end is standard institutional thinking. They are right in the sense that bitcoin is unproven in an inflationary environment, but given its design (limited supply), the gods are on its side. Otherwise, this note, which includes collectibles (wine, art), is excellent.

Cryptonomy - Shadowbanning

by Laura Johansson

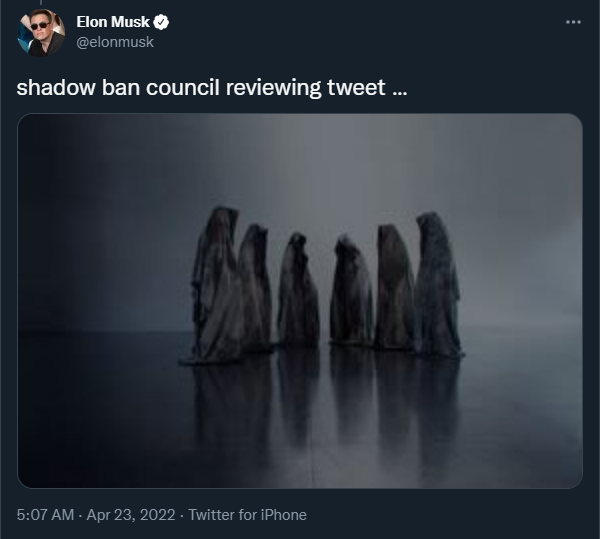

Last week, the headlines stated that the world’s richest man buying the world’s 15th largest social media platform would be a long shot. Last night, it was confirmed - Elon Musk now owns Twitter.

After the $44bn deal closed, Twitter became a privately held company. Scouring our Twitter feed reveals some mixed emotions amongst users. However, Musk himself appears to be excited over the newfound prospects, tweeting“I also want to make Twitter better than ever by enhancing the product with new features, making algorithms open source to increase trust, defeating spam bots, and authenticating all humans”.

All great things, I am sure, but what does it mean for the crypto space? For some time, there have been murmurings about Twitter manipulating the visibility and reach of crypto accounts. Ghost or shadowbanning is when your posts and activity suddenly become invisible on the social media platform, but you haven’t received an official ban notification. Twitter has previously denied shadowbanning accounts but added that they do rank tweets and search results. With Musk being an ally and advocate of the crypto space, will we see these supposed limitations being lifted in the future?

Source: Twitter

The other new feature in the pipeline is of course Twitter Blue. Currently only available in the US, Canada, Australia and New Zealand, the new paid-for premium Twitter includes setting your profile picture to a verified NFT. Perhaps we can now expect more crypto-enabled features to be added?

It has been less than 24 hours since the acquisition announcement, so it’s safe to say that nobody really knows for sure what the future of Twitter will look like, but Musk does have a track record of very successful businesses. Changes, improvements and updates will be made for sure, but I do not buy into the theory that DOGE will become the official currency of Twitter.

Summary

A free Twitter could be a boon for crypto, and we must not underestimate this.

Comments ()