Slowdown

Disclaimer: Your capital is at risk. This is not investment advice.

Atlas Pulse Gold Report - Issue 70;

“Central banks weren’t cutting interest rates in 2019 because things were great.” - Patrick Perret-Green.

Highlights

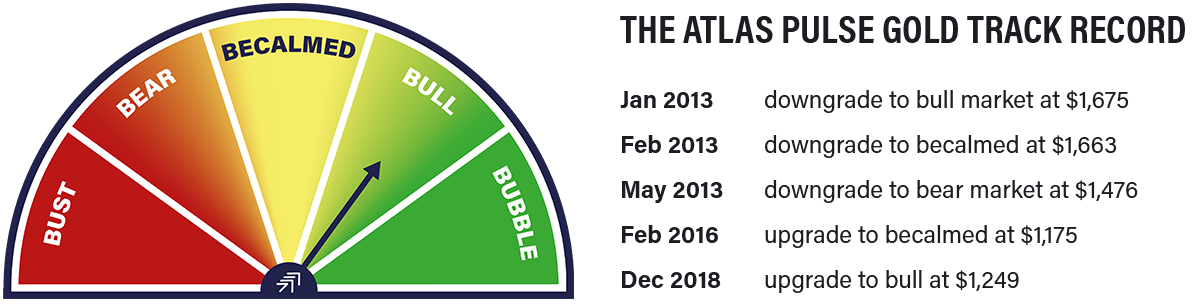

| Regime | Gold bull market |

| Macro | Real rates rise |

| Valuation | 10% above fair value |

| Flows and Sentiment | Bullish |

| Technical | Uptrend |

Regime - Gold Bull Market

Historically gold has been a buy when two or more of the following have held true:

- Short-term real interest rates are below 1.8%. TRUE

- The gold price, measured in a basket of currencies, is rising, measured by a 35-month exponential moving average. TRUE

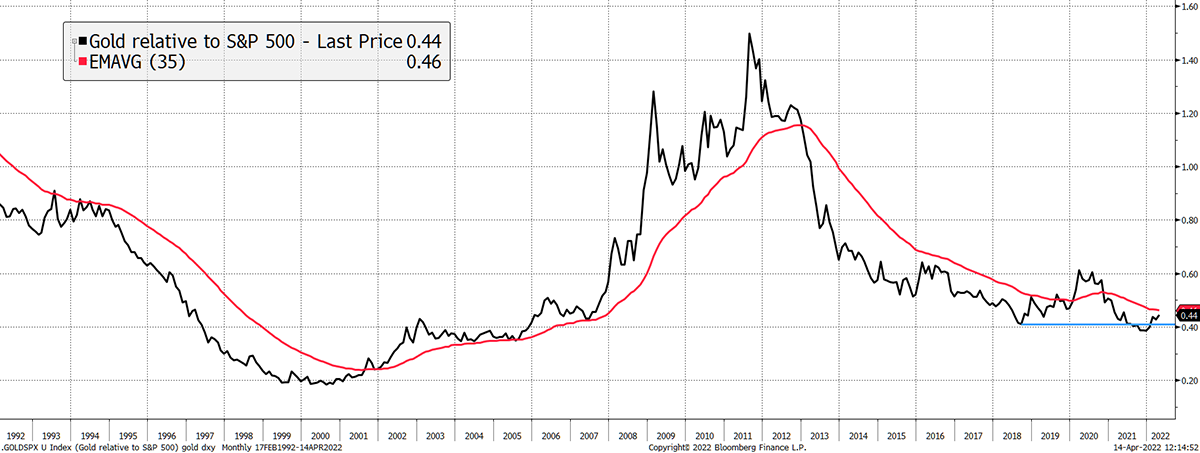

- The gold price relative to the S&P 500, measured by a 35-month exponential moving average, is rising. CLOSE AT HAND

When I tested this simple model back to the 1970s, the answer was to stay long gold when the score was 2 or better. Times could be choppy, but you’d end up better off.

Point 3 has been the frustration, but gold is fighting back against the stockmarket, and my view is that the gold to S&P ratio will double, from its current level, over the next few years.

Gold versus S&P 500 Strengthens

Few gold watchers are surprised that the S&P 500 is down 6% this year while gold is up 8% this year. The macro stinks, and quite simply, investors are buying gold as a diversifier, an inflation hedge and a safe haven.

Macro

I spoke to my friend and macro guru, Patrick Perret-Green, who is always ahead of the curve when it comes to assessing economic train wrecks. He made some great observations. His thesis is that the stimulus was a one-off event, and we are heading back to the misery of 2019; that is the long-term move towards Japanification. He said:

“Central banks weren’t cutting interest rates in 2019 because things were great.”

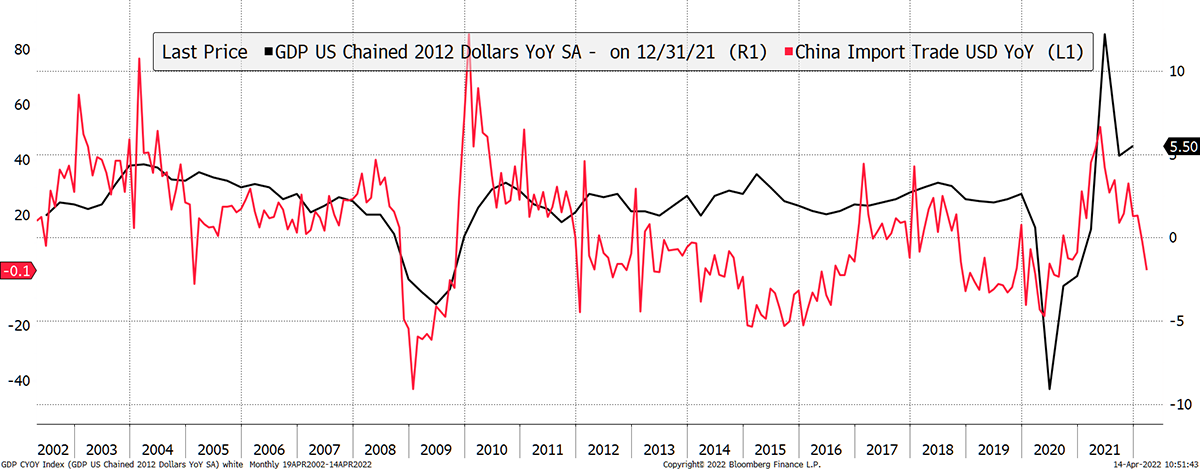

Now there is a slowdown, which has been flagged by the flattening yield curve. He pointed towards China, where import growth has turned down, which has been closely linked to US GDP. This comes on top of the problems in Chinese real estate.

It Always Starts in Asia

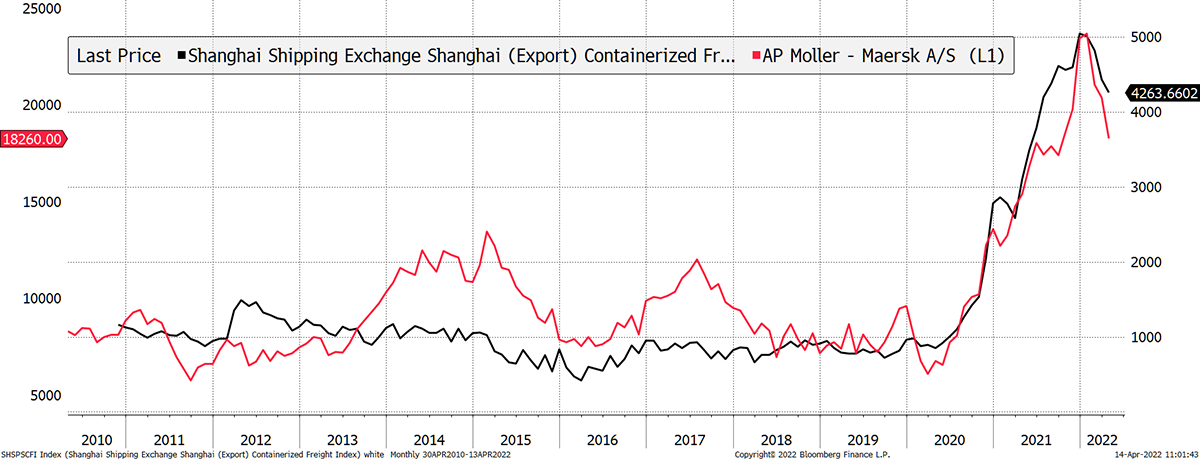

We can see the freight sector rolling over. Remember how freight rocketed as the Ever Given got stuck in the Suez Canal. There were bottlenecks all over the world, but these have subsequently eased.

Freight Rates Ease

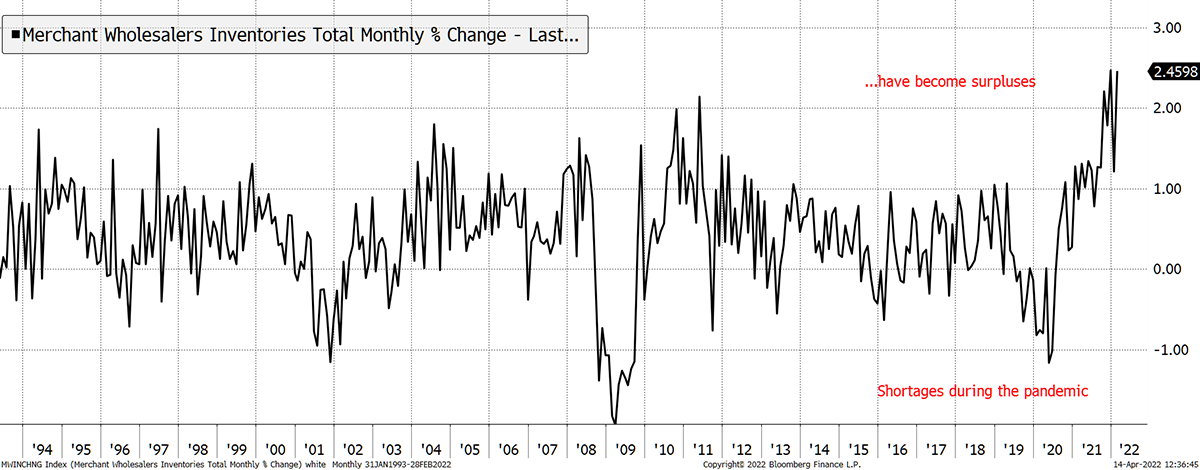

This led to shortages of goods, but even this has reversed, and now there’s a glut. Inventories are through the roof.

Record Inventories

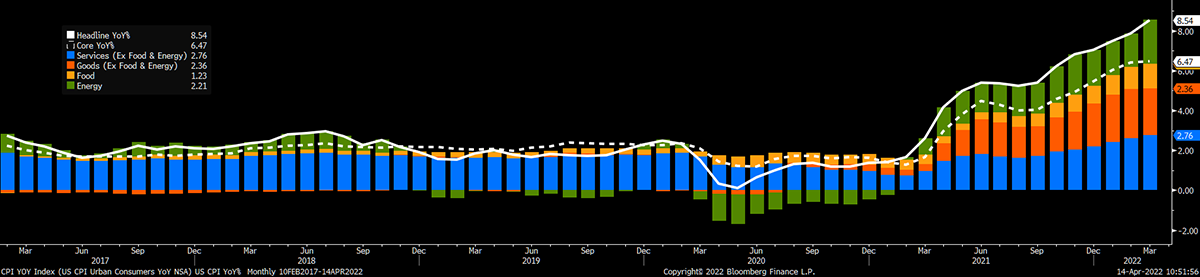

Looking at the causes of inflation, people talk much about food and energy, and they are right to do so. But what gets less of a mention is the price of goods (dark orange). Goods have enjoyed steady pricing for years, something which reversed when lockdowns eased in 2021.

Inflation Breakdown

Perret-Green believes goods inflation will flatten out and may even return to negative territory by the year-end.

He was less sure about food and energy but felt the political pressure on the “friendly” producing countries was enormous, and they would drill harder. The bottom line is that inflationary pressures will ease, but the trend rate will remain higher than pre-2020. Of course, on top of that come unknown unknowns.

As the economy brushes with recession, Perret-Green felt the central banks will not print money like they did in 2020 because they have now been scarred by inflation. A better question he asked is, “what breaks?”.

Going back to unknown unknowns, we don’t know what, but with a build-up of credit, lofty asset prices, excess goods and homes, something will.

This stuff matters because inflation and growth drive the bond market, and in my opinion, the bond market drives gold.

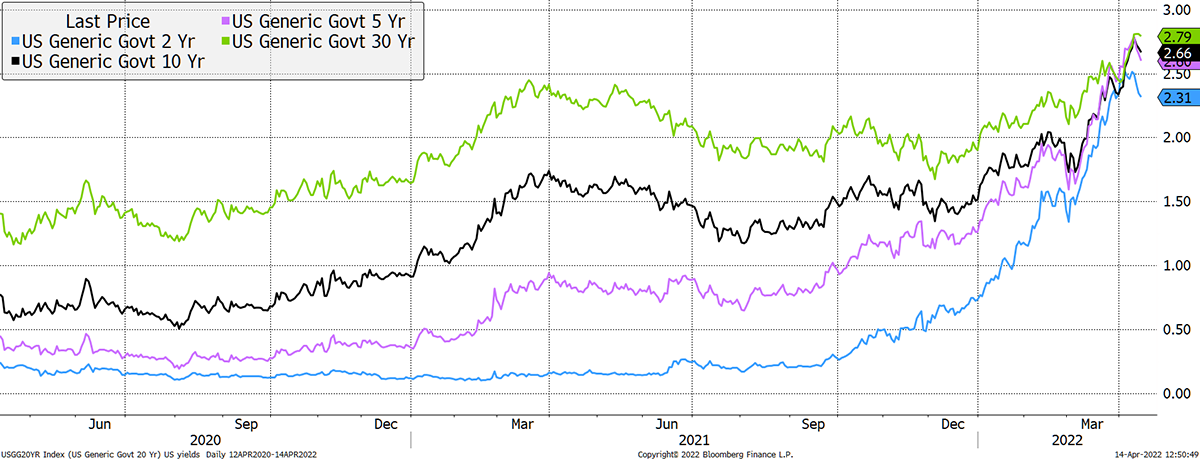

Higher bond yields weigh down on gold, and we have just seen these turn down over the past week. Given the impending slowdown, it is entirely possible that bond yields have peaked.

Might Bond Yields Have Peaked?

That’s great for gold, which likes nothing more than an economy on its knees. Falling bond yields are a plus.

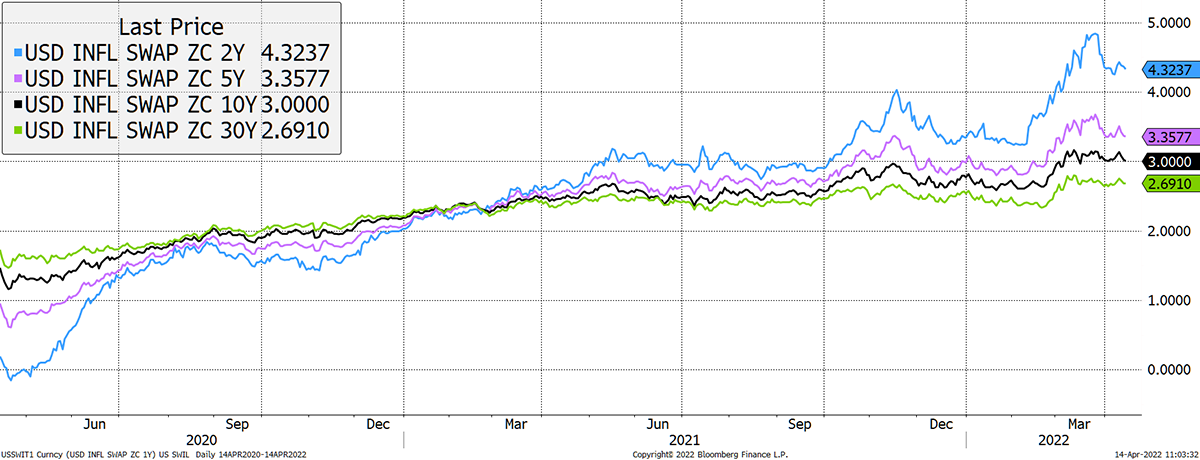

But what if inflation expectations have turned down as well? That would go against the popular narrative. It’s too early to tell, but I suspect if oil settles below $100, we should be prepared for this.

Great Expectations?

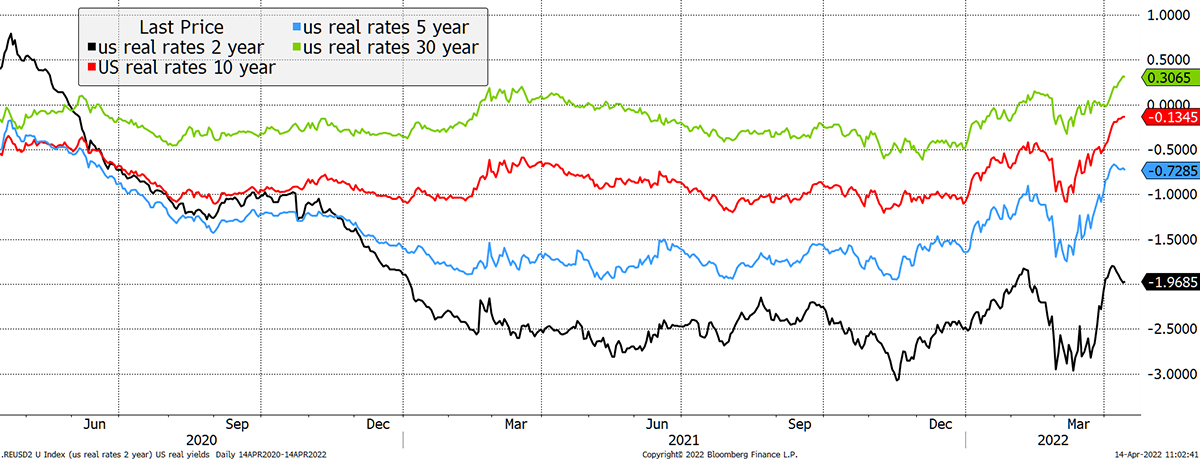

Low rates and high inflation would be Disneyland for gold. This would reflect an ultra-low real yield. In contrast, when rates are high and inflation is absent, this is Dismaland (Banksy’s theme park). Recall that gold is most sensitive to long-term real rates (green and red).

Real Rates Are Rising Again

Other macro considerations have been a strong US dollar, and gold has advanced like a hot knife through butter. Sooner or later, this will reverse, and probably when the central banks see the economy tank and reverse their tightening programme. That will be another tailwind for gold to look forward to.

Valuation, Flows and Sentiment

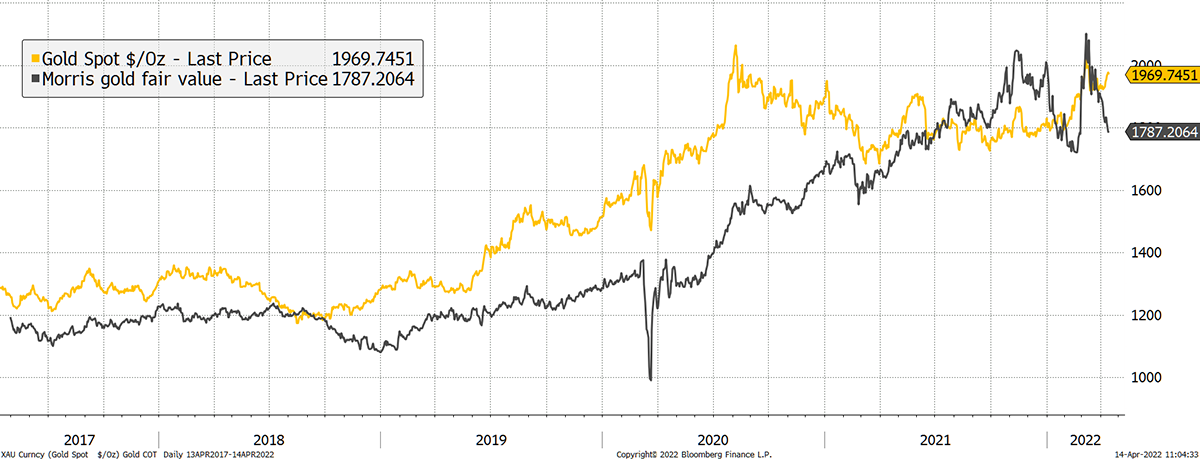

My magical gold model hasn’t liked the recent rise in bond yields. For it to be more agreeable, it would like to see higher long-term inflation.

Gold Is Still in the Fair Value Range

Flows and sentiment

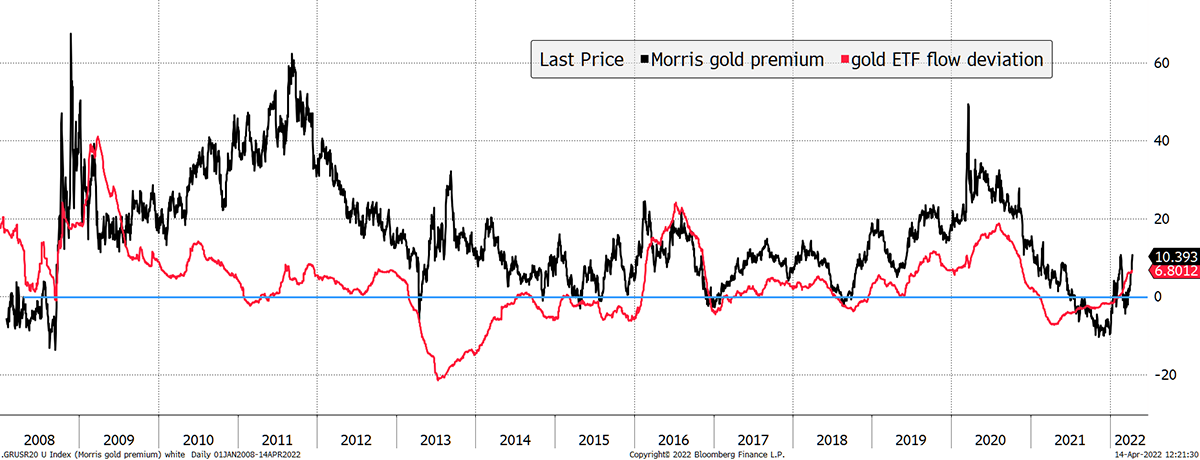

The premium to fair value is shown in black and is now 10%. That is no cause for concern. However, this latest premium has been driven by inflows as investors have been (rightly) buying gold. The link between the change in the premium and the change in gold ETF flows is a remarkable fit.

Flows Drive Premiums

Don’t forget that gold ETF flows are freely available on our mighty fine website.

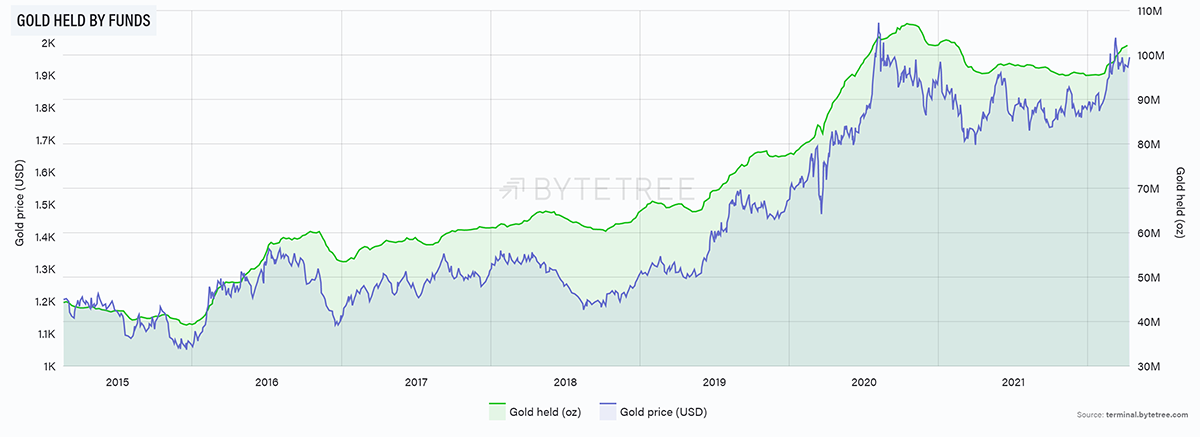

The Gold ETFs will Need a Bigger Vault

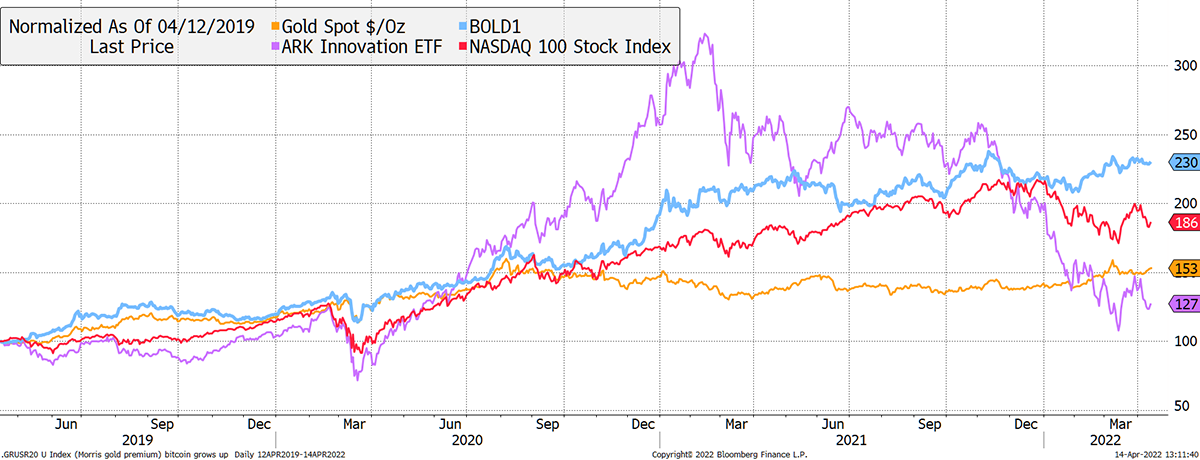

Before I go, I wanted to show you how ByteTree’s BOLD Index is getting on. This combines bitcoin and gold on a risk-weighted basis; currently, 82% gold and 18% bitcoin. The portfolio is neatly balanced between risk-on and risk-off, making for a fabulous outcome during the good times and bad.

BOLD

“I would take the gold and sprinkle a little bitcoin on top.” - Ray Dalio, Founder, Bridgewater Associates

We are doing some interesting things with this, and if you would like to learn more, please subscribe to our mailing list.

Summary

Just remember that all paths lead to gold. I wish you all a Happy Easter.

Thank you for reading Atlas Pulse.

Thank you for reading Atlas Pulse. The Gold Dial Remains on Bull Market.

Charlie Morris is the Founder and Editor of the Atlas Pulse Gold Report, established in 2012. His pioneering gold valuation model, developed in 2012, was published by the London Mastels Bullion Association (LBMA) and the World Gold Council (WGC). It is widely regarded as a major contribution to understanding the behaviour of the gold price.

Please email charlie.morris@bytetree.com with your thoughts.

Comments ()