Monero: Decentralised Privacy

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: XMR;

Monero is an open-source, privacy-oriented cryptocurrency that launched in 2014, making it one of the longest-running digital assets in the crypto space. In this Token Takeaway, we will analyse the Monero Network and its native token, XMR.

Overview

With the introduction of Bitcoin in 2009, many flocked to this asset as a means of gaining financial freedom and executing private transactions. The ability to conduct transactions while maintaining anonymity was made possible via wallet addresses, not requiring any KYC. However, due to Bitcoin’s open-source nature, many crypto analytics companies were able to track transactions through various wallets. This made Bitcoin, along with many other crypto assets, more traceable than cash. To address this market gap, the Monero blockchain was launched in 2014 as a privacy-focused blockchain, where the wallet addresses of the sender and the receiver, as well as the value of transactions, were hidden. Unlike many other crypto projects at that time, Monero was not a fork of Bitcoin but instead forked off from another privacy coin, Bytecoin. The Bytecoin token was not well received by the community as more than 80% of the token was pre-mined by the developers and has since fallen under the radar.

Today, Monero is the market leader in the privacy-coin sector, and during the early days of the project, the development was led by Monero co-founder Riccardo Spagni. However, in the essence of decentralisation, Spagni relieved himself from his duties in 2019. Since then, the development of the Monero blockchain has been handled by the community on a voluntary basis. To date, the blockchain has attracted over 500 active developers, further developing the blockchain and implementing updates.

The Six-Month Fork

Monero is a proof of work (POW) blockchain, and all of its governance is done off-chain. Improvement proposals are submitted to GitHub and voted upon by the community. Once consensus is met and agreed upon, the new code is added to the Monero Core Client, and full nodes can (eventually) implement this update. Due to the decentralised aspect of the blockchain, the process of updating nodes can be a lengthy process. To tackle this issue, the blockchain hard forks every six months to ensure that the node operators are active within the community and updates are implemented in a timely manner. The most recent Monero hard fork was on 16 July 2022.

While the hard fork itself creates no separate token for the Monero mainnet, the announcement of the hard fork in April this year did cause XMR to have explosive price growth. However, a report published by Bloomberg suggests that the price surge might be related to a seemingly coordinated effort from the Monero community members to withdraw their holdings from major crypto exchanges.

XMR Is Ideal for Private Transactions

Monero is synonymous with darknet transactions and is the most widely accepted payment method, along with Bitcoin. The utility of Monero grew among users due to the ability to provide privacy through Stealth Addresses, Ring Signatures and RingCT. These privacy features, along with the decentralised nature of the network, make Monero nearly impossible to regulate by authorities. While Monero is not illegal to own and trade with, many top crypto exchanges, such as Coinbase and FTX, do not offer XMR trading pairs. To ensure that XMR is easily available and resistant to censorship, the Monero website lists a directory of over 1000 vendors from which XMR can be bought. This also includes atomic swaps, a decentralised way to swap Bitcoin to Monero while maintaining privacy.

However, Monero comes with its own downsides, as the Monero blockchain prioritises security and decentralisation over scalability. Consequently, the blockchain is not able to provide blazing transaction speed like other blockchains, as a Monero transaction can take up to two minutes to process. Furthermore, to ensure that the transactions are irreversible, approximately fifteen block confirmations are required, which can take up to thirty minutes.

POW Blockchain with a Justifiable Reason

After Ethereum goes proof of stake (POS) later this year, Monero and Bitcoin will be among the few remaining blockchain leaders that utilise POW as a consensus method. One of the key benefits of a POW consensus method is anyone with computation resources can operate nodes and mine XMR, making the network more decentralised. However, as seen with Bitcoin and Ethereum mining, the mining process of these assets has become quite centralised with the aid of ASIC miners. To ensure that the same doesn’t happen with Monero, the mining algorithm for Monero is constantly changing, effectively keeping ASIC miners out of the network and making XMR mineable only via CPUs and graphic cards.

Another benefit of a POW blockchain is that the miners can ‘out mine’ the holdings of whales, who have accumulated a good proportion of the overall supply, thereby diluting their holdings over time. That said, it is almost impossible to assess the number of users and the distribution of XMR amongst its holders due to its privacy features and closed nature. These privacy features, along with decentralised governance and energy consumption through XMR-mining, make Monero one of the least ESG-compliant assets.

Tokenomics

Unlike many other crypto assets, Monero did not have an ICO or a pre-mine. Users who wanted to invest in Monero initially had to mine XMR. Since launching in 2014, Monero has amassed a market cap of approximately $2.4 billion, propelling XMR into the top 50 crypto assets by market cap.

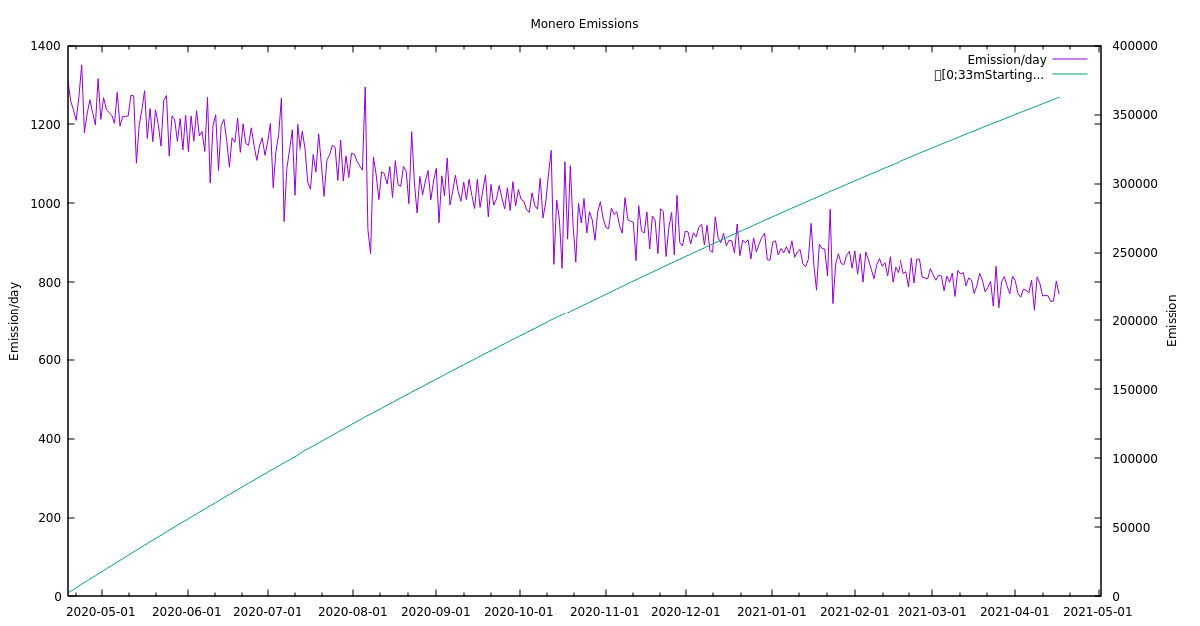

The circulating supply of XMR is approximately 18.16 million tokens, with an uncapped max supply, as miners are incentivised in XMR to secure the network. In 2021, the emission rate per block was 1.26 XMR, resulting in 362,406 XMR being minted last year, which makes Monero an inflationary asset. However, the emission rate of XMR has further decreased this year to 0.6 XMR per block, decreasing Monero’s inflation rate by 39.5%.

| 2020 | 2021 | Percentage Increase YoY | |

| Blockchain Growth in Digital size | 7.41GB | 13.34GB | 80.02% |

| Total Transactions | 2,811,244 | 5,868,096 | 108.73% |

Source: GetMonero. This Year in Monero - 2021.

While the data available on the Monero blockchain is sparse, we can assess the network growth by looking at the growth in blockchain size and the number of transactions. The table above compares these figures to help visualise the growth of the blockchain in 2020 and 2021, respectively. The total transactions on the Monero network increased by 108% YoY, signifying a strong adoption rate of the network.

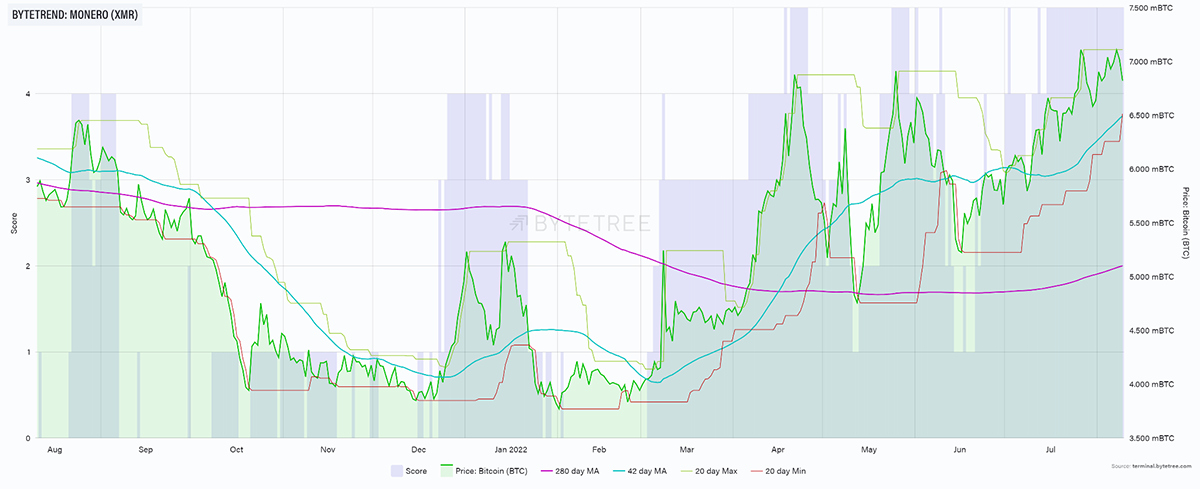

In the ByteTrend chart above, we can see that the XMR token had a steep drop in price in October 2021. The price continued to be suppressed towards the end of 2021, signifying that XMR is not highly correlated to Bitcoin, as Bitcoin hit its all-time high in the same period. As the crypto market collapsed in the first quarter of 2022, XMR culminated in explosive price action in April 2022 due to speculations discussed before. The XMR token is currently outperforming BTC, scoring a 5-star ByteTrend in BTC since mid-July 2022.

Another reason why XMR has had bullish price action can be attributed to privacy concerns many have with the anticipated rollout of Central Bank Digital Currencies (CDBC) by governments worldwide. Every transaction conducted through CBDCs would be traceable, making some uneasy. Third parties would be able to assess an individual’s spending habits, which could be used for nefarious reasons, such as profiling individuals for tailored advertisements.

Conclusion

While Monero has certain limitations and will never be able to compete with goliaths such as Ethereum and Bitcoin, it offers something niche: privacy while remaining decentralised. With our society going more digital every day, privacy is a very prevalent issue that will play a significant role when countries eventually roll out their own version of CBDCs. Users who want to maintain control over their privacy and ensure their transactions remain private will subsequently turn to these privacy coins as an alternative, where Monero is the current market leader. However, factors such as being one of the least ESG-compliant crypto assets, lack of any regulation and scalability issues might inhibit the growth of the network and keep XMR out of the top 10 crypto assets by market cap.

Comments ()