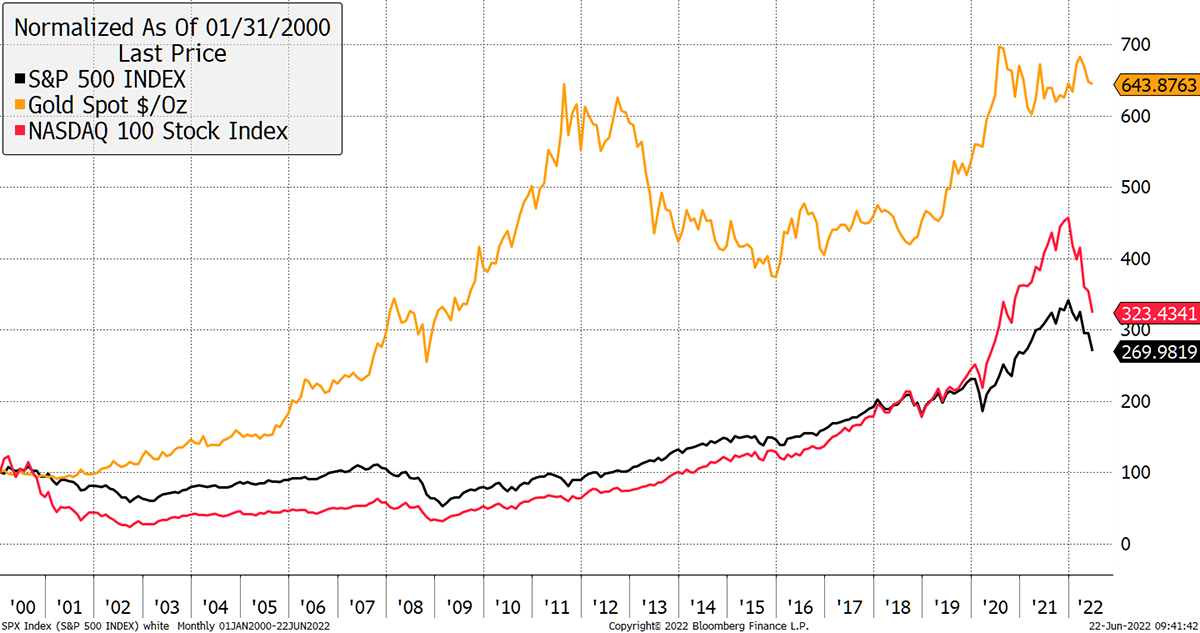

The chart below shows the performance of gold against the S&P500 and NASDAQ since 2000. Gold has demolished both. It’s a striking picture because this has been achieved during a golden age for equity investing. Yet it seems that few investment portfolios have any proper strategic allocation to gold, and if they do, it’s normally derisory.

In a ByteTree webinar in February, John Reade of the World Gold Council estimated that gold, as a standalone, strategic allocation, was owned by less than 10% of institutions. I asked a roomful of investors last week how many had more than 5% of their portfolios in gold. Not a single hand went up.

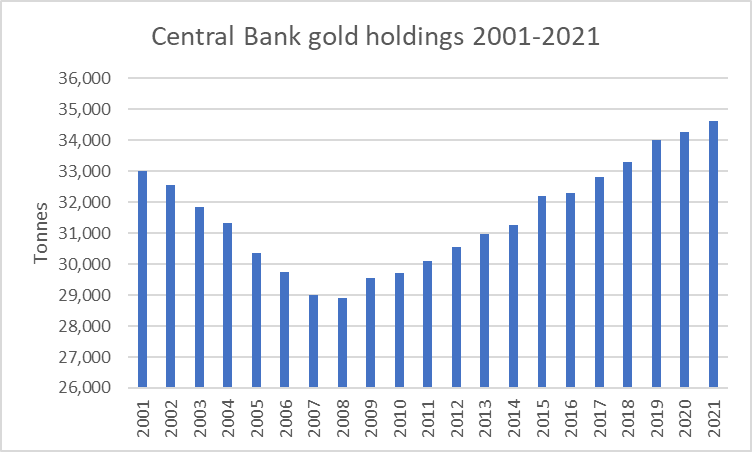

It has got me wondering. Why is gold so widely ignored in professional investment circles when it’s done such a fine job of protecting wealth over a long period of time? It’s not as though it’s unregulated, like bitcoin. Indeed, Central Banks have been sending out a clear message about what they think of the yellow metal for the last 13 years, as shown in the chart below. Since 2009, they’ve been adding at an average of 1.4% per annum, a fraction lower than the average rate of supply increase of around 2.2%.

There are two major culprits in my view: the investment industry and Warren Buffett.

The investment industry covers both the fund management industry and the investment banks that serve them. Between them, they have an iron lock on the world’s savings. Neither have any incentive to promote the ownership of gold. An asset that just sits in a vault generating a paltry amount of fees is of zero interest to an industry that feeds off activity, whether it be issuance, corporate action, trading or derivatives. There is little money to be made from gold by the people who set the investment agenda. The investment industry is heavily incentivised to drive money into equities and bonds. Indeed, it is an industry incentivised to ridicule it.

This is where Warren Buffett comes in. The world’s most celebrated and avuncular investor has a well-known aversion to gold, and when he plays the pipes, the investment industry gleefully dances to his merry tune. He points out, quite rightly, that unlike equities, gold is an unproductive asset. His comments generally make fun of it, and this is backed up by an industry vernacular that paints a picture of gold investors as being a bit, er, different. Are you or are you not a gold “bug” or a “doomster”? The general sense is that gold is something that you are all in on or believe is absurd. There is little room in the world of traditional asset allocation for some sort of middle ground.

The whole point of gold, however, is that it is unproductive. America’s second-richest man is providing no insight whatsoever into its intrinsic value as a store of worth. He points out that it doesn’t pay dividends or generate a return on capital. Fine. But it also doesn’t have profit warnings, rights issues, lawsuits, new competition, patent cliffs, asset write-downs, leverage, liquidity mismatches, management scandals or fraud. It is just a blob of uncopiable metal that sits there, quietly ticking higher over long stretches of time as governments debase currencies. It is no one else’s liability, and if you own some, it is very, very unlikely to surprise you (state confiscation notwithstanding, an area where bitcoin is functionally superior).

Central banks and doomsters are the outliers who understand this. For the rest of the world’s investors, ownership of gold as part of a long-term savings strategy remains unconventional, despite its extremely long and illustrious track record. This has particularly been the case during eras of high inflation and political unrest, such as we face now.

Gold should be a core part of a properly diversified portfolio. But you can be sure of one thing. An industry that is incentivised to ignore it will be in no hurry to tell you so.