Sideways Makes Sense

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 52

That crypto has been weak is no secret. What matters is where we go from here. Macro is supportive, network activity and institutional behaviour are steady, and companies are managing for a harsher climate. This is what you’d want to see in a bottoming-out phase.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | Ambivalent. Ethereum unhappy. |

| On-chain | Cruising speed |

| Macro | Markets see more inflation |

| Investment Flows | Holding steady regardless of price |

| Crypto | Crypto winter |

Technical

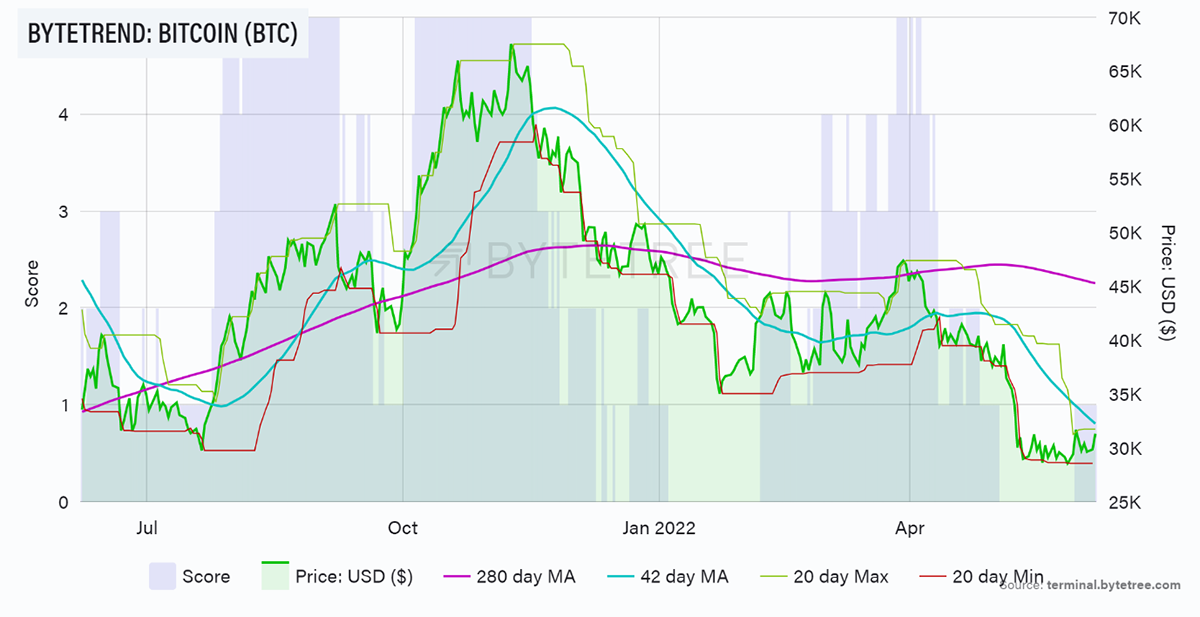

There’s little in the technical picture that cries for a call to arms. Our ByteTrend analysis scores bitcoin at 1 star out of a possible 5. A confirmed break above the 280-day moving average of US$32,359 would be good to see, while a drop below US$28,000 would be a concern. It is very hard to make a firm case in either direction. If history is any guide, we are likely to see a decisive break one way or the other fairly soon.

Source: ByteTree. BTC ByteTrend measured in USD for the past year.

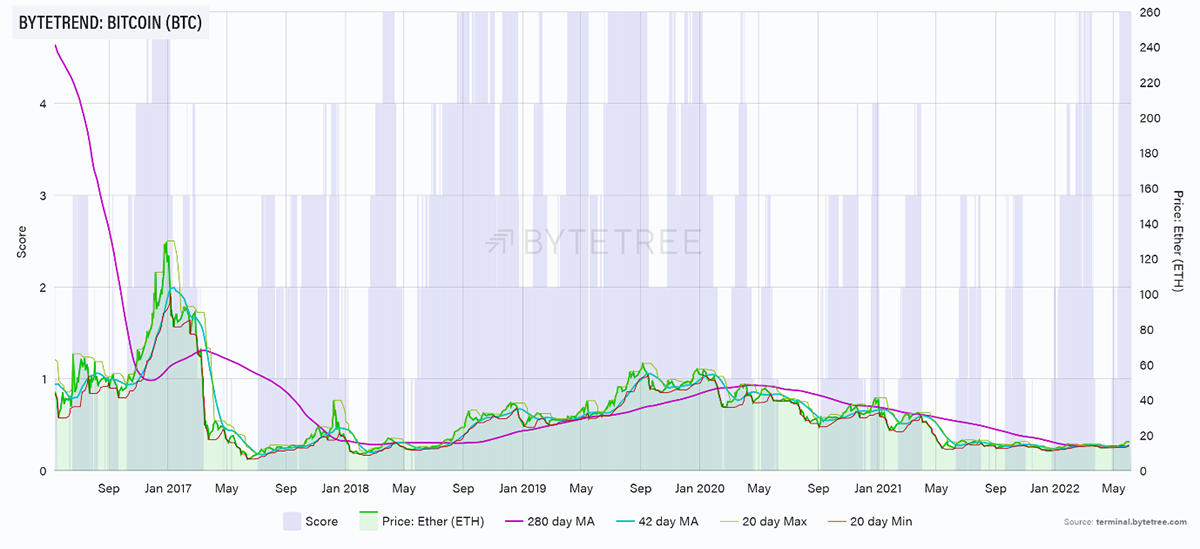

However, if you thought bitcoin was bad, it’s positively been the safe haven in the space. This is dramatically shown in the following chart, which shows how strong it has been compared to Ethereum.

Source: ByteTree. BTC ByteTrend measured in ETH since May 2016.

On-Chain

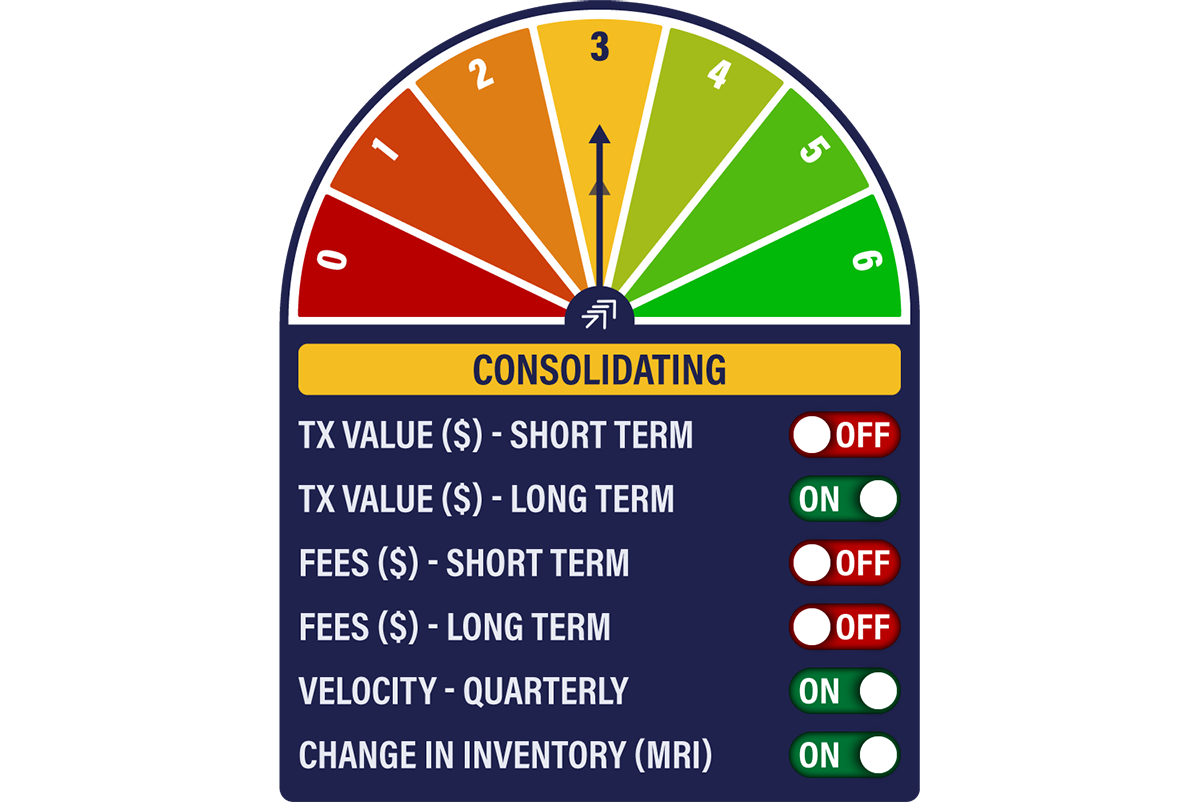

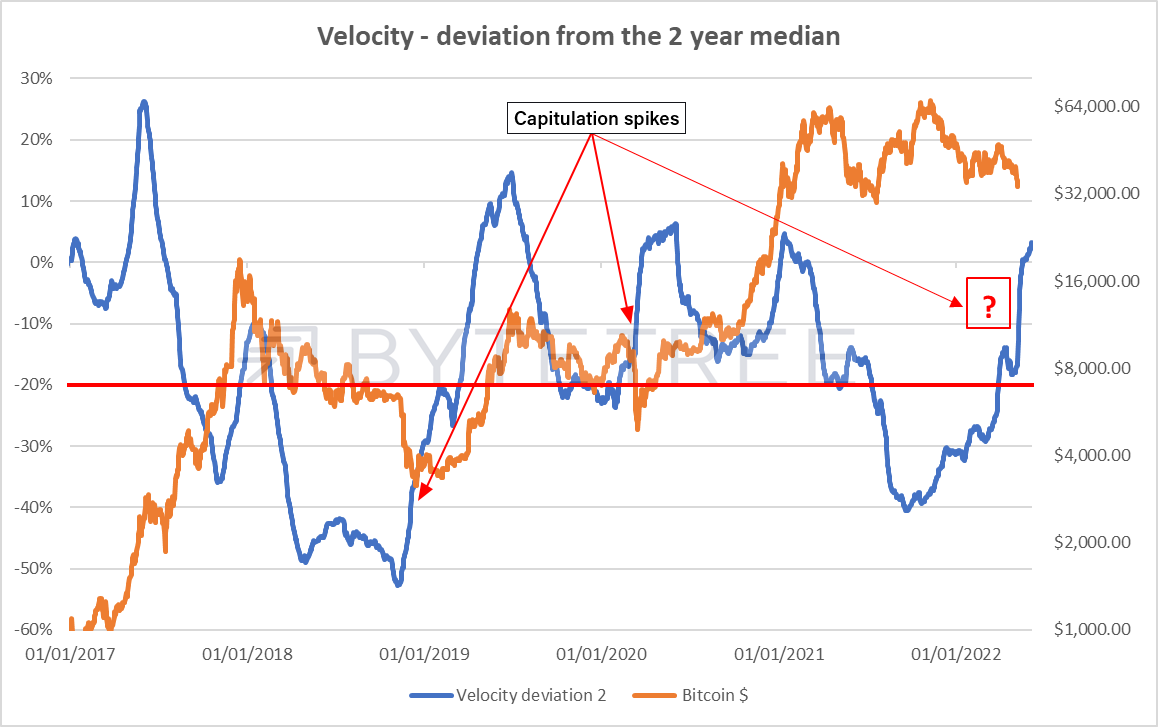

The NDM remains on 3/6 this week, which means the model is on, but it’s somewhat tentative. The good news is that velocity remains strong, which means coins are changing hands rapidly, and the network is doing a good job of transferring value.

Source: BTAM. The horizontal red line is the level at which the Velocity signal turns on.

Similarly, new inventory from the miners continues to be comfortably absorbed, and there are no alarm bells from this direction.

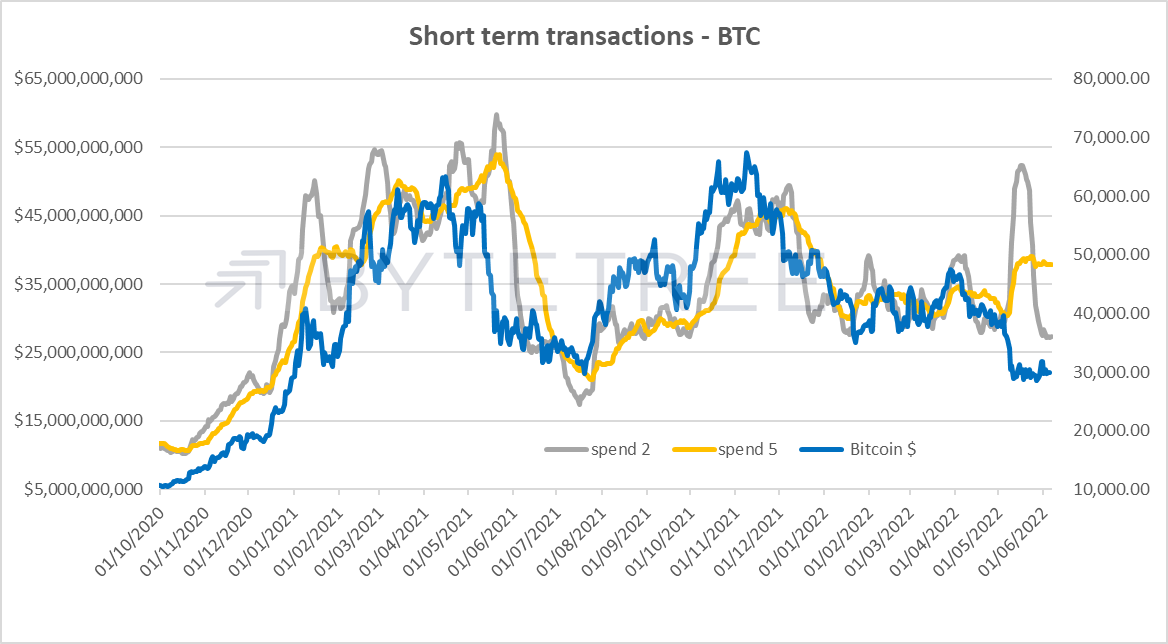

A possible source of concern might come from waning transaction value over the network. We had an enormous capitulation spike in early May, which is now falling out of the short term numbers. This has turned off the short term transaction signal, as shown below. We are back to a fair cruising speed, but it would be good to see a bit of positive momentum here.

Source: ByteTree. Bitcoin short-term transactions and price.

The broad conclusion is somewhat neutral, with little reason to fear a slump but little evidence that we can expect materially higher prices in the near term. Sideways is justified.

Macro

All eyes remain on inflation. Whatever politicians claim, markets are telling us that we’re not out of the woods. This reinforces the case for holding hard assets (gold and bitcoin) in a balanced portfolio.

We’ve seen a recent uptick in bond market expectations across all timeframes.

Source: Bloomberg

Currencies corroborate this. You can see in the chart below how “commodity currencies”, like the Australian dollar and the Canadian dollar, have been strengthening against the US$. Meanwhile, in Japan, where policy-makers continue to run a loose monetary policy, the Yen is anything but a safe haven.

Source: Bloomberg

Investment Flows

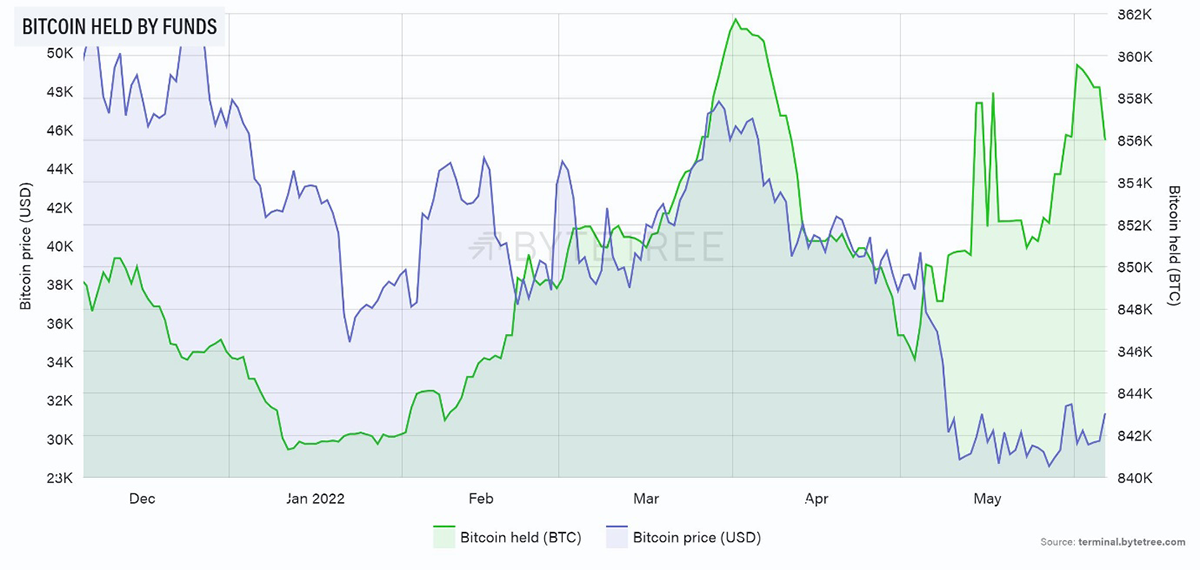

There has been little change in the number of bitcoin held by funds over the week. It remains good to see that fund holdings have been steady regardless of the change in price since the start of the year. The pattern appears to be that funds have been accumulating on weakness in the year to date. The acid test of institutional ownership will be whether they hold at these levels if the price breaks below the current range, but for now, that is a hypothetical. All evidence points to a slow increase in investors building positions and are willing to take a longer-term view.

Source: ByteTree. BTC held by funds (green) and BTC price in USD (blue) over the past six months.

Despite its relative weakness versus bitcoin, the same pattern can be observed for Ethereum.

Source: ByteTree. ETH held by funds (green) and ETH price in USD (blue) over the past year.

Cryptonomy

By: Laura Johansson

It used to be that when you could see 12 or more tower cranes in the London cityscape, we were in a period of economic boom. Crypto doesn’t have tower cranes, but I’ll use the same principle for job hiring, which, at the moment, looks shaky.

At the start of 2022, Coinbase had planned to triple the size of the company but has now reprioritised its business goals due to current market conditions. An announcement published on 17 May stated that the company would slow hiring while also reassuring that they were still in a strong position. Then last week, Coinbase announced that they would continue the hiring pause for the foreseeable future and also rescind many accepted offers, which caught newly hired employees off-guard and without a job.

A Coinbase shareholder letter published on 10 May, revealed that their net revenue for Q1 2022 was down by 27% from Q1 2021 and down 53% from Q4 2022. The letter also disclosed that their projected outlook for Q2 2022 would be even lower than Q1 2022, so with that in mind, the hiring freeze makes sense but still leaves a bitter aftertaste.

Coinbase was not alone on this front either, as the “crypto winter” hits hard across the industry. Gemini has cut down their workforce by 10%, while Robinhood reduced their full-time employees by 9% in April.

Still, Ripple and FTX are seemingly in a comfortable position as they are currently looking to profit on the bear market by buying other companies. An article from Blockworks also reveals that other crypto companies like Binance US and Crypto.com are taking on new staff in compliance, marketing and web3 roles.

This seems to be the start of a new business restructuring phase where crypto companies are adapting to the current macro environment while preparing for the future by focusing on the sectors that will enable growth and innovation. It will be interesting to see which companies make it to the other side.

Summary

Bitcoin might be unexciting at the moment, but the good news is that price behaviour is rational. Network activity and institutional flows are steady, while organisations are sensibly managing resources in a tough environment. All the while, macro pressures strengthen the case for hard assets. Consolidation at these levels makes a lot of sense.

Comments ()