Bitcoin: Where from Here?

Disclaimer: Your capital is at risk. This is not investment advice.

In this piece, we argue that bitcoin should be considered as an option on a store of value. We also look at the reasons behind the current weakness and whether financial repression is likely to go away. Lastly, we look at where we are in terms of bitcoin’s valuation and how this cycle compares to previous ones.

Bad, but no worse than other risk assets

It’s been a torrid couple of months for bitcoin and the cryptosphere. This is partly because it’s been a torrid time for just about everything, but also because crypto has involved itself in another foot-shooting incident.

On the first point, it’s worth reflecting that while bitcoin has been hit hard recently, it’s far from being alone in that regard. Since the start of this year, BTC has fallen 34%, which compares to Meta Platforms (aka Facebook, -41%), Tesla (-31%), Alphabet and Microsoft (both -20%). The vaunted Baillie Gifford US Growth Trust has fallen 46% during the period, so bitcoin has gone with the bunch in what is clearly a nasty period of tech de-rating. As so often, when everything goes pear-shaped, correlations veer towards one.

Secondly, there’s been the collapse of the UST “algorithmic stablecoin”. I won’t go into detail here, but this is a setback for the aspirations of decentralised finance. That said, it’s far from fatal. Crypto is a laboratory with lofty ideals and madcap experiments. It’s not the first time there’s been a blow-up in the space, and it won’t be the last. Unlike blow-ups in the real world, however, the losses aren’t paid for by the many so that the few can prosper. These mistakes hurt and therefore won’t be repeated. The space will learn, gather itself up and move forward stronger.

An option on a store of value

Aha, you say, but isn’t bitcoin supposed to be a store of value, an inflation hedge? How can it be an inflation hedge if it falls 34% when inflation spikes? Setting aside that nothing is an inflation hedge when it has gone up too much, consider two things. First, an inflation hedge is ultimately judged by its ability to maintain its purchasing power over time, and second, bitcoin is still extremely early in terms of adoption. While we can, perhaps churlishly, argue that by increasing five-fold since the start of the pandemic, bitcoin has already done a fantastic job of protecting wealth, its volatility (a function of its immaturity) makes it a bad “port in a storm”. But that’s not really its role - yet. The key point is that bitcoin aims to be a solid store of value in the future, seen in a similar light as gold is now.

This is why I like Ruffer Investment’s Duncan MacInnes’ description of bitcoin as “an option on a store of value” so much. Bitcoin’s advocates see bitcoin as one day becoming a form of global reserve asset, alongside the more analogue gold and US$. Because of its design brilliance and inviolability, I also see this as a desirable outcome but am in no doubt that it is not certain. Hence at this stage, it makes sense to see it as an option. It is a network effect asset, and its value hinges on a consensus built up by a global network of users. If that network shrinks, for whatever reason - technical, regulatory, competition? - its appeal will fade. But long term, I think that’s unlikely.

Stealing money from old people slowly

The best reason for bitcoin to fail is that the incumbent forms of money - the dollar and other conventional currencies - improve as stores of value. This means that policymakers must resist the urge to expand their supply, otherwise known as financial repression, or, as Russell Napier so brilliantly puts it, “stealing money from old people slowly”. Although the Fed is currently trying to assert its inflation-fighting credentials (now that inflation is hitting consumer prices as well as asset prices), history suggests that the temptation to borrow money from the future when growth is weak far outweighs the political pain of prudence. Allied to various structural factors, notably de-globalisation (a by-product of elevated political risk), it is hard to see currency debasement – and therefore inflation, and therefore bitcoin - becoming a thing of the past.

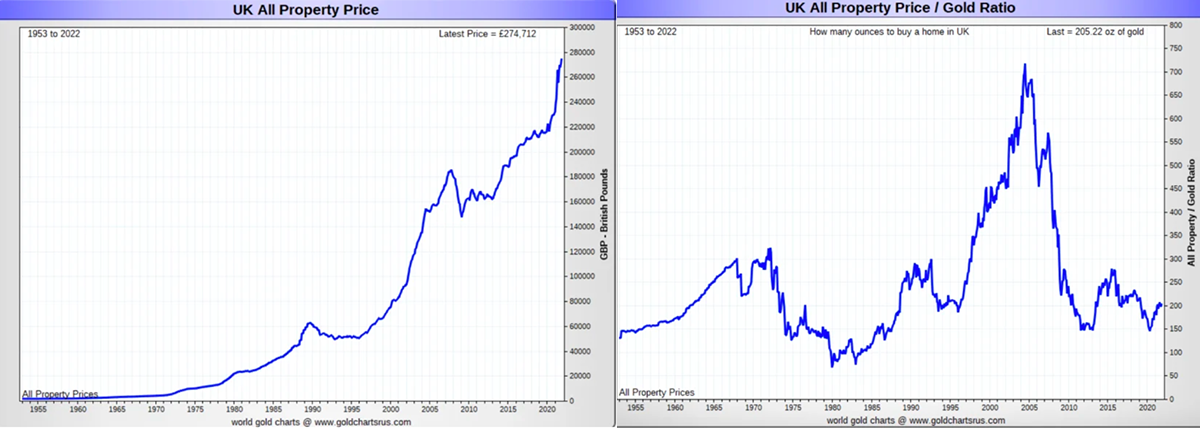

The performance of gold is fascinating in this regard. Among most investors that I’ve grown up with, it’s generally held in low regard. And yet, over the long term, it has performed superbly. A great example of this I have shamelessly pinched from a MoneyWeek article by Dominic Frisby, where he shows the following two graphs. One is UK house prices since the early 1950s in British Pounds, and the other is UK house prices in gold. Since 1953 UK house prices have only risen 30% when priced in gold. Astonishing.

Also, note that this is only thinking about financial repression in terms of developed economy currencies. In emerging markets, the impact of currency debasement is far greater and far more severe. Note, for instance, the recent move of the Indian Rupee, which once again looks to be breaking down out of a multi-year range against the US$. It is no surprise that this is a nation of gold hoarders… and crypto enthusiasts (>100m or 7.3% of the population).

If we accept that bitcoin is an option on a store of value, and if we also accept that financial repression is likely to remain with us, we have a good case for some sort of allocation.

When and how much?

How much first. Size your asset allocation according to risk. If an asset is volatile, have an amount that won’t give you sleepless nights. For this very reason, we created the BOLD strategy, which mixes bitcoin and gold according to the riskiness of each asset and rebalances monthly. The current mix of 18:82 bitcoin/gold makes it the perfect way of owning bitcoin for the long term without freaking out daily. And you also get to own gold, the world’s steadiest financial tortoise.

When to buy bitcoin is harder. Let’s look at a) valuation and b) the cycle.

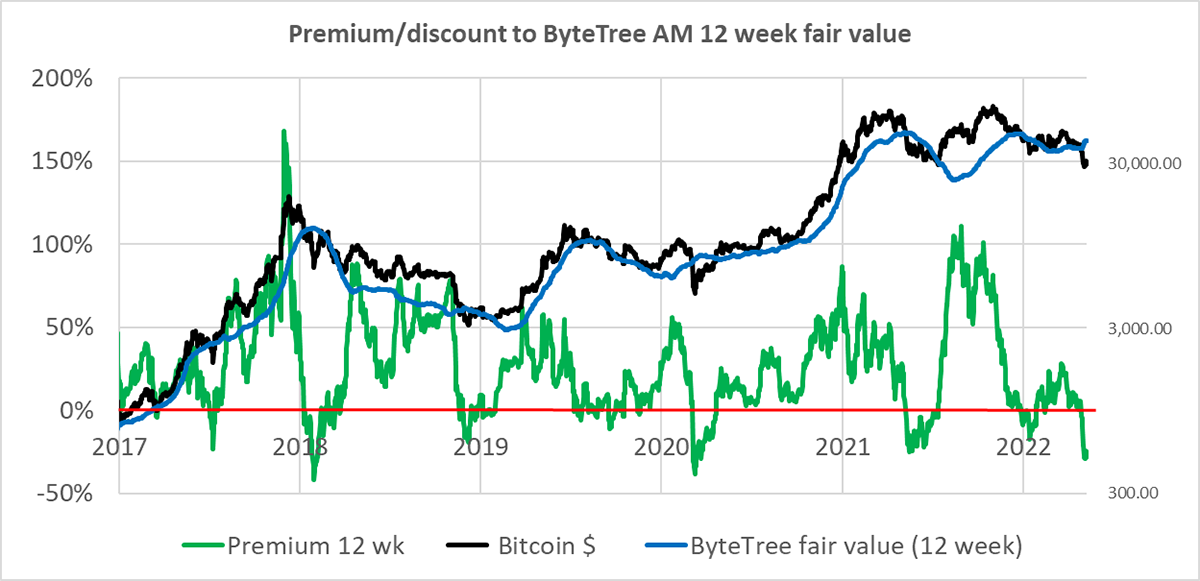

At ByteTree, we look at bitcoin as a network effect asset. In other words, the more people that use it and transact in it, the more valuable it becomes. In its simplest form, we can look at how much value is being transacted over the network on a rolling period basis, and from that, we can derive a valuation based on its history. At the moment, because we’ve seen a massive recent surge in activity, that number is around US$41,800. The last time we were at such a steep discount was in March 2020, as shown below. So, we have a decent margin of safety on this basis.

While this looks enormously compelling, we mustn’t disregard the idea that this surge of activity might just be a phase in a larger pattern of capitulation. Note, for example, how the valuation looked “cheap” in the first phase of the 2018 sell-off, giving a false signal (albeit remedied by a correct sell signal soon after when the premium expanded again).

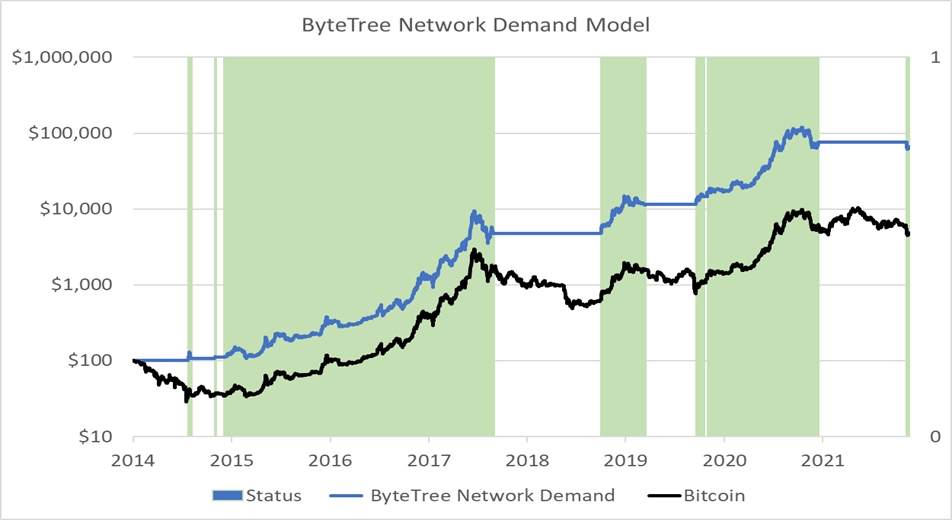

This is where it’s important to visualise where we are in the cycle. We look at bitcoin in terms of epochs, which tally with the 4-yearly halving events (when the amount of new bitcoin that can be mined halves). The graph below shows where we are in the current epoch, which began in May 2020.

The first thing to note is that the moves have been less extreme compared to previous epochs, as befits a maturing asset. The second is that we are entering a period of around 300 days in which, historically, the price has based. Prior to this period, there has typically been an event that has poured cold water over the entire sector and forced the community to go back and think about use cases for distributed ledger technology, aside from overt speculation. It’s painful but good for the long-term structural growth of the cryptosphere. In 2014 it was the Mt Gox hack. In 2018, the bitcoin forks. Today, it is the collapse of the UST stablecoin. Today’s weakness is also due in part to a macro backdrop that, for the first time in bitcoin’s existence, is withdrawing rather than injecting financial Kool-Aid, a factor which might continue to weigh negatively.

The second part of our valuation toolkit is a multi-factor model to guide us on network momentum. The model has been bearish since June 2021 but has recently turned back on (as shown by the green shaded areas below). Owning bitcoin when the model is on and holding US$ when it’s off has been hugely profitable, as shown by the blue line. It’s only a backtest, of course, but nonetheless, it’s interesting to see it indicating a positive momentum turn in network activity at a time when few would expect it.

The last thing to look at is a price regression chart, which shows that the price is now 1 standard deviation below its trend. Historically, this has been a good time to sharpen your pencil. We are now in oversold territory.

Conclusion

For investors who agree with us that bitcoin is here to stay and that financial repression isn’t going away, everything we see indicates that we have entered a medium-term accumulation phase. While macro settings are currently a headwind, authorities are unlikely to relinquish the power to debase currencies, which means that hard assets will retain their value over the long term, especially when acquired at weak points in their cycle, as bitcoin is now. We also believe bitcoin is cheap relative to its history and argue that the network activity cycle is bottoming out.

Bitcoin’s trajectory will be uneven, driven by factors such as usage, regulation and broader macro settings. As it gains acceptance, its credibility will increase, and its volatility will decrease. Allocations should be managed accordingly and investments made incrementally.

In the Bitcoin & Gold in 2022 webinar, Duncan MacInnes of Ruffer Investments acknowledges that he borrowed from Ray Dalio of Bridgwater, who wrote that “Bitcoin looks like a long-duration option on a highly unknown future that I could put an amount of money in that I wouldn’t mind losing about 80% of.” The webinar and Dalio’s note on Bitcoin are both highly recommended.

Comments ()