At Low Prices, Bitcoin Is Once Again an Effective Inflation Hedge

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 49

Most assets are inflation hedges when prices are low, and nothing is when prices are too high. You cannot reasonably expect an asset to be an inflation hedge at any price.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

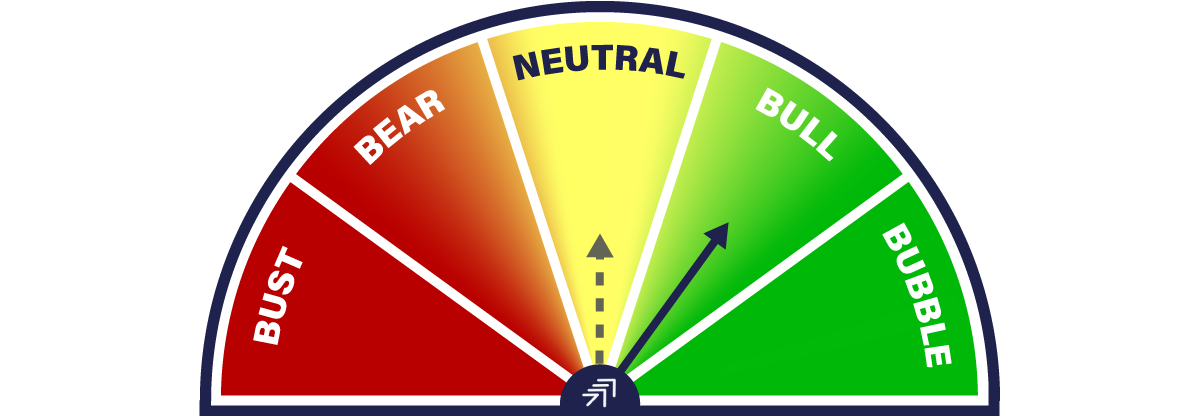

| Technicals | Seen better days |

| On-chain | Network Demand 4/6 heading for 6/6 |

| Investment Flows | Deep discounts |

| Macro | Inflation hedge |

| Crypto | Bitcoin’s Head of Marketing |

Last week, I called buy. I have no regrets.

Technical

By Charlie Morris

The ByteTrend star count for the top 15 tokens fell to 5/75. Next week, I hope our long-promised breadth charts will be ready. They are a magical visualisation.

If all 15 coins had a 5-star trend, that would be 75 stars, which would reflect the max bullish technical conditions.

The trend is awful, but it also smells of capitulation. In last week’s “So Bad It’s Good”, I was a day early in calling bull. Remarkably, the price dipped lower but is back to the same level today as it was a week ago. You really can’t keep a good coin down.

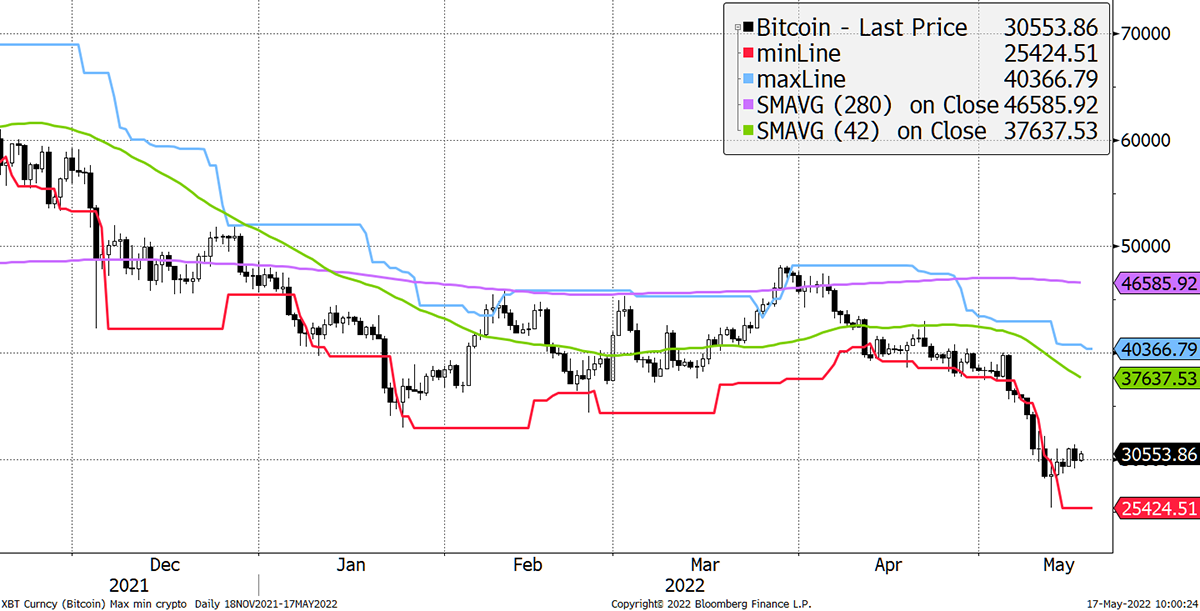

Bitcoin 0/5

Source: Bloomberg

Last week I showed how oversold bitcoin was against the 30-day moving average. This week, we look at the 200-day comparison. Last Wednesday, it touched -38%, which is severely oversold. Back in March 2020, there was a severe macro shock, and in late 2018, there was a “bitcoin-is-bust” moment. Of course, it wasn’t and promptly recovered. In my opinion, this is as bad as it gets.

Bitcoin trades 32% below the 200-day moving average

Source: Bloomberg

To remind you of the post-2013 price regression, we are in oversold territory.

Source: Bloomberg

And since the 2017 high, the price is also into buy territory. Note, however, that the IRR drops to 70% from 97%. This is probably a more realistic framework, and it will slow further, but it’s still pretty attractive.

Source: Bloomberg

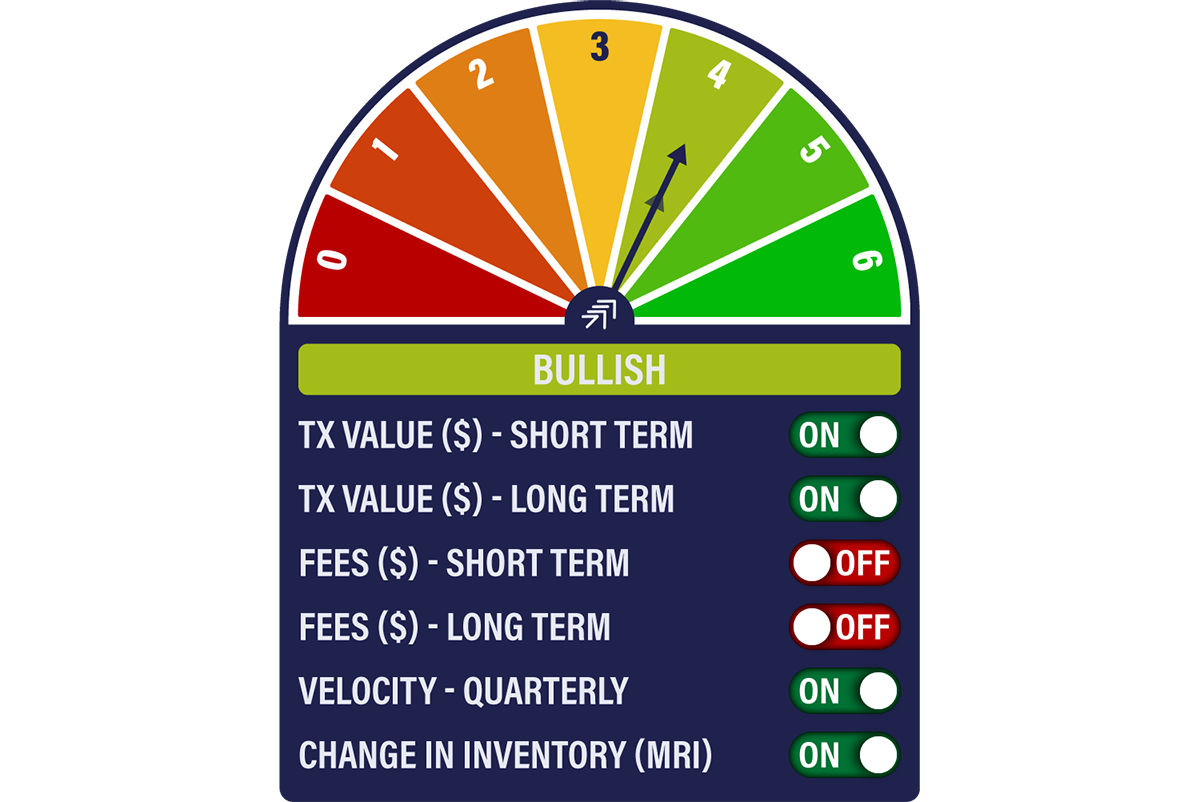

On-chain

By Charlie Erith

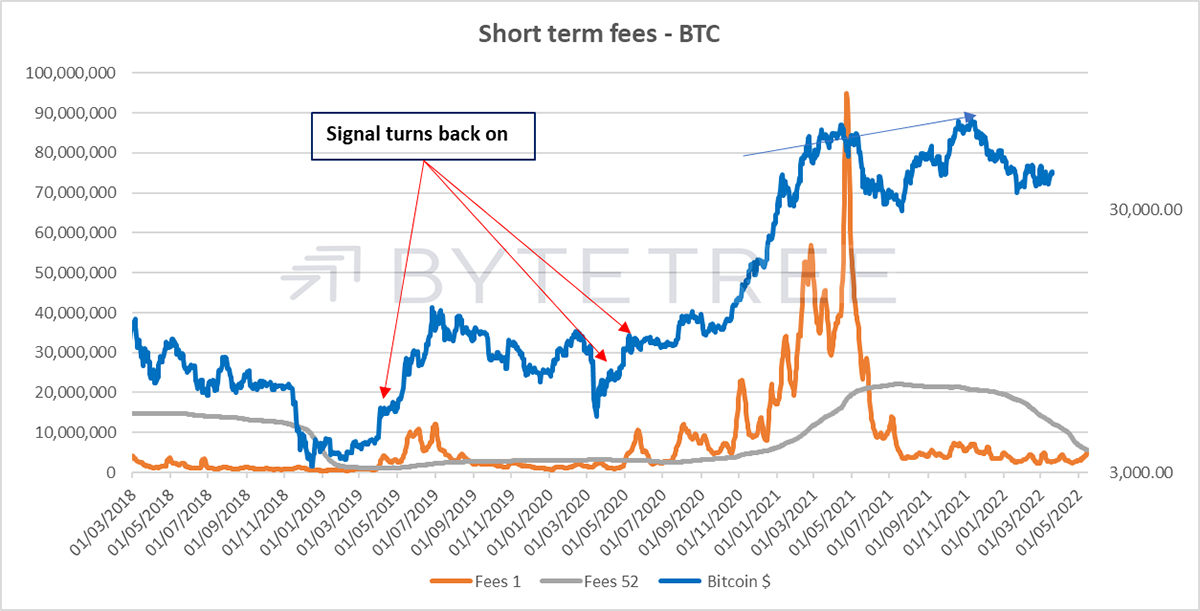

The bitcoin price might be unhappy, but the Network Demand Model is fizzing. The model remains on 4/6, with a huge breakout in transaction activity, while it looks like the two fee signals will turn back on imminently.

Velocity, a good measure of capitulation, has continued higher, while miner inventory is being easily absorbed at these levels. With our in-house valuation models climbing to US$41,600, a lot of risk has been baked in at these levels.

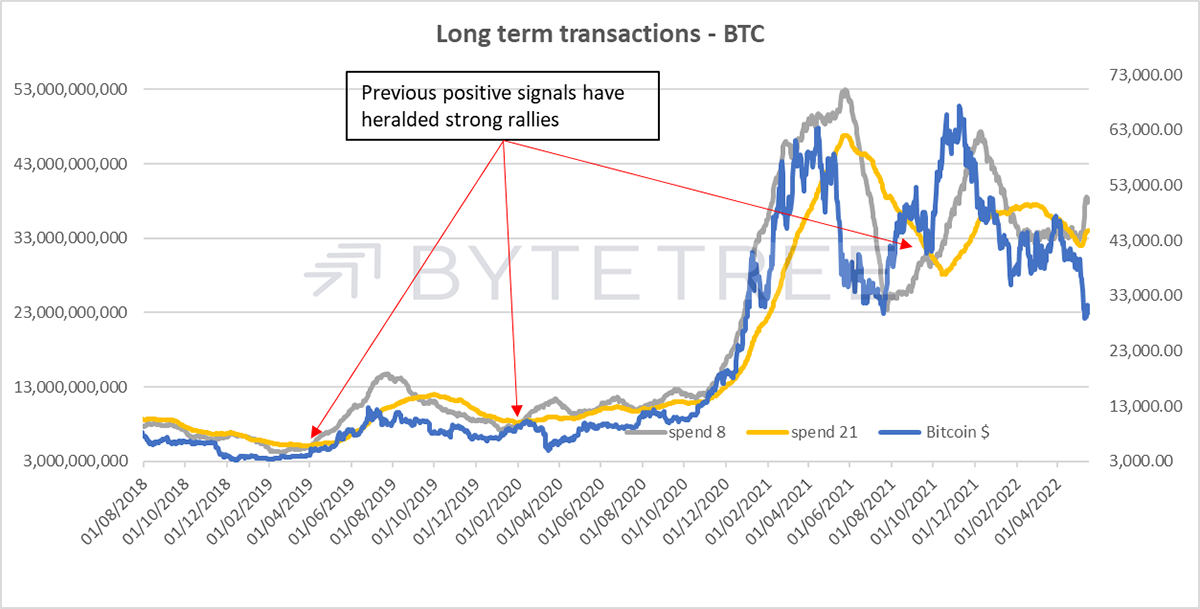

The long-term transaction signal doesn’t move often. Historically it has been a good indicator of strong secular bull markets, as shown below.

This time the signal turned back on at US$41,000, so the price has already fallen 30% from there. But note that a similar thing occurred in early 2020 when the price tanked with the onset of Covid. This time we’ve had the shock of the UST stablecoin collapse. It would have been painful in the short term if one had bought the signal in 2020, but it worked out spectacularly well for those who held on.

After a very long wait, it looks like the fee indicators will soon start to turn positive. The short-term fee indicator is another that doesn’t move often, but it has generally only turned on at the bottom of cycles, as shown below. Mind you, it hasn’t happened yet, and if activity slumps again, it might not, but worth being aware of because this is a sharp move in the right direction.

Investment Flows

By Charlie Erith

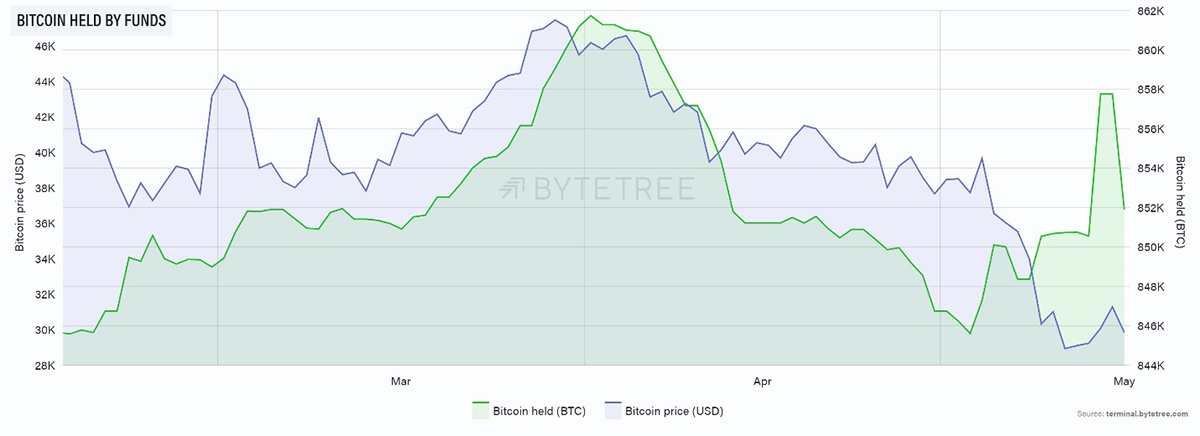

Fund flows are providing decent fodder for contrarians and value investors. Discounts to NAV for the closed-end funds are as high as they’ve ever been (this is frequently used as a contrarian indicator). Yet, there is no sign of panic from the ETFs, which have gently grown as the bitcoin price has tumbled from US$40k to US$30k, shown below.

Source: ByteTree. Bitcoin held by funds over the past three months.

Grayscale premium/discount to NAV

Source: ByteTree.

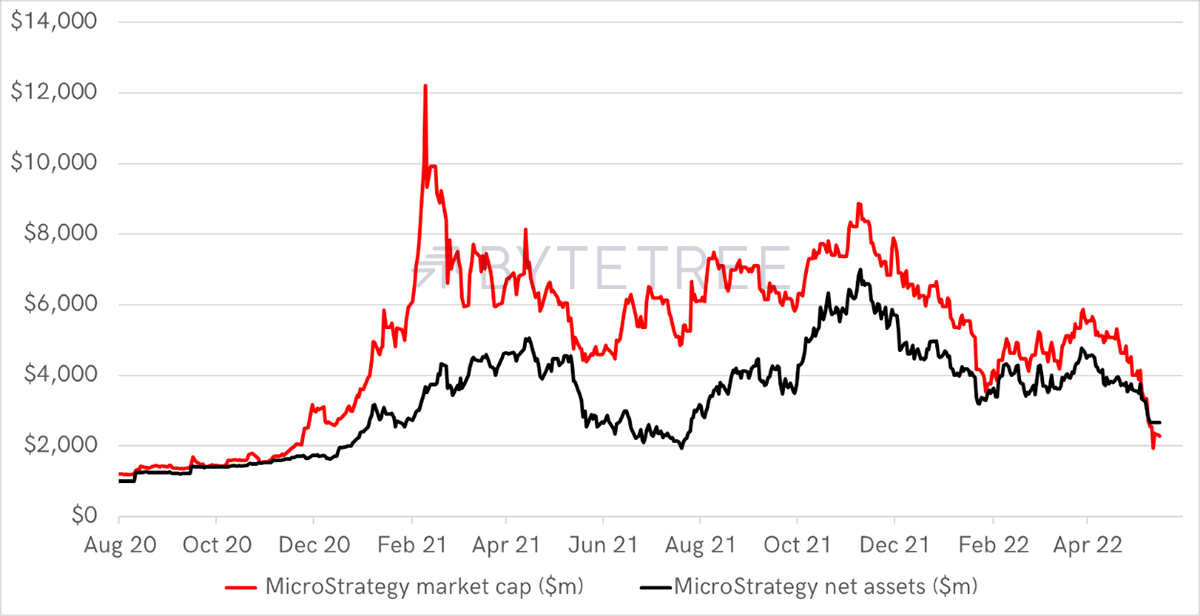

The stockmarket has taken a bearish view on crypto, as we can see looking at the price of MicroStrategy. Our valuation model puts the shares at a 14% discount to fair value, as shown here, so again a lot of bad news is in the price. For the more racy investor, it’s worth remembering that the company has a net debt/equity ratio of 45%, so buying the shares at this level is getting you leveraged exposure.

What is clear is that the market has already priced in further deterioration in the space. If prices stabilise these are the perfect conditions for a healthy bounce.

Macro

By Charlie Morris

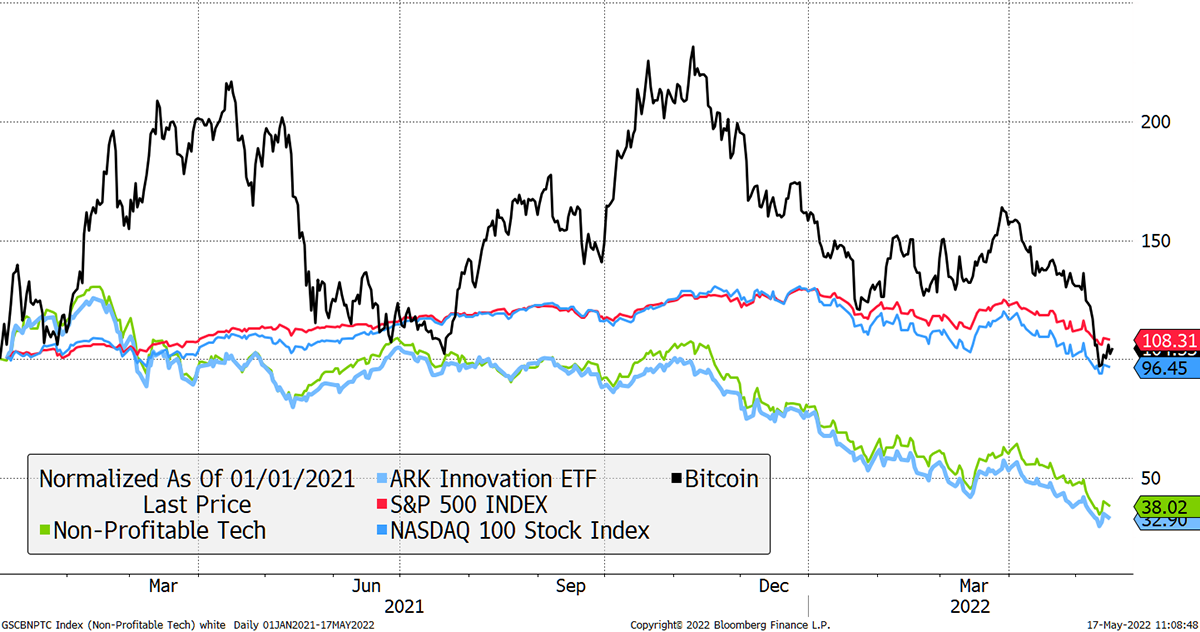

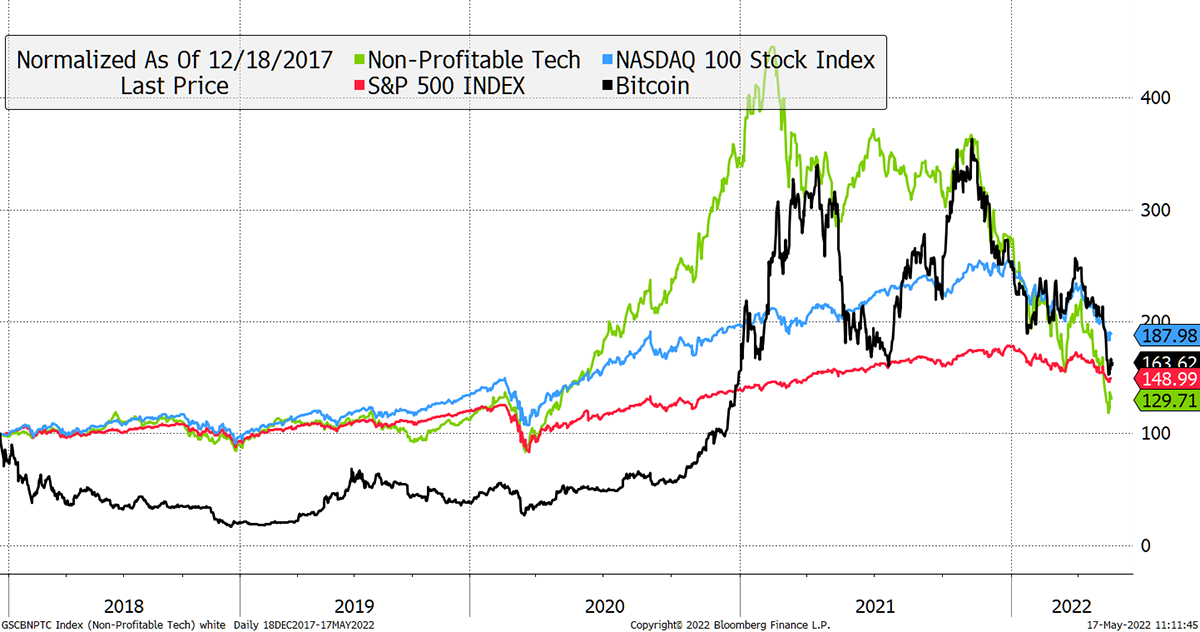

The problem in financial markets is the trainwreck in speculative stocks. It was inevitable, but for the bitcoin bulls, there is a significant disconnect. Since early 2021, bitcoin has been volatile, but the result is closer to the S&P 500 or NASDAQ than it is to the non-profitable tech stocks (NPTS).

Tech bust

Source: Bloomberg

NPTS are deeply oversold and not far from their March 2020 low. I’m not saying they are a buy and may fall further, but the worst of this chapter is behind us. Looking back at the December 2017 bitcoin high, it is remarkable how asset prices have converged. Furthermore, it is clear how over the past six months, they have all fallen together.

Source: Bloomberg

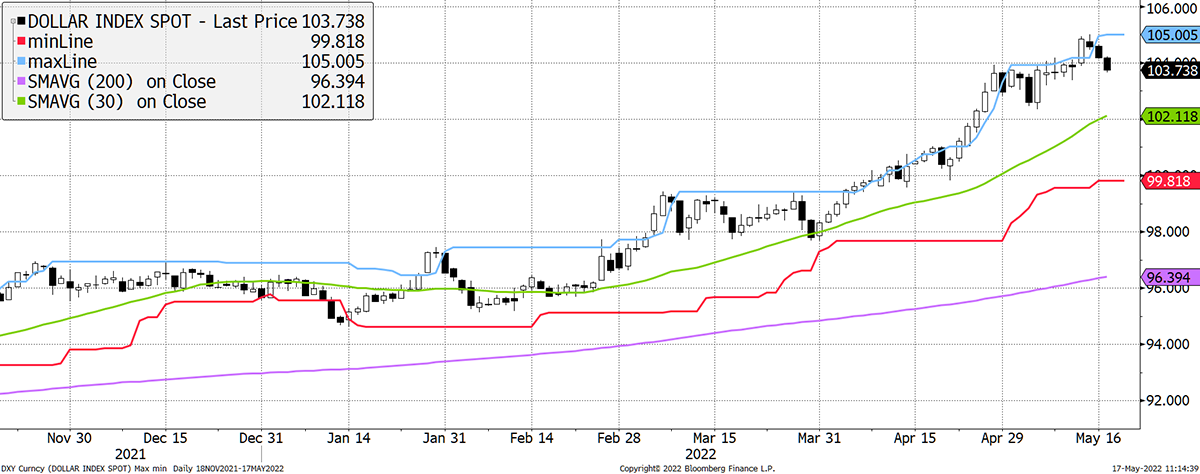

Some good news comes from the dollar. Just as everyone is talking about euro-dollar parity, it starts to ease off. A strong dollar is the enemy of markets, and so cooling will help.

Dollar exhausted?

Source: Bloomberg

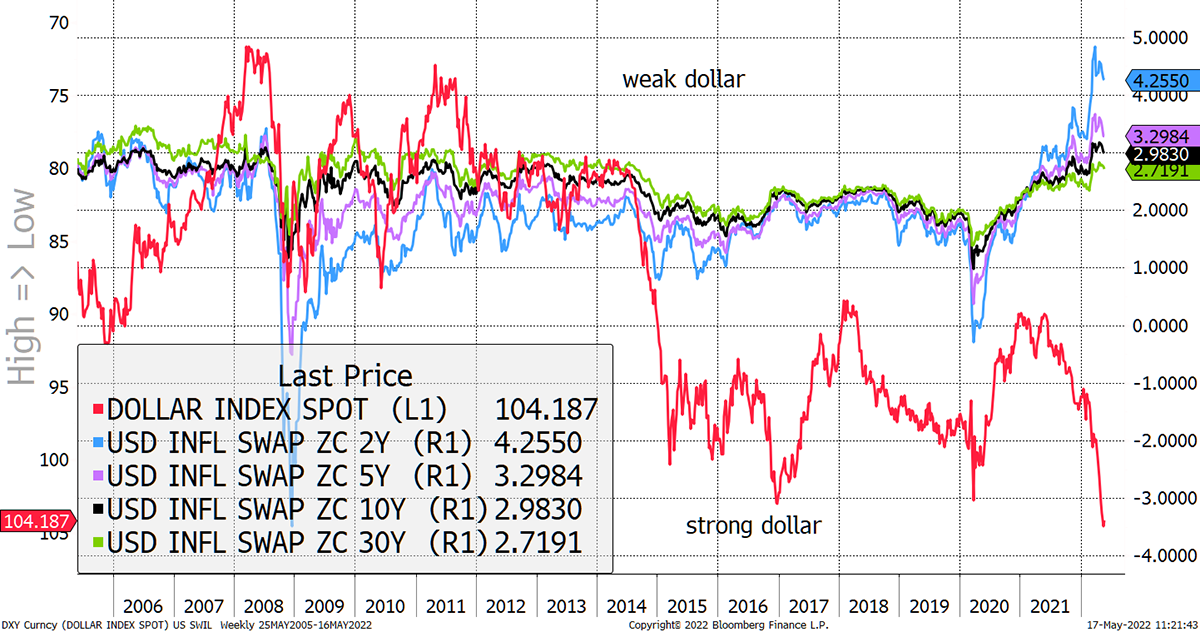

I will next overlay the dollar (inverted axis) with inflation expectations. Normally a strong dollar (red line down) eases inflation, and vice versa. Not this time. Inflation expectations have stabilised, but in times past, would have collapsed on this extreme strength in the dollar.

The VIX trends higher

Source: Bloomberg

That is telling you something, and bitcoin is supposed to be an inflation hedge. It is, but much more so following a 50% + selloff than when it is full of hot money. Most assets are inflation hedges when prices are low, and nothing is when prices are too high. You cannot reasonably expect an asset to be an inflation hedge at any price.

This applies to TIPS too. For when prices are too high, the real yield turns negative, as they have done in UK inflation-linked gilts.

Cryptonomy: Bitcoin’s Head of Marketing

By: Laura Johansson

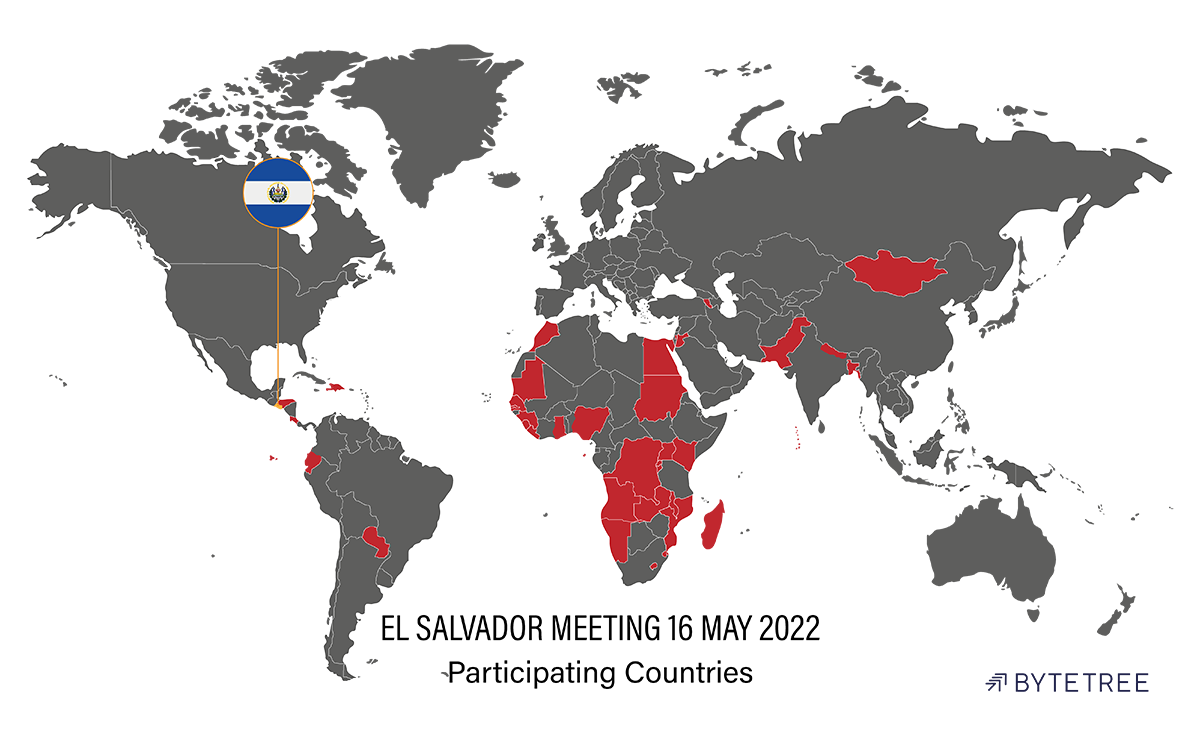

Nayib Bukele, the President of El Salvador, announced a surprise meeting in a Twitter thread yesterday.

Charlie has already awarded Michael Saylor the honorary title of Bitcoin’s Head of Sales. So, in turn, I’ll reward Bukele with Head of Marketing.

Source: Twitter

Just over 8 months ago, El Salvador became the first country to adopt Bitcoin as legal tender. With around 70% of the adult population classified as unbanked, and 24.1% of the country’s GDPoriginating from personal remittances, Bitcoin sure seems like an attractive solution for a nation that is trying to distance themselves from the US dollar (their other legal tender). Interestingly, at the time, Bukele was criticised for choosing BTC over a stablecoin, but I think the events over the past couple of weeks may have put the final nail in that coffin.

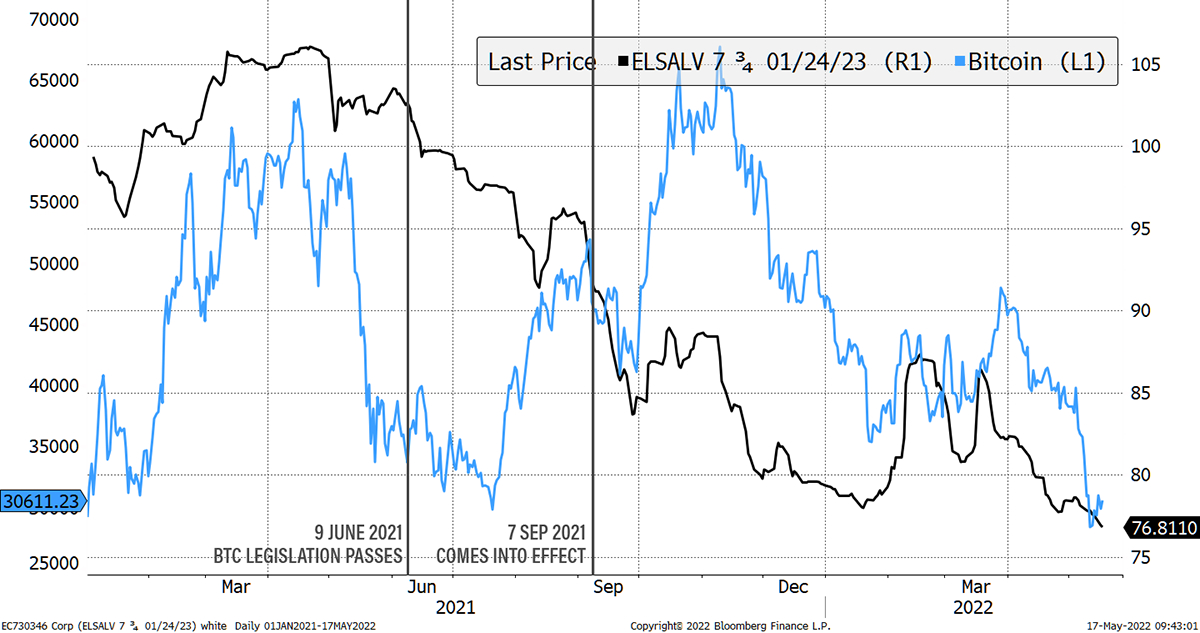

Source: Bloomberg

The El Salvador bond, which redeems at $100 next January, trades at $76. Given the coupon is 7¾%, that’s not bad at all, assuming they repay. Presumably, the market thinks they won’t. According to Bloomberg, that’s a 51% Gross Redemption Yield for the brave.

According to a report from PwC, roughly a month after the law came into effect, 50% of the population was using the nation’s Bitcoin wallet Chivo, with around $2 million in daily remittance transactions. Admittedly, it’s not been entirely smooth sailing domestically since the adoption, but Bukele has not lost his stride. “Financial inclusion [and] banking the unbanked” aside, with Bitcoin also comes the global limelight. From the collaboration with Jack Mallers’s Strike to building Bitcoin City, investors have turned to Central America. Other developing nations have witnessed the possibilities and now come to learn from the OG.

Source: Twitter, ByteTree.

As illustrated in the map above, many African nations are attending the meeting, which is unsurprising considering Africa has the highest crypto adoption rateglobally. There are over 40 different currenciesacross the continent, but the idea of a single African currency has been on the agenda for nearly 60 years. More recently, there’s been talk of using a stablecoin for a unified African currency, sort of like a 21st century version of the Euro. Bitcoin or stablecoin, I can see either option being an attractive solution to the illiquid and volatile domestic currencies while also lowering the barriers for international investors.

We have yet to find out the impact of this three-day meeting, but it may be too much to hope for a catalyst for global Bitcoin adoption. Once again, we are reminded of how much can happen in the crypto space over the course of a year.

Summary

These are interesting times, and markets are due a bounce. The hope is that bitcoin can lead the way and shake off the stablecoin saga.

Comments ()