ATOMIC 70

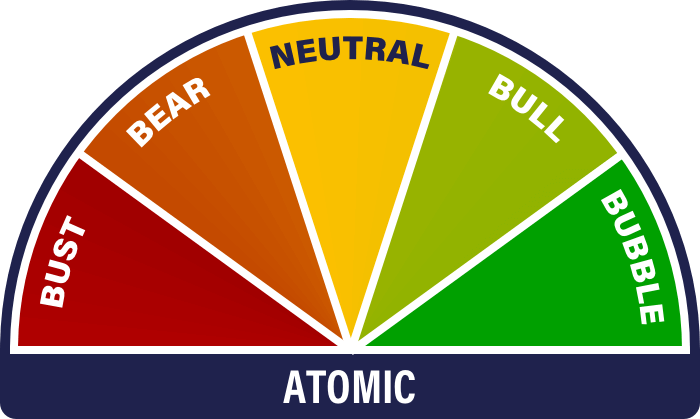

On-chain weakness remains a challenge, but structural factors give room for optimism. Quant tyres are given a kick. Remain at Neutral.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | So bad that any good news would be a trigger |

| On-chain | Fair valuation falling |

| Macro | Pivot potential |

| Investment Flows | Next halving coming into view |

| Cryptonomy | Quant is for real |

Technical

Bitcoin is on 1 star out of a possible 5 against the US$ on ByteTrend. The 280-day moving average sits at US$30,000 and slopes downwards, so we are a long way from that. Note how tough it has been for BTC to break out from the shorter-term 42-day moving average, which over the last couple of months has acted as resistance. Indeed, over the last year, a break below the moving average has been a powerful sell signal. A decisive break higher after this period of relative calm would be a very encouraging signal.

Source: ByteTree. ByteTrend for Bitcoin (BTC) in USD over the past year.

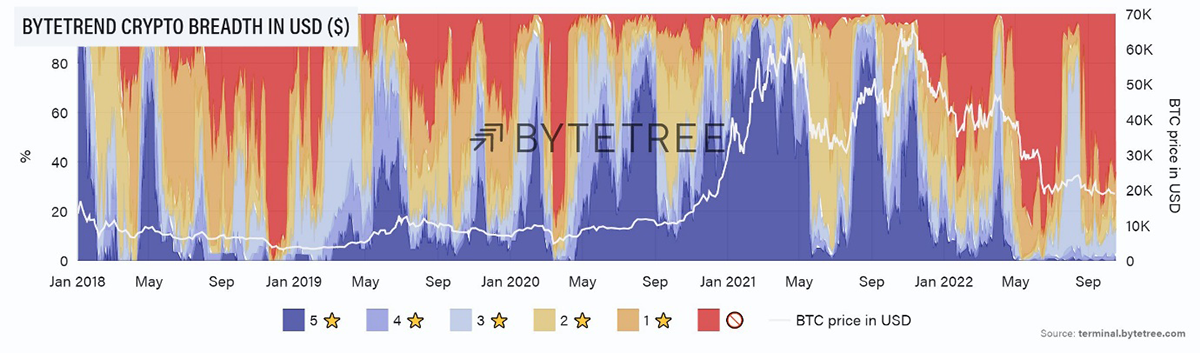

We’re all now familiar with the extent of US$ strength. In the breadth chart below, red skies show us how many coins and tokens are on zero. We remain in depressed territory, shown by the lack of 4 and 5 stars on display. It’s rarely been worse, suggesting a sprinkling of good news would have a major impact.

Source: ByteTree. ByteTrend crypto breadth chart for the top 100 crypto tokens since 2018.

On-Chain

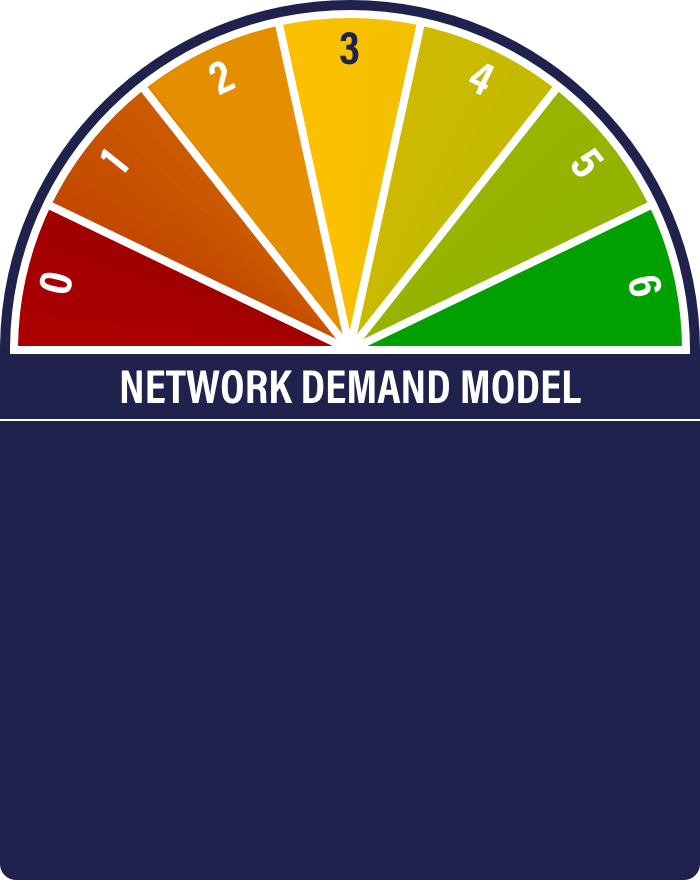

Little to shout about again this week. The Network Demand Model remains on 1/6, with velocity as the only metric remaining on.

Last week’s difficulty increase has had the desired effect, with block times returning to 10 minutes. Fees remain in a down channel.

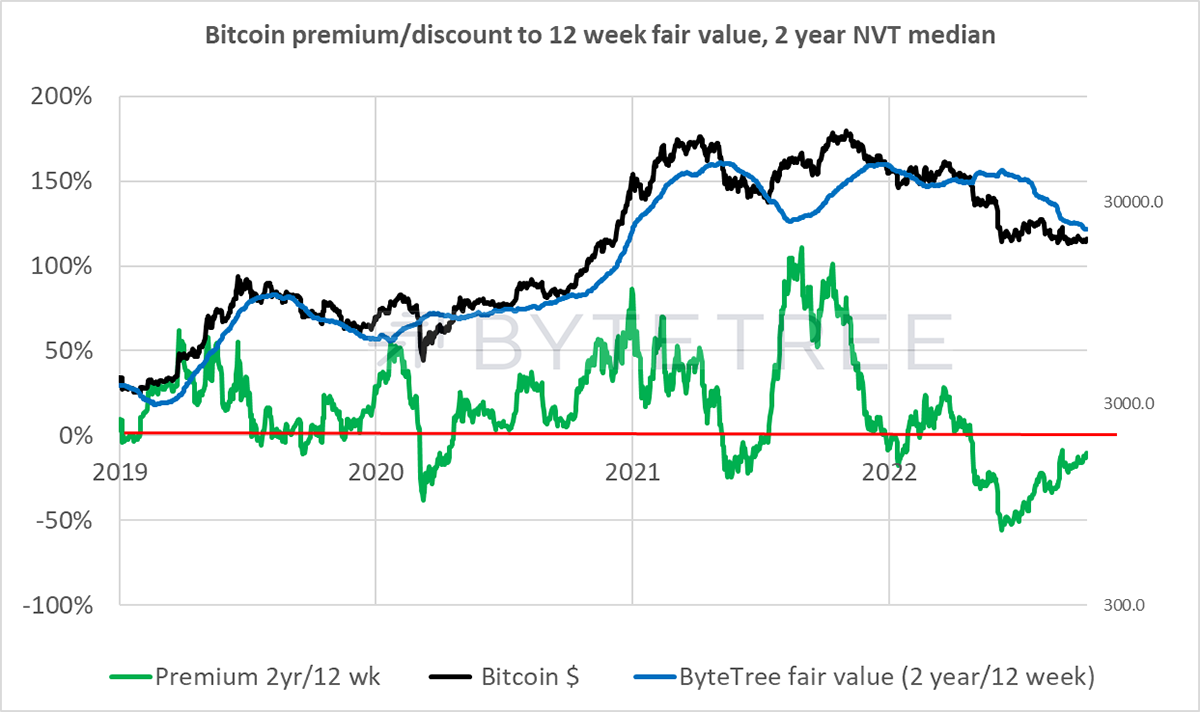

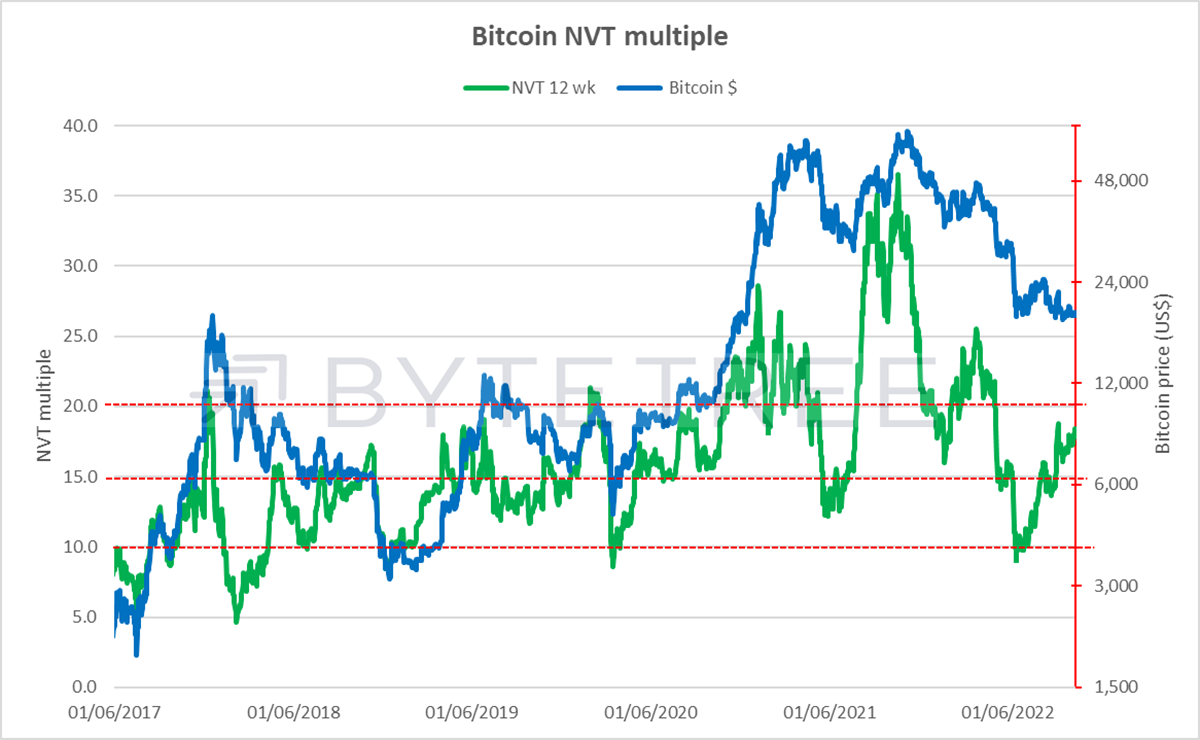

The lack of on-chain activity continues to weigh on our fair value models. Using the average NVT multiple over the last 2 years, we see that the discount to fair value has continued to narrow (chart 1). The inverse way of looking at that is that the fair value multiple has continued to rise (chart 2). Looking at the second chart, we’re not yet into critical territory, but a move over the 20x upper level has generally proved unsustainable, leading either to a de-rating or a recovery in transaction value.

We keep saying it, but bitcoin needs a catalyst to boost activity and justify the price remaining at these levels.

Source: ByteTree Asset Management

Source: ByteTree Asset Management

Macro

Everything continues to hinge on the Fed and the prospect of a pivot. And the rationale for any pivot will be clear evidence that the inflation dragon has been slain, regardless of the damage done in the slaying process.

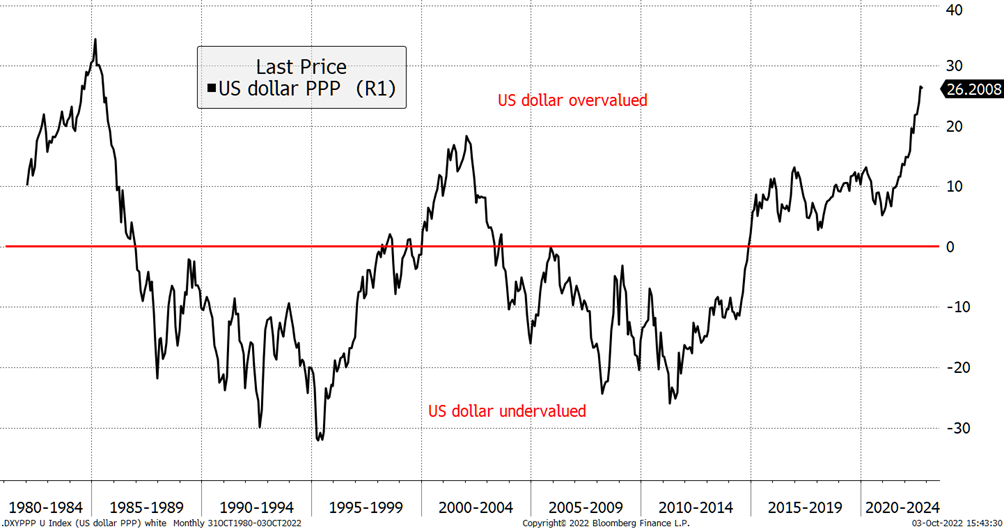

One can sense the market starting to feel for a change in direction. Bitcoin’s refusal to break below the June low is one indicator, but the performance of currencies is incredibly stretched. As Charlie Morris highlighted in the latest edition of Atlas Pulse, the dollar is meaningfully overvalued.

“Using purchasing power parity (long-term inflation differentials), I have valued the dollar on a weighted basis against the JPY, EUR, GBP, SEK, NOK, CHF, AUD and CAD. The dollar trades at a premium to all of them, the smallest being CHF at 3% and the largest, JPY at 48%. The result is that the US dollar is 26% overvalued against a global basket of developed currencies.”

Source: Bloomberg

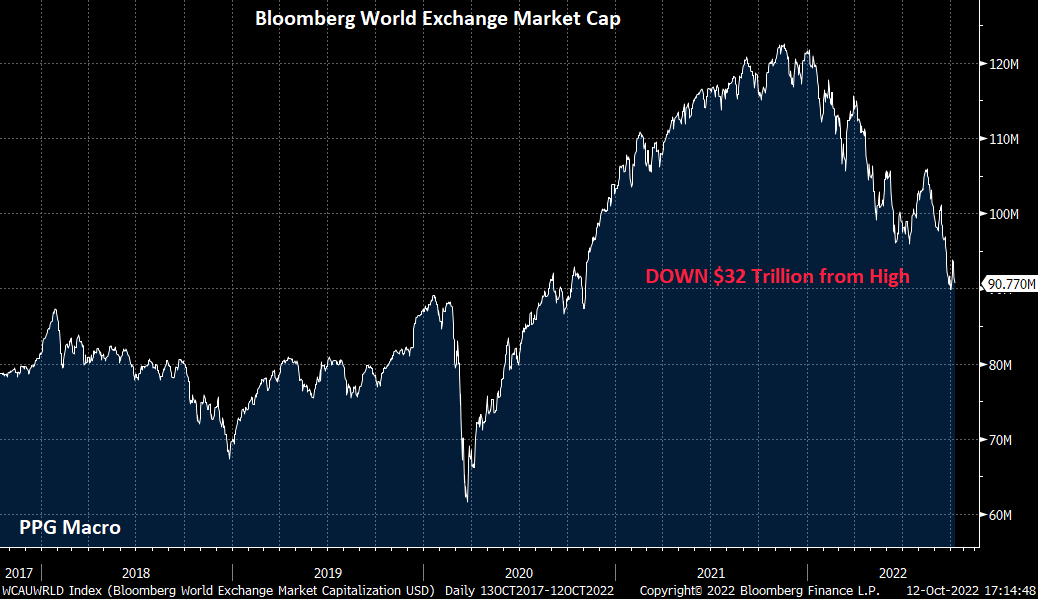

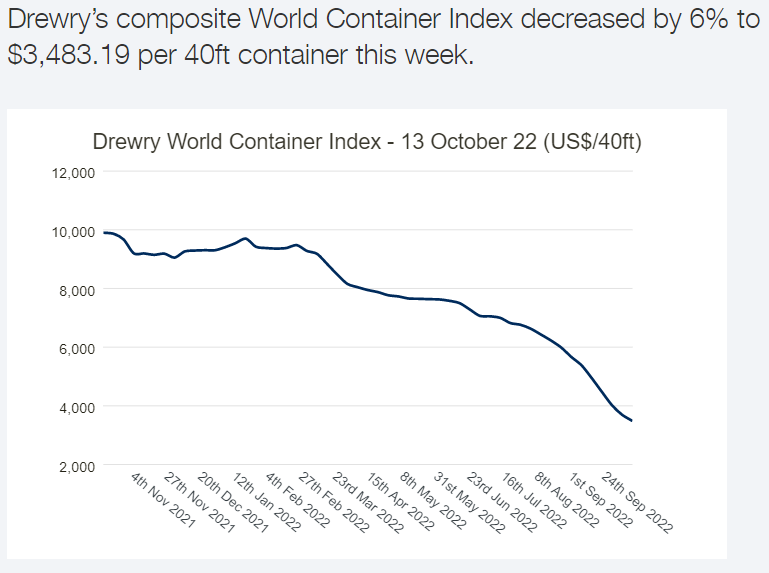

What leading indicators can we look at to figure out whether we’re close to a turning point, and is the worst of this bout of inflation behind us? Some suggestions below:

1. Household wealth savaged

Source: Bloomberg

2. Shipping rates – sinking like a stone

Source: World Container Index, Drewry Supply Chain Advisors, 13/10/22

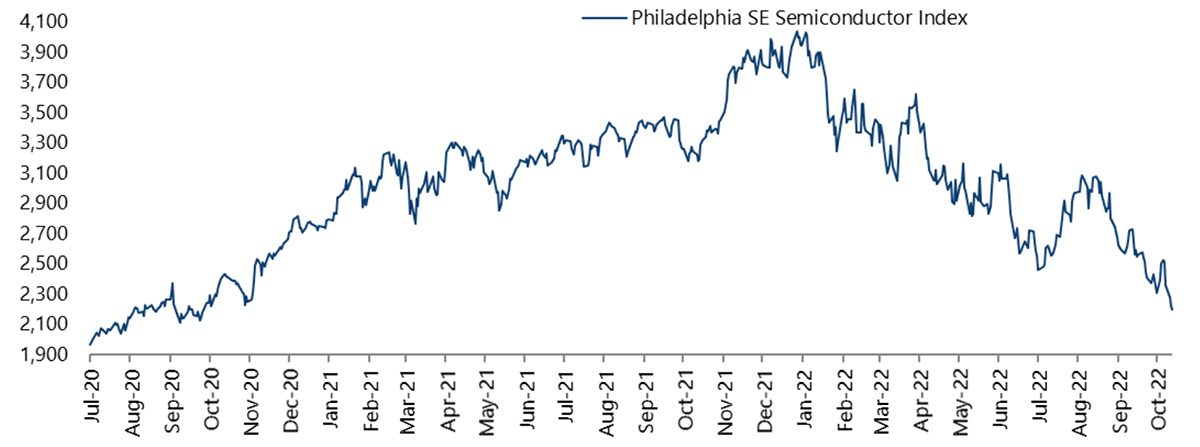

3. Semiconductors – memory loss

Source: Bloomberg

It wouldn’t be beyond the bounds of irony that just at the point that consensus swings around to thinking that inflation isn’t transitory, it turns out that it is. What the crypto market needs is an adjustment in the rate of change. There are some compelling indicators to suggest we’re close to getting it.

Institutional Flows

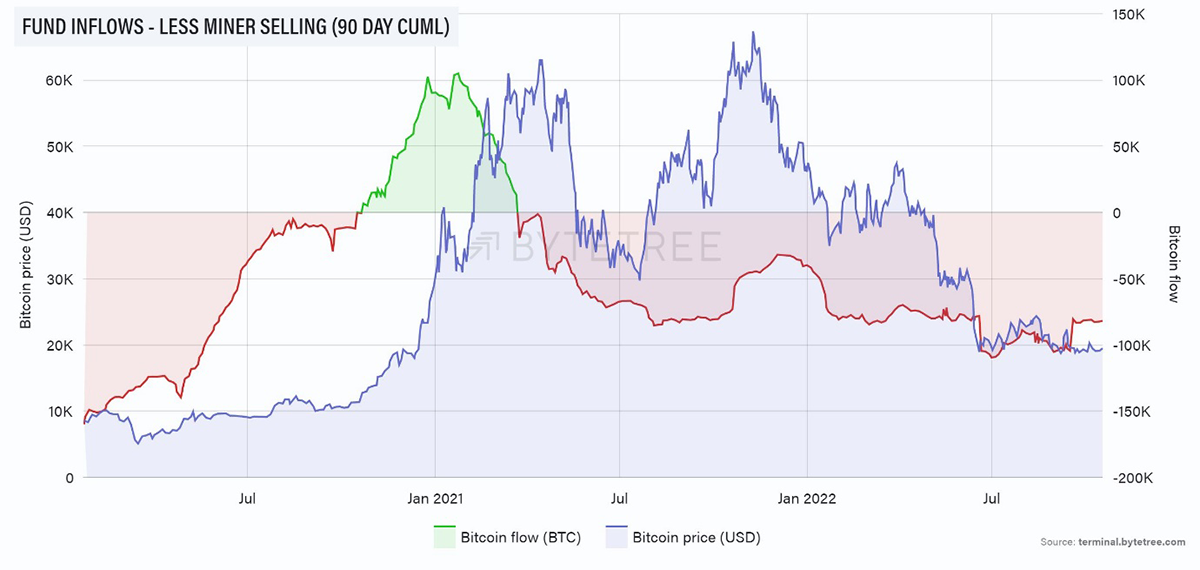

The resilience of bitcoin held by funds continues. Since early September, we have seen gradual accumulation. That said, the amount being bought compared to the amount that miners are selling remains tiny, as shown below.

Source: ByteTree. Bitcoin fund inflows, less miner selling (90-day cumulative), over the past two years.

To put this in perspective, roughly between 27,000 and 28,000 new bitcoins are minted every month. At a price of US$20,000, this amounts to somewhere between US$540m and US$560m of new dollars that need to be found every month to absorb the supply. At a time when risk-assets of all descriptions are on their heels, and there seems to be huge bearishness towards crypto in particular, the fact that the bitcoin price is holding its ground is impressive, particularly when you consider that the vast majority of institutions can’t buy it.

It is also a good reminder of the potential impact of the halving cycle. ByteTree estimates the next halving to happen mid-afternoon on 9th April 2024. That’s less than 18 months away, which in market terms isn’t that far off.

If we turn the tables around and imagine that bitcoin has to continue absorbing US$550m of new investment every month (as it does now), but there will only be 13,500 new coins coming to market, theoretically the price would have to move to just over US$40,000. A 100% return in 18 months, anyone…in these markets?

Cryptonomy: Quant Is for Real

By Laura Johansson

The crypto market remains pretty starved of options, so when something decouples from the broader market, we sit up. Last week, this was the case with Quant (QNT), which upgraded to a bullish 5-star ByteTrend score in US dollar terms.

Source: ByteTree. ByteTrend chart for Quant (QNT) in USD (green) over the past two years, overlaid with moving averages, max/min lines and the ByteTrend trend score (blue fill).

As an avid reader of ByteTree research, this would not be the first time you’ve heard us mention Quant. The protocol has been an ongoing discussion in the ByteFolio notes, and our analyst, Ali, wrote a Token Takeaway on Quant in mid-August.

In light of the recent price performance, ByteTree co-founder Mark Griffiths took a look at Quant from a developer’s perspective and gave it a thumbs-up.

Quant is a unique crypto project as it doesn’t have a blockchain but a blockchain operating system called Overledger. Basically, Quant allows developers to build any kind of application and connect it with the entire crypto ecosystem through Overledger. There’s a beautiful simplicity to this, as unlike layer-0 protocols like Cosmos, developers do not need to build a new blockchain to use it.

Because of the simplicity behind the Quant interface, it is ideal for legacy applications, i.e., applications that already exist and were created without the blockchain element in mind. This means that corporations can enter the blockchain space on a very low financial barrier ($100 + transaction fees) and without restructuring their existing processes or gaining specialist blockchain knowledge. When the time comes for the mass adoption of blockchain technology, Quant is extremely well-positioned.

Until then, Quant appears to be focusing on Central Bank Digital Currencies (CBDCs). Their website boasts that Quant can facilitate the issuance and transactions of CBDCs, commercial stablecoins, and tokenised money, supporting a wide range of use cases on a national and international level. The founder and CEO of Quant, Gilbert Verdian, is already well-connected with European banks, not to mention highly involved with building the UK’s CBDC.

Source: Quant/Twitter. Quant CEO Gilbert Verdian (second from the right) participated in a panel discussion at the European Central Bank’s P2P Financial Systems event in 2019.

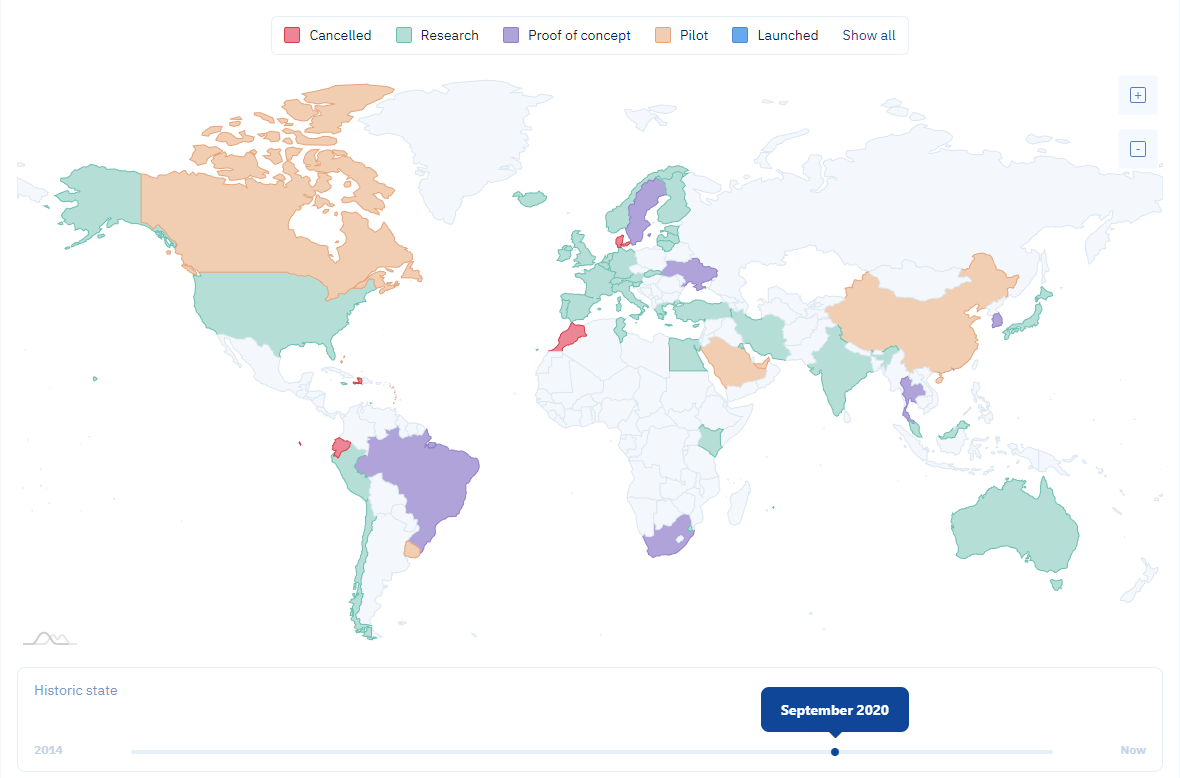

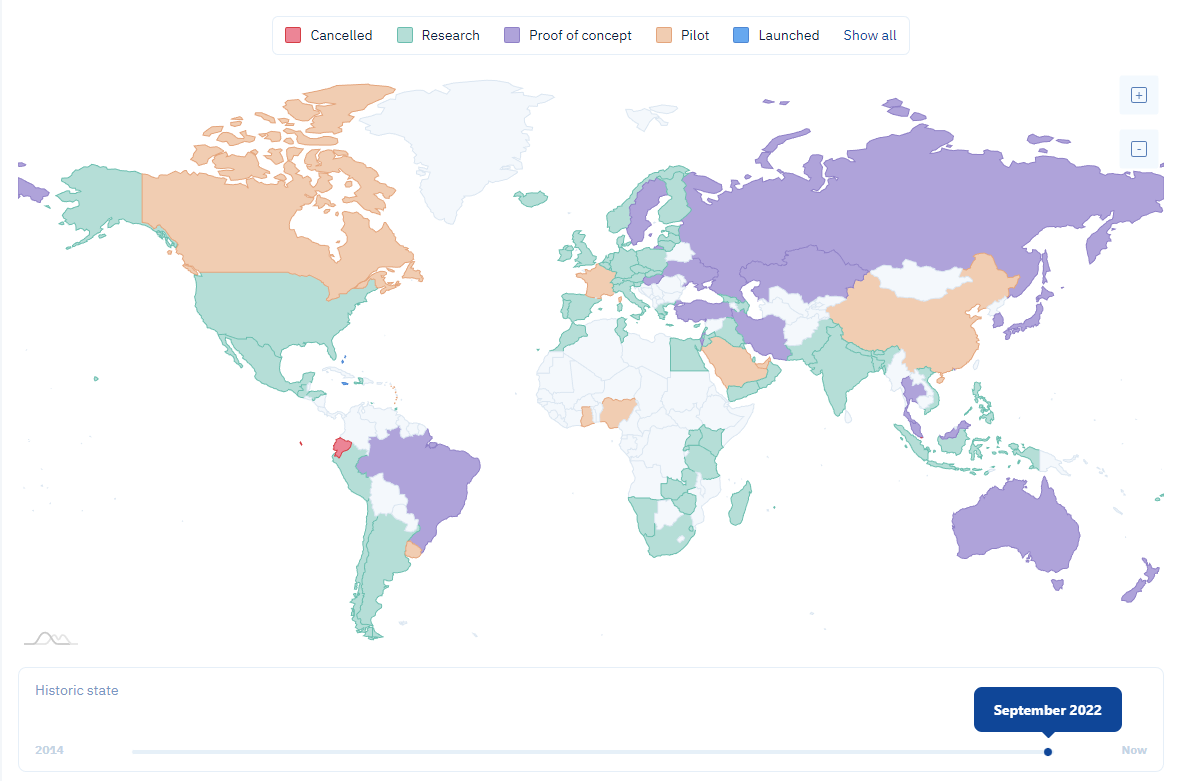

Despite the ongoing bear market, CBDC development is still in full force. This is particularly evident from looking at the progress made in the last two years.

CBDC Status September 2020

Source: CBDC Tracker

CBDC Status September 2022

Source: CBDC Tracker

Further evidence is the SWIFT flagship conference, Sibos 2022, which took place in mid-October with the theme “Progressive finance for a changing world”, focusing heavily on digital and blockchain-based finance, including CBDCs. Senior Quant representatives also attended the conference, which certainly gave them some good publicity.

Quant is a unique crypto project with a good team, a product that is already generating revenue, and a massive addressable market. Quant’s involvement in CBDCs, which are making continued progress, provides a genuine and substantial usecase. The market appears to be waking up to the potential.

Summary

Current activity is soft, which explains the price today. But there are good reasons, both macro and bottom-up, to look ahead with confidence.