Could Gold Collapse?

Disclaimer: Your capital is at risk. This is not investment advice.

Atlas Pulse Gold Report - Issue 71;

I ask the question of what could happen to the gold price if the Fed tightening gets out of hand.

Highlights

| Regime | Gold bull market |

| Macro | Bond yields peak |

| Valuation | Scenarios explored |

| Flows and Sentiment | Neutral |

| Technical | Pullback |

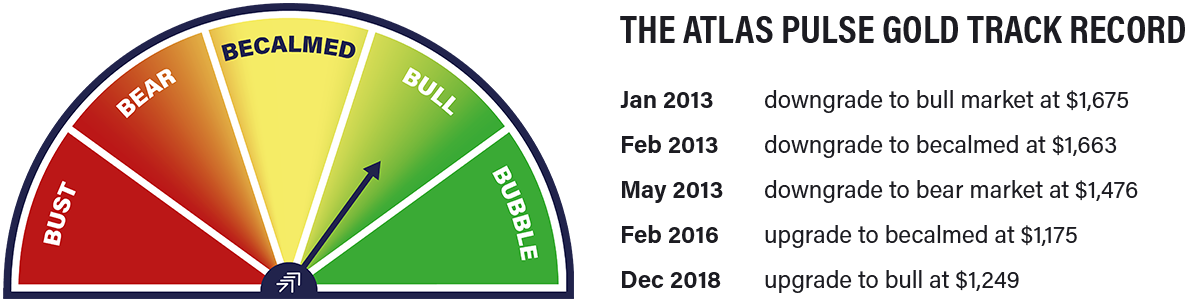

Regime - Gold Bull Market

Historically gold has been a buy when two or more of the following have held true:

- Short-term real interest rates are below 1.8%. TRUE

- The gold price, measured in a basket of currencies, is rising, measured by a 35-month exponential moving average. TRUE

- The gold price relative to the S&P 500 is rising, measured by a 35-month exponential. TRUE

The equity bear market has begun, especially in tech, which has helped gold outperform stocks. All three conditions are now true, which may set gold up for a prolonged period of outperformance.

Gold Outperforms the S&P 500

Gold is doing what it does best, which is to protect investors during times of crisis. Many don’t get that and criticise gold for not paying a yield. Alternative assets are not supposed to be yield generating, for if they were, they wouldn’t be alternative. Paying a yield would make gold a financial asset. Besides, the only yield I would want would be paid in gold.

In this issue, I will update you on the drivers behind gold and ask what could possibly go wrong? When real interest rates rose in 2013, I told it how it was and promptly downgraded the dial to neutral and then bear. I would gladly do it again if that is what I believe lies ahead.

But I don’t.

Macro

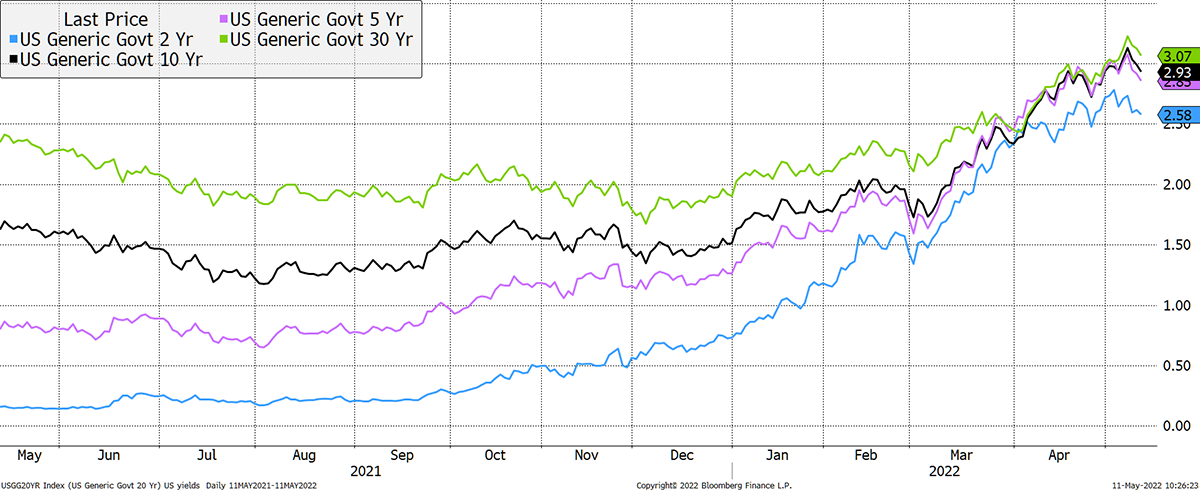

The 10-year bond, which paid 0.5% in mid-2020, went above 3% last week, only to stop and reverse.

Have Bond Yields Peaked?

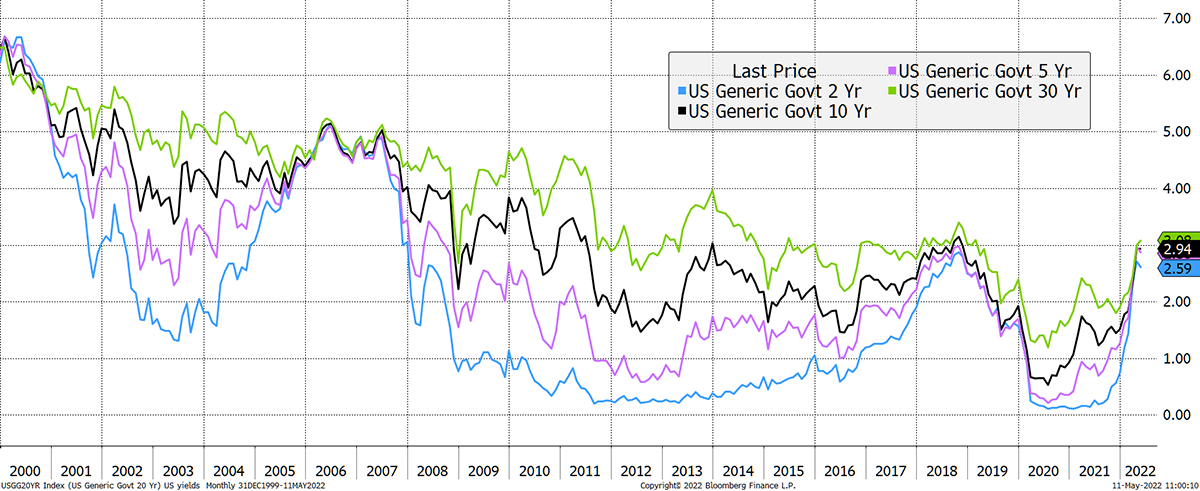

One thing that stands out is how yields have not only risen but also converged. That is another way of saying the yield curve has flattened, forecasting a slowdown in the real economy.

Looking at yields since 2000, this is the fourth time this has happened. The previous times in 2000, 2006/7 and 2018 didn’t turn out well for financial assets, yet each one triggered renewed interest in gold. In fact, gold’s worst moments this century occurred when the yields diverged and the economy strengthened.

Beware of Convergence in Yields

The tough talk from the Federal Reserve is seeing inflation expectations ease for gold. Yet interestingly, just as the inflation surge last year did little to move long-term expectations higher, this time, it is doing little to move them lower. The Fed seems to have the next two to five years under their grasp, but the longer-term outlook seems to be beyond their reach.

Inflation Cools

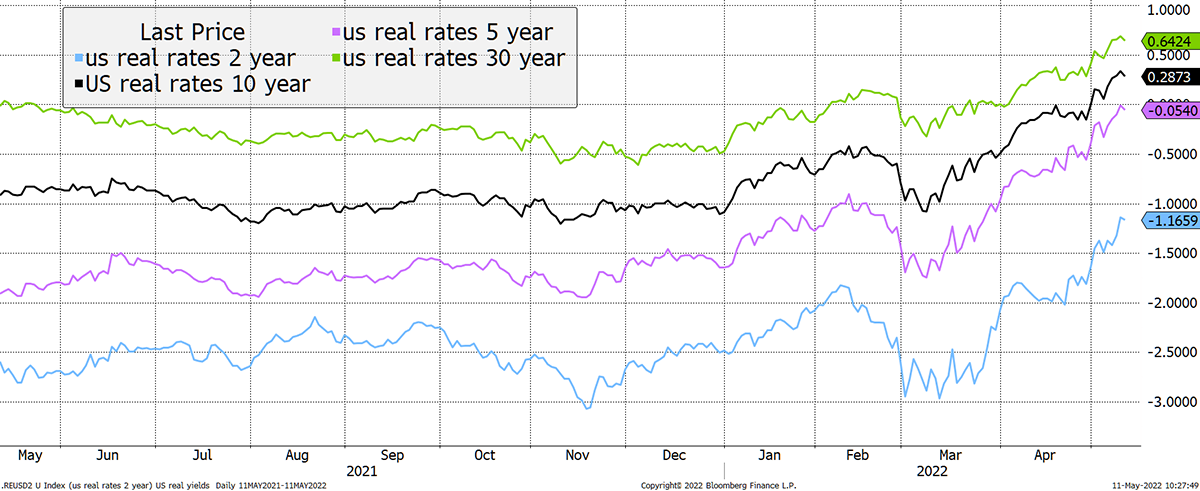

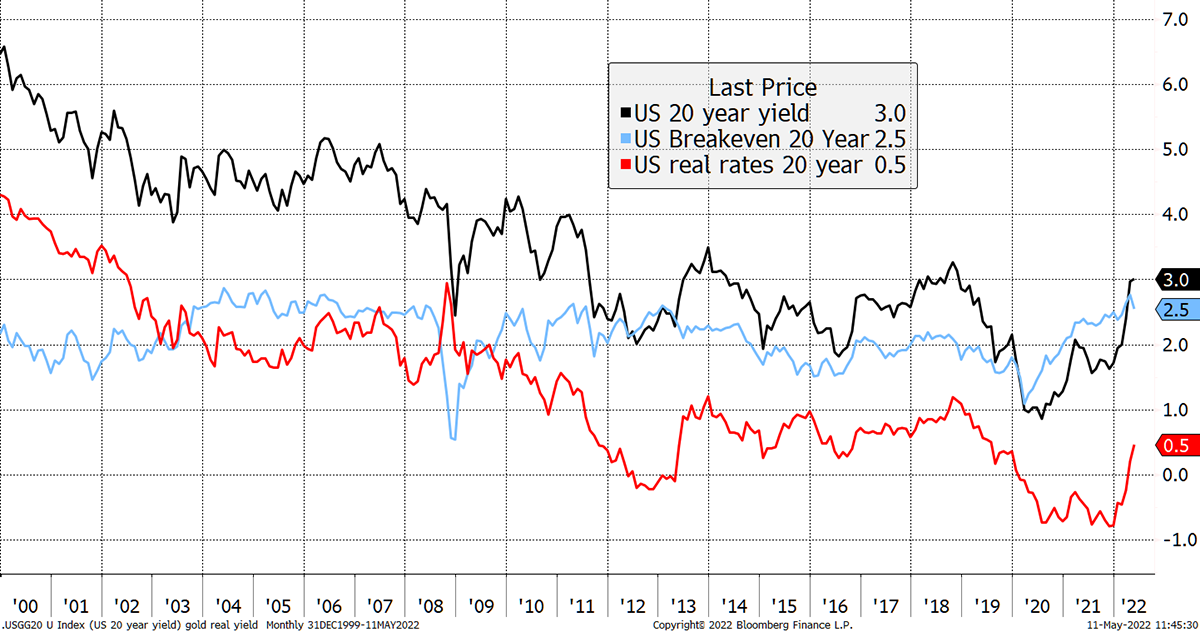

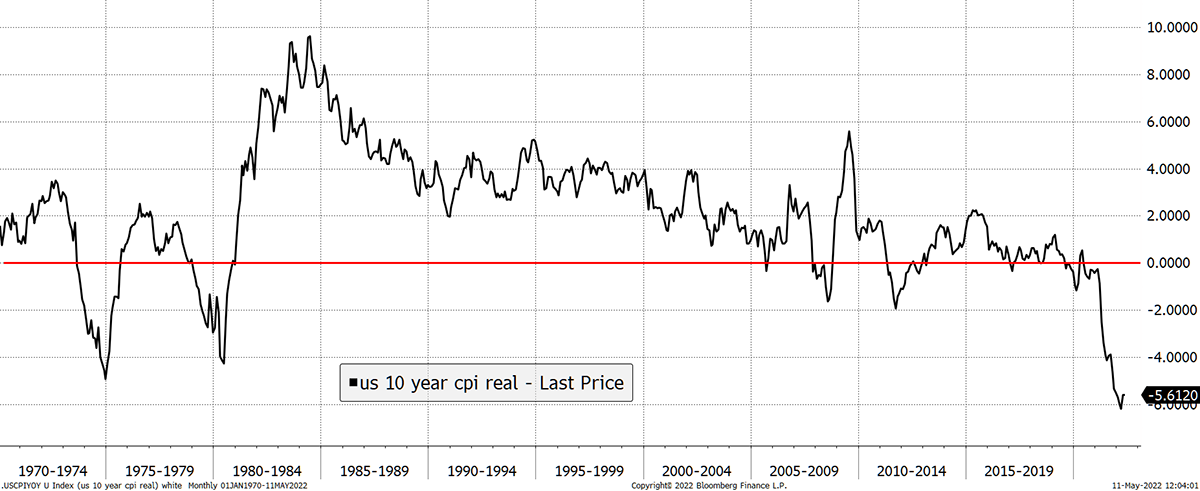

The real yield drives gold (rates less inflation), and in the short-term, this has risen a great deal. The two-year real rate is up nearly 2% since March. Yet once again, the longer-term expectations have been slower to move. In this issue, I will look at the impact of what this means.

Real Rates Rise

Valuation

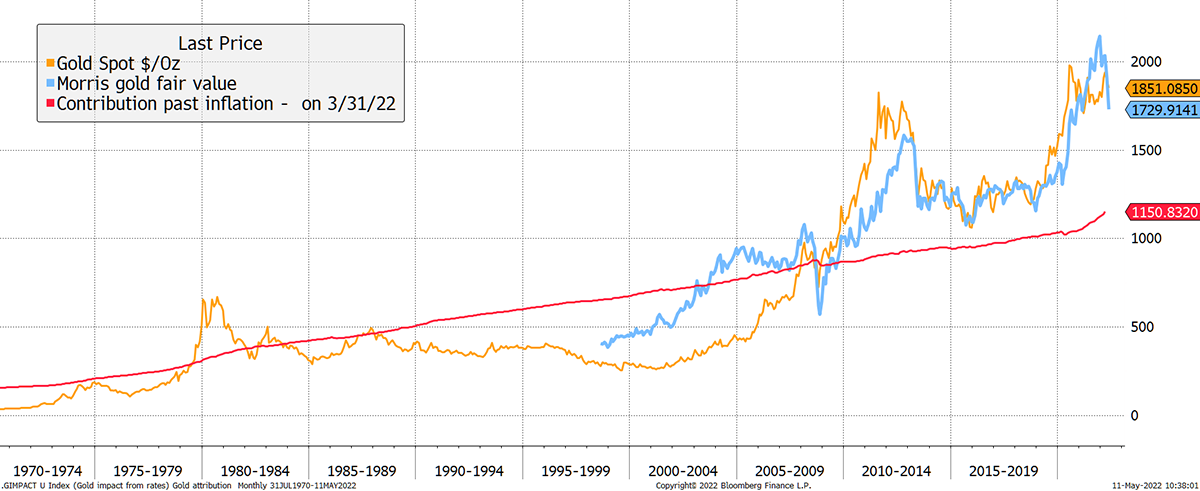

There is much confusion as to the impact of yields versus inflation in terms of sensitivity. The answer to this comes in two parts. Use this chart for reference.

The Yields that Drive Gold

Valuation: Part 1

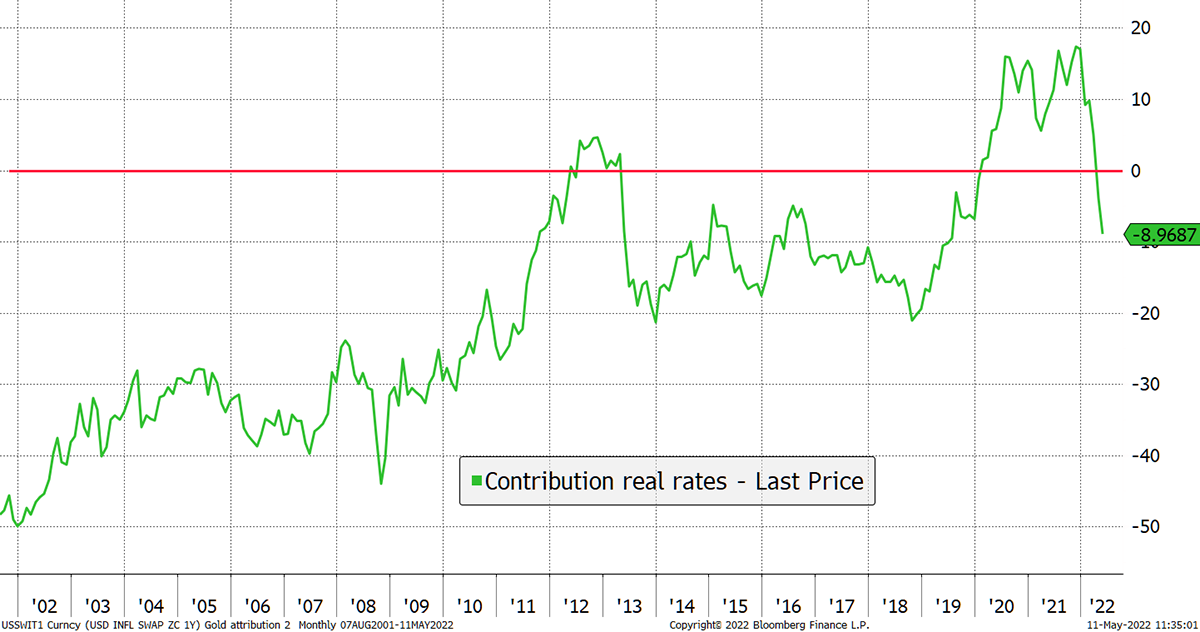

Part one is the impact of 20-year real rates, shown by the red line above and the green line below. When real rates have been below zero, which has only been seen in 2012 and 2020/1, there has been a positive impact on the gold price. The rest of the time, when real rates have been positive, they held the gold price down.

For example, back in 2000, when the real yield was 4%, that had a -50% impact on the fair value of gold. For real rates to send gold to a premium, they needed to be deeply negative. Overall, from 2000 to 2012, falling real rates swung the fair value of gold from a 50% discount to a 15% premium. Today, that is a 9% discount.

Negative Real Rates Rarely Cause a Gold Premium

Valuation: Part 2

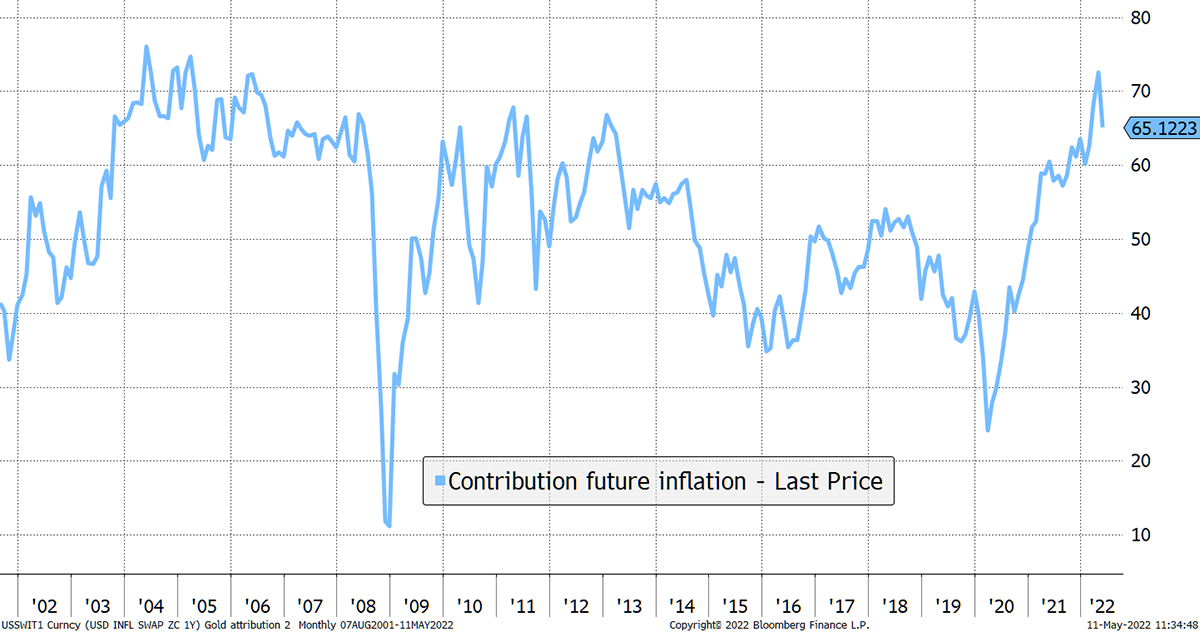

Part two is what you will end up with 20 years from now. Gold protects you from future inflation, as is the case with inflation-linked bonds (TIPS), which see their redemption value linked to inflation over the term of the bond.

As you’ll see on the reference chart above, 20-year inflation expectations have mean reverted around 2%. The gold price is highly sensitive to future inflation; we just haven’t had any. At 2%, 20-year inflation expectations add ~50% to the fair value of gold. That is simply saying that 2% compounded over 20 years means that you need to make up for a 48.6% loss in purchasing power.

During the financial crisis in 2008, that briefly dipped to 10% during a deflation shock. Recently it touched 70%, so the swings can be quite severe, as we have seen over the past two years.

Great Expectations

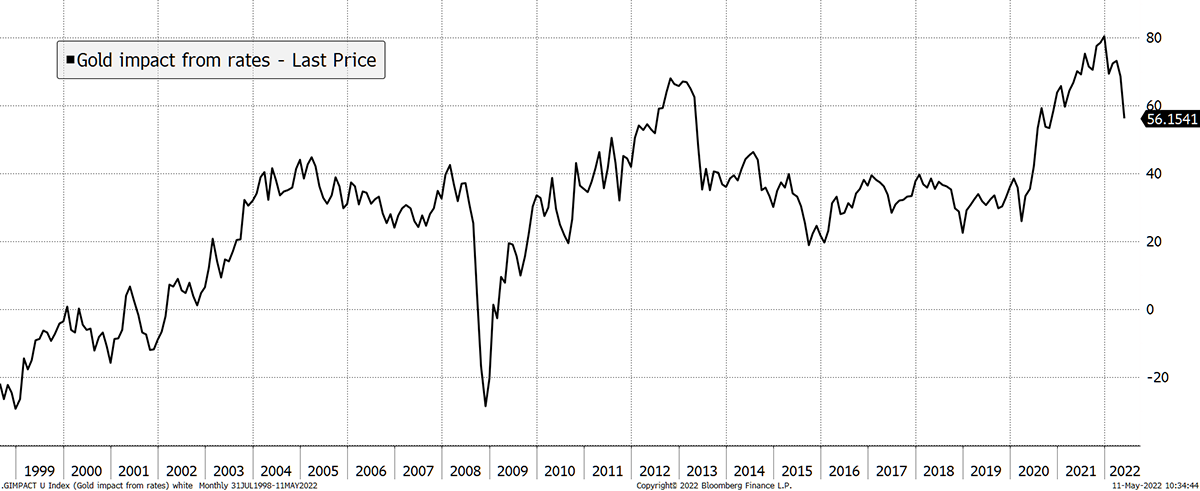

These two different drivers sometimes work in harmony but can work against one another. Inflation was driving the fair value of gold higher in 2020 and 2021, but real rates had already stalled, and have applied a downward pressure this year.

Putting them together, this is the net impact. The force was very positive in 2020 but has turned down this year.

The Impact of Rates on the Gold Price

The non-rates part of gold’s valuation is historical inflation, or past debasement, which is baked into the gold price. This is shown by chained CPI in the red line back to 1970.

Gold was obviously cheap in 1970 as the price was fixed. It went to a premium which few would doubt. Gold was dirt cheap in 2000, which after two bad decades, few would disagree with. In conclusion, today’s gold premium above historical inflation has been driven principally by unusually low bond yields.

Historical Inflation Is Baked into the Gold Price

We do not know what inflation expectations were before 1998, but we can guess what real yields might have looked like using CPI. After a painful period in the mid-1980s, they must have averaged around 4% in the late 1980s and 1990s. That implies the impact from high real yields would have held the price back by around 50% during that period, which oversaw falling inflation.

Real Yields Were High in the 1980s and 1990s

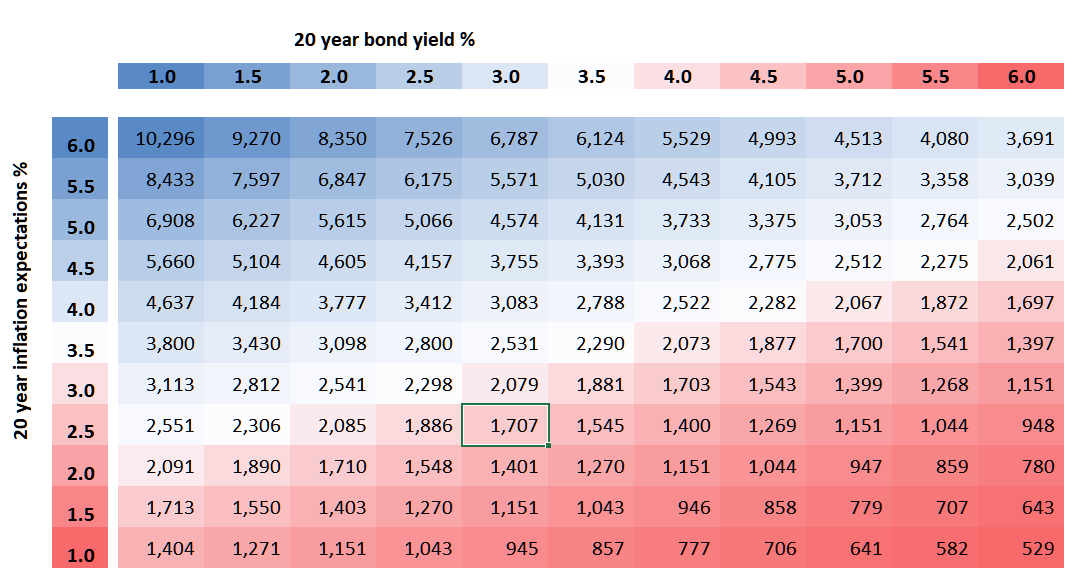

With 20-year yields at 3% and 20-year inflation expectations at 2.5%, we are in the box highlighted below. The fair value of gold is $1,707. With the price at $1,850, there is a ~7% to 10% premium depending on your calibration.

Gold Price Scenarios

My personal view is that long-term inflation expectations will drift higher as they are outside of the Fed’s control. The instinct of policy will be to keep rates lower than they probably ought to be. That means the likely scenarios are more likely to be towards the northwest than the southeast.

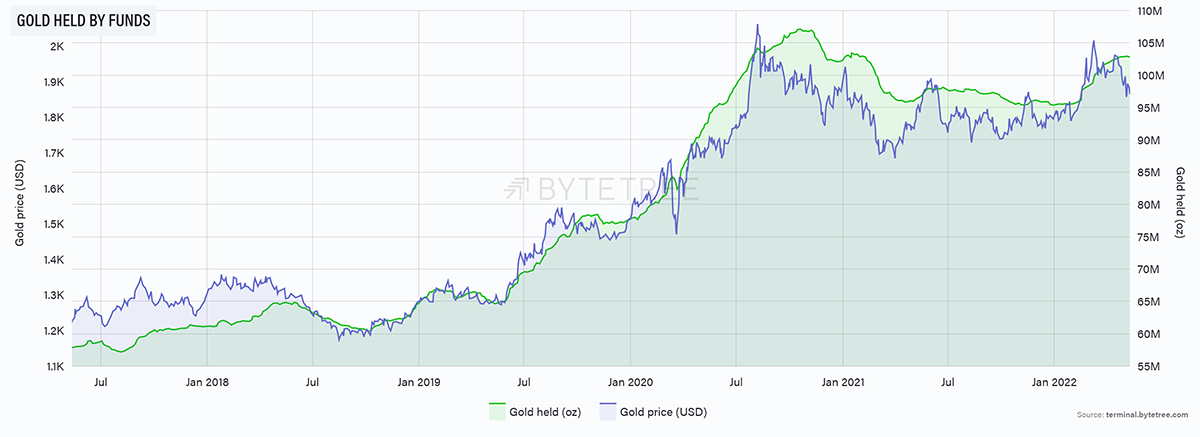

Flows and Sentiment

It is notable that investors have stopped buying the gold ETFs. So far, the outflows are modest, but they are selling rather than buying. Hmmm.

But there can be no accusation of hype in the gold market because the speculators, who left in late 2020, are nowhere to be seen.

Speculative Gold Longs Are Modest Compared to Shorts

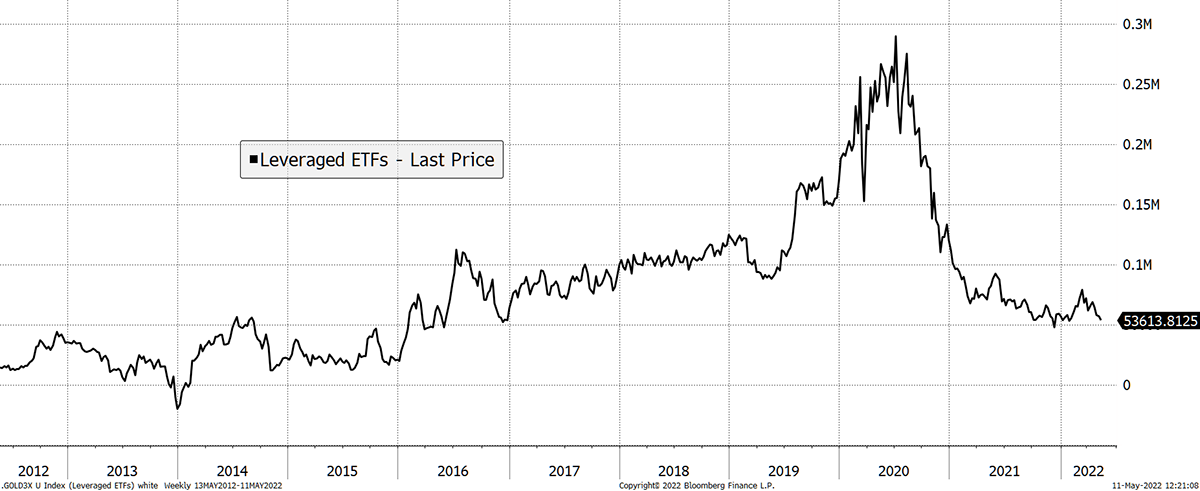

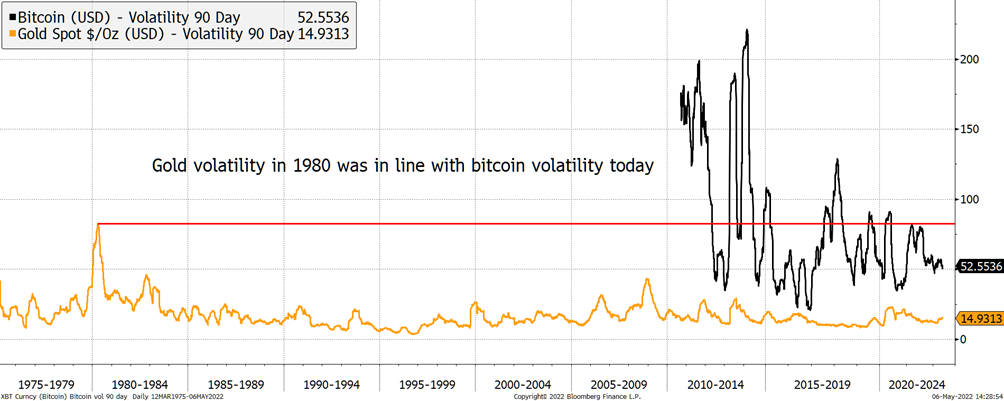

While we are talking about history, I was recently reminded that gold had 80% volatility at its peak in 1980. Doesn’t that make bitcoin look good?

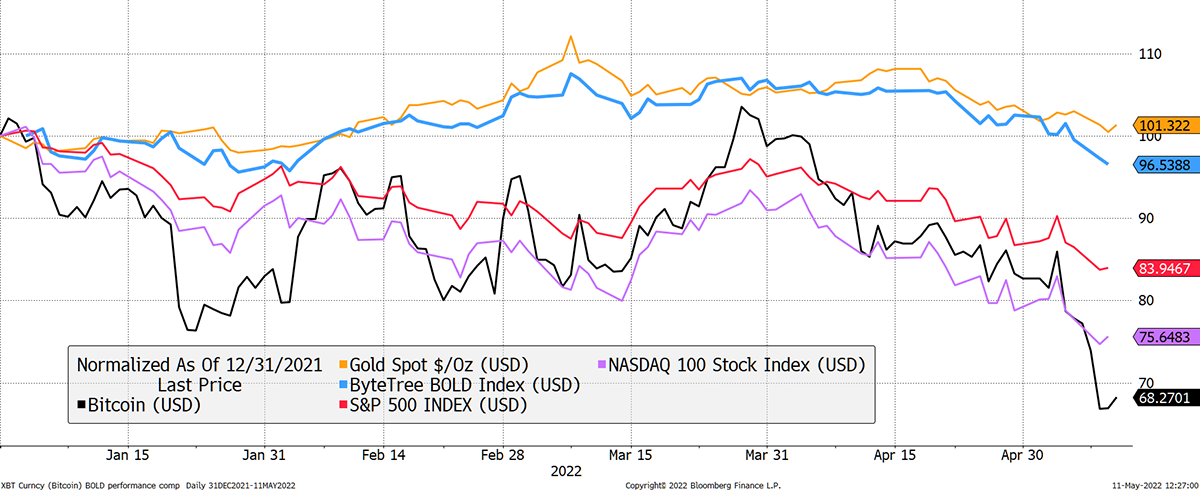

I mention bitcoin at this late stage because we have written much about our BOLD Index, which combines bitcoin and gold. It behaves extremely well over time as the two assets naturally offset each another.

BOLD Holds its Ground in 2022

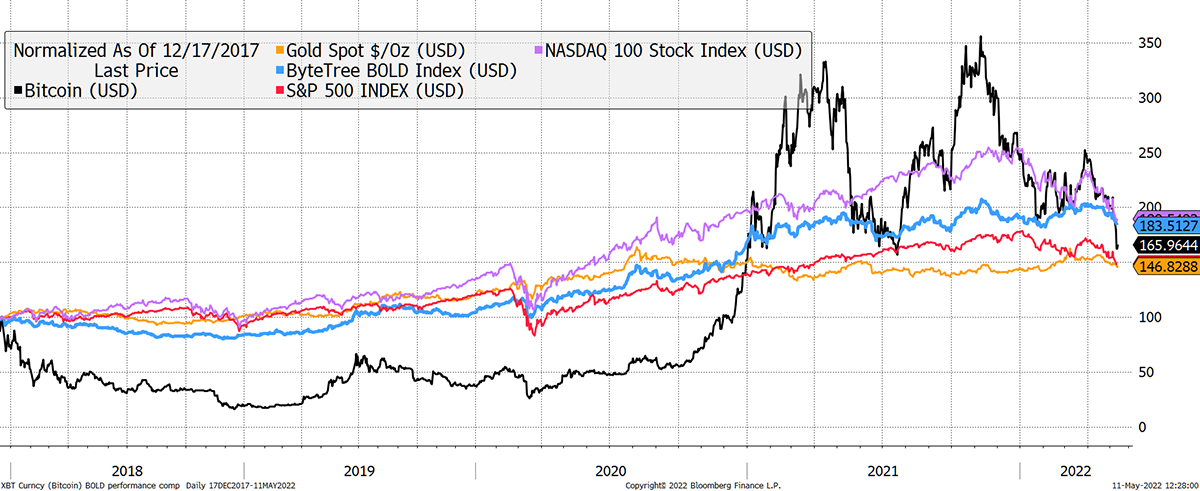

And since the bitcoin peak in 2017…

BOLD Does the Job, Just Without the Volatility

If you would like to learn more about our BOLD strategy, please visit BOLD.report.

Summary

There are rate scenarios where the Fed could collapse the gold price, but seeing as we have already had the largest fall in bond prices since the 1980s, the worst headwinds are already behind us. Inflation is likely to be much stickier over the next decade as globalisation goes into reverse.

Above all, there will be increased demand for alternative assets as investors realise that the 60/40 equity/bond portfolio has come to the end of the road.

Thank you for reading Atlas Pulse.

Thank you for reading Atlas Pulse. The Gold Dial Remains on Bull Market.

Charlie Morris is the Founder and Editor of the Atlas Pulse Gold Report, established in 2012. His pioneering gold valuation model, developed in 2012, was published by the London Mastels Bullion Association (LBMA) and the World Gold Council (WGC). It is widely regarded as a major contribution to understanding the behaviour of the gold price.

Please email charlie.morris@bytetree.com with your thoughts.

Comments ()