Liquidity and Risk - Perception vs Reality for Gold and Bitcoin

Disclaimer: Your capital is at risk. This is not investment advice.

We have been asked on more than one occasion why we don’t throw silver into the BOLD (bitcoin and gold) mix. It’s a commodity with similarities to gold - mainly in so far that it has been used as money - so wouldn’t it be a good complement to the blend?

The main reason that silver isn’t included is because it’s riskier. It would reduce the quality of the BOLD mix, and BOLD is designed as an optimal store of value on a risk/return basis. Generally speaking, diversification reduces risk. But in this case, mixing gold with more speculative precious metals increases risk because gold is indisputably the most pristine alternative store of value. The same applies in crypto. Although you open up the potential of increasing reward, adding other cryptocurrencies to bitcoin materially increases your risk. The recent collapse of Terra LUNA, until last week seen as one of the leading coins, illustrates the point.

Take a look at liquidity, for example. I suspect most investors assume silver is more liquid than bitcoin. This is not the case. Gold trades around US$145bn/day, silver around US$14.5bn and bitcoin US$40.3bn. When institutions are looking for safe ways to park funds, liquidity is a key consideration. Bitcoin and gold are the standout leaders in this regard.

| Gold liquidity - $145.5bn/day | |

| 200,000 contracts/day each 100 oz = $40bn | source |

| LBMA data $57.8bn/day | source |

| World Gold Council estimates $145.5bn as they add all the other futures and physical metal trading | source |

| Silver liquidity - $14.5bn/day | |

| 80,000 contracts/day each 5,000 oz of XAG = $9.2bn | source |

| ETF SLV trades $0.6bn/day and has a 66% share of all XAG ETFs, so approx. $1bn/day in total - will not include as double counting as ETFs will engage with either CME or LBMA or both. | source |

| LBMA data $5.4bn/day | source |

| Bitcoin liquidity - $40.3bn/day | |

| 11,000 contracts/day each 5 BTC = $1.65bn/day | source |

| On-chain $40bn per week so $5.7bn per day | source |

| ETFs included in on-chain data or futures for BITO | |

| Then crypto futures are around $33bn/day (some double counting with on-chain data) | source |

This brings us to a broader discussion about how to think about gold and bitcoin in terms of risk, as compared to other asset classes.

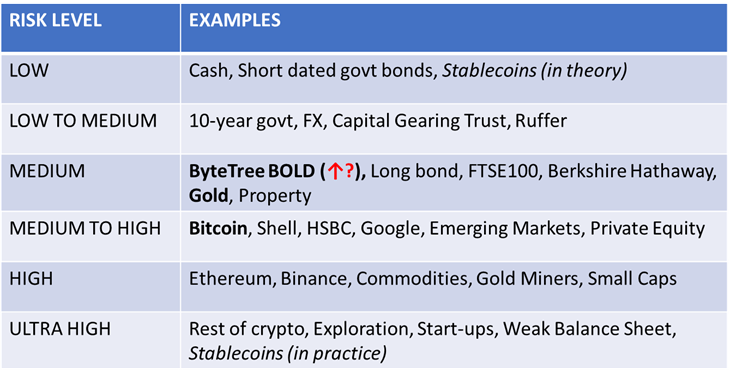

The following table might raise some eyebrows. Treat it as a thought experiment. It’s our way of classifying different asset classes in terms of risk, using standard measures of risk such as liquidity and volatility. The idea is to be as objective as possible. There is room for debate, and we’d welcome any feedback.

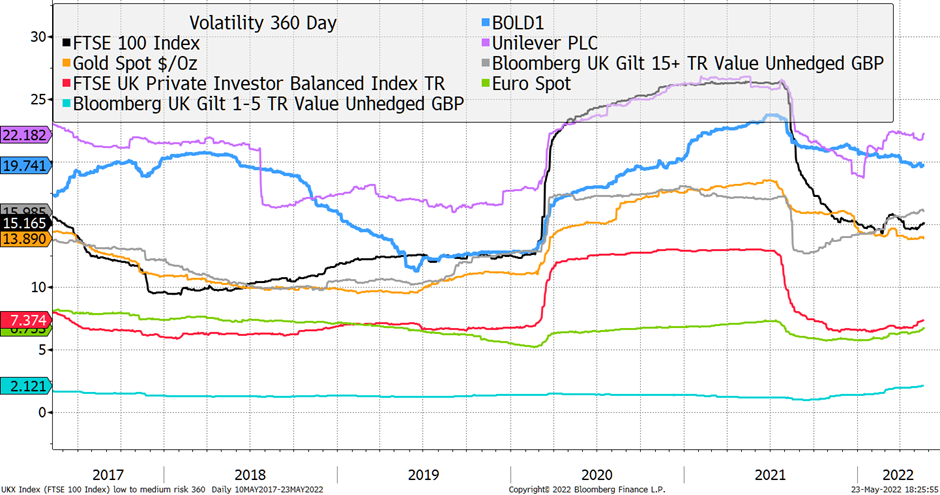

Gold comes out as a medium risk asset, similar to the US long bond or Berkshire Hathaway. The chart below shows it in the middle of the pack in terms of historic 360-day volatility. Perhaps we’re being a bit harsh on gold given its multi-millennial track record, but it has had some pretty grim drawdowns, so we’ll leave it there for the time being.

BOLD is currently classified as a medium risk asset, like gold. But when we look closer, it seems to be increasingly behaving like a low to medium risk asset, similar to a 10-year treasury or a high-quality balanced investment trust like the Ruffer Investment Company. While its volatility is a shred higher than gold’s, BOLD’s historic drawdowns have been lower in its brief history. After peaking in August 2020, gold fell by around 19% to March 2021. BOLD’s largest recent drawdown has been around 14% from its peak in November 2021 to the middle of this month. Also, note how only BOLD and gold in the chart above appear to be trending lower.

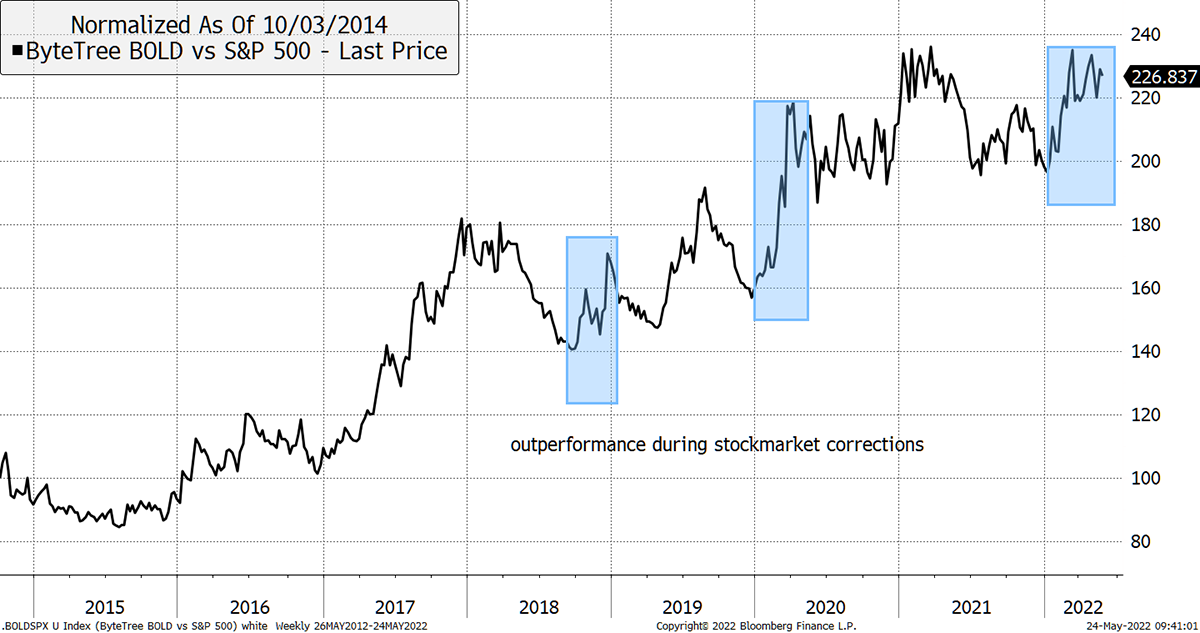

Another feature of BOLD, and why we’re thinking about it in this way, is that it has been outperforming the stockmarket during corrections, which is exactly what a diversifier should do, shown in the next chart. It also demonstrates the beauty of properly sizing assets in a portfolio and diligently rebalancing them to target weights. In this way, we are able to combine a medium to high risk asset (bitcoin) with a medium risk asset (gold) and produce something that’s an improvement on both (BOLD). This echoes the intentions of the balanced 60/40 portfolio, which has dominated investment allocation thinking for a generation.

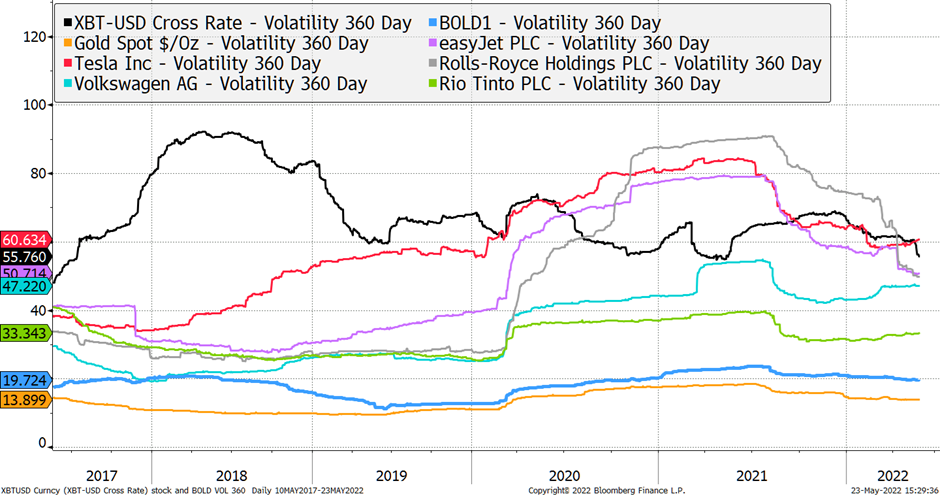

Meanwhile, bitcoin has been behaving like a cyclical blue-chip stock, hence we classify it as medium-high risk. From a statistical standpoint it is not a high or ultra-high risk asset. It certainly was in the early stages of its existence, but every data point we look at tells a different story. It is highly liquid, and its volatility is reducing. All other crypto falls into the high or ultra-high categories, but bitcoin has started to behave in a higher quality manner. Its volatility also appears to be structurally decreasing, as shown below. This is what a maturing asset looks like, and this behaviour will support those who believe that bitcoin is the only crypto asset at the moment with a durable use case. It should be thought of as very separate to the collapse of speculative tech.

Conclusion

Perception and reality can move at very different speeds. While the general perception of bitcoin is as an ultra-high risk asset, the reality is that it’s not. As a result, the perception of BOLD as a high-risk combination of assets is similarly misplaced. We argue that it is low to medium risk, similar to a 10-year treasury. BOLD’s history also points to the magic of a disciplined rebalancing process between assets with a different risk profile.

The next five to ten years are likely to be defined by elevated economic and political volatility. Corporate earnings will become erratic and harder to discount, and the threat of stubborn inflation is real. Equities and bonds may rally from time to time, but it’s hard to make a case for a secular bull market in either from here. A prudently managed combination of these two alternative stores of value, gold and bitcoin, makes a strong investment case in this new paradigm.