BitDaq

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 47

Bitcoin in NASDAQ is the most important chart of them all. So much so that it needs a nickname. We will call it BitDaq.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | Weak |

| On-chain | Resilient |

| Investment Flows | Outflows continue |

| Macro | Dollar is extended |

| Crypto | First Kitties, Now Apes |

Technical

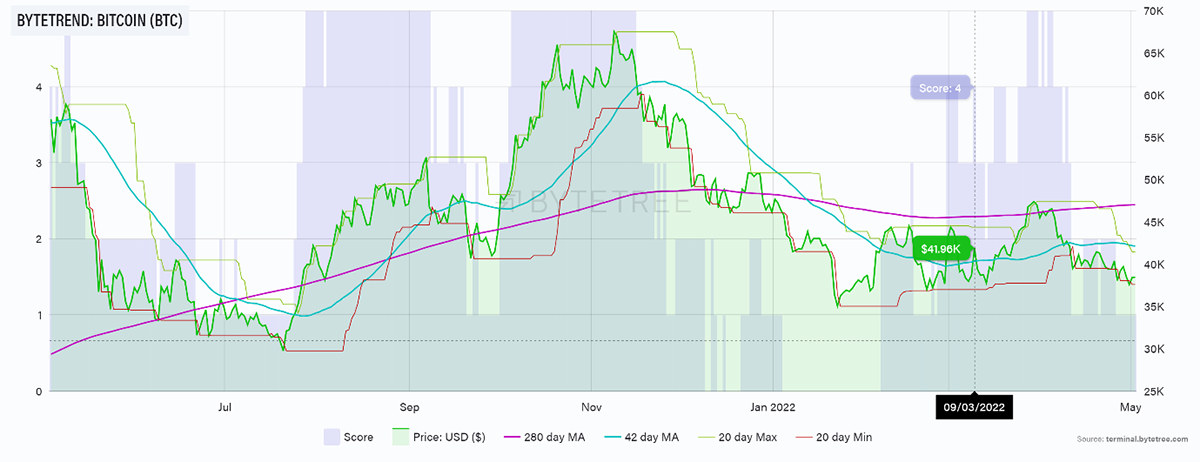

The ByteTrend star count for the top 15 tokens fell again from 39/75 to 12/75. This is weak.

If all 15 coins had a 5-star trend, that would be 75 stars, which would reflect the max bullish technical conditions.

Bitcoin back to 1/5

Source: ByteTree. Bitcoin (BTC) ByteTrend, measured in USD, since May 2021.

It’s a good time to revisit the long-term trend, which, when using a regression starting from the 2013 peak, basically doubles every year. The highest returns were achieved when starting from oversold (lower lines), and the lowest when overbought (upper lines).

Bitcoin trend still 97% IRR since 2013

Source: Bloomberg

The lower grey line sits at $30,000, and the level of blockchain activity would see that well supported. I can’t put lipstick on these charts, as they are soft, but they are a long way from terrible.

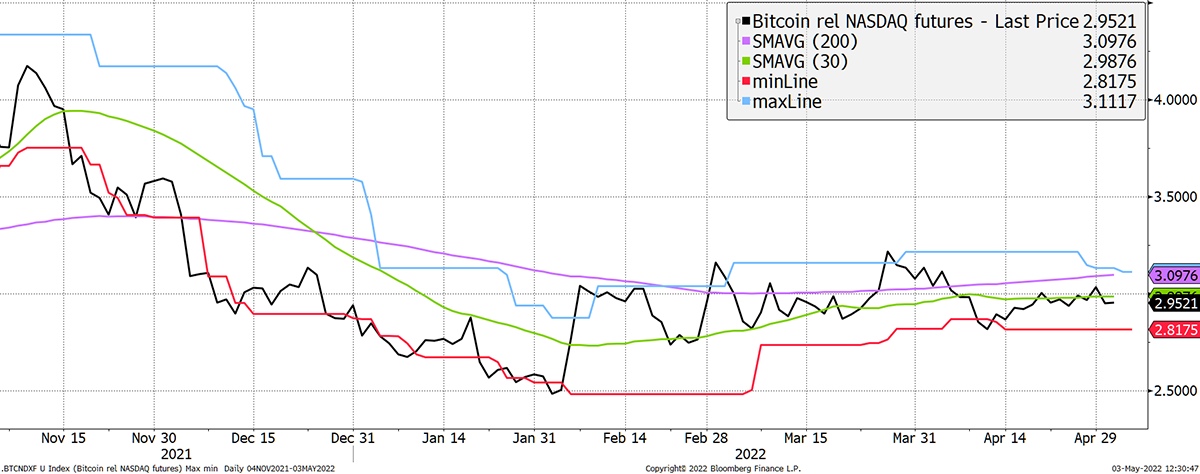

I keep coming back to external factors that are currently driving the price. Bitcoin in NASDAQ is the most important chart of them all. So much so that it needs a nickname. From hereon, it will be known as BitDaq.

BitDaq since 2013 shows breakouts and consolidations

Source: Bloomberg

Since 2013, there have been three clear channels. The first two weren’t broken for 3.5 and 3 years respectively. The latest blue one is only 1.5 so it is perhaps early for new all-time highs. But we have already had a major low last July and a successful retest.

I remain of the view that this cycle will be much more resilient than past cycles, and the dial holds neutral. It wouldn’t take much for BitDaq to move higher. I take comfort when the ratio is above 3.

BitDaq past six months 1/5

Source: Bloomberg

On-chain

- by Charlie Erith

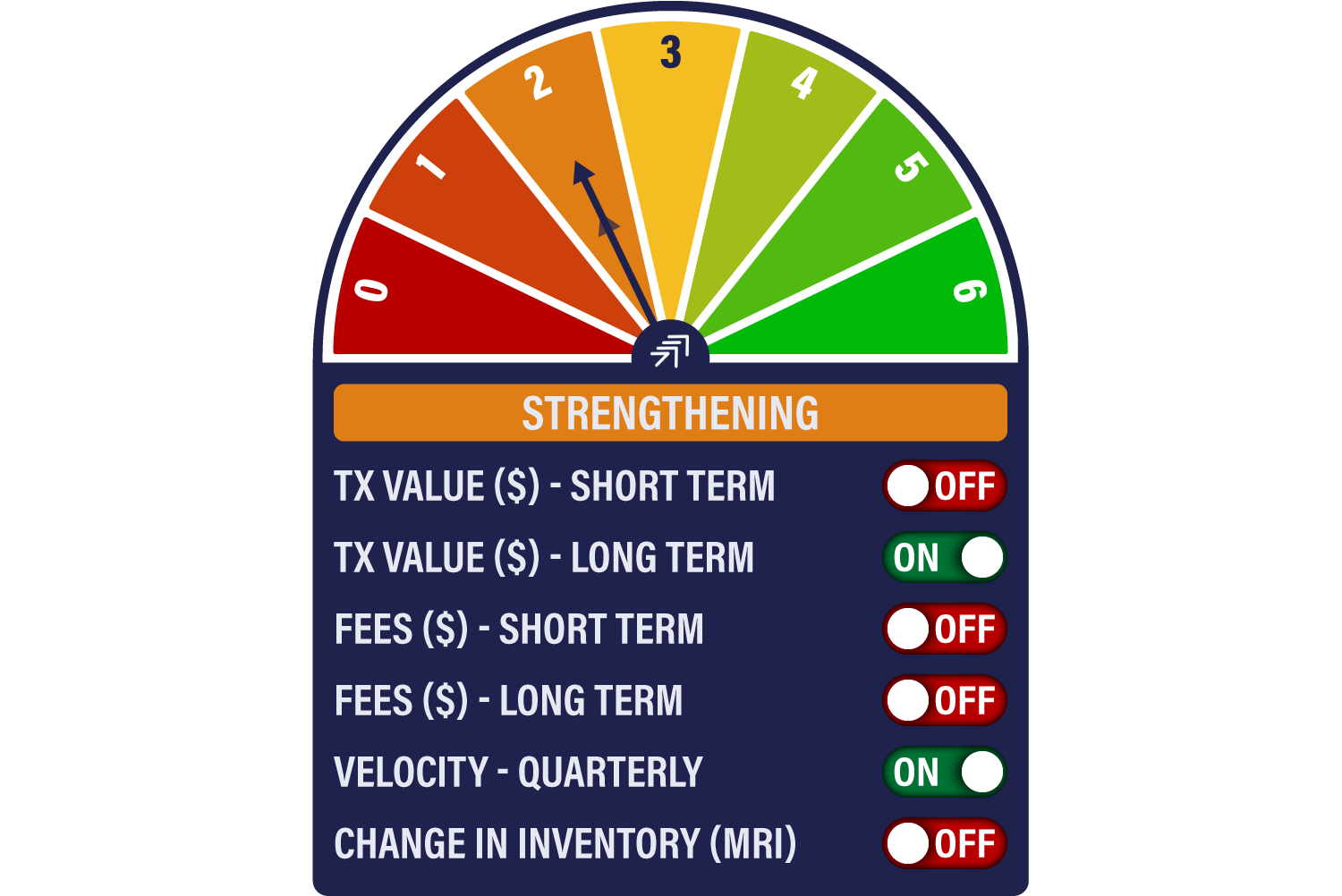

The Network Demand Model holds at 2/6 this week, with the long-term transactions and velocity measures remaining on. Fair value remains rangebound between US$37-38,000, while MRI treads water at a healthy level. It’s good to see the number of transactions rising, a good sign of network vibrancy.

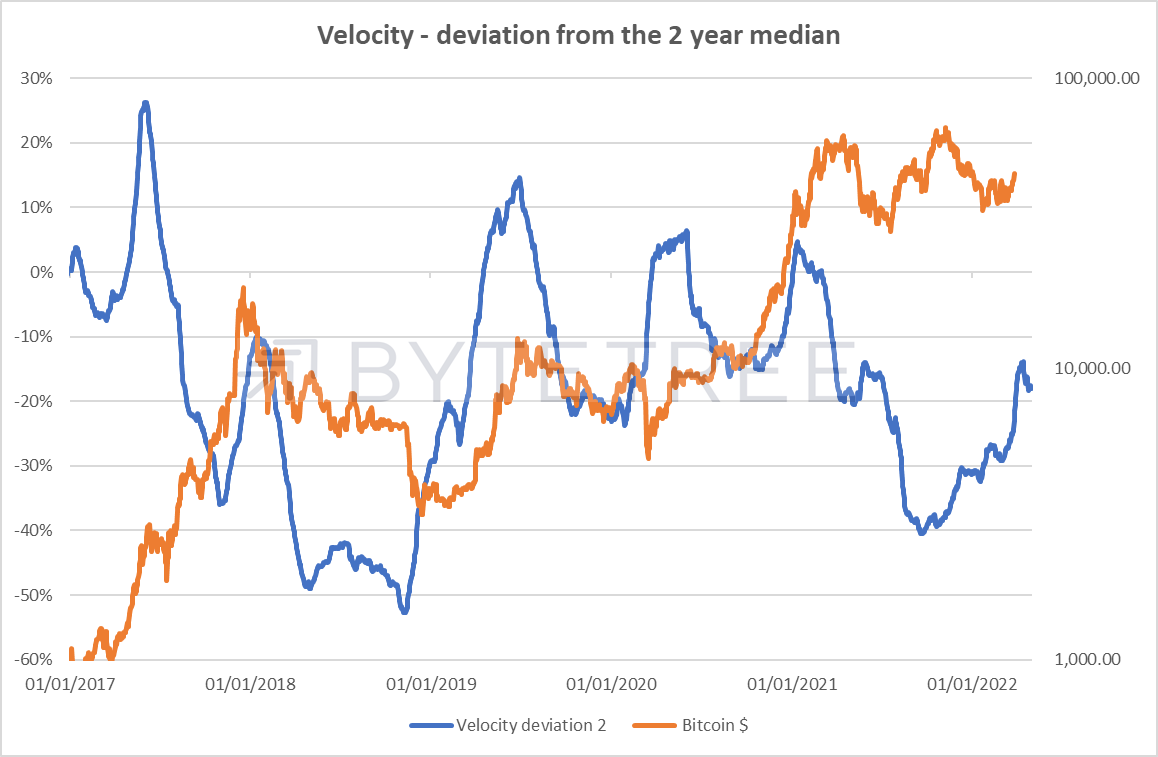

Velocity, which tells us about the speed with which coins are moving around the network, remains healthy.

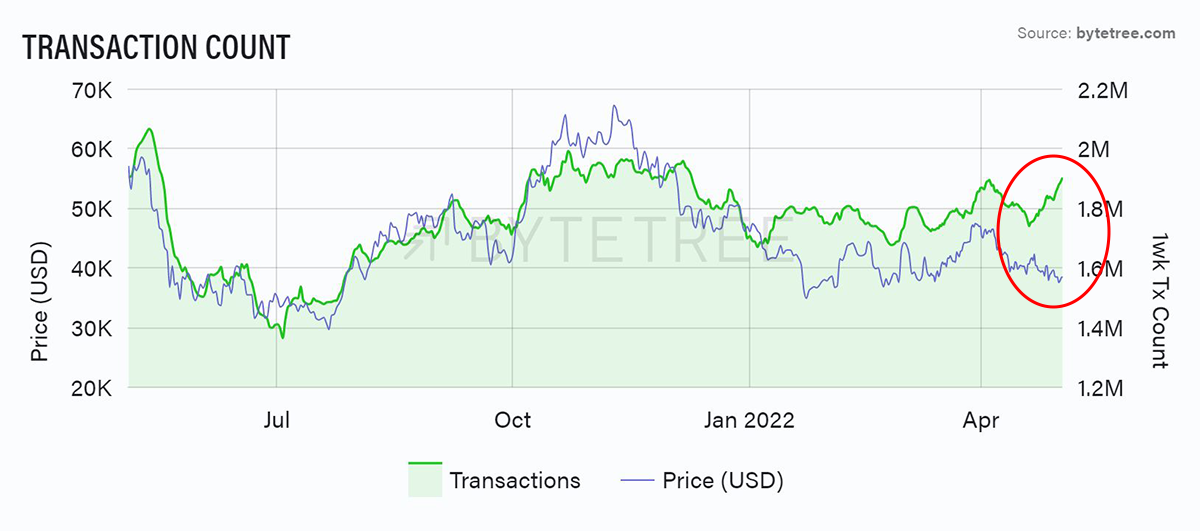

This is corroborated by the number of on-chain transactions, as seen below, which have also ticked up nicely. What is particularly interesting with this chart is how transactions and price have recently diverged, something we haven’t seen over the last 12 months. If the price follows, we’re in business.

Source: ByteTree. Bitcoin transactions (1-week cumulative), since May 2021.

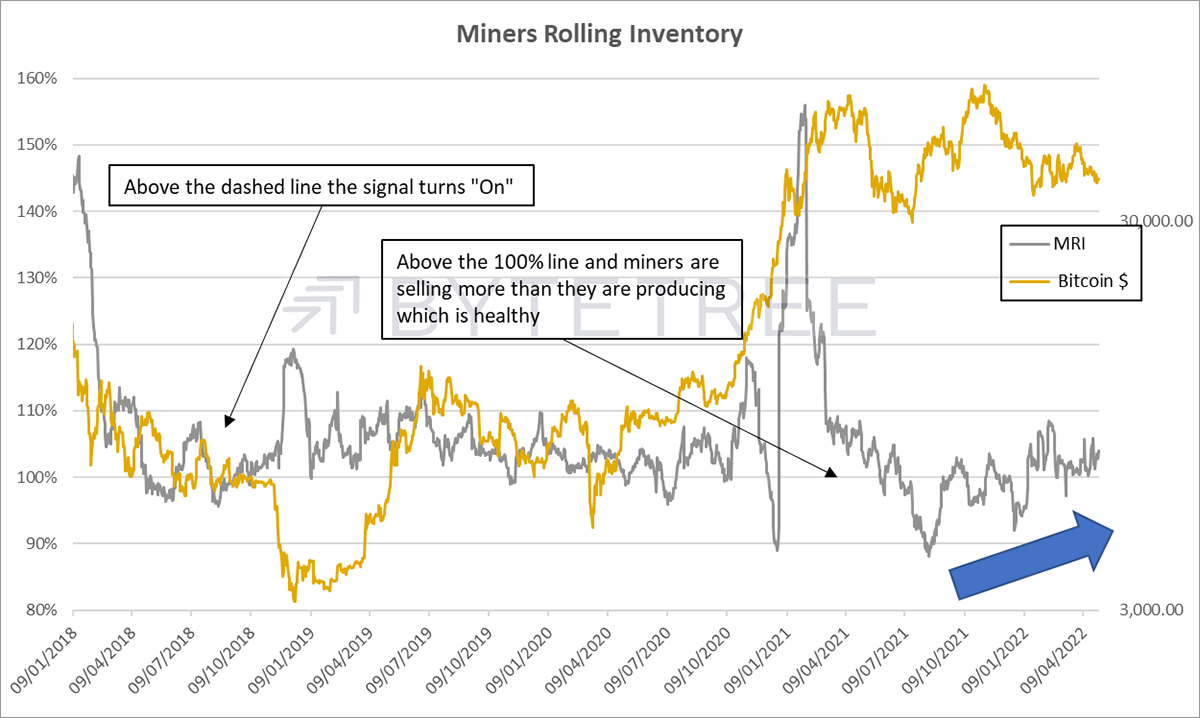

Meanwhile, MRI remains within a healthy range.

Investment Flows

- by Charlie Erith

It’s been a bad month for BTC holdings in funds, but it’s been a pretty torrid month for risk assets in general.

It’s interesting to look back to the mid-year trough of 2021 when the price briefly dipped to US$29,000. You might remember this was when such luminaries as Cathy Wood at ARKK Invest started loudly advocating the long-term prospects of crypto. After the August low, funds only really started increasing holdings in October and November, when the bitcoin price rallied up to year highs.

Assuming an average price of around US$55,000 and 50,000 new BTC bought by the funds, around US$2.75bn of new money came into funds during that period. Approximately 16,000 BTC left funds in April 2022, which, if we assume an average price of US$40,000, is around US$640m, a lot less than went in.

That amounts to around 2% of all BTC held in funds heading for the door. Of course, flows like this have an impact in the short term, but the big picture is fine. The vast majority look like they’re here for the long term.

Source: ByteTree. Bitcoin held by funds, since May 2021.

Macro

The dollar has been harming risky assets, and the good news is that it is now in overbought territory. Either the Federal Reserve eases off its tightening programme, or US inflation returns with a vengeance. Either way, this year-old rally is long in the tooth.

An extended dollar

Source: Bloomberg

The DXY, a broad measure of the dollar against developed currencies, was 8% above its 200-day moving average yesterday. Going back 22 years, that is a number on the edge of the extreme.

The financial crisis in 2008, the Greek debt crisis in 2012 and the commodity/emerging market crisis in 2015 saw higher readings. I would think that if it that is going to be repeated, it will happen soon.

Dollar is up there with the greats

Source: Bloomberg

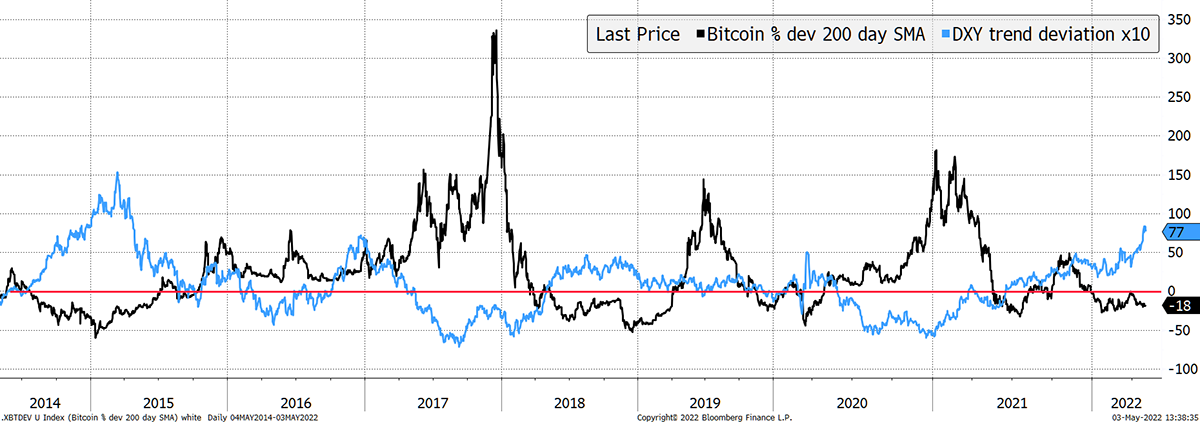

When the dollar cools, bitcoin will benefit as I illustrate below. The dollar and bitcoin are generally counter-cyclical. Since 8% above trend is nothing compared to bitcoin, which has seen 300%, I have multiplied the DXY deviation by 10x.

What’s good for the dollar is bad for bitcoin

Source: Bloomberg

The counter cyclicality is pretty clear most of the time, and indeed crypto started cooling off in early 2021 when the dollar turned up. When it next falls, crypto will rally hard, which gives me comfort.

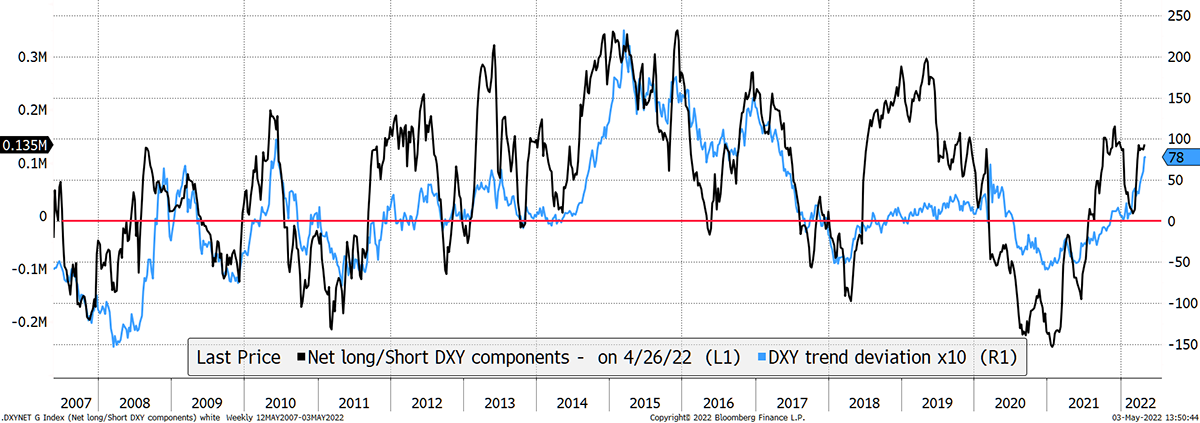

I do not know when the dollar will peak, but investor positioning is already net long, so it can’t be too long now.

Investors are already long the dollar

Source: Bloomberg

Cryptonomy – First Kitties, Now Apes

- by Laura Johansson

NFTs are once again causing havoc on Ethereum as the network got congested over the weekend when Yuga Labs launched their virtual land sale for their upcoming “Otherside” metaverse project. The creators of Bored Ape Yacht Club (BAYC) NFTs saw a lot of interest for their latest public release, which required potential buyers to preregister their wallets and complete KYC a week before the sale to participate in the minting.

The Otherside project is Yuga Labs’ contender for virtual worlds, described as “a gamified and interoperable metaverse […] that blends mechanics from massively multiplayer online role playing games (MMORPGs) and web3-enabled virtual worlds”. The so-called “Otherdeeds” released this weekend act as the keys to participating in the upcoming game and enable players to claim plots of land once it is released. The total supply of Otherdeeds is capped at 200,000, where half was released on Saturday, with 30% given to owners of Bored and Mutant Apes, 15% to developers and the remaining 55% went to the public sale.

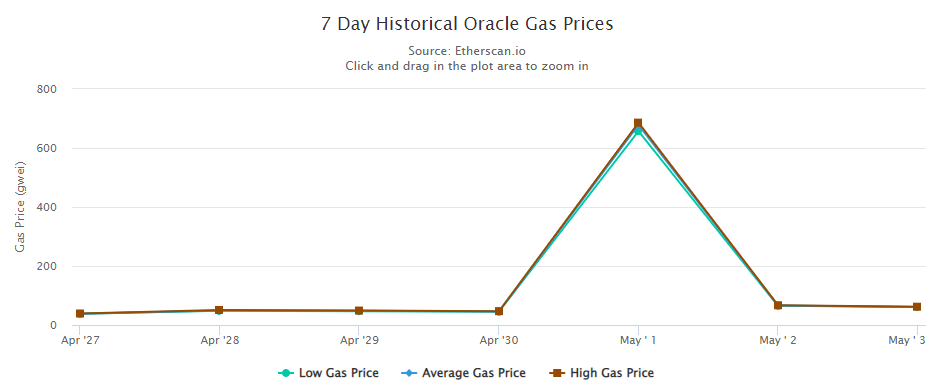

The 55,000 Otherdeeds NFTs, which could only be bought with ApeCoin (APE), flew off the shelves and generated $285 million in revenue for the company. However, it came at a high cost as Ethereum fees soared to the highest ever, with buyers spending $182 million in feesover a 24h window since the sale went live. Ahead of the sale, APE spiked to an all-time high of US$27.79 but has since plummeted back down to US$15.42.

Source: Coinbase. APE price (USD) since March 2022.

Ethereum users have heavily criticised the Yuga Labs Otherdeeds sale as it single-handedly upped the cost of using the network. Although the company apologised for “turning off the lights on Ethereum for a while”, they also used it to argue that ApeCoin needs to migrate to its own chain. This prompted more criticism from users who saw Yuga Labs’ comment as a direct stab at Ethereum, projecting blame away from themselves to promote their own agenda.

Source: Etherscan.io. Ethereum gas prices (gwei) over the past week.

In summary, the Otherdeeds NFT sale drew some mixed reviews over the weekend as Ethereum gas prices soared. Luckily, the spike appears to have been short-lived, but it remains to be seen whether the criticism will be too.

Summary

The space charges forward, leaving most scrambling to catch up. The prices are blowing around in the macro winds, but when those winds change, the crypto space is ready and willing to do great things.

I’m not sure Warren Buffett gets it.

Comments ()