Token Takeaway: DOT;

Polkadot is a blockchain platform that hosts various interoperable chains on a single network. Users can use these chains to build their own blockchain projects and seamlessly transfer value and data between them. In this article, we will examine the fundamentals of Polkadot and its native token, DOT.

Overview

Polkadot is a decentralised blockchain platform that hosts multiple chains on its primary blockchain, the Relay Chain, creating an interconnected blockchain ecosystem. While hosting these chains, the Relay Chain also handles the transactions and allows the chains to communicate with each other.

Polkadot offers a vast number of services while also providing one of the best features in its space. It uses a Nominated Proof of Stake (nPoS) consensus mechanism to validate transactions on the network, enabling the network to process around 1000 TPS. It uses a model called Sharding for scalability, which spreads the network load, eliminating network congestion and allowing higher throughput. Additionally, the network is decentralised and offers a community-driven governance process. Moreover, the Polkadot Network is upgradable, meaning the network does not use hard forks for upgrades (similar to Tezos).

Protocols like Polkadot are often referred to as “Ethereum Killers”, i.e., protocols that improve on the current Ethereum performance, like security, scalability, fees, inflation, and ESG. However, if the five upcoming Ethereum upgrades are successful, “Ethereum Killers” may well be a thing of the past. This is, of course, highly significant for Polkadot, especially with the Ethereum Merge upgrade potentially only days away. However, in reality, we are still years away from all Ethereum upgrades being completed, which gives Polkadot time to adapt and develop.

Polkadot Architecture and Parachains

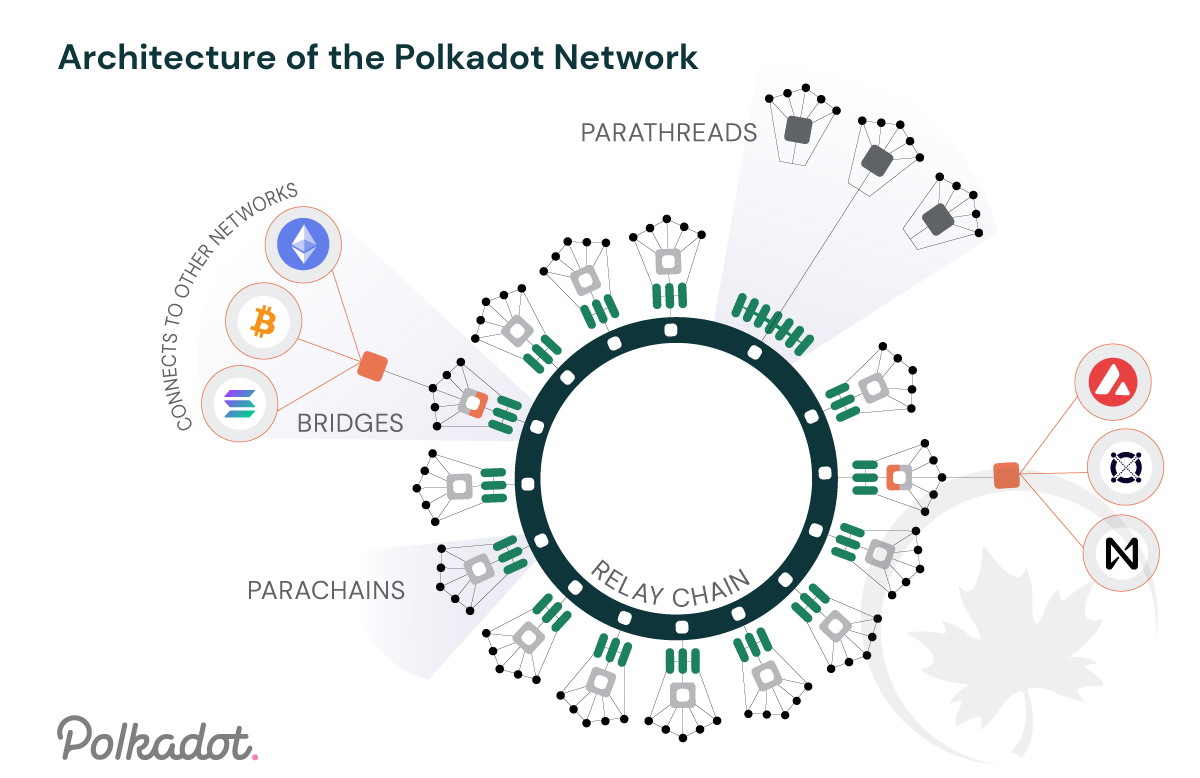

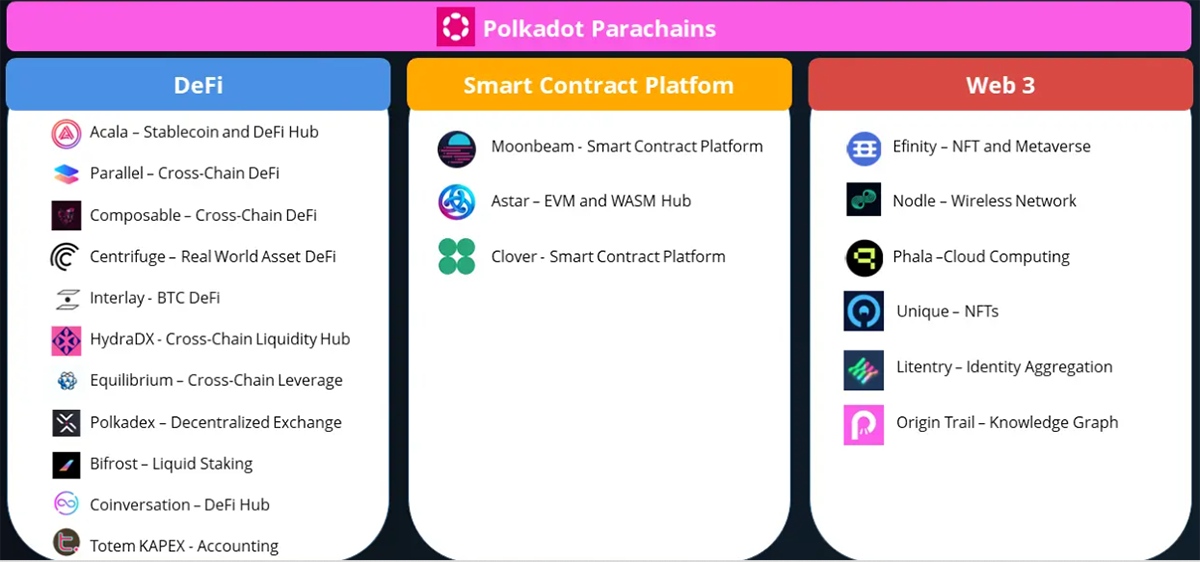

The Relay Chain is the core Polkadot blockchain, while the sub-blockchains connected to the Relay Chain are called Parallelised chains or Parachains. The Relay Chain is a Layer-0 blockchain which cannot be used for smart-contract development, whereas parachains are Layer-1 blockchains that can offer multiple development functionalities. Additionally, external independent blockchains like Bitcoin or Ethereum can also connect with the Relay Chain with the help of bridges.

To run a parachain on Polkadot, the project first needs to acquire one of the 100 parachain slots on the network. The slots can be won (primarily) through an auction and are leased for a maximumof two years. There is also the option to acquire a Parathread, which offers similar features to Parachains, but with a pay-as-you-go model. This model is ideal for projects that do not need to be constantly connected to the Polkadot Network.

According to Parachains.info, the Polkadot Network has successfully awarded 24 Parachain slots to various projects. Some popular Parachains are Acala, Moonbeam, Centrifuge, and Clover. Recently, Acala’s decentralised stablecoin aUSD made a low of $0.07 on KuCoin. This was due to a hack that allowed hackers to mint 1.3 billion aUSD for free from a liquidity pool.

Another noteworthy protocol is Kusama, a Polkadot project with a Relay Chain. Kusama, which can test and experiment on early-stage blockchains before official deployment, also has 39 Parachains on its network.

Launch and Tokenomics

Gavin Wood, the founder of Polkadot, has an impressive resume. He holds a master’s and a doctorate in computer science and is also the co-founder of Ethereum and was previously its CTO for two years. Additionally, he is also the founder of Kusama, Web3 Foundation, and Parity Technologies and the inventor of Solidity, a smart-contract language. Basically, a genius superstar in the Web3 space.

The first Polkadot white paper was released in 2016, and its native token DOT was launched in October 2017 via a token sale, raising $145m in under two weeks. Unfortunately, within a month of the token sale, a vulnerability was exploited in the parity multi-sig wallets. One of the wallets contained $98m or around 67% of the funds raised from the sale. These funds are still frozen and inaccessible, causing a huge hurdle for the development of the Polkadot Network. However, in January 2019, they sold another 500,000 DOT to compensate for the lost funds and raised around $60m.

With around $8.1bn in market cap, Polkadot’s native token DOT ranks 11th in the market, ahead of its nearest competitor Cosmos (ATOM), ranked 23rd. Currently, there are over 1.2 billion tokens available in the market, of which 52% (worth $4.6bn) is locked for staking, making Polkadot the 8th largest in terms of staking market cap. Additionally, 11% of the remaining supply (worth $950m) is locked in Parachains and crowd loans. This removes a large chunk of DOT from circulation and creates scarcity. To learn more about the DOT token’s utility, please see our previous article on Polkadot.

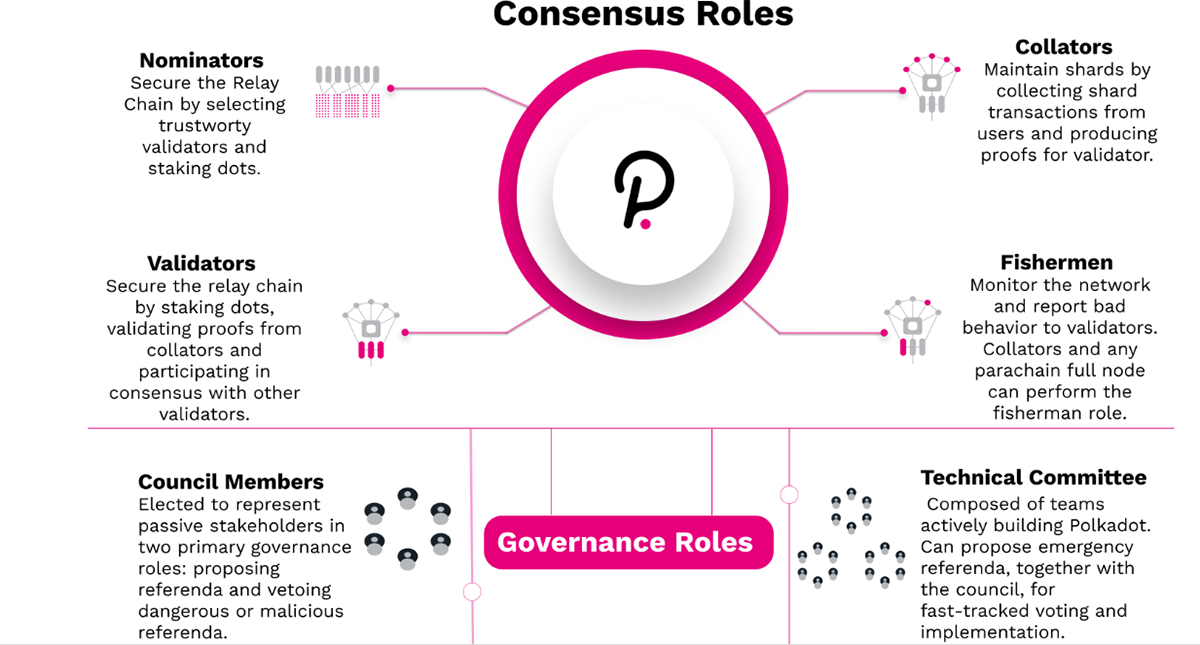

Staking, Governance and Grants

The Polkadot Network uses a Nominated Proof of Stake (nPoS) consensus mechanism to validate transactions on the network. nPoS is like a Proof of Stake consensus method, but better. It provides improved decentralisation and security in the network. The network specifically uses a hybrid consensus mechanism that includes two consensus protocols called GRANDPA (GHOST-based Recursive Ancestor Deriving Prefix Agreement) and BABE (Blind Assignment for Blockchain Extension). GRANDPA is a finality tool in the Relay Chain, which speeds up the finalisation process to improve throughput. BABE is a mechanism that runs among validator nodes to help determine new block authors to produce blocks.

The consensus mechanism involves four key players: Nominators, Validators, Collators and Fishermen as shown in the image below.

The Polkadot network uses a decentralised governance mechanism to help the Network function in the best interest of its users. It allows its users to submit proposals, which may be implemented following a vote. The governance process involves three key players: Council Members, Technical Committee and DOT holders (see above). Additionally, Council Members also dictate the use of Treasury funds, which fund the implementation of approved proposals.

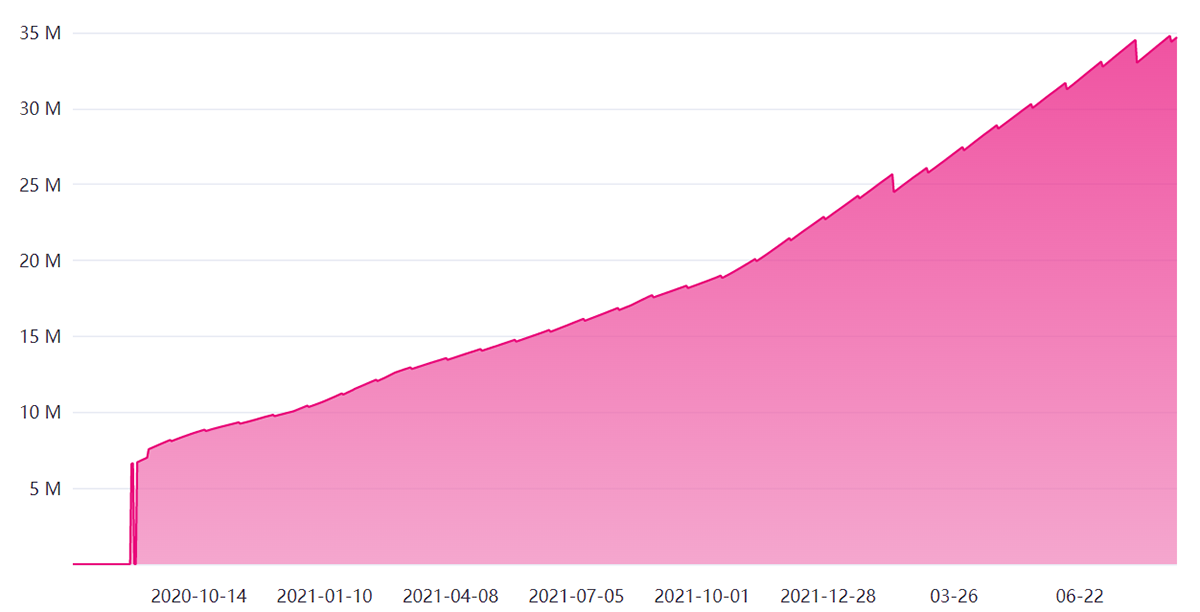

The Polkadot Treasury has almost 35 million DOT in holding, worth around $257m as of writing. These funds are generally used for network development and other essentials. During Q2 2022, the Polkadot Treasury spent 240,000 DOT (worth $1.7 million) across nine transactions. Additionally, the Web3 Foundation, among other grant programs, also awards funds for Polkadot Network projects, currently benefitting around 400 projects.

Network Analysis and Key Metrics

With such a vast ecosystem, the Polkadot community is very active. In fact, the network reported 1400 monthly active developers (+75% YoY), which is the second largest after Ethereum. Based on code repositories and code commits, the developer activity on the Polkadot Network has been consistent in 2022, with an average of 11,000 activities per month, the strongest in the space. As more parachain slots get allocated in the future, developer activity should rise further.

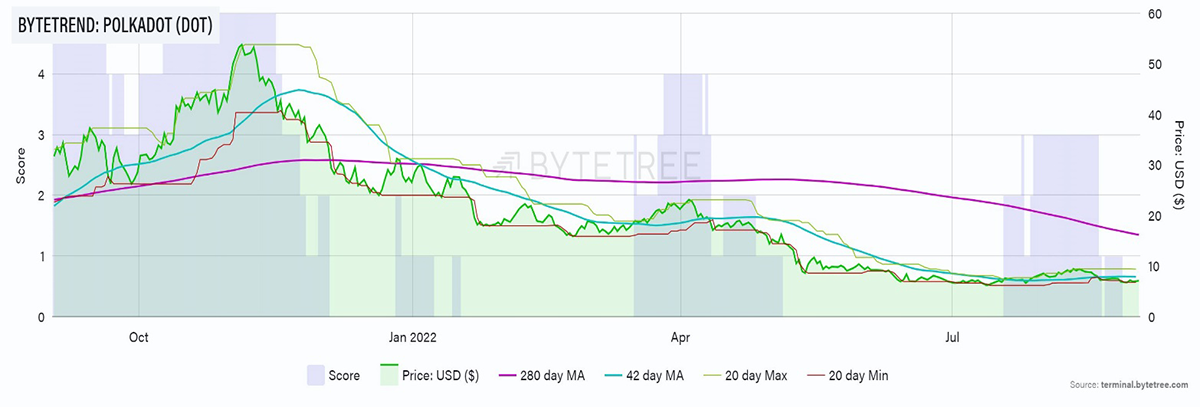

In contrast to the development side, DOT transfers, active and new accounts have seen a huge downward move since last November, as illustrated above.

With the amount of DOT currently locked, even a slight increase in demand could boost the price, yet it has been plummeting for months, as illustrated above. There could be two reasons for this; one is token inflation, which is around 7.7%, and the other is a current lack of demand for DOT.

Conclusion

Polkadot is easily one of the most complicated projects in the crypto space, creating an impressive interconnected blockchain web. On top of this, the network offers improved finality, decentralisation and security with its unique consensus protocols, which immensely benefits the projects in the Parachains. Moreover, Polkadot bridges can also interoperate with unique networks like Ethereum, Solana, and Cardano, opening a gateway to a whole new universe.

However, the network is struggling in terms of technical metrics. Most notably, user accounts and DOT transfers have seen a considerable downturn. Although a vast chunk of DOT is locked, the correlation between DOT’s increasing supply and its price is daunting. Nevertheless, network developers, the backbone of any blockchain, are impressively the most active, showcasing a strong fundamental value.

The crypto space is constantly evolving and brimming with diverse projects. We are moving towards a future where interconnectivity between projects could be the key, and Polkadot is a strong player long-term.