Atlas Pulse Gold Report - Issue 75;

The risk facing gold is marginal compared to the risk facing US equities, and it is hard to see a scenario where gold doesn’t win.

Highlights

| Regime | Checking in on the bull market |

| Macro | Inflation cools, but when will the dollar? |

| Valuation | A modest 9% premium for a high quality asset |

| Flows | Investors sell gold, central banks buy it |

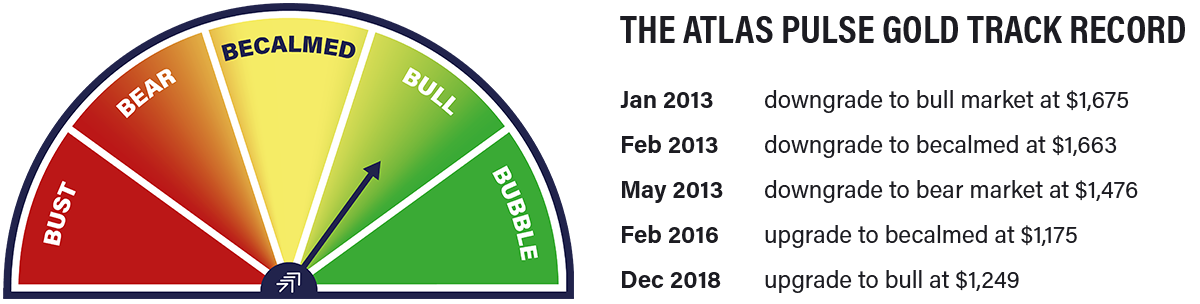

Regime - Gold Bull Market

At times like these, best to check in. Historically gold has been a buy when two or more of the following have held true:

- Short-term real interest rates are below 1.8%. TRUE

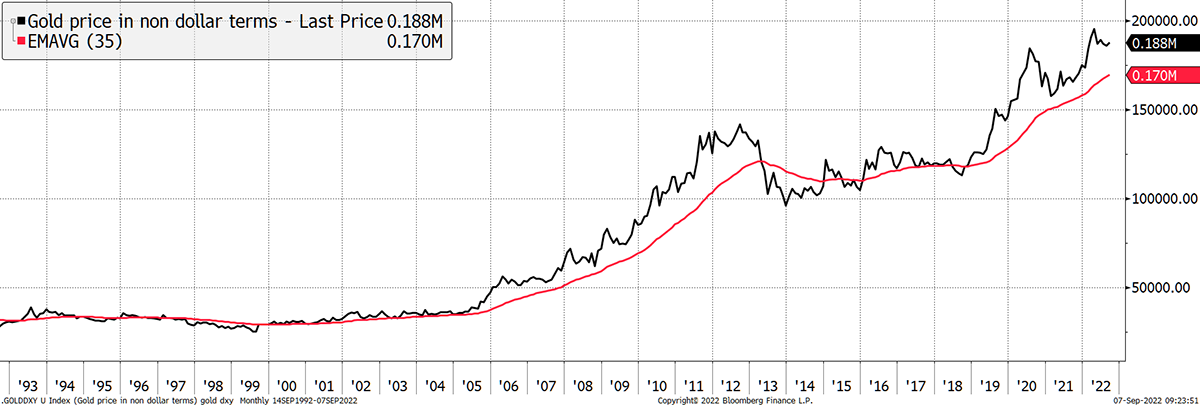

- The gold price, measured in a basket of currencies is rising, measured by a 35-month exponential moving average. TRUE

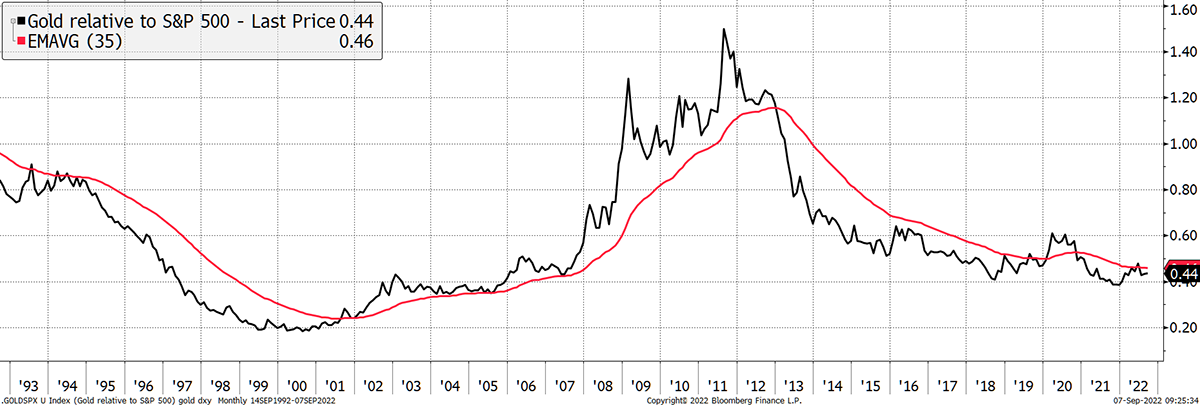

- The gold price relative to the S&P 500, measured by a 35-month exponential. CLOSE

The first rule is well in the money as the current real interest rate (Fed interest rate 3% less last CPI 8.5%) is deeply negative. Historically a reading below 1.8% has tended to be onside for the gold price.

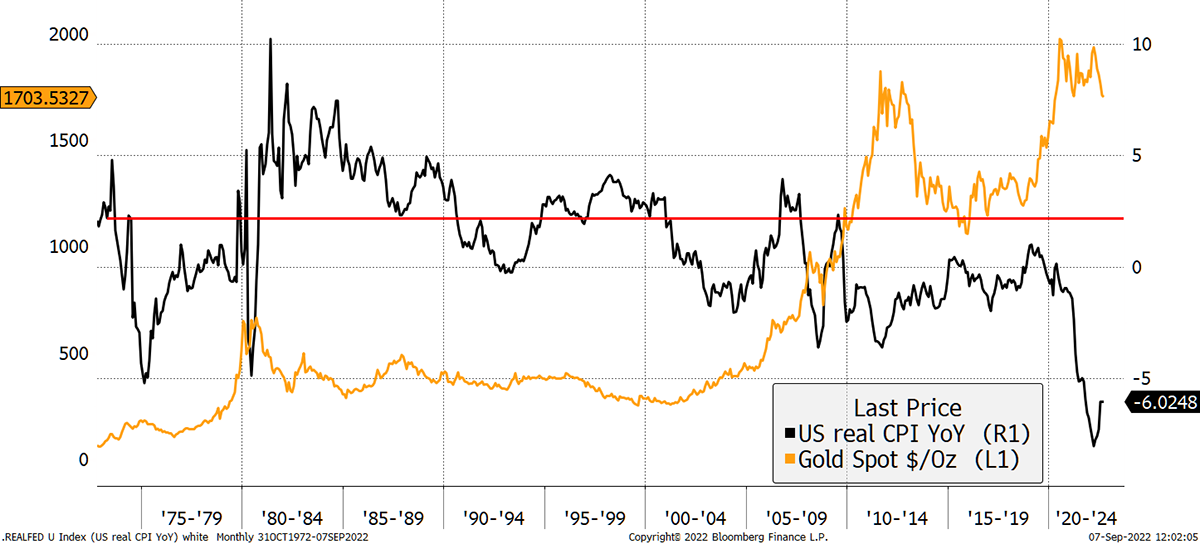

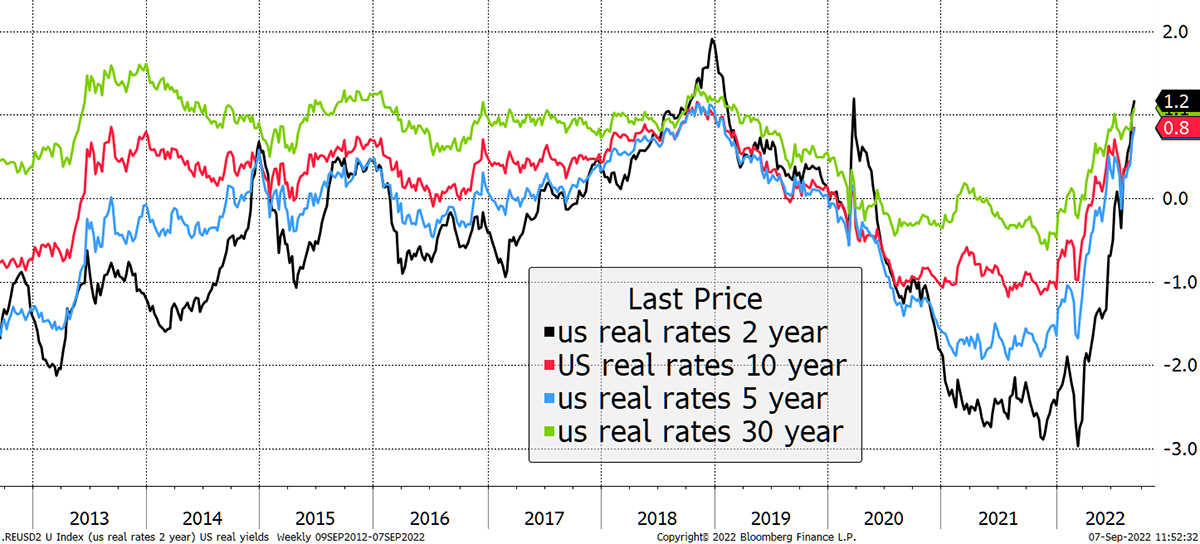

Cheap Money

But that is backward looking. It matters more where interest rates and inflation will be in the future, rather than where they are today or have been in the past. On that basis, looking just two years ahead, we never saw real rates at -9% or even -6%, but at -3% (black line, below). That forward-looking number has already surged to +1.2%, which is where things have broken in the past.

Why the US Dollar Has Surged

The Fed want to see positive real rates across the curve, which was one of their objectives, and they’ve already achieved it. How much is enough?

The financial markets understand this, but the media will focus heavily on the next CPI data next Tuesday. In that sense, the risk of an overshoot becomes political as the last time they said inflation was transitory, it wasn’t. The Fed are keen to restore their credibility.

The dollar is rising on the back of this tightening party, while all other currencies slump. One day this will reverse, because it always does. Gold is struggling in US/Singapore/Canadian/Aussie dollars and maybe Swiss Francs and Yuan too but is flying in the other 100 or so currencies around the world. I would say 90% of the world’s population is experiencing a gold bull market in their home currency.

Gold Is Strong by Most Measures

Next, we come to the relative performance against the stockmarket. Since 2018, gold is still marginally ahead of the S&P 500, but you’d hardly call it a trend.

Gold Neutral versus US Equities

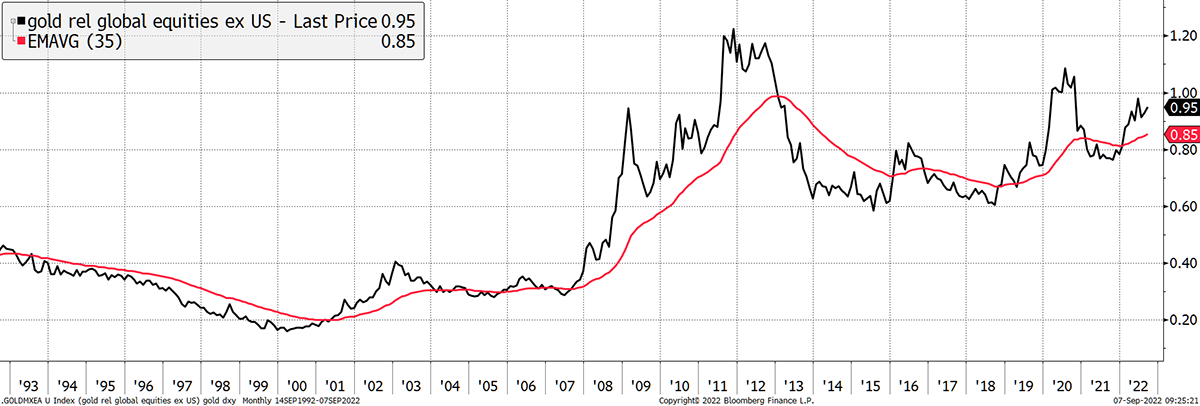

Yet when viewed against the world ex-US, it’s a different story. The outperformance against the EAFE Index (Europe, Australia and the Far East) is strong, and very much what I’d call a trend.

Gold Strong versus the World ex-US

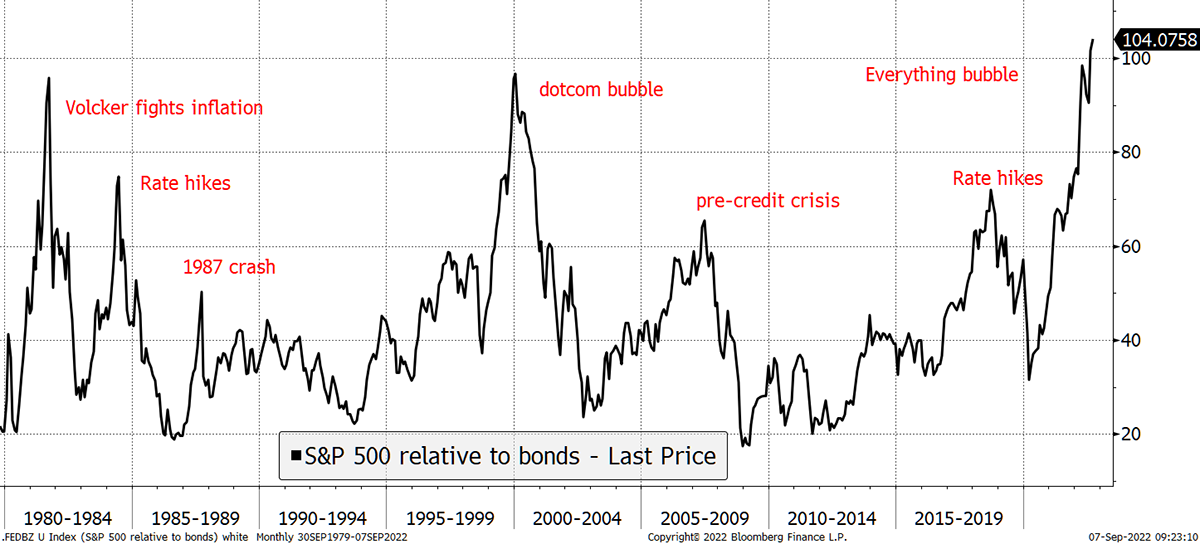

The trouble with US equities, which are nearly keeping up with gold, is that they are stretched to the limits. While gold is close to fair value, US equities are rich on most measures, especially against bonds.

S&P Returns vs US 30-year Bonds

As the bond yield continues to rise, the downward pressure on US equities bites as they become extended. The move since March 2020 is one for the record books.

The risk facing gold is marginal compared to the risk facing US equities, and it is hard to see a scenario where gold doesn’t win.

Macro

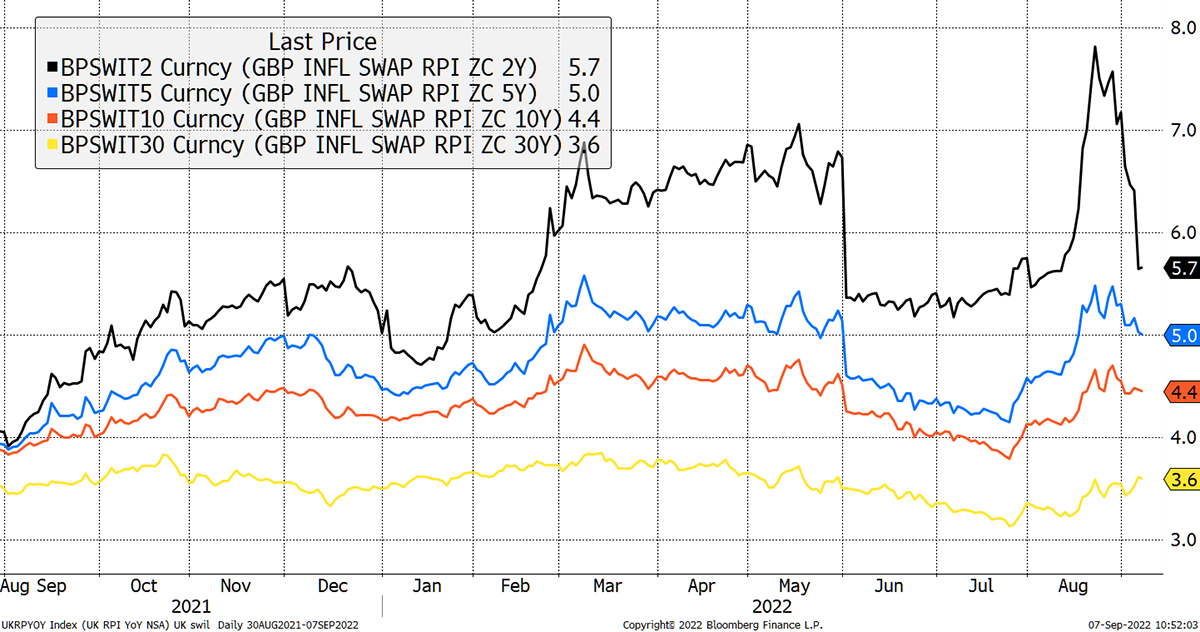

Looking across the ocean, inflation expectations have collapsed in the UK too. This is all very recent and so a bit early to congratulate our new prime minister, Liz Truss, but it’s there for the eye to see.

UK Inflation Expectations Retreat from Panic Levels

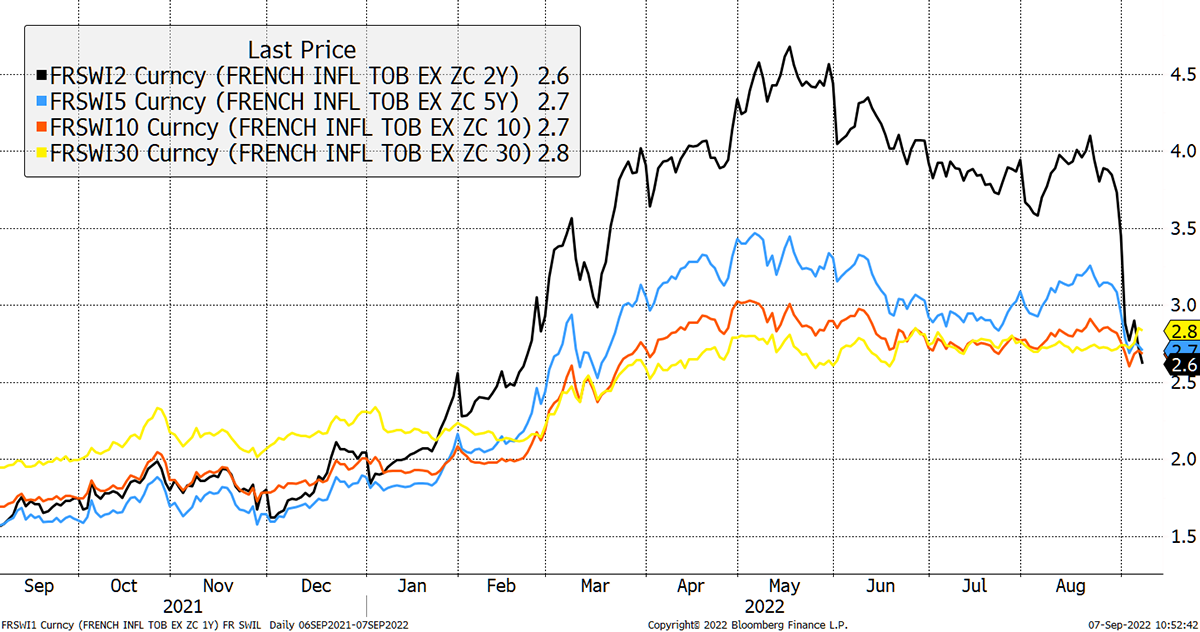

That’s also true in France.

Also Seen in France

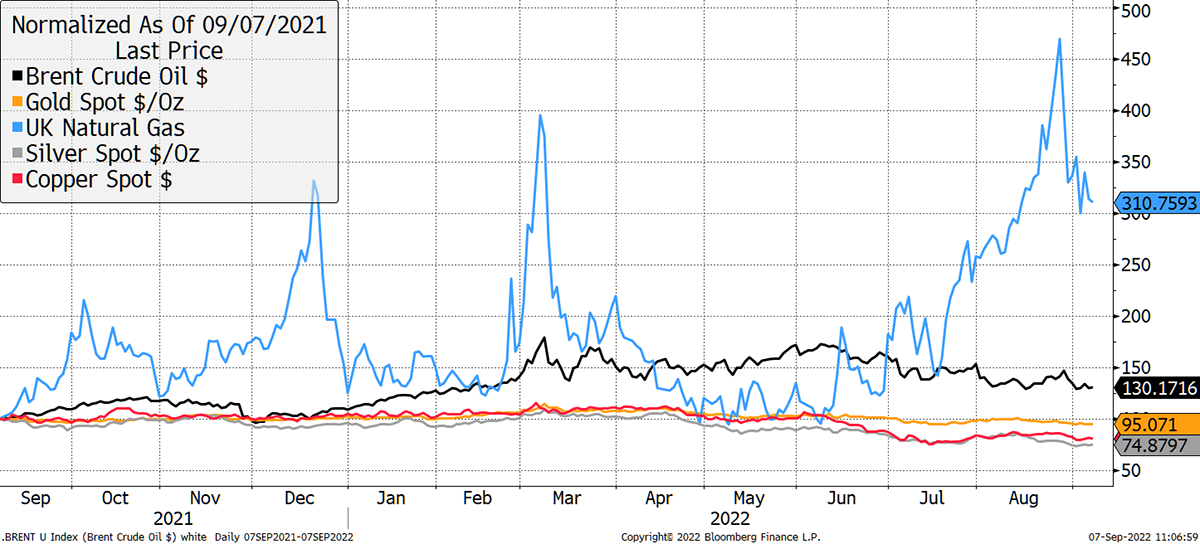

How can this be in the midst of a cost-of-living crisis? The main culprit in Europe has been the rising cost of natural gas, up 210% over the past year. Oil is 30% higher while gold, silver and copper are lower.

Energy Beats Metals

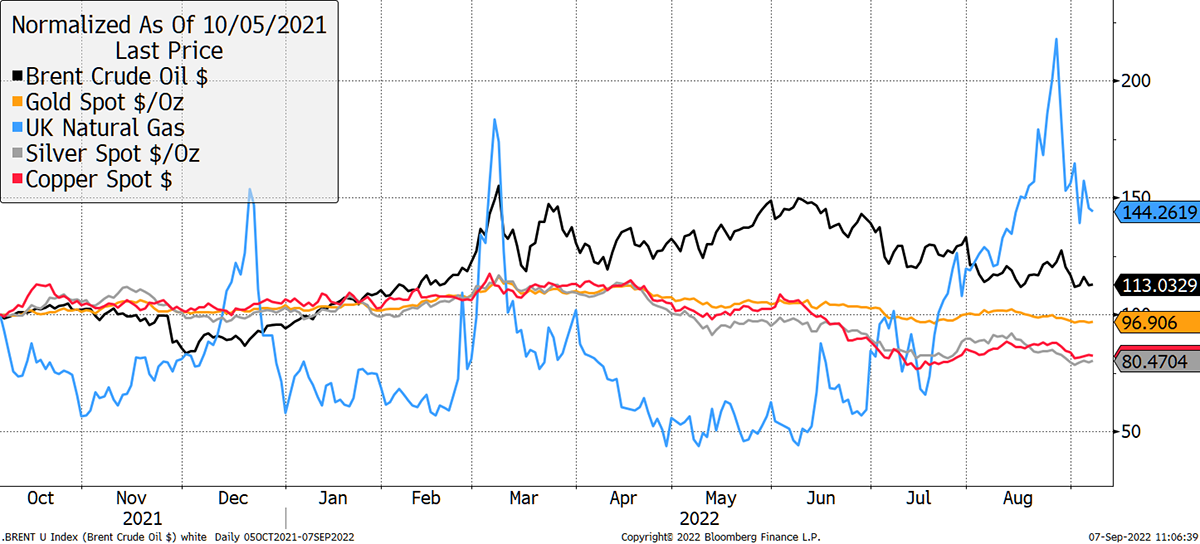

If you start the chart a month later, in October, the picture looks very different. Gas is now up 44%, oil 13% and the metals slightly negative. This is what the bond market is discounting. Last year was terrible, and while prices won’t necessarily fall, they won’t surge either. Looking ahead, the view is far more stable than in the rear-view mirror. It is the rate of change that inflation is measuring. High prices have already been discounted.

Inflation Softens When You Strip Out Last September

Valuation

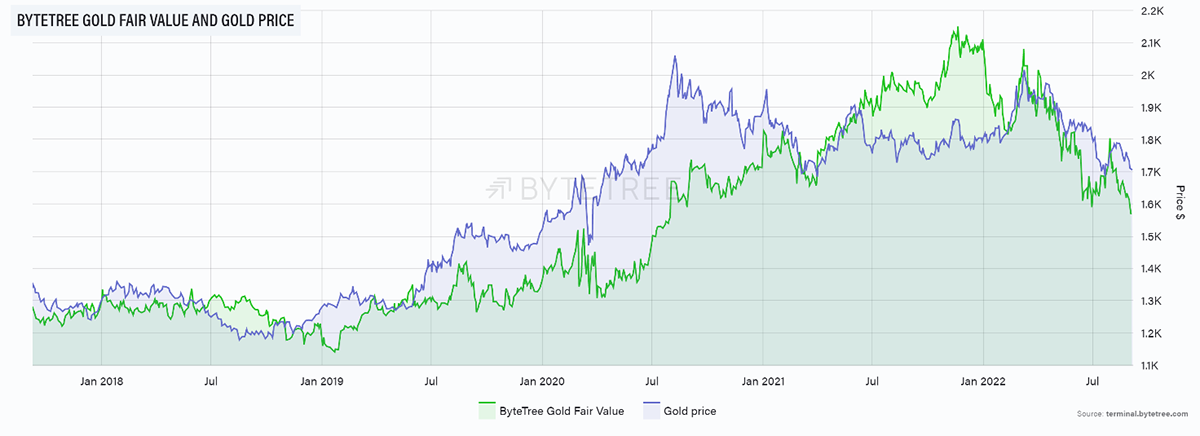

Gold takes all of this into its stride. Using my tried and tested valuation model, gold is trading at a modest 9% premium to fair value.

I would prefer a discount, but 9% isn’t much, and no cause to sell.

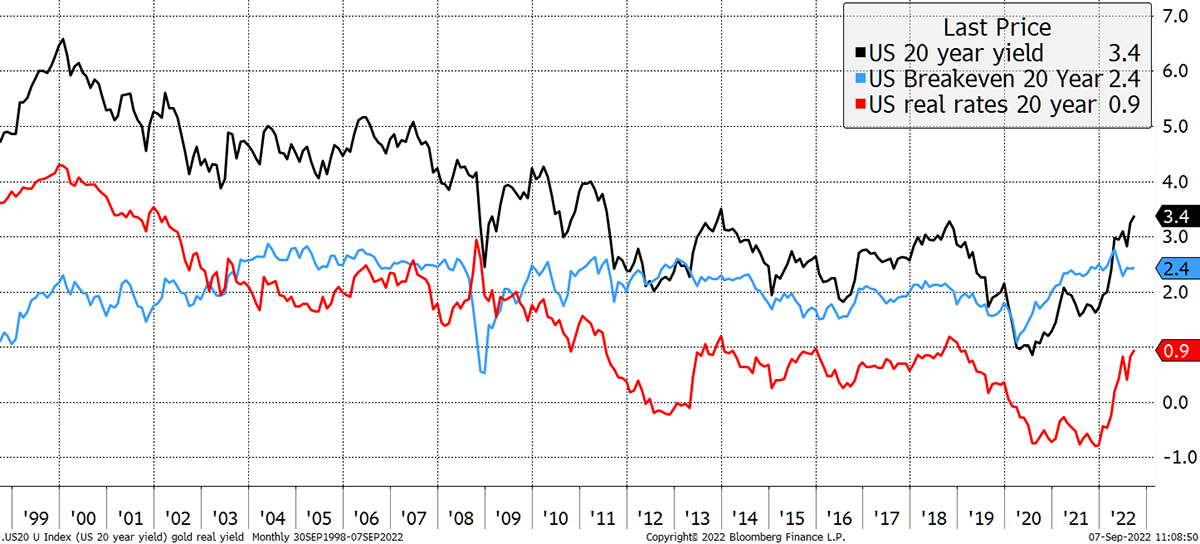

The model prices gold off 20-year US real rates (red) because it is a dollar-based model. They have risen a great deal, as seen earlier. Moving from -0.9% to +0.9% is the largest upswing we’ve seen this century. Because gold was 15% undervalued before this move, the pain has been moderate in comparison to other asset classes.

Rates Rise + Inflation Cools = Real Rates Surge

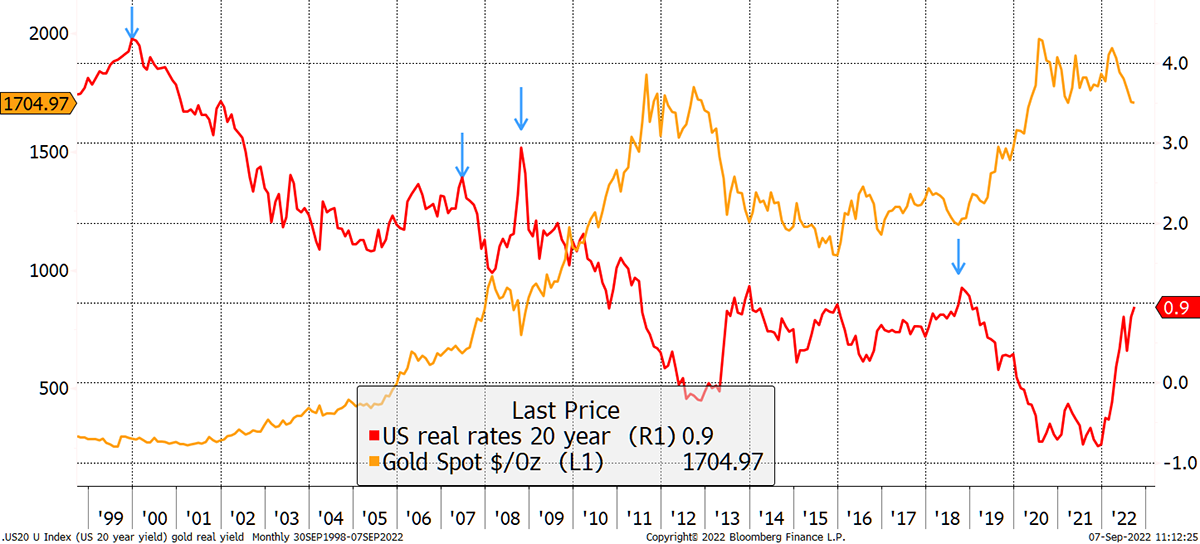

The bullish point here is that ALL the great gold rallies in this century started from a peak in real rates, as shown. The level could go higher than the current 0.9%, but that was enough to shake financial markets in 2018. The high in 2007 marked the beginning of the financial crisis, and the peak in 2008 marked the market low in the thick of a deflation shock.

The Great Rallies Started From a High in Real Rates

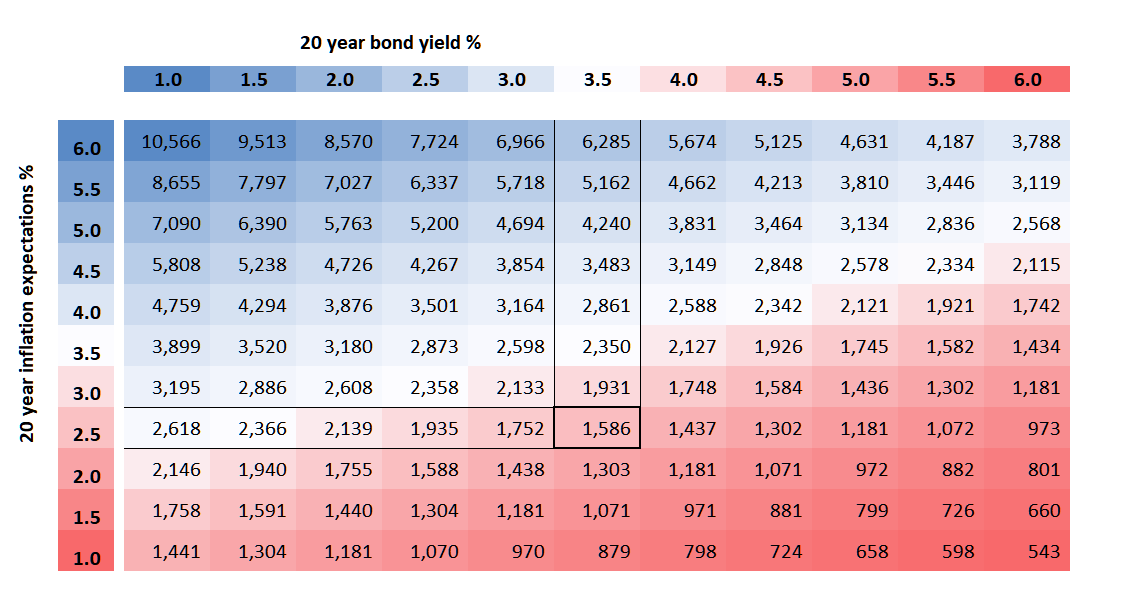

Given how an overshoot has worked out in the past, we have to be close to a peak. But the future is uncertain, and here are a few scenarios.

Gold Valuation Scenarios (present highlighted)

For the Bears

If we returned to rates in 2000, with inflation at 2% and the bond yield at 6%, gold would slump to around $801. The 2007 scenario sees inflation at 2.5% with a bond yield at 5%. Then expect gold to touch $1,181.

For the Bulls

We soon see a peak in the bond yield at 3.5%, which is not far away from where we already are, but long-term inflation expectations fail to return to 2%. Instead, they rise to 3% and suddenly, gold trades at $1,931. This bullish scenario seems likely because the world has changed.

If 3.5% inflation moves up to 4%, gold trades at $2,861 before you know it.

Flows

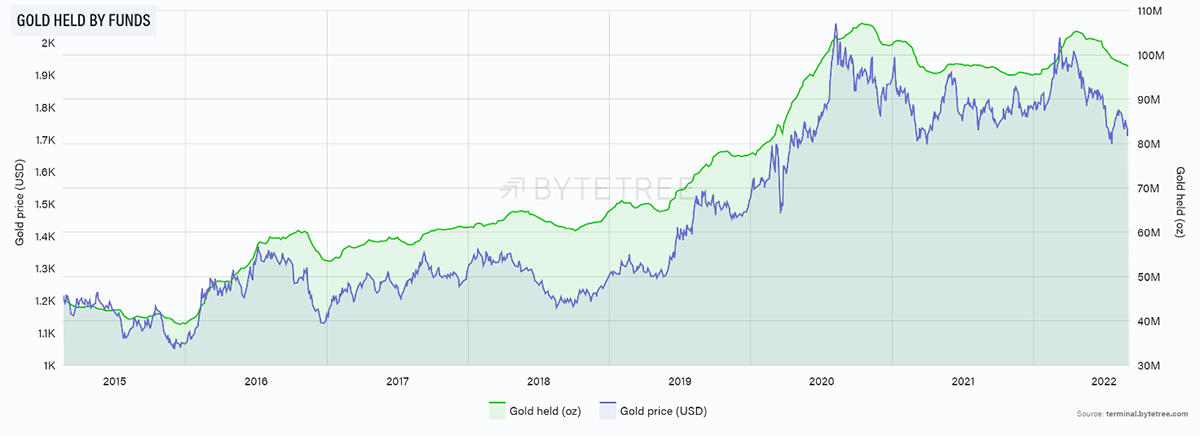

Asset allocators clearly don’t read Atlas Pulse because they’d find something else to sell other than gold if they did. Fund holdings have dropped 8 million ounces. Don’t worry, they’re collectively behind the curve, and you can guarantee they’ll be back.

Gold Investor Outflows ersist

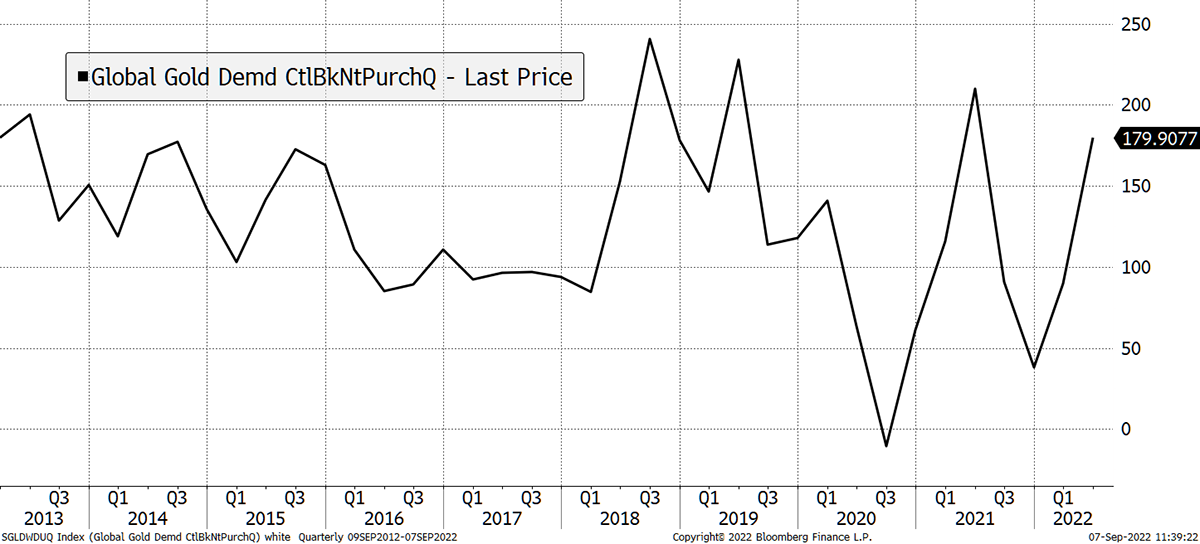

But someone is buying their gold, and it’s the central banks, who have been net buyers every quarter bar one since 2013. Which quarter? They sold in Q3 2020, right at the top of the market.

Don’t Bet Against the Central Banks

Summary

There are easy times to invest in, and there are hard times. These times are most definitely hard. Yet gold is inexpensive, and macro settings are now consistent with levels from where the price has performed well in the past. Gold also has a long history of preserving value in times of political crisis. In a world that is becoming increasingly divided, it is the timeless store of value we can all agree on.

Thank you for reading Atlas Pulse. The Gold Dial Remains on Bull Market.

Charlie Morris is the Founder and Editor of the Atlas Pulse Gold Report, established in 2012. His pioneering gold valuation model, developed in 2012, was published by the London Mastels Bullion Association (LBMA) and the World Gold Council (WGC). It is widely regarded as a major contribution to understanding the behaviour of the gold price.

Please email charlie.morris@bytetree.com with your thoughts.