No Shortage of Appetite in the Bitcoin Market

Disclaimer: Your capital is at risk. This is not investment advice.

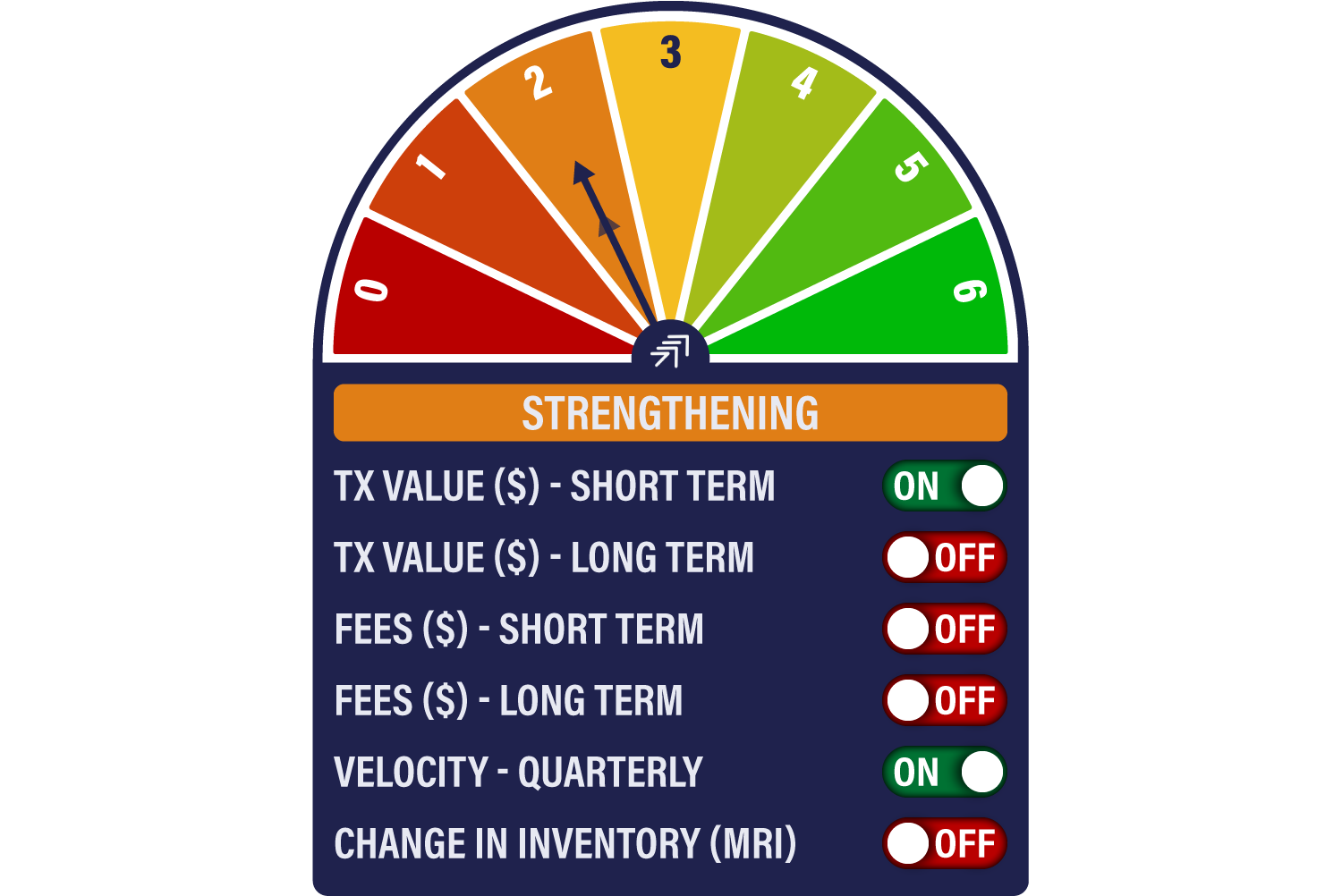

Bitcoin Network Demand Model

The model remains on 2/6 this week. The short-term transactions and velocity signals remain on, but fees have lurched lower. There are positives, however. Miner inventory levels have fallen to a 12-week low, showing that there has been solid underlying demand, while our valuation model has been quietly ticking higher.

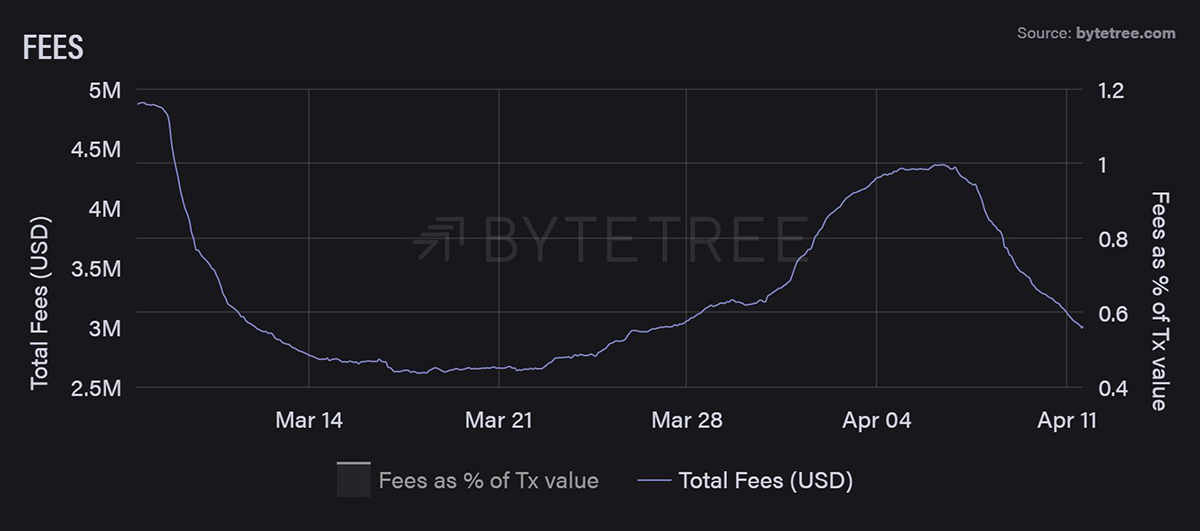

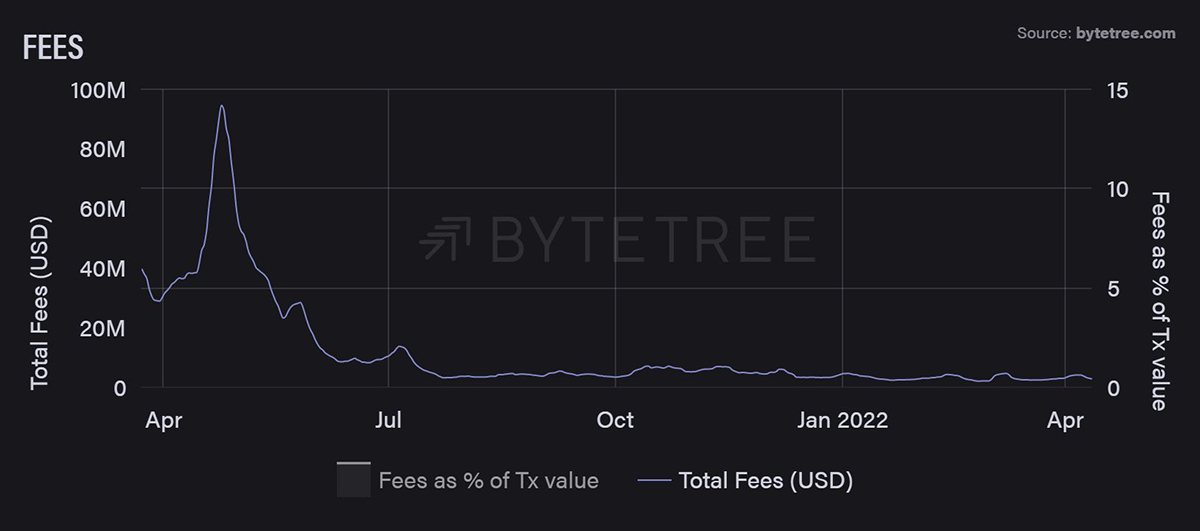

The positive signals remain the same as last week, so we won’t dwell on those. At the start of the month, we had been encouraged by an upturn in miner fees, but this has tailed off in conjunction with the number of transactions.

Zooming out, however, we can see that this is not a major move in the context of the last 12 months.

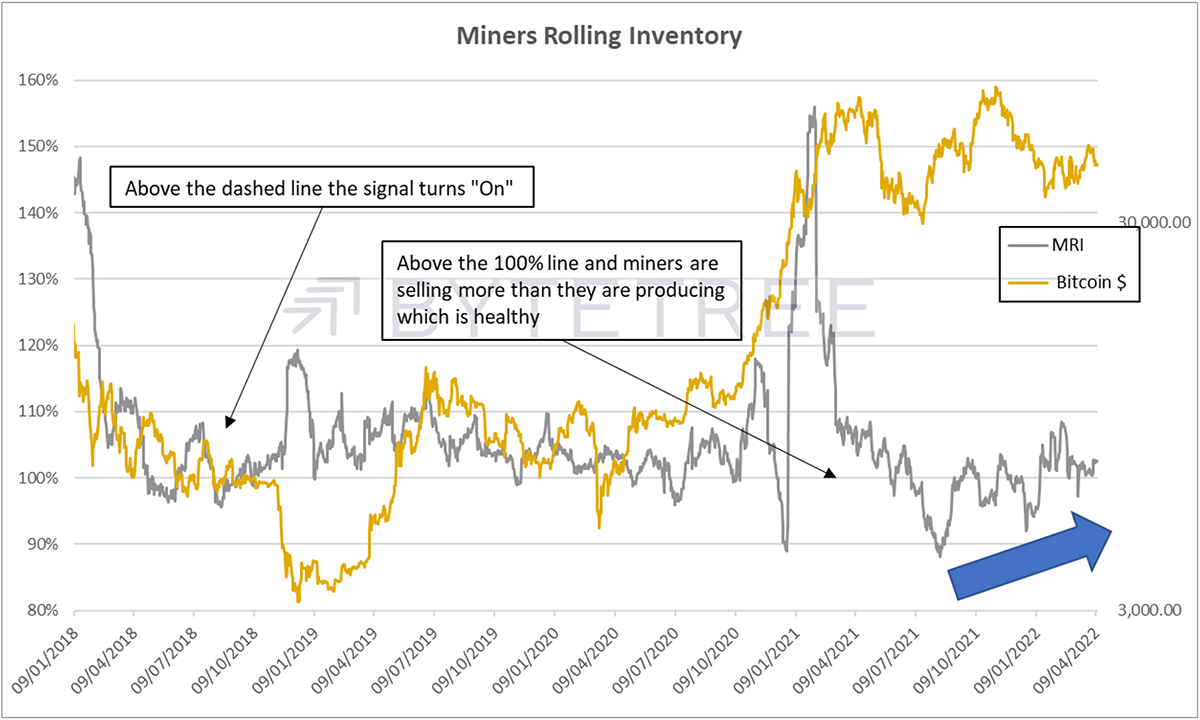

Miners have been offloading inventory more aggressively of late. As long as there’s sufficient demand, we regard this as healthy. Indeed, one of our long-term pre-conditions for a bull market resumption is for a reduction in “unspent” inventory. As can be seen in the chart below, miner inventory has been gradually falling since the start of the year.

The general picture we get from miner activity is healthy, as shown below. Despite the somewhat moribund price behaviour this year, there is no shortage of appetite in the market. Indeed, the general direction of late looks broadly constructive.

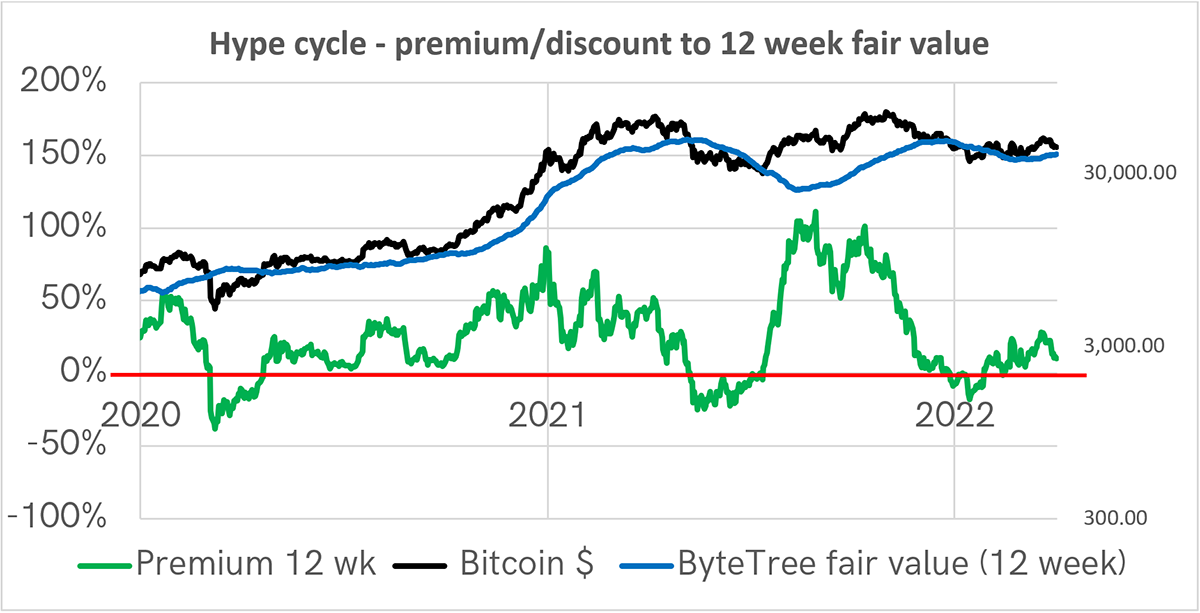

Meanwhile, our valuation model, which is based on transaction value, has gently ticked higher, despite the softness in the price. As the green line below moves towards the 0% line (which indicates that the price has hit fair value), so the risk of lower prices deteriorates.

The conclusion from all this is that the main weight on the bitcoin price comes from external macro factors. There nothing in the NDM to suggest that there is any meaningful deterioration in activity.

Comments ()