Buffett and Munger simply don't get it

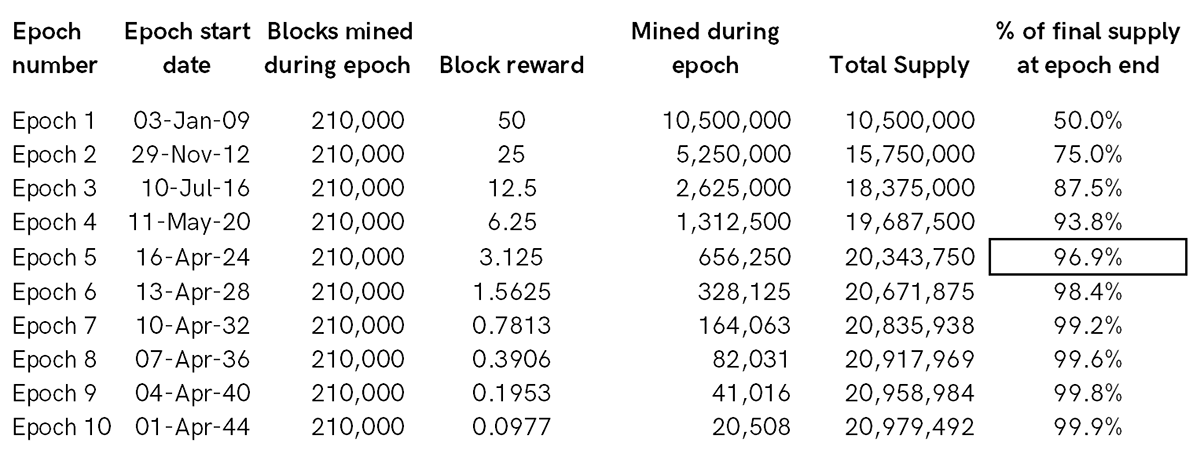

Tomorrow, Thursday 5 May 2022, block number 735,000 will be mined at approximately 11:00 BST (10:00 GMT). Halving periods are separated by 210,000 blocks, which, given a block is mined every 10 minutes or so, come around every four years.

Tomorrow’s block will be the 105,000th since the last halving on 11 May 2020. There will then be a further 105,000 blocks mined until the next halving event, estimated to take place on 15 April 2024. Tomorrow will mark the halfway point from the last halving in May 2020 until the next.

At that point, 19,031,250 of the 21 million bitcoins that will ever exist will have been mined. That is 90.6% of the total.

The halving periods are known as epochs, and at the beginning of epoch 5, 93.8% of bitcoins will have been mined, and by April 2028 (est.), 96.9%. The limited supply story is playing out as planned.

The bottom line is that bitcoin’s rate of new supply is already just 1.8% per annum, roughly in line with gold. From epoch 5 in 2024, that falls to 0.8% and tends towards zero from thereon.

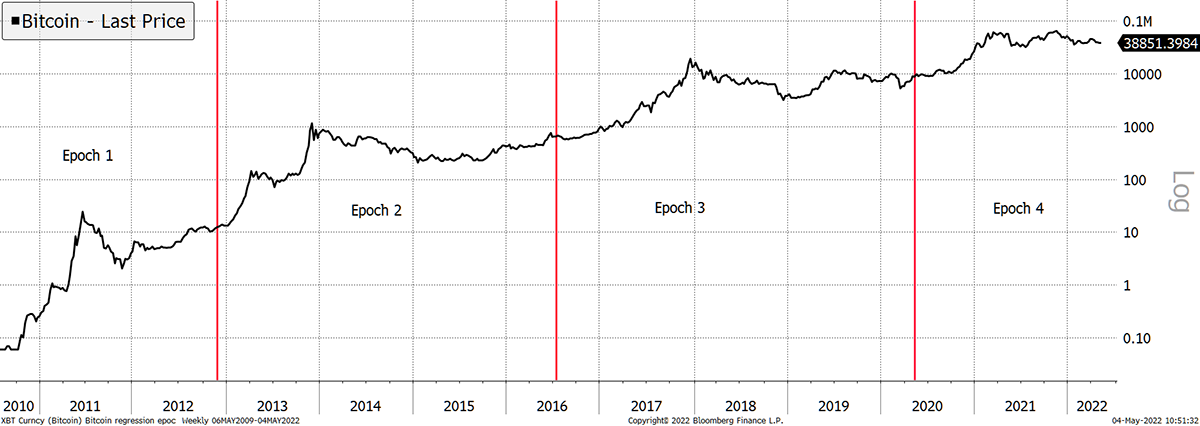

The price of bitcoin has tended to have a cycle around the new epochs, as the fall in supply has seen a constant level of demand have a positive impact on price.

Halving cycles are crystal clear

The boost around halving events was approximately 100x in epoch 2, 30x in epoch 3, and 7x in epoch 4. The price boost is still positive but clearly in decline as bitcoin matures. It is unrealistic to assume that an asset worth around $700 billion can appreciate in the same way as it did when it was a minnow.

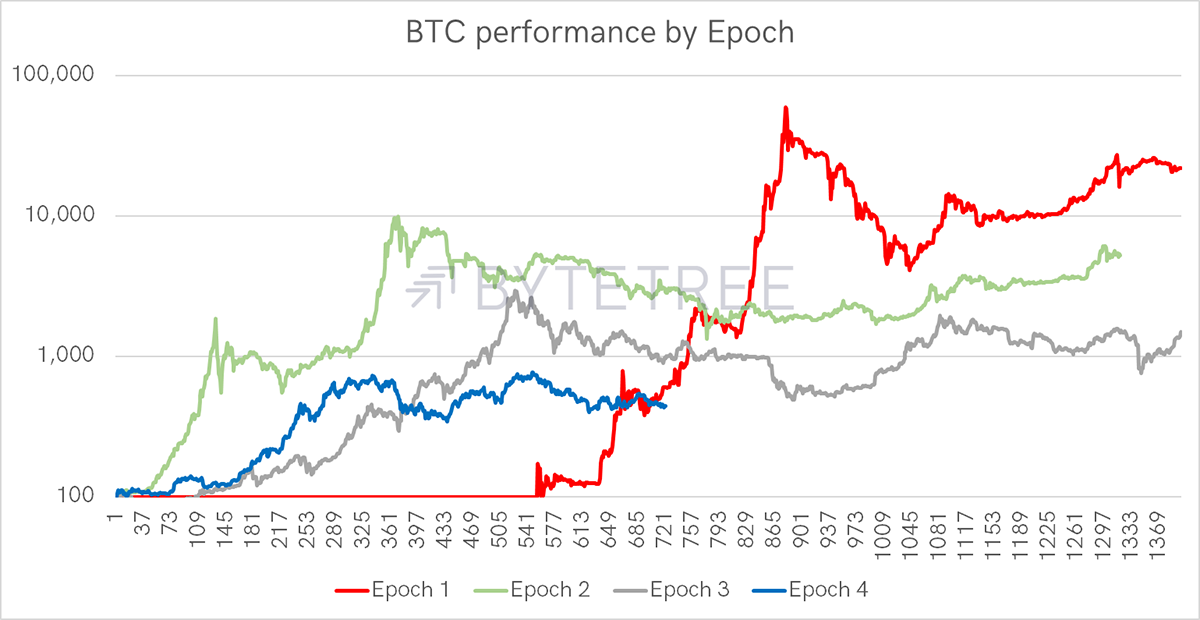

BTC Performance by Epoch

The chart rebases the price of bitcoin to $100 at the start of each epoch and plots the number of days since halving.

The price has risen substantially on each occasion, only to peak within 12 to 17 months from halving. After that, the price then fell, reaching its final low within 2 years and five months in the last epoch (3).

I’ll now bring in the first epoch. There was no reference price for some time, which left a level of catch up as the early adopters flocked in. But we can see that in epochs 1, 2 and 3, there was a run-up to the next halving event.

Epoch 1 is an anomaly as things started late, and the project was in its infancy. For that reason, there is more to be learnt from epochs 2 and 3. Yet, in all cases, there was an excitable rally that eventually came to an end.

With the last halving in May 2020, we are two years into epoch 4. History shows us that the lowest point has occurred within two years and five months, at the latest, before the pre-halving rally begins.

On that basis, the next few months will pose some risk to the bitcoin price, especially when risk assets in general are under pressure, as they are today.

Compared to past cycles, what keeps me bullish is that the underlying level of blockchain activity is far higher than in years past. That underpins how low the price of bitcoin is likely to fall, notwithstanding the negative impact of a short-term economic shock.

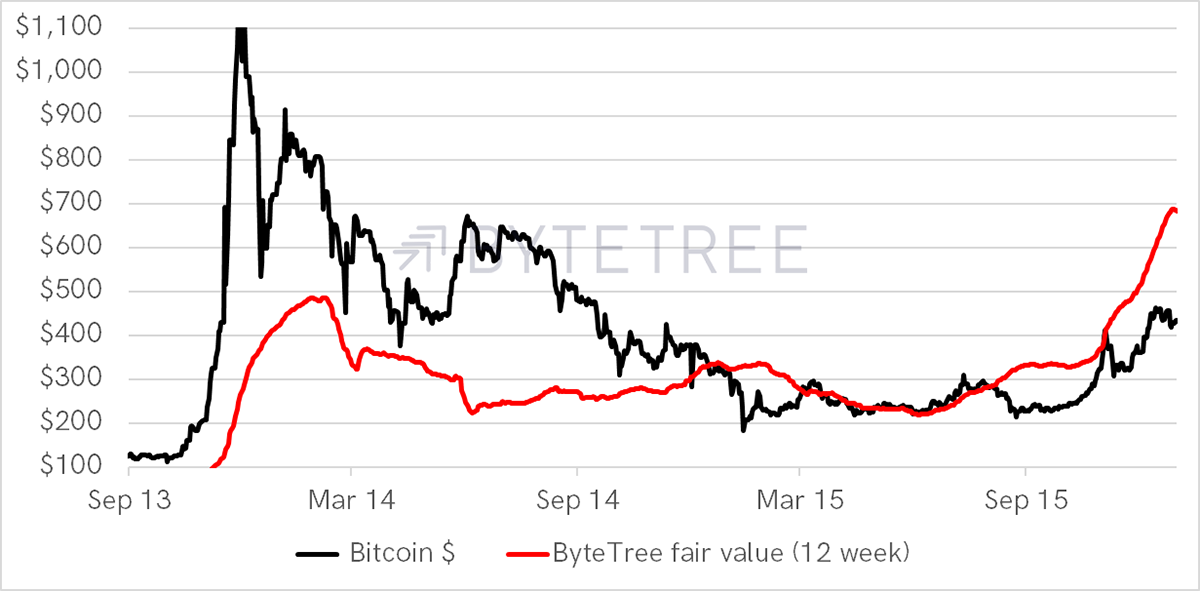

ByteTree has been measuring the level of activity on bitcoin’s blockchain, which gives a close idea of the “intrinsic value” generated by the network. A valuable blockchain is busy, whereas an idle one is worthless. It’s all about the network effect. I’ll show you the bears in 2014, 2018 and 2022 for comparison.

In late 2013, bitcoin traded at a huge premium to fair value. In 2014, the price fell back to equilibrium at around $200.

Epoch 2: The 2014 bitcoin bear

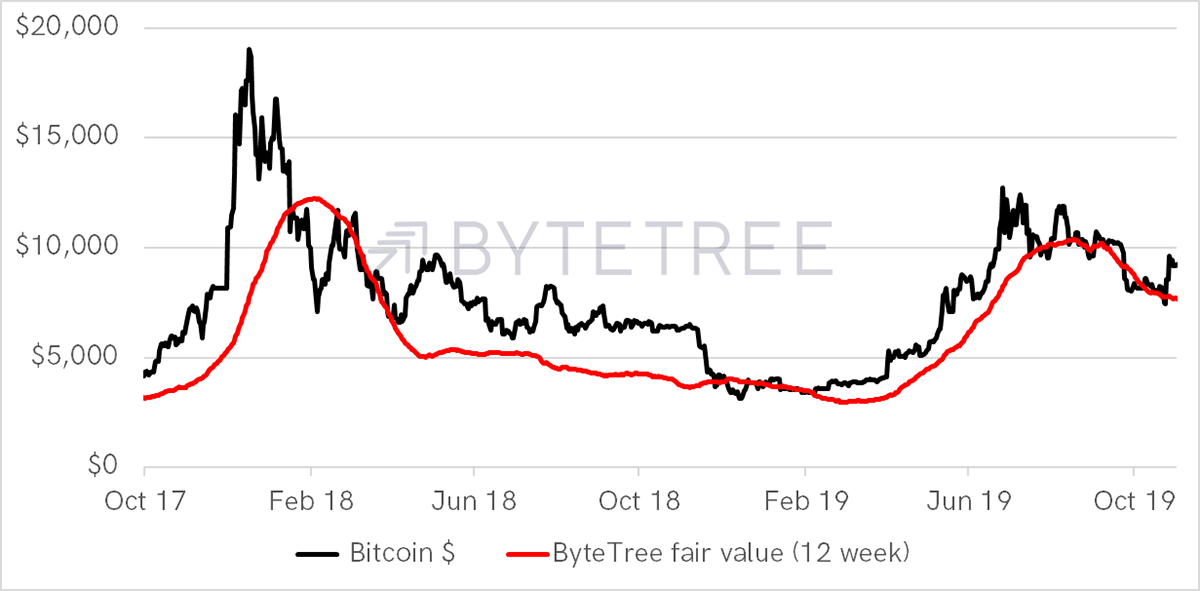

Again in 2017, the bull market went too far. On-chain activity collapsed in Q2 2018, and our fair value fell to around $3,000. Price duly followed. The bull did not resume until the blockchain traffic picked up in 2019.

Epoch 3: The 2018 bitcoin bear

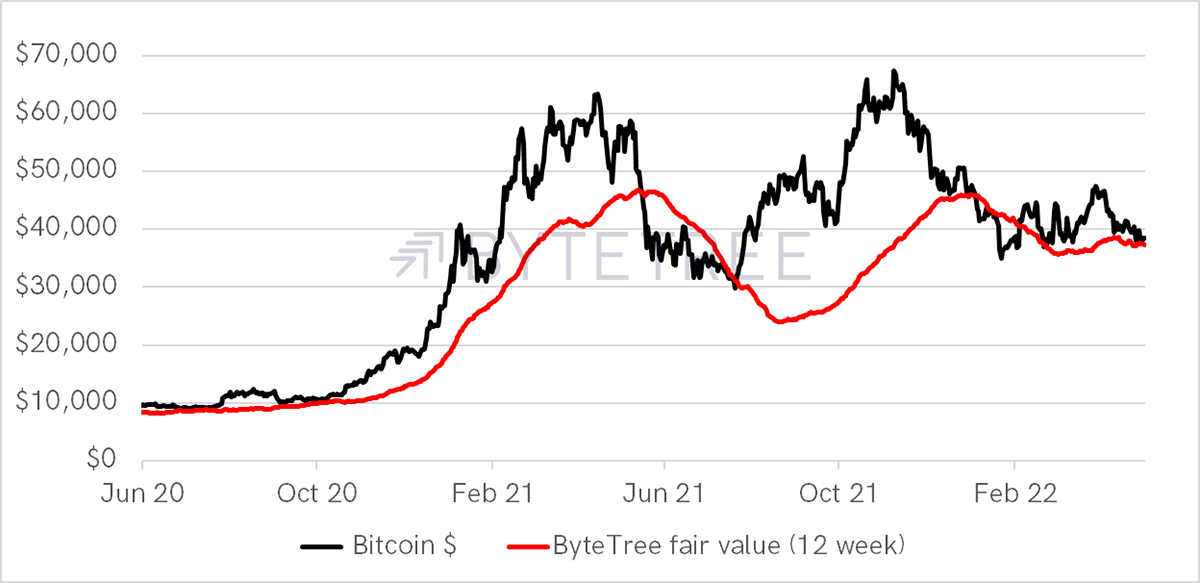

In 2022, we don’t seem to have a bear market, more of a “neutral”, which reflects bitcoin’s maturing status as an institutional asset. This methodology puts bitcoin’s fair value close to current levels. Moreover, the levels of activity are much more stable than they ever have been in past epochs.

The 2022 bitcoin “neutral”

In my humble opinion, it is unlikely that bitcoin will collapse in epoch 4 because the price is roughly in line with fundamentals. There is every chance that external factors, such as macro shocks, wars, tightening and potential a liquidity crisis, put short-term downward pressure on the price, but that will soon pass.

Bitcoin today is an institutional-grade asset that is driven by the network effect. I do not expect Warren Buffett or Charlie Munger to understand that networks are valuable. They are the new brands with a real use case that brings together millions of people worldwide. They cut across borders, cultures, religions and anything else you care to mention.

I will always respect Buffett and Munger for their views on bonds and equities, but I will beg to differ when it comes to crypto.

It’s halfway to halving, and bitcoin is trading at fair value. Never before has this asset looked so credible as it does today. The best bit is that you know that most financial institutions will own bitcoin by epoch 6, yet few do today. Stay long.

Webinar: Bitcoin and Gold in 2022

Join Charlie Morris, CIO of ByteTree Asset Management in conversation with James Butterfill, Head of Research at CoinShares, for a live presentation on Bitcoin & Gold. Charlie and James used to work together at HSBC, and in recent years, have spent an unhealthy amount of time thinking about the magic that occurs when gold and bitcoin are put together. It’s not a matter of Bitcoin OR Gold, but Bitcoin AND Gold.

Thursday 5 May at 15:30 BST - Register to attend on Zoom