ByteFolio Update 22

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree's Crypto Leaders

ByteFolio brings together ATOMIC, ByteTrend and Token Takeaway to create ByteTree’s model portfolio, known as ByteFolio. This is a selection of crypto tokens, which are weighted according to their risk/reward characteristics. ByteFolio has a modest turnover and will not suit traders. It will appeal to investors who wish to diversify beyond bitcoin, with the aim to beat it.

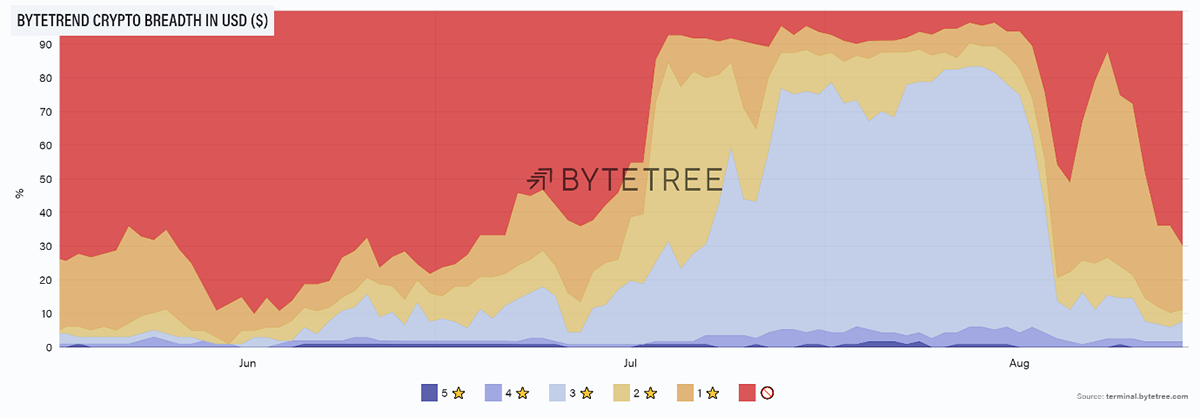

The breadth charts show the broad weakness in crypto, as 70% of tokens are now in downtrends in USD terms.

Source: ByteTree. ByteTrend breadth chart relative to USD over the past 12 weeks.

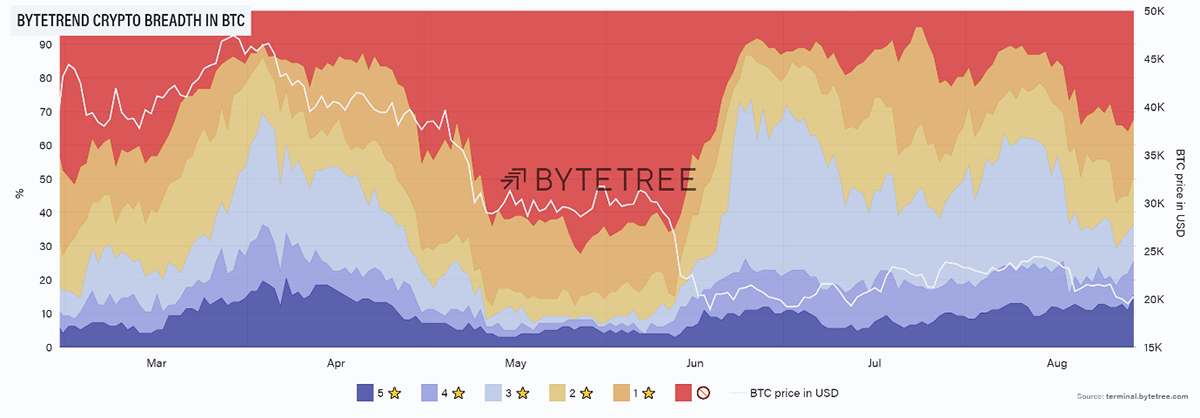

But bitcoin has recently taken a hit, and when measured in BTC, there is a divergence appearing with a growing number of strong trends (dark blue) and an even larger group of laggards (red). That means some projects are proving more resilient than bitcoin itself, which contrasts with what happened in Q2.

Source: ByteTree. ByteTrend breadth chart relative to BTC over the past six months.

Back in April, as the price of bitcoin fell, the number of tokens lagging bitcoin exploded. Bitcoin fell, but most tokens fell by more. Something then changed in June. Bitcoin kept falling, but this time the red skies retreated, meaning a growing list of tokens had started to stabilise.

The leading trends that have emerged in recent months have one thing in common - they are revenue-generating business models. There are numerous crypto projects, and some of them will change the world. Those that do are guaranteed to pass through the 5-star ByteTrend filter as they beat the market. This approach is designed to identify and lock on to the future leaders.

This week, the 5-star trends in BTC are dominated by exchanges, which generate revenue. ByteFolio holds Binance (BNB) and FTX (FTT), which are deemed to be the best two. But there are others and ByteTree will look at all of the major exchanges and compare them. This will be an interesting exercise.

In addition, there was ATOM with a 4-star trend, having been 5-star yesterday. The 280-day moving average turned down, but this relates more to prices late last year than it does today.