UNUS SED LEO: A Tokenised IOU?

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: LEO;

The UNUS SED LEO (LEO) token is a utility token for the Bitfinex exchange. However, unlike other centralised exchange tokens like Crypto.com's CRO and KuCoin’s KCS, LEO was created to cope with the crisis that arose after the exchange was accused of illegally using Tether reserves to conceal a loss of $850 million. In this Token Takeaway, we will analyse the origins of LEO and the utility of this token within the Bitfinex ecosystem.

Overview

iFinex Inc, the parent company of the Tether stablecoin, also owns the Bitfinex trading platform. The cryptocurrency trading platform is based in Taipei, Taiwan and was founded by Tether CFO Giancarlo Devasini and software engineer Raphael Nicolle. The exchange opened its doors for trading in 2012, making it one of the earliest crypto exchanges available. Since its inception, Bitfinex has established itself as a top centralised crypto exchange and, through its initial coin offering (ICO), has raised funding from Arrington XRP Capital and IOSG Ventures.

After the successful launch of Bitfinex in 2012, Raphael Nicolle handed over the management of the platform to a competent team of experienced investors, who manage the platform and ensure its continued success. Raphael currently serves as a technical advisor, and, as of writing, Bitfinex hires over 280 employees worldwide.

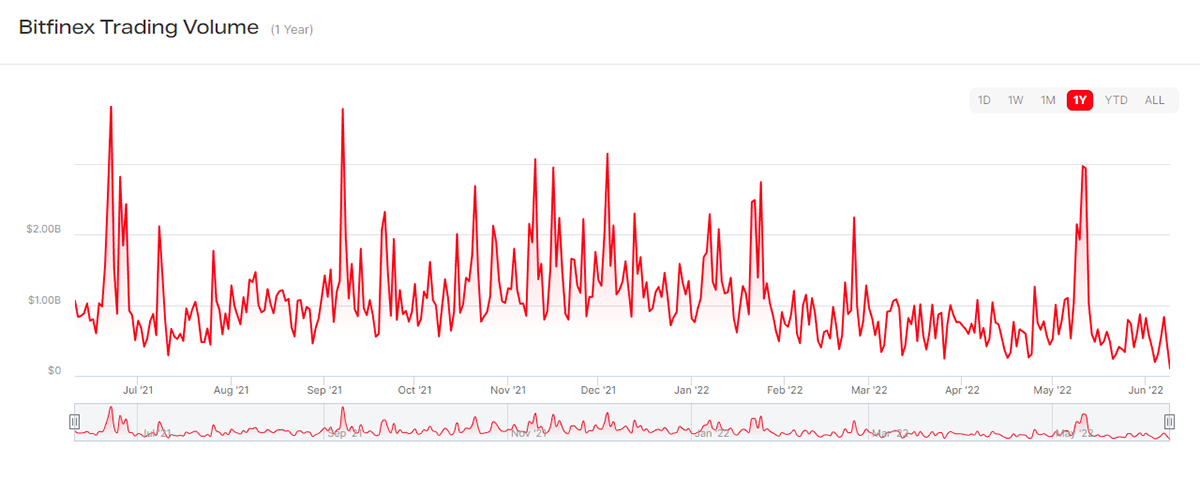

The Taiwanese exchange serves over 380 markets, with the most popular trading pairs being BTC/USDT, BTC/USD and ETH/USDT. As illustrated in the graph above, the trading volume on the exchange has been in an overall downtrend this year.

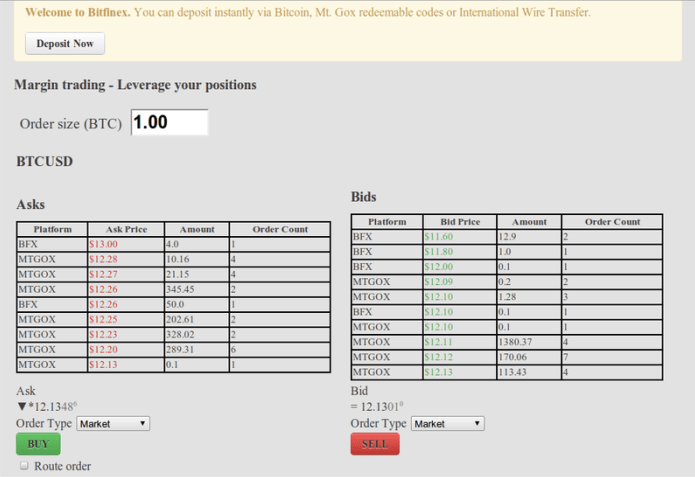

Users can buy, sell, and trade an extensive list of crypto assets and benefit from relatively low trading fees. In addition to a suite of advanced trading features and charting tools, Bitfinex provides access to peer-to-peer (P2P) financing, an OTC market and margin trading for a wide selection of digital assets and derivatives trading.

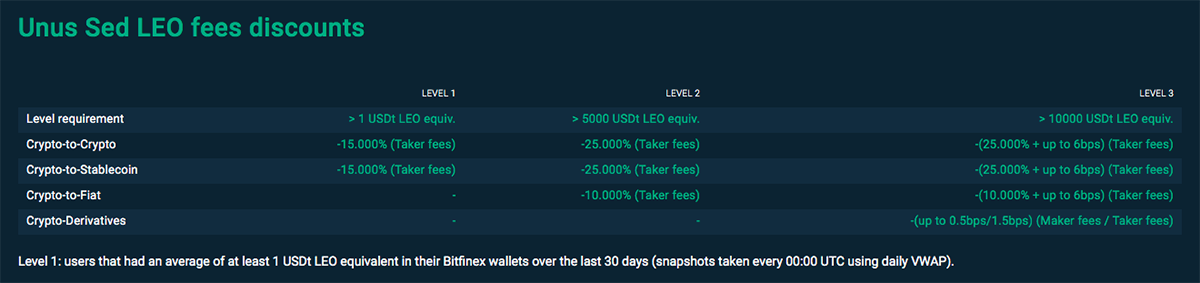

Like other crypto exchanges, Bitfinex has a native token, LEO. Holders of LEO are eligible for trading discounts within the Bitfinex platform. The lowest tier lists a 15% discount on taker fees, while the highest tier offers up to a 25% discount. Additionally, LEO holders are eligible for a discount of up to 5% on peer-to-peer lending fees. Holders receive a 0.05% discount accrued monthly for every 10,000 USDT held in LEO. The maximum discount of 5% is reached when 1 million USDT in LEO is held across the previous month.

What particularly caught my eye was that the lowest tier discounts were applied for holding just $1 of LEO, the lowest entry requirement I have seen amongst similar offerings. To access the lowest tier of trading discount on Binance, you would need to hold a minimum of 25 BNB, or over $6000 at the current market rate, making it inaccessible to many newcomers.

What Is LEO?

In early 2015, Bitfinex established a relationship with Crypto Capital as their primary payment processor. In 2018, Crypto Capital claimed that $850 million of the exchange’s funds in its custody had been subject to a government seizure. By early 2019, it was clear that Crypto Capital could not return the funds and began negotiating a credit facility for a secured, revolving line of credit on commercially reasonable terms.

To cope with the $850 million shortfall, Bitfinex held an initial coin offering (ICO) in 2019 for LEO to pay off this obligation and launched 1 billion LEO tokens at $1 each. At the time of deployment, Bitfinex launched 66% (660 million) of the total supply on Ethereum and the remaining 34% (340 million) of the supply on the EOS blockchain, a proof-of-stake smart contract compatible blockchain created by block.one.

This dual protocol approach was implemented to ease the use of LEO for token holders while contributing to developments focused on blockchain interoperability. The feat of raising $1 billion was achieved in 10 days, illustrating that Bitfinex has a strong community base regardless of allegations.

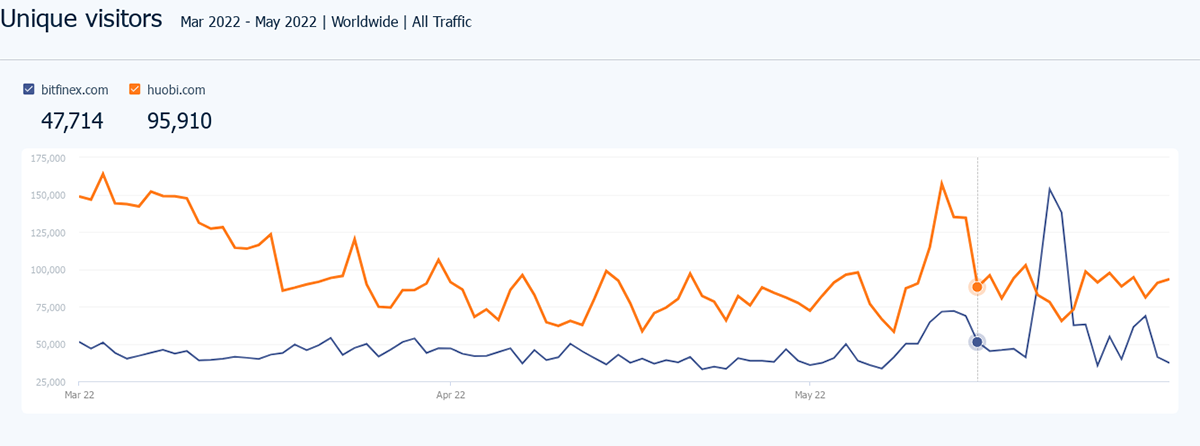

Huobi, another prominent crypto exchange founded in 2013, has seen exponential growth over the years and can be seen as a direct competitor to Bitfinex. The graph below compares the number of unique daily visitors on Bitfinex compared to Huobi for the past three months.

Both exchanges have a strong number of daily visitors. From the graph above, we can see Huobi boasts a higher number of unique visitors but is on a downtrend. In contrast, the number of Bitfinex users remains fairly stable. The peak in late May 2022 coincided with the market downturn following the Terra LUNA collapse.

Tokenomics

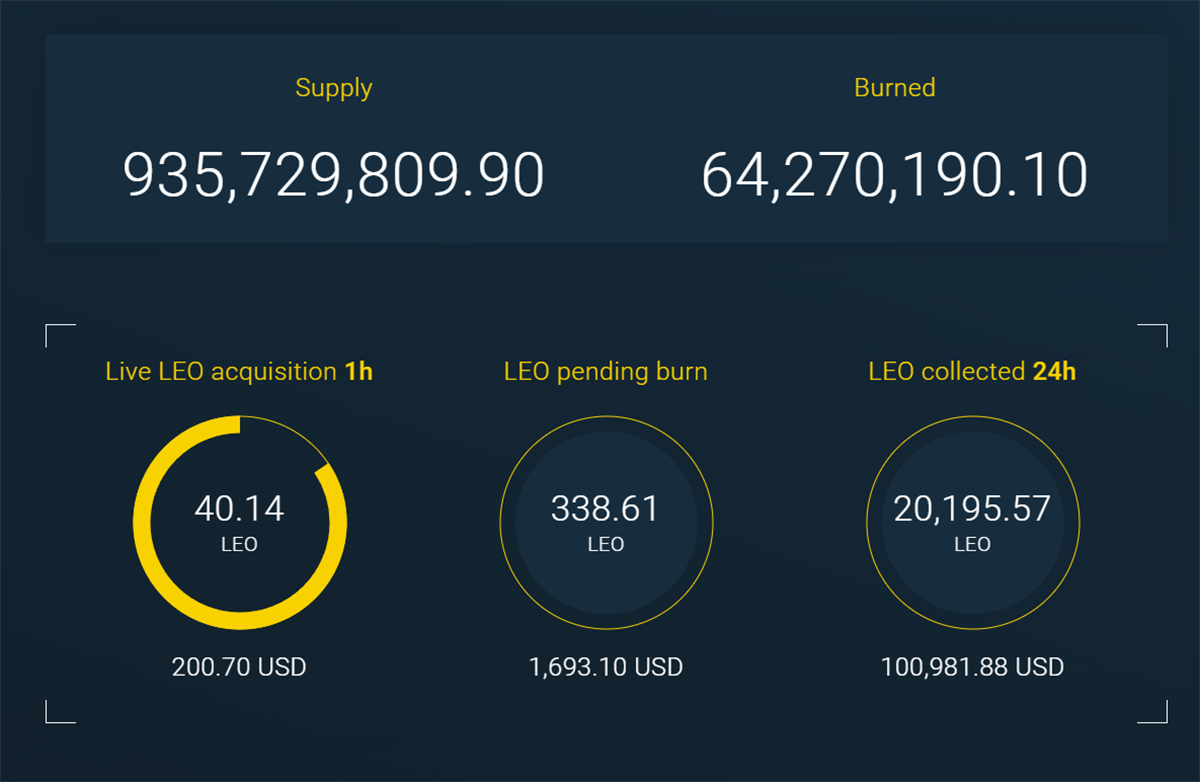

Since its ICO in 2019, LEO ranks as the 17th largest crypto asset with a market cap of approximately $5.15 billion. LEO originally had a total supply of 1 billion tokens. However, due to the deflationary nature of LEO, the total supply has reduced to approximately 985.2 million, with 935.7 million in circulating supply. More details on the burning process later.

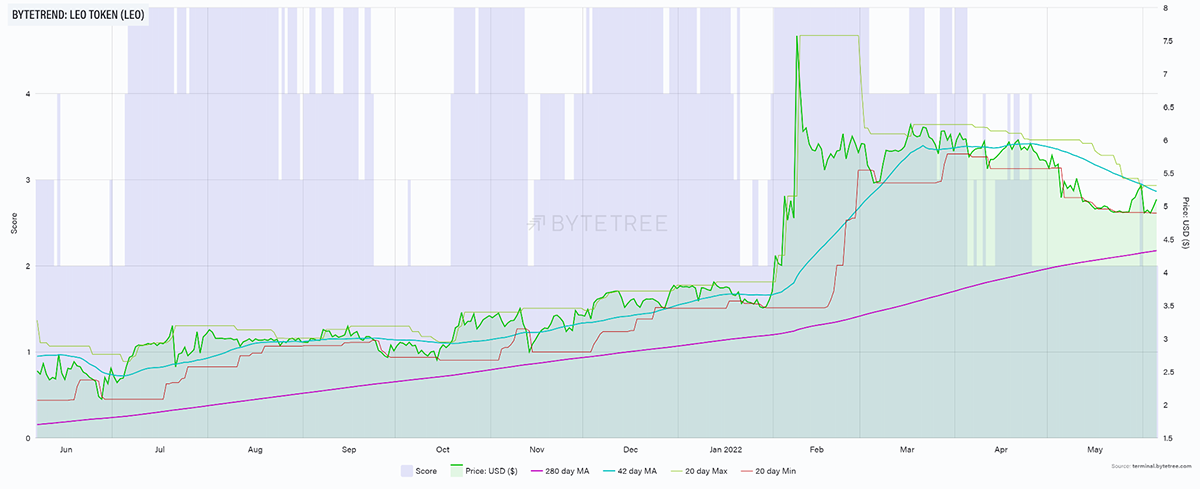

In the ByteTrend chart above, we can see that LEO was in an accumulation phase throughout the latter half of 2021, culminating in explosive price action in January 2022 and an all-time high of $7.51 on 8 February 2022. This positive price action corresponded with the news that the US Department of Justice (DOJ) had seized roughly 94,000 BTC connected to the 2016 Bitfinex hack. The bullish run for LEO ended shortly after, but considering the carnage across the sector, it has held up well since.

The May price drop for the LEO token can be attributed to the flash crash of Terra LUNA and the current bearish sentiments of the market. However, the price downtrend appears to have flattened, suggesting that LEO has entered a consolidation phase over the past month.

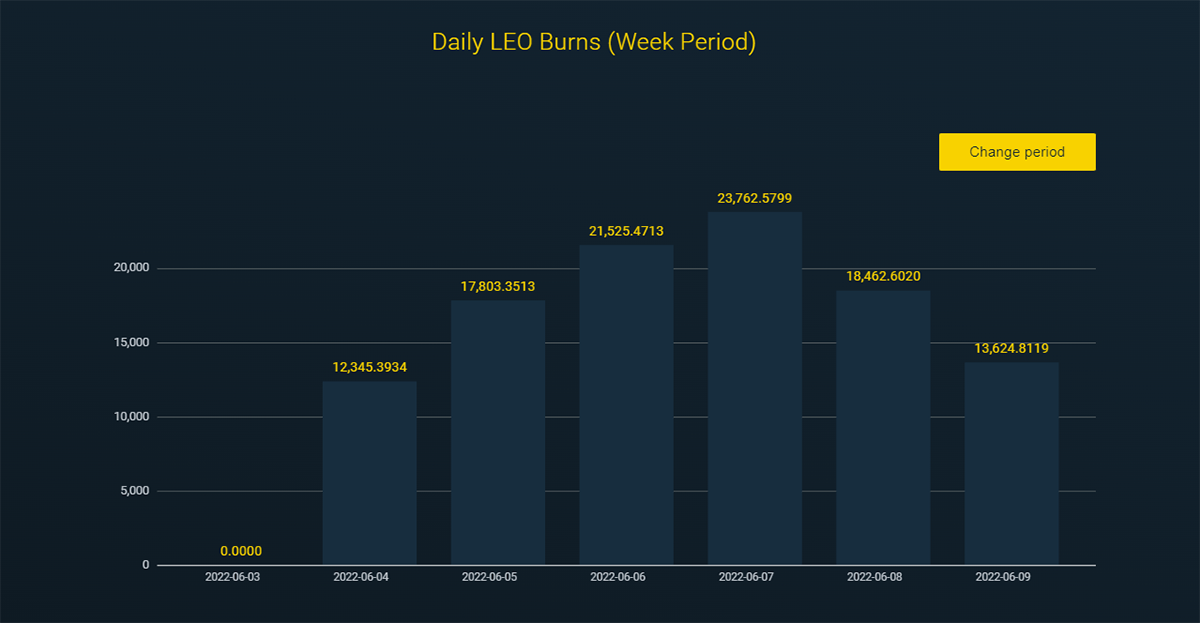

Since its creation, Bitfinex has used 27% of the monthly profits generated by the exchange to buy back tokens from the open market at the current market rate and then burn them to reduce the overall supply. In its whitepaper, Bitfinex promised that once the debt was paid off, all LEO tokens created would be burned, which could be a factor in its continued price strength. To date, 64,270,190.10 LEO tokens have been purchased from the open market and burned.

The burning mechanism implemented by Bitfinex to make LEO a deflationary asset is an excellent way to ensure the token appreciates in value. However, the burning process is quite inconsistent as the monthly exchange profits vary in size. In the months when Bitfinex sees minimal trading activity, we can safely assume less LEO will be burned in the process, making LEO’s price strongly correlated with the exchange’s performance.

Burning all LEO tokens would be complex, as holders have complete ownership of their tokens. Since LEO is available as an ERC-20 token, holders can withdraw their tokens from the exchange and store them in personal wallets, making burning the total supply of LEO an uphill battle.

It is reasonable to assume that the burning process of LEO will continue for a few years before Bitfinex can pay off its debt. Until then, I do not see Bitfinex introducing another token to replace the role of LEO within the Bitfinex platform.

Conclusion

Despite the controversies surrounding the exchange, Bitfinex remains one of the largest crypto exchanges. The community responded favourably to the launch of LEO, which culminated in the sale of over a billion tokens in 10 days. However, there's always the possibility that Bitfinex might be outcompeted by other crypto exchanges offering higher liquidity. If Bitfinex loses popularity as an exchange, it will also negatively impact the demand for LEO.

The origin story of LEO is truly unique and can be used as a model by others for raising capital while showcasing the use case scenario offered by blockchain technology. To date, only 64.27 million LEO of the 1 billion total supply have been burned. Given that Bitfinex aims to burn all LEO, it is reasonable to predict that the token's bullish price momentum will continue in the long term.