PancakeSwap: The Largest DEX on the BNB Smart Chain

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: CAKE;

PancakeSwap is a Decentralised Exchange (DEX) that provides an open-source, permissionless, peer-to-peer trading platform where trades and transactions occur directly between users without intermediaries. This article will examine the fundamentals of PancakeSwap and its native token, CAKE.

Overview

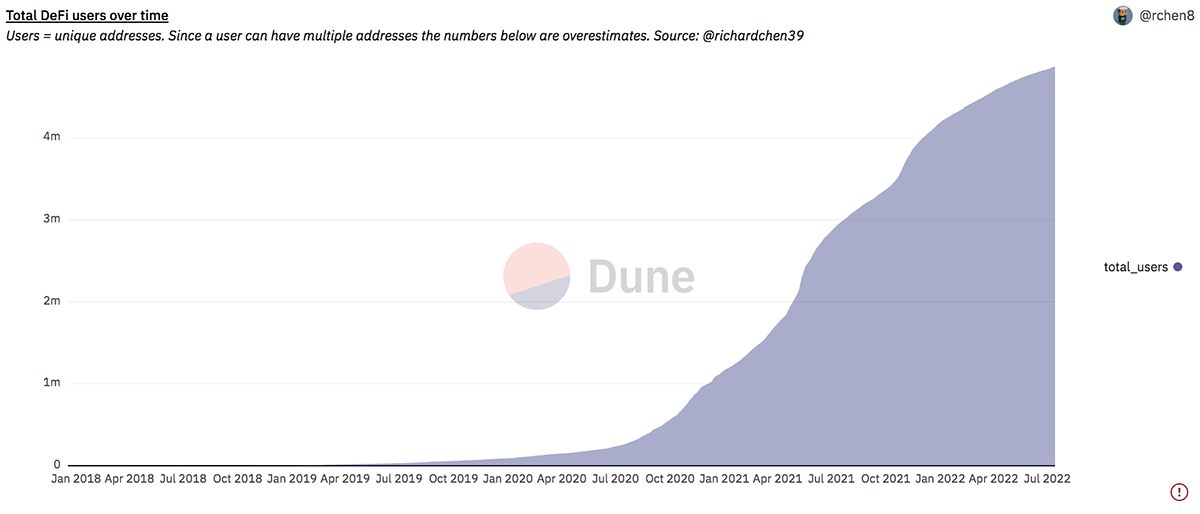

In recent years, the rapid growth of Decentralised Finance (DeFi) has immensely empowered anonymity, speed, decentralisation and accessibility in new protocols and applications. This is especially true in the Decentralised Exchange (DEX) space, which offers a vast range of DeFi services, where users can participate in automated markets to trade and swap tokens.

One of the most popular DEX is PancakeSwap, built by anonymous developers on the Binance Smart Chain (BSC) (now BNB Smart Chain (BSC)) in September 2020. It has over $4bn in TVL and offers a wide range of services like staking, farming, an NFT marketplace, and launchpad services on the platform. It employs an Automated Market Maker (AMM) mechanism to process token trades and swaps on the platform. In the last 30 days, PancakeSwap had around 1.9 million users, who made a total of 22 million trades.

Being built on the BNB Smart Chain, PancakeSwap benefits from low transaction fees and higher throughput compared to other blockchains like Bitcoin or Ethereum. However, BNB Smart Chain’s DeFi ecosystem is small compared to Ethereum, which is said to be the DeFi hub. This limits the rapid growth and adoption of DeFi platforms built on other chains. Nevertheless, the DeFi hub is eventually spreading across multiple chains and ecosystems, benefitting the whole industry. There are now several other DEXs on the BNB Smart Chain, namely BiSwap, Wombat Exchange, MDEX, and W3swap.

In Centralised Crypto Exchanges (CEXs) like Binance and FTX, the tokens are custodied by the exchange, and a user must undergo an extensive account set-up process to start using the exchange (same as traditional stock exchanges/brokers). Whereas in PancakeSwap, users maintain 100% ownership of their funds and do not have to create an account or undergo Know Your Customer (KYC) and Anti-Money Laundering (AML) verification to use the platform. They can simply connect their wallet to the platform and start using the DEX. Moreover, CEXs also carry a risk of defaulting and have the authority to block user fund withdrawals in certain situations, whereas PancakeSwap is a non-custodian and has no central authority.

Functionality and Features

PancakeSwap is a fork of Uniswap, the largest DEX in the space built on the Ethereum blockchain. It is often criticised for being its clone, but PancakeSwap offers many additional services and lower fees compared to Uniswap. Meanwhile, another DEX called SushiSwap, which is also built on the Ethereum blockchain, is also a fork of Uniswap.

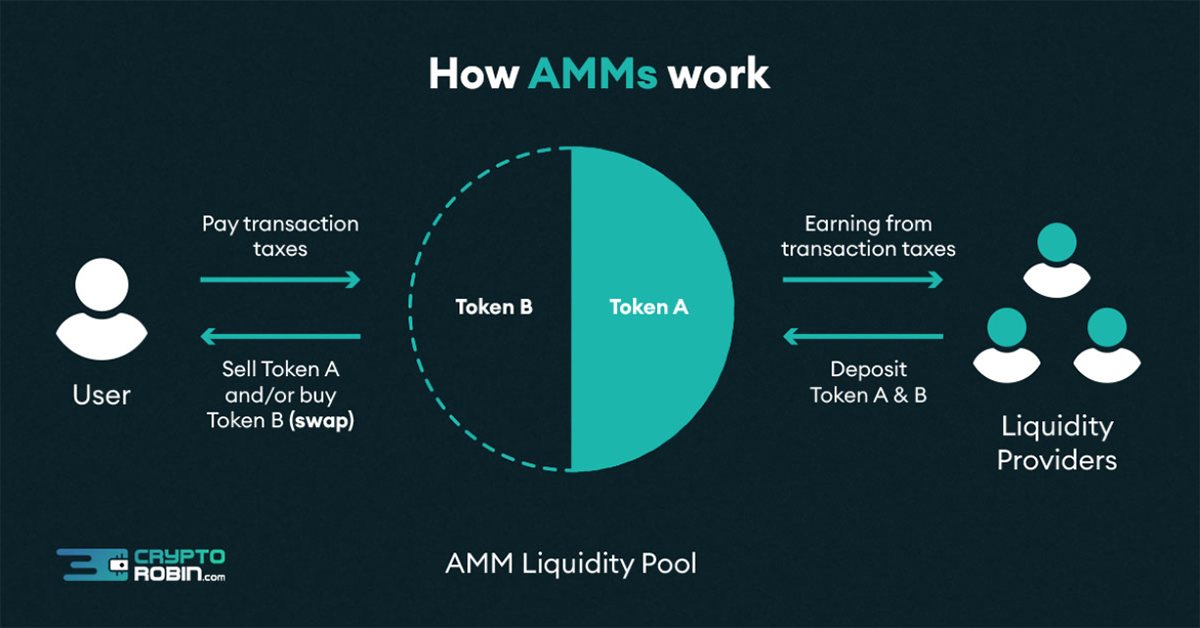

The AMM mechanism is used to facilitate trades and swaps on PancakeSwap, allowing users to trade their tokens against a liquidity pool. There isn’t an order book that matches your order quantity and price. Instead, you just swap your token A for token B from the pool directly.

The tokens in the pool are deposited by other users who want to provide liquidity. In return for their contributions, they receive Liquidity Provider tokens (LP tokens). These LP tokens represent their share in the pool and can be used to reclaim deposits and a portion of the fees generated as rewards.

You can also farm (stake) your LP token to earn PancakeSwap’s native token, CAKE, as a reward. The cycle then continues, as you can stake or lock CAKE in a Syrup Pool to receive more CAKE or other tokens as rewards.

Additionally, the platform also offers Prediction Market, Lottery, Perpetual Futures Trading, Initial Farm Offering (IFO), and an NFT marketplace, creating a basket of DeFi services.

Tokenomics and Fees

CAKE is the native token of the PancakeSwap DEX. It has a total supply of 332 million, with 140 million CAKE currently circulating in the market.

In May 2022, PancakeSwap released a lite paper called Tokenomics 2.0, which highlighted that they are introducing a hardcap of 750 million CAKE on the increasing supply. The paper estimates that it will take 3 years before the cap ceiling is reached, which makes the token inflation around 40% per year.

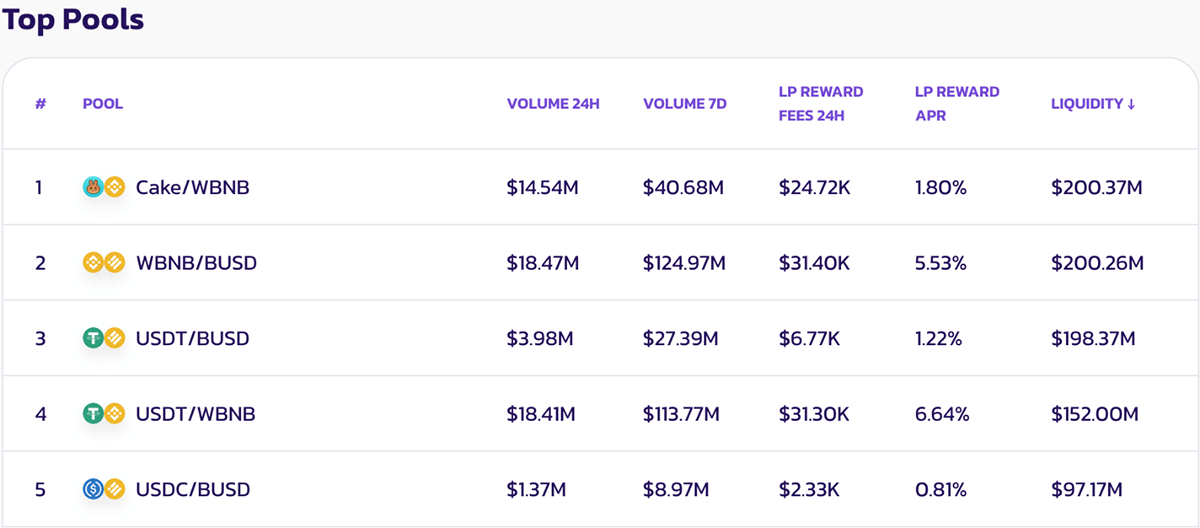

In addition to CAKE being used for staking and farming, it is also used to participate in the lottery and IFO token sales, create a profile to mint NFTs, and vote on governance proposals. When swapping (trading) tokens on PancakeSwap, the platform charges 0.25% in trading fees, of which 0.17% is given to the liquidity providers as rewards, 0.02% is sent to the treasury, and 0.05% is used for CAKE buybacks and burns.

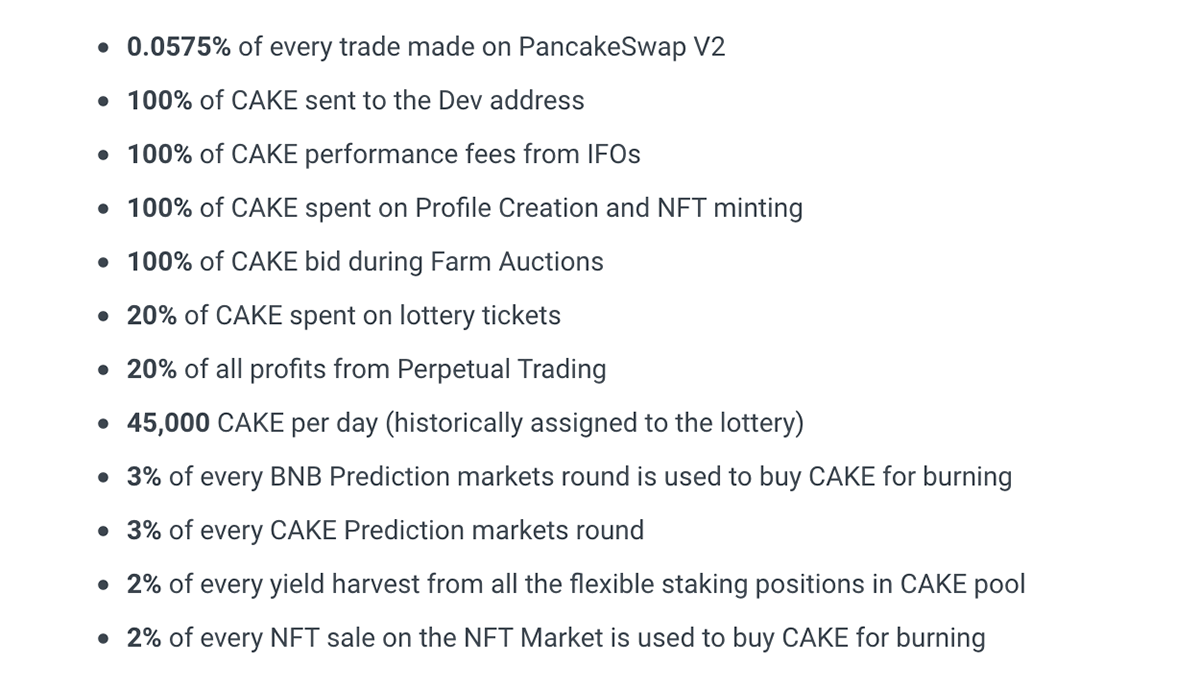

The team’s future goal is to build a deflationary model by encouraging the staking and locking of CAKE to decrease its circulating supply while also maintaining the CAKE burn to be higher than the creation of new CAKE. As of writing, a total of 592 million CAKE have been burned. Moreover, out of the total TVL on the BNB Smart Chain, over 58% ($4bn) is contributed by PancakeSwap. This model aims to create scarcity in the circulating CAKE, potentially increasing its value and demand.

Moreover, other methods are also used to burn CAKE on the platform, as highlighted by the list below;

With the revised tokenomics and active burning, the circulating supply of CAKE has significantly decreased since May 2022. Although the price hasn’t shown any strong move, it is starting to gradually go up. I believe the impact of the decreased circulating supply and burn is yet to be reflected on the price.

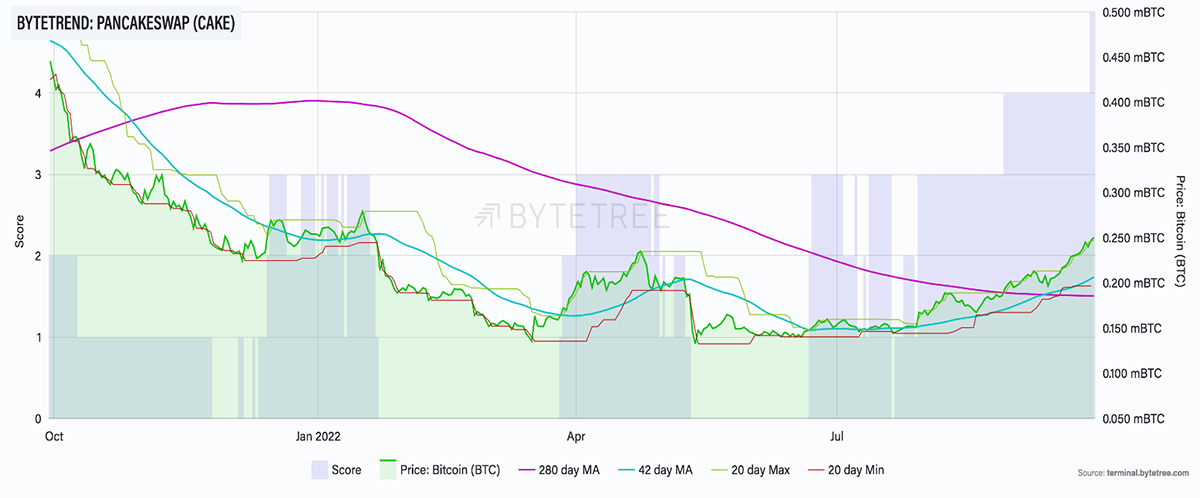

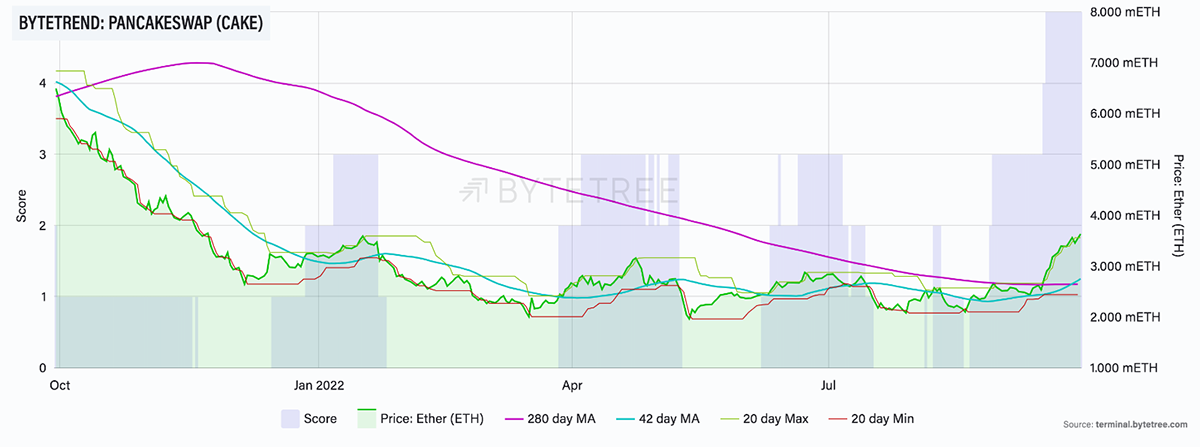

Moreover, as we can see in the charts below, CAKE currently holds 5-star trends against BTC and ETH on ByteTrend, showcasing a strong bullish trend against the two largest cryptos.

Competition and Other Risks

PancakeSwap competes with all the exchanges in the space, in which, Uniswap is its strongest competitor. Possessing a first mover advantage and benefitting from the vast Ethereum ecosystem, Uniswap has managed to outperform all the other DEXs.

| PancakeSwap (CAKE) | Uniswap (UNI) | |

| Market Cap | $700m | $4.9bn |

| TVL | $4.1bn | $5.2bn |

| Platform Trading Fees | 0.25% | 0.05%, 0.3%, or 1% (previously fixed at 0.3%) |

| Blockchain Affiliation | BNB Smart Chain | Ethereum |

| Current and All-Time-High Average Transaction Fees (USD) | $0.1 and $1 | $0.6 and $71 |

| Current Token Inflation | 46% | 28.2% |

| Maximum Supply | 750m | 1bn |

| Volume (in the last 24 hours) | $208m | $1bn |

| Governance | Community driven | Community driven |

| Top 3 Coins on the Platform (by volume) | WBNB, BUSD, USDT | ETH, USDC, USDT |

| Pool with the Highest Volume (past 7 days) | WBNB/BUSD ($124m) | USDC/ETH ($2.5bn) |

Source: PancakeSwap; Uniswap; DeFiLlama; Messari; YCHARTS/ETH; YCHARTS/BSC. A comparison table of PancakeSwap and Uniswap.

However, with just under 30% in token inflation and a recent significant increase in the circulating supply, Uniswap’s tokenomics are not that strong. Moreover, the ratio of market cap to TVL for Uniswap is 0.94, whereas it is 0.17 for PancakeSwap, implying that PancakeSwap is highly undervalued compared to Uniswap (in terms of MCap/TVL ratio metric).

In terms of other risks, impermanent loss in liquidity pools is another major issue - note that this is not specific to PancakeSwap but concerns any platform with liquidity pools. In a nutshell, an impermanent loss is caused if the price of the deposited tokens has changed since the deposit was made, making the deposited tokens worth less. An impermanent loss is a complex phenomenon, and out of the scope of this article. Please refer to this Binance article for a more in-depth explanation.

Finally, due to PancakeSwap allowing the funds to be held in user wallets, it may attract less regulatory pressure compared to a CEX like Binance or FTX. On the flip side, due to no KYC and AML, PancakeSwap is likely to be subject to tighter regulation in the future.

Conclusion

The crypto exchange space is quickly evolving to harness the increasing user demand and needs. Especially DEXs have come a long way, now serving millions of monthly users.

Due to severe competition in the space, PancakeSwap is constantly challenged by other players and is not likely to overtake Uniswap any time soon. However, with the offer of lower fees, a well-rounded DeFi experience, and providing passive income via staking and locking of tokens, PancakeSwap is an attractive platform for new users, with space for further growth.

In addition to DEXs, PancakeSwap also competes with CEXs, which makes the space even more cut-throat. Nevertheless, with strong tokenomics, billions in TVL, and a plethora of services, PancakeSwap does make an impressive contender. However, it’s essential for the platform to stay fundamentally robust (and evolving) to maintain its position as a top DEX. Provided all the challenges and risks are met, there is a great chance for PancakeSwap to continue to be an important player in the DEX/DeFi space.

Comments ()